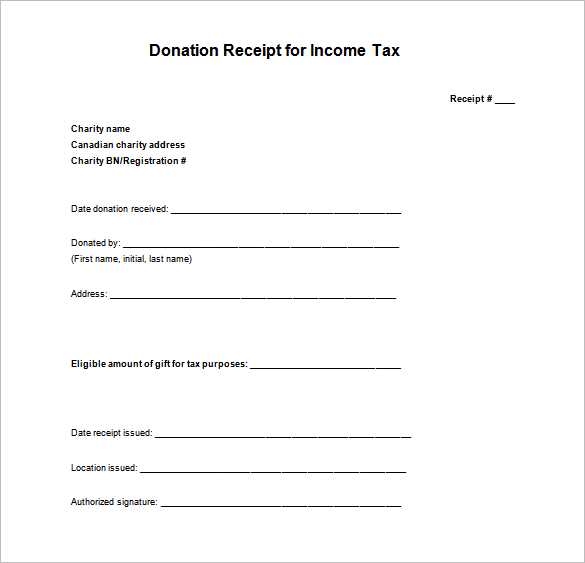

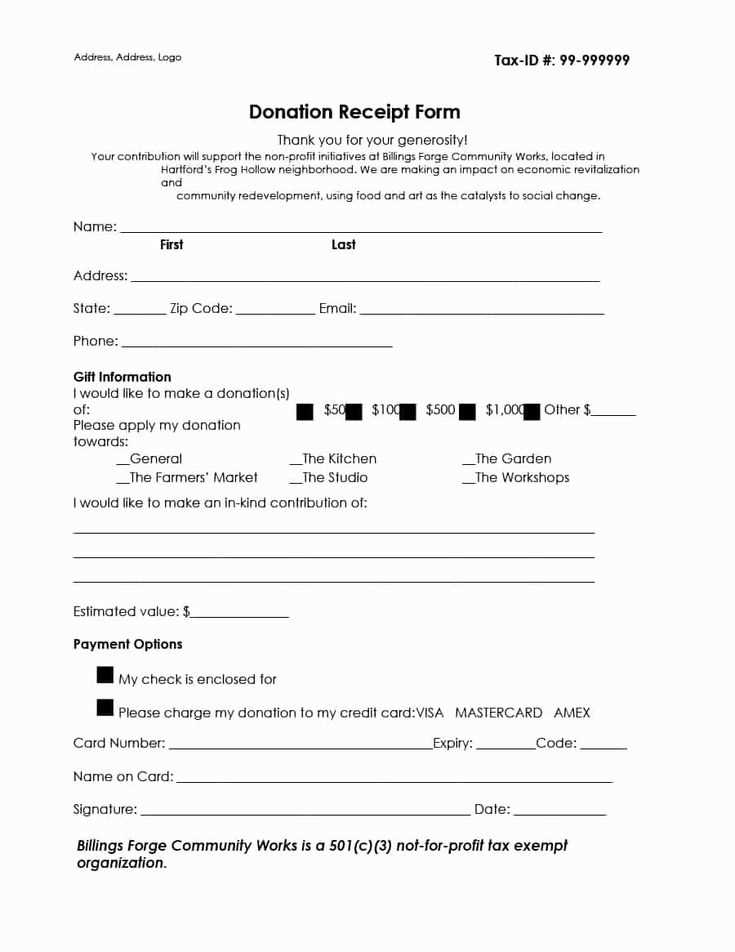

Creating an in-kind tax receipt is straightforward when you have a solid template in hand. This document serves as proof of donations made in the form of goods or services, which can be used by the donor for tax deduction purposes. The receipt should contain specific information, including the description of the donated items, their fair market value, and confirmation that no goods or services were exchanged in return for the donation.

Key elements to include in your template are the donor’s name and address, the organization’s name, and a detailed list of the donated goods or services. Make sure to clearly state whether the donation was a partial or full donation of the item. If possible, include an estimated value of the items, as this will help the donor claim the correct deduction. Also, ensure the receipt is signed by an authorized representative from your organization to make it valid.

The tax receipt template should be simple but thorough. You don’t need to complicate things–focus on clarity and accuracy. The template can be customized based on the type of donation or the needs of your organization. Use a consistent format for all donations to maintain professionalism and accuracy across all receipts.

Here’s the revised version:

When drafting an in-kind tax receipt, ensure it includes the donor’s full name and contact information. Clearly state the description of the donated items or services, avoiding ambiguous terms. Each item should be listed with sufficient detail, including quantity and condition, along with a statement confirming that no goods or services were exchanged for the donation.

Providing Accurate Valuation

For in-kind donations, the IRS requires that the donor provides an estimated fair market value (FMV) of the items. If the donation exceeds $500 in value, the donor must complete and attach IRS Form 8283. Make sure to include this form when issuing receipts for large donations, particularly for non-cash items such as vehicles or real estate.

Additional Notes for Donors

While the recipient organization doesn’t need to provide an FMV estimate, donors are advised to keep records, including purchase receipts, appraisals, or similar documents, to support their valuations. Be clear in your receipt about the donor’s responsibility for determining the FMV and the tax implications of their donation.

- In-kind Tax Receipt Template

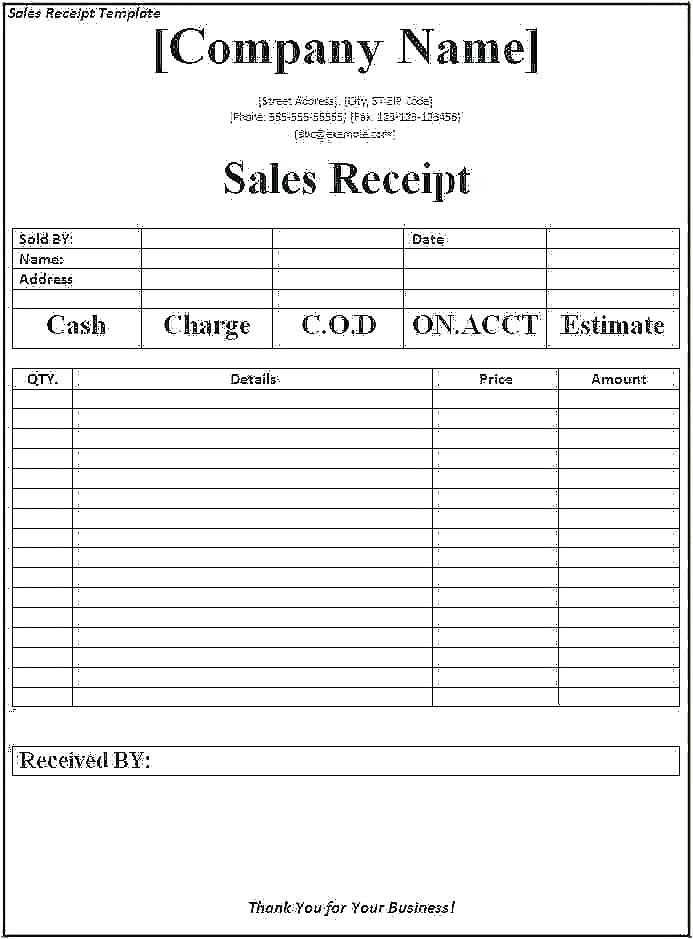

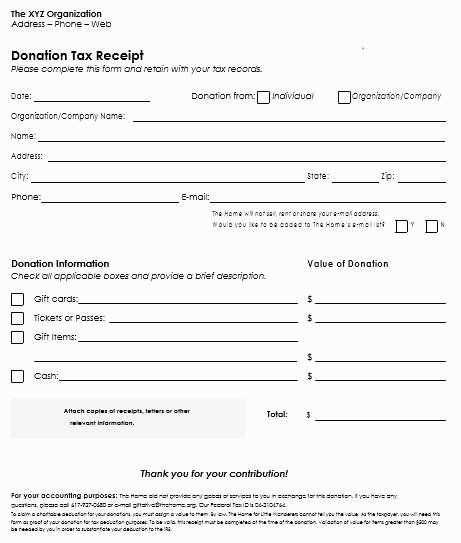

Creating an in-kind tax receipt is straightforward if you include the right details. Below is a basic template you can follow for your donations. Make sure to fill in the specifics for the donation, donor, and organization.

Template Structure

Use the following sections to guide the formatting of your receipt:

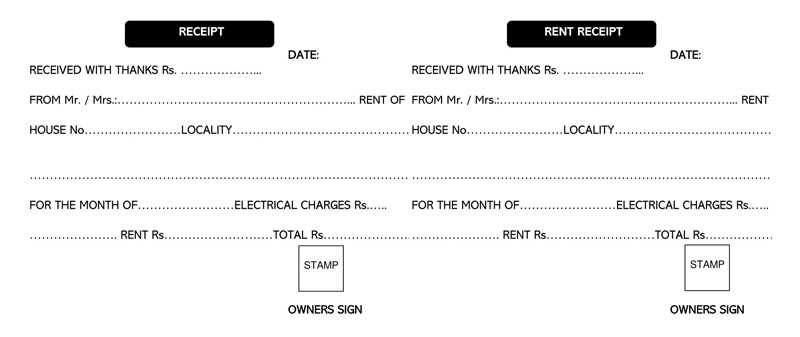

- Organization Name and Contact Information: At the top of the receipt, include the organization’s name, address, phone number, and email address. This lets the donor know where the donation is coming from and provides contact details if any follow-up is needed.

- Donor Information: Clearly mention the donor’s name, address, and contact details to ensure proper recordkeeping.

- Donation Details: Describe the donated items clearly, including the type of goods, quantity, and condition. For example, “10 used office chairs in good condition.” Avoid estimating monetary value for the donor’s tax purposes.

- Date of Donation: Include the exact date when the donation was made. This is important for tax filing and verification.

- Statement of No Goods or Services Provided: If the organization did not provide anything in exchange for the donation, include a statement like: “No goods or services were provided in exchange for this donation.”

- Signature: A signature from an authorized representative of the organization is required to validate the receipt.

Tips for Accuracy

Always be clear about the non-monetary nature of the donation. The IRS does not allow organizations to assign a dollar value to donated items. Donors must assess the value themselves for tax purposes. Double-check for any changes in tax laws that could affect the receipt template or its use.

To create an accurate in-kind receipt for donations, follow these key steps:

- Include the Date: Specify the date of the donation. This is crucial for tax reporting purposes.

- Detail the Donor Information: Include the donor’s full name, address, and contact information. This ensures the receipt is properly attributed.

- Describe the Donated Items: List each item donated, along with a brief description. Avoid using vague terms like “assorted goods” and provide as much detail as possible.

- Estimate the Value: Clearly indicate the estimated value of each item. If the donor provides an estimate, note it. If necessary, refer to an independent source (e.g., online pricing) to assign fair market value.

- State the Receipt Issuer’s Details: Provide the name, address, and contact information of your organization or the person issuing the receipt.

- Include a Disclaimer: Clarify that your organization does not provide valuations for tax purposes. Mention that the donor is responsible for determining the value of the donation.

- Sign the Receipt: Ensure that the authorized person signs the receipt. This confirms the donation was received by your organization.

What to Avoid in In-kind Receipts

- Do not assign a value to items unless it’s based on fair market value.

- Avoid providing receipts for non-deductible items, such as personal services or items not accepted by the organization.

- Refrain from including vague or non-specific descriptions of items.

Additional Tips for Donors

- If the donation is large or unusual, consider getting an appraisal to determine its value accurately.

- Always keep a copy of the receipt for your records.

To ensure your in-kind receipt meets tax requirements, make sure to include the following details:

| Item Description | Quantity | Fair Market Value | Date of Donation | Donor Information | Nonprofit Acknowledgment |

|---|---|---|---|---|---|

| A clear description of the donated item(s) or service(s) | The quantity of the donation | The fair market value (FMV) of the item or service | The date the donation was received | Donor’s name, address, and contact information | A statement acknowledging the donation without assigning a value to it |

Ensure all values are accurate and reflective of the donation. Always consult with a tax advisor to verify compliance with specific jurisdictional guidelines.

Ensure that the receipt includes the correct donor information. Missing or incorrect names or addresses can lead to issues for both the donor and your organization. Always double-check these details before issuing the receipt.

- Incorrect Donation Valuation: When donating non-cash items, it’s crucial to accurately assess the fair market value. Failing to do so or providing an inflated value can result in tax complications for the donor.

- Failure to Provide a Description of Donated Goods: Tax receipts for in-kind donations must include a clear description of the donated items. Vague descriptions can confuse the donor or tax authorities, causing delays or rejections in tax filings.

- Not Including the Date of Donation: A common mistake is neglecting to include the exact date of the donation. This is critical for both record-keeping and tax purposes, as donations must be reported in the correct tax year.

- Missing Charitable Organization Number: If your organization is a registered charity, always include your charity number. Without this, the receipt may be invalid for tax purposes.

- Not Issuing a Receipt for Donations Exceeding a Certain Value: Some tax jurisdictions require that receipts be issued only for donations exceeding a specific value. Failing to follow this can result in complications for both the donor and your organization.

- Incorrectly Issuing Receipts for Services or Time: Receipts can only be issued for tangible goods or money. Do not issue receipts for volunteer time or services, as these are not tax-deductible.

- Failure to Sign the Receipt: Ensure that the receipt is signed by an authorized representative of your organization. An unsigned receipt may not be valid for tax purposes.

By avoiding these common mistakes, you can ensure smooth processing of tax receipts and help donors benefit from their contributions. Accuracy and attention to detail go a long way in maintaining compliance and trust with your supporters.

When creating an in-kind tax receipt template, ensure it includes the following key elements for clarity and compliance:

Item Description

Each donation should be clearly listed, detailing the item or service contributed. Include specifics such as quantity, condition, and any distinguishing features to avoid ambiguity.

Valuation

Provide a fair market value for the donated items. This can be based on the donor’s assessment or third-party appraisals, especially for high-value goods.

Donor Information

Capture the full name and address of the donor. This will be useful for tax reporting purposes and helps personalize the receipt.

Receipt Date

Indicate the exact date when the donation was made to establish the time frame for tax deductions.

Organization Information

Include the organization’s name, address, and tax-exempt status, along with the official signature of an authorized person for validation.

Make sure the format is easy to read and professional. Avoid unnecessary details that may distract from the essential information required for tax purposes.