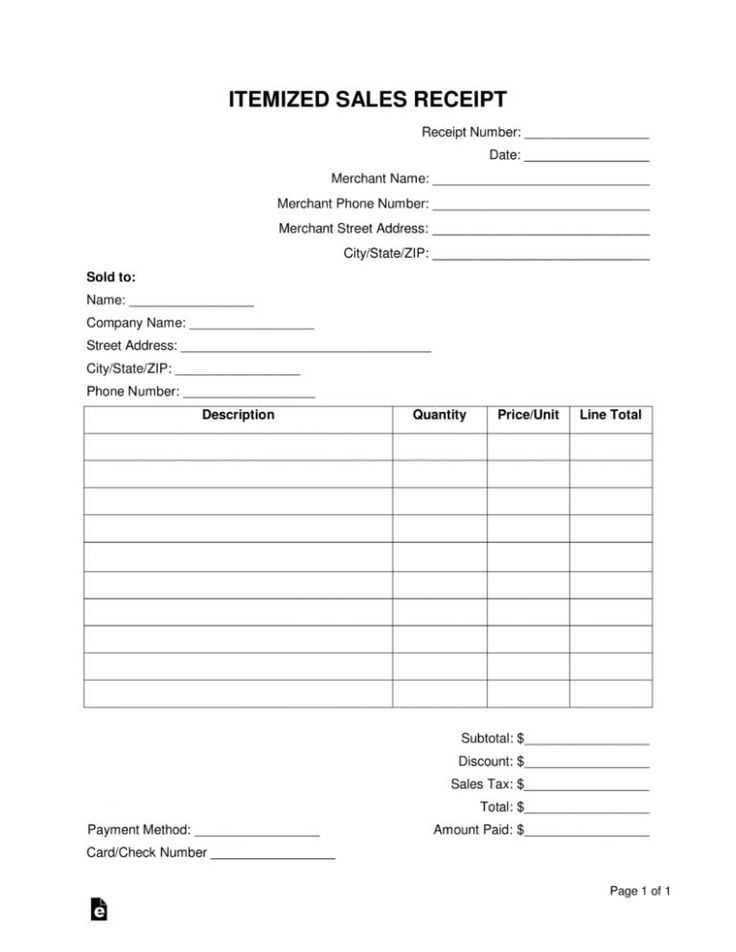

For businesses and individuals managing inventory or supplies, having a clear and precise template for supply receipts can streamline record-keeping and minimize errors. A good template should include key details such as the date, item description, quantity, unit price, and the total cost, ensuring all parties involved have an accurate record of the transaction.

The layout of your receipt should be straightforward, with easily identifiable sections for each piece of information. This includes a space for the supplier’s details, along with any relevant invoice numbers or references. It’s also helpful to include an area for any applicable taxes or discounts to maintain transparency and simplify accounting processes.

By using a reliable supply receipt template, you ensure that all relevant data is captured and presented consistently. Whether you’re managing a small business or simply need a quick way to keep track of supplies, a well-structured receipt template is a simple yet effective tool that saves time and reduces potential confusion.

Sure! Here is the revised version with minimal repetition of words:

For creating a supply receipt, begin by including the vendor’s name and address clearly at the top. Include the recipient’s details as well. Follow this by listing the purchased items with their descriptions, quantities, and unit prices. Add the total amount due at the bottom to ensure clarity. Double-check the calculations to avoid errors. Provide space for any applicable taxes or discounts that might apply to the purchase.

Ensure each item is listed on a new line to enhance readability. If the supply receipt is part of a larger order, include an order number for easy tracking. Use a simple and straightforward layout to keep all necessary details visible at a glance. Avoid clutter by limiting the use of complex language or unnecessary information.

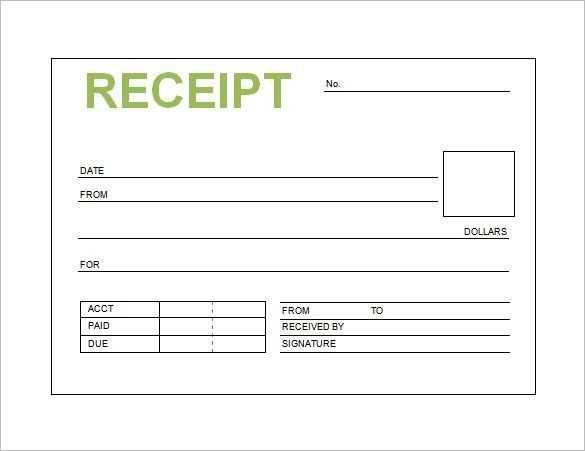

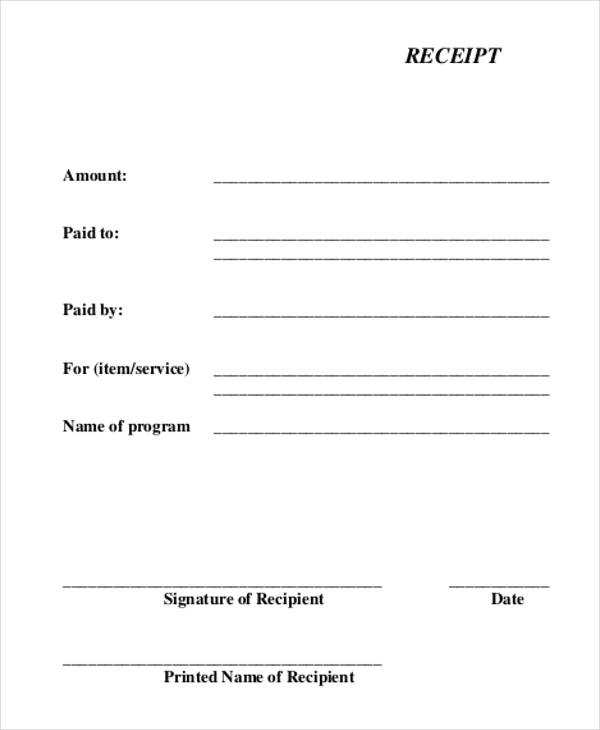

Finally, sign or date the receipt to confirm its authenticity. This helps in maintaining a clear record for both parties involved in the transaction. A clean, well-organized format minimizes confusion and ensures transparency in the transaction.

- Supply Receipt Template: A Practical Guide

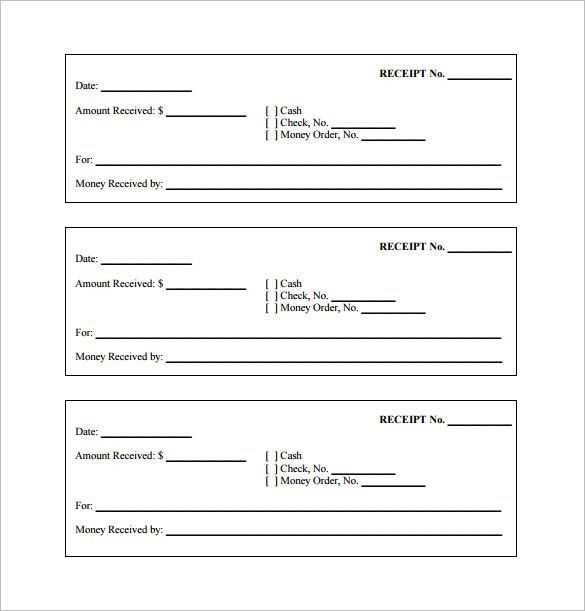

To create a functional supply receipt template, start by including basic details like the supplier’s name, the date of the transaction, and the items received. This ensures both parties have a clear record of the transaction, avoiding misunderstandings.

Key Elements to Include

- Supplier Information: List the supplier’s name, contact information, and address for clarity and future reference.

- Transaction Date: Always include the date of receipt. This helps with tracking the timing of the supply for inventory management.

- Item Description: Include a detailed description of each item received, such as quantity, unit, and any distinguishing features. This makes it easy to verify the delivery against the order.

- Condition of Goods: Indicate whether the items were received in good condition or if there were any damages. This will help during the claims process if necessary.

- Signature Section: Provide space for signatures of both the supplier and the receiver. This confirms mutual agreement on the goods received.

Creating the Template

Begin with a simple layout, clearly dividing the sections for supplier information, item details, and signatures. Use tables for item descriptions and quantities, as they keep the data organized. Make sure there’s enough space for additional notes or special instructions. Ensure the template is easy to fill out, either digitally or by hand.

Finally, check that the template suits your industry’s needs. You might need additional sections like tracking numbers or purchase order references depending on the nature of the supply and your company’s processes. Keeping the format simple and flexible ensures the template will work across different transactions.

Begin by opening a new Excel workbook. Set up a clean sheet with clear headings for key information: date, receipt number, payer’s name, items purchased, quantity, price per item, total amount, and any applicable taxes. Use bold fonts for headings to make them stand out.

Next, define the columns clearly. For example, in the first column, include “Item Description”, the second for “Quantity”, and the third for “Price”. This layout will make it easy to fill in the details and calculate totals.

Use Excel’s built-in formulas to calculate totals automatically. In the “Total” column, apply a simple formula that multiplies quantity by price per item. For taxes, you can create a separate row where a percentage of the total amount is calculated based on the tax rate you set. This will save time during future entries.

Add a footer for additional details like business name, contact information, or return policy. For an extra touch, consider adding a small logo or branding at the top.

Finally, save your template as a file you can reuse. If needed, use Excel’s “Save As” feature to save it as a template, so you won’t have to reformat it each time. This streamlined approach keeps your receipts uniform and professional-looking every time.

Customize your receipt template to reflect your brand and improve customer experience. Tailor it to suit your business type and specific needs, focusing on clarity, accuracy, and visual appeal. Follow these steps to ensure your receipt serves its purpose efficiently.

1. Include Your Business Information

Start by adding your company’s name, logo, address, contact details, and any other relevant information. This ensures that customers can easily reach you if needed. Make sure the font is legible and the design is aligned with your brand identity.

2. Adjust the Layout

Organize the sections of your receipt logically. Begin with the business information, followed by the date of purchase, transaction details, and total amount. Use clear headings to guide the customer through the details. Avoid overcrowding; a clean layout enhances readability.

3. Include Specific Transaction Details

Include a detailed breakdown of the items purchased, including quantities, unit prices, and total prices. For services, list the nature of the service and the charge. Be sure to separate taxes, discounts, and any other additional charges for transparency.

4. Add a Return and Refund Policy

Clearly state your return and refund policies at the bottom of the receipt. This provides customers with the necessary information if they need to return a product or request a refund in the future. Keep it concise but informative.

5. Customize for Promotions

If your business runs promotions or discounts, include space to feature them on receipts. This could be a limited-time offer or a special discount code. You can also add loyalty program details to encourage repeat business.

6. Test and Review

Before using your customized receipt template, print a few samples to ensure all information fits well and is easy to read. Double-check for accuracy and make adjustments where needed. The goal is a seamless experience for both you and the customer.

| Element | Details |

|---|---|

| Business Information | Name, logo, address, contact |

| Transaction Details | Item name, quantity, price, total |

| Taxes and Discounts | Separate itemization for clarity |

| Return/Refund Policy | Brief, clear, customer-friendly |

| Promotions | Discounts, offers, loyalty codes |

To ensure clarity and avoid confusion, include the following details in a supply receipt:

- Receipt Number: A unique identifier for each transaction. It helps track orders and simplifies record-keeping.

- Supplier Information: Name, address, and contact details of the supplier. This establishes who provided the goods.

- Recipient Information: The name and address of the recipient. It confirms who receives the supply.

- Itemized List of Goods: A clear breakdown of each item supplied, including quantities, descriptions, and unit prices. This prevents misunderstandings regarding what was delivered.

- Total Amount: The total cost of the supplies, including taxes and any discounts applied.

- Delivery Date: The date when the supplies were delivered. This ensures both parties have a clear record of the transaction timeline.

- Payment Terms: Specify if payment was made immediately or is due at a later date, including payment methods (e.g., bank transfer, credit card).

Additional Information

- Purchase Order Reference: If applicable, include the reference number from the original purchase order for easy cross-referencing.

- Signature: The recipient’s signature confirms the goods were received in the specified condition.

Include barcode scanning functionality in your receipt system to streamline data collection and inventory management. This integration allows you to scan products directly, ensuring quick and accurate item identification. By linking the barcode to your receipt, you can instantly pull up product information, such as price, quantity, and description, saving time during checkout.

Ensure your receipt template accommodates the barcode by providing a designated area for it. This can be a scannable image or a numeric code displayed clearly on the receipt. When scanning the barcode, the system should automatically populate the relevant fields on the receipt, eliminating manual entry and reducing errors.

To make barcode scanning work seamlessly, choose a barcode type that matches the needs of your products (e.g., UPC, EAN). Ensure your point-of-sale system supports this format and integrates with your inventory database for real-time tracking. Make sure your receipt printer can handle barcode printing, and test the output for clarity and scannability.

For advanced features, consider adding the ability to scan barcodes for returns and exchanges. This lets your system quickly verify items, providing a faster, more accurate process for customers and staff alike.

Sort receipts by categories such as business, personal, or tax-related to simplify finding what you need. Keep paper receipts organized by using labeled folders or accordion files for easy access. For digital receipts, use a dedicated folder system on your computer or cloud storage with clear naming conventions to help locate them quickly. A folder for each month or year can help track expenses over time.

Digital Organization

For a clutter-free experience, scan and save paper receipts as PDFs. Make sure to back up your files regularly to avoid losing important documents. Use receipt management apps that allow you to capture, categorize, and store receipts securely on your phone. Many of these apps offer features like searching by date or vendor, making it easier to find receipts later.

Proper Storage Techniques

Store physical receipts in a cool, dry place away from direct sunlight to prevent fading. If space is a concern, consider transitioning to a fully digital system by scanning receipts as soon as you receive them. For long-term storage, use file boxes with clear labels or dedicated filing cabinets to keep receipts safe and accessible.

Ensure your receipt template complies with local tax laws by including required information such as the business name, tax identification number, transaction date, and clear item descriptions. Without these details, you risk potential fines or delays in processing tax reports. Additionally, if you operate in a jurisdiction that mandates issuing receipts for specific transactions, failure to do so can lead to legal complications.

Verify the appropriate tax rate for your area, ensuring it’s reflected on the receipt. This includes both sales tax and VAT where applicable. Incorrect tax information can result in underpayment or overpayment, which might require you to amend your tax returns or face penalties.

For businesses dealing with international transactions, be aware that tax obligations might vary by country. Ensure that receipts for cross-border sales meet the requirements of the relevant tax authorities, including currency exchange and local tax regulations.

Always store copies of receipts for a period specified by local laws. This can protect your business in case of audits or disputes. Check with a tax professional to determine the required retention time based on your location and business type.

This version keeps the meaning intact while reducing word repetition. Let me know if you need further adjustments!

To create a supply receipt template, ensure it includes the necessary fields for both the supplier and buyer information. The template should have spaces for the product description, quantity, unit price, total amount, and any applicable taxes. Use clear labels for each section to avoid confusion during data entry.

Key Elements of a Supply Receipt

Start with a header that identifies the document as a supply receipt, followed by the date of issue and unique receipt number for reference. Add sections for contact details on both sides of the transaction, ensuring the names, addresses, and phone numbers are visible. List items purchased with their unit prices and quantities, calculating totals at the bottom of the section.

Formatting Tips

Keep the design clean and straightforward. Use bold for section headings to distinguish them from the rest of the content. Provide enough space between items to make the receipt easy to read. Consider adding a note for special instructions or terms of the transaction at the bottom to avoid misunderstandings.