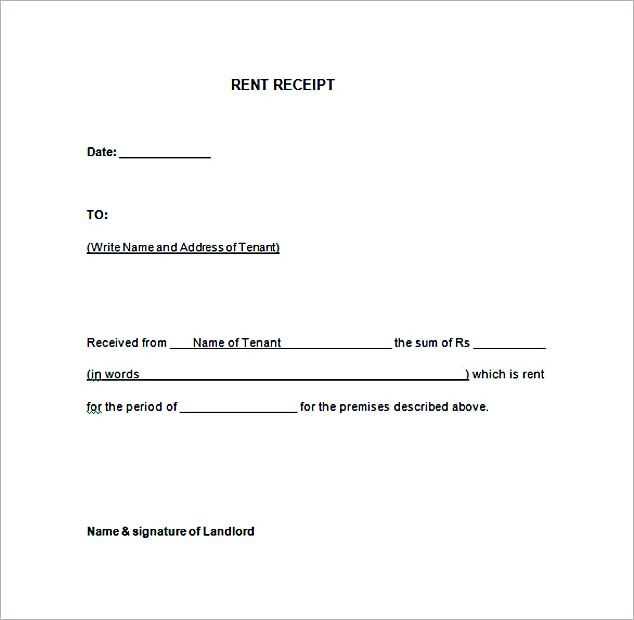

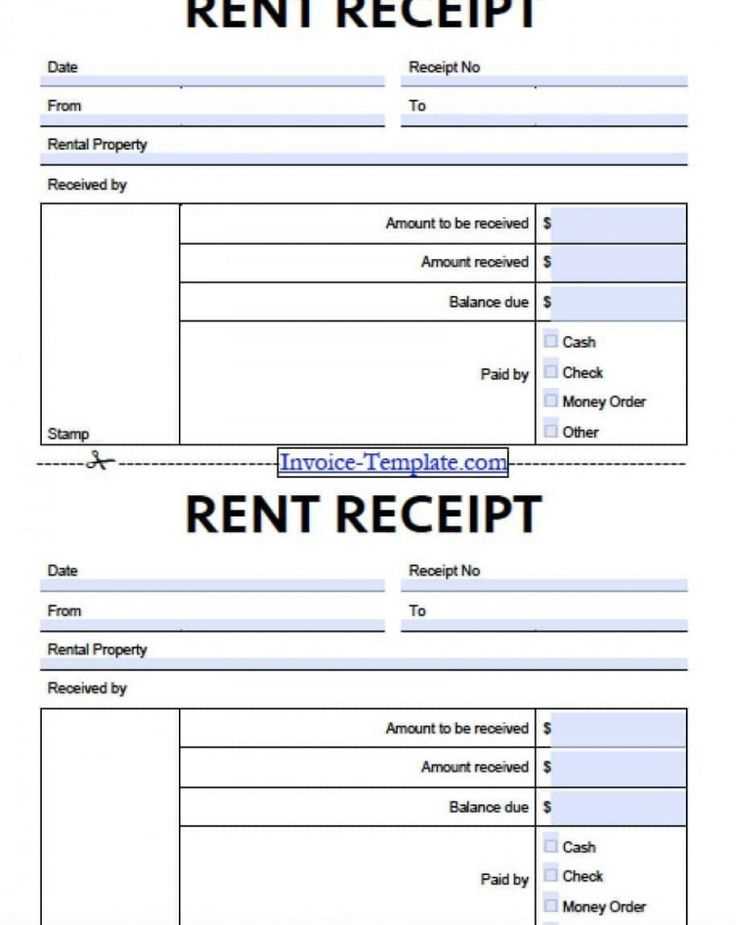

To create a rent receipt, make sure it includes specific details that protect both the landlord and tenant. First, clearly state the date of payment, as this confirms when the transaction occurred. The tenant’s name and the rental property’s address should also be present to avoid confusion. It’s essential to include the exact amount paid, and specify whether the payment covers rent, utilities, or both.

Next, always mention the payment method (e.g., cash, check, bank transfer). This provides clarity on how the tenant completed the transaction. If the rent is paid in installments, list the payment period covered by the receipt. Finally, ensure there’s a section for the landlord’s signature and contact information, making the document official and easily verifiable if needed in the future.

Sure! Here’s the revised version with reduced repetitions:

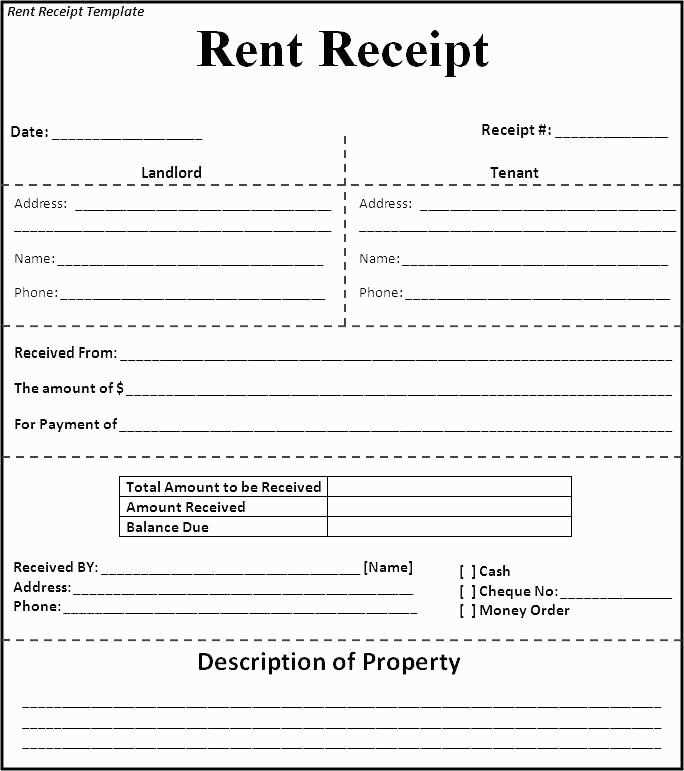

When drafting a rent receipt statement template, include key details: the tenant’s name, the landlord’s name, the rental amount, and the payment date. Clearly state the address of the rental property and confirm the payment method. Make the template flexible to accommodate various payment periods, such as monthly or yearly.

For added clarity, consider incorporating fields for late fees, security deposits, or other charges. Make sure the template includes both the tenant’s and landlord’s signatures to validate the receipt. Keep the format clean, and provide enough space for each piece of information to be easily readable.

Lastly, keep the wording straightforward, avoiding jargon. The receipt should reflect the payment made without unnecessary complexity, ensuring it can be easily understood by both parties involved.

- Rent Receipt Statement Template

For clear documentation, use a rent receipt statement template that includes all necessary transaction details. Below is a simple layout for organizing this information.

Template Details

| Information | Example |

|---|---|

| Tenant Name | John Doe |

| Landlord Name | Jane Smith |

| Amount Paid | $1000 |

| Payment Date | February 1, 2025 |

| Payment Method | Bank Transfer |

| Rental Period | February 1, 2025 – February 28, 2025 |

| Property Address | 456 Maple Ave, Springfield |

| Landlord Signature | Jane Smith |

How to Fill Out the Template

Enter the tenant’s name, landlord’s details, the exact amount paid, and the payment date. Add the rental period, payment method, and the property’s address. Don’t forget to include the landlord’s signature for verification. This will provide both parties with an accurate record of the transaction.

Ensure your rent receipt includes the tenant’s name, rental property address, and the landlord’s details. This provides clear identification of both parties involved.

Clearly state the rent amount paid, including the period covered by the payment. This prevents misunderstandings regarding the payment date or amount.

Include the date the payment was received. This helps establish a record of when the transaction occurred for both parties.

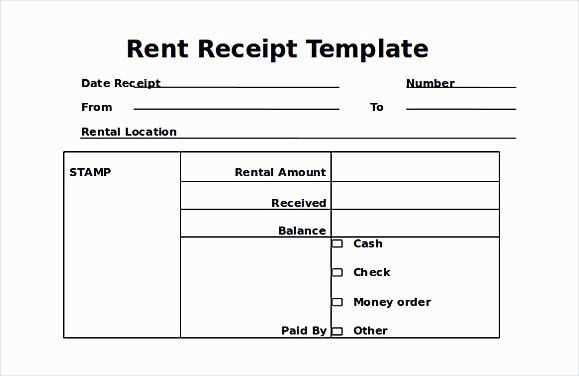

Specify the payment method used, such as cash, check, or bank transfer. This adds clarity to the type of transaction processed.

Make sure to include a receipt number for future reference, which is useful in case of disputes or inquiries about past payments.

If applicable, mention any late fees or discounts applied to the rent amount. This ensures transparency about additional charges or adjustments.

Lastly, provide a clear statement confirming the rent has been paid in full for the stated period. This gives the tenant proof of payment and helps maintain accurate financial records for both parties.

Adjust the template based on the payment method used. For cash payments, include a note confirming the exact amount paid. If the payment was made by check, specify the check number and the bank name. For bank transfers, list the transaction reference number and the transfer date.

In cases of partial payments, add a section showing the amount due after the current payment. This helps track outstanding balances. For installment plans, you can include the payment schedule and any remaining amounts due. This provides transparency and helps both parties stay on track.

When dealing with late payments, incorporate a reminder section outlining any late fees or penalties. You can also adjust the due date for each payment to reflect any changes. If the payment was made ahead of schedule, acknowledge the early payment and update the next payment due date accordingly.

For online payments, it is helpful to include a confirmation number or transaction ID. This adds security and helps with tracking. Make sure to modify any relevant fields based on the payment situation to maintain clarity and accuracy in each receipt.

Rent receipts are not just documents for confirming payments but play a significant role in legal and tax matters. Here’s how:

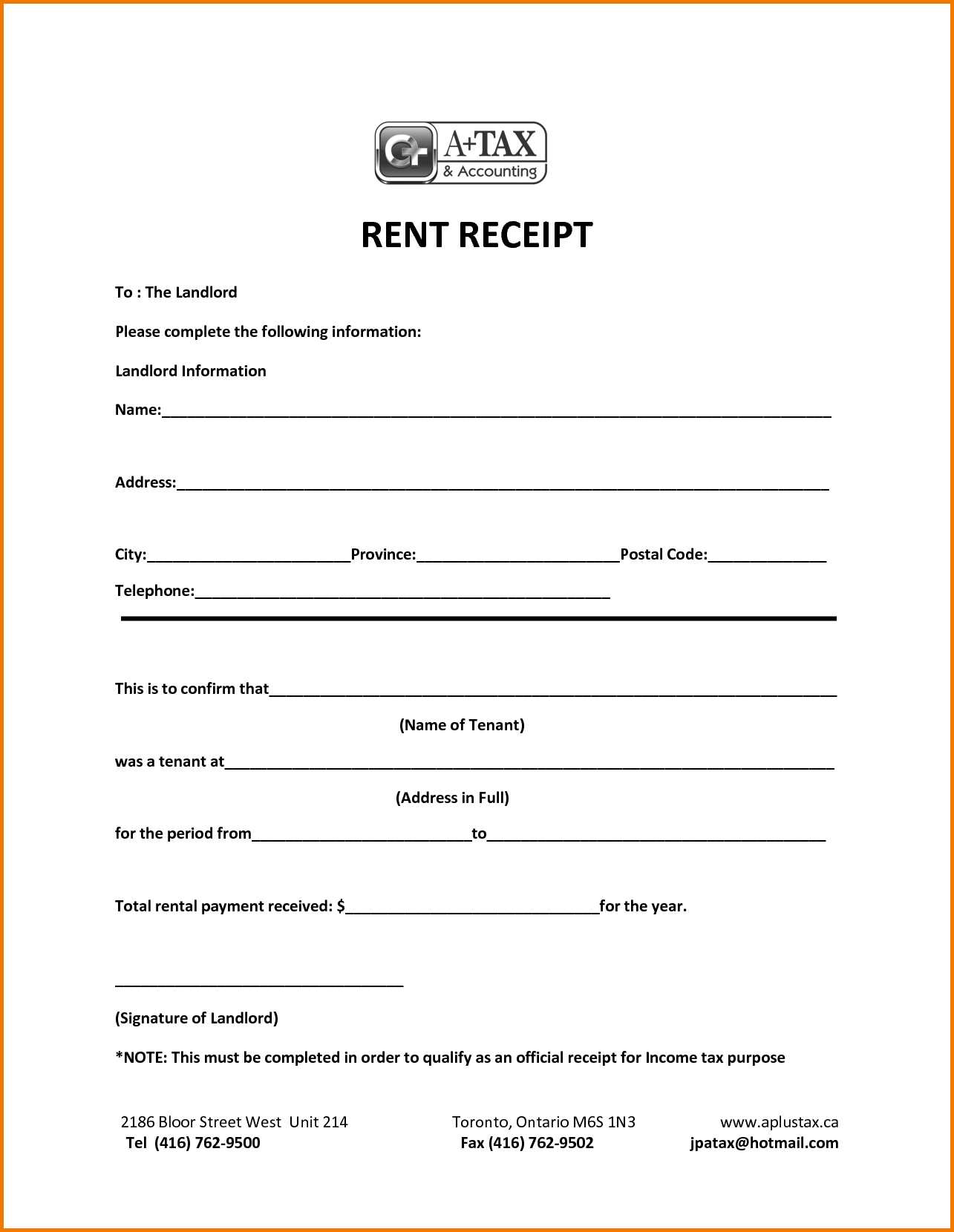

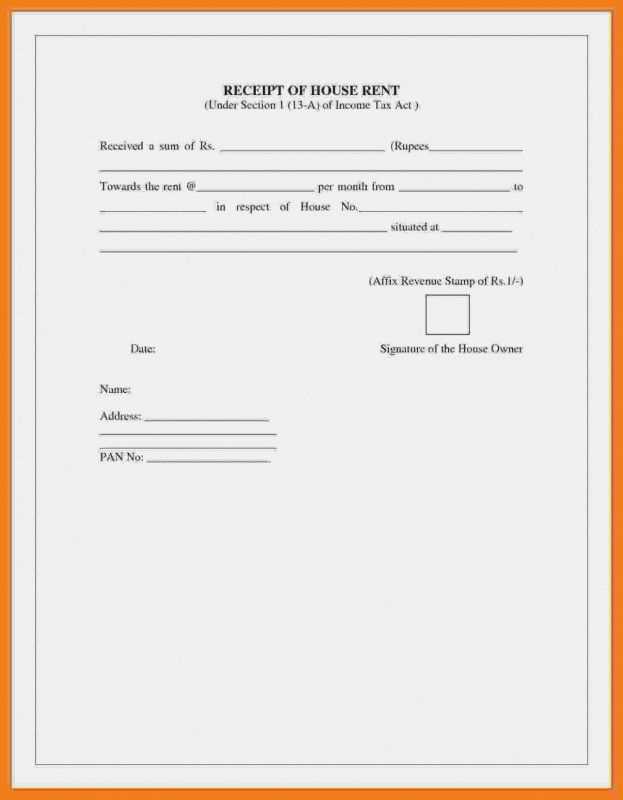

Tax Deductions for Tenants

Tenants can use rent receipts to claim deductions on their income tax. If you’re renting a property for business purposes, you can deduct the rental expenses from your taxable income. Ensure that your rent receipts contain all the necessary information, including the tenant’s and landlord’s names, rental amount, and dates of payment.

Landlord’s Tax Liabilities

Landlords must report rental income on their tax returns. Rent receipts provide a clear record of income received and can be used to substantiate tax filings. If a tenant claims deductions for rent, the landlord may be required to provide receipts during audits or disputes.

- Accuracy: Ensure all details on rent receipts are accurate to avoid complications with tax authorities.

- Documentation: Keep records of rent receipts for at least five years, as required by tax authorities.

- Legal Disputes: In case of legal disputes regarding payments, rent receipts serve as evidence in court.

Rent receipts thus hold substantial value both for tenants claiming deductions and landlords ensuring proper tax reporting. Always keep a consistent and organized record of receipts to prevent any potential legal or tax issues.

To create a rent receipt statement, ensure it includes the date of payment, tenant’s name, landlord’s name, amount paid, and payment method. Specify the rental period clearly, highlighting the start and end dates. Include the property address, and make sure the statement is signed by the landlord or property manager. This provides transparency and protection for both parties involved.

Make use of a simple format, where each key element is separated clearly. You can also include a receipt number for tracking purposes, which can be useful for both tenant and landlord in case of any future discrepancies. It is recommended to keep a copy of each statement for personal records.