For businesses or individuals who require a quick and professional way to document deposit transactions, a printable deposit receipt template is a practical solution. This template ensures that all key details are captured clearly and consistently, helping to avoid confusion or mistakes. The document typically includes sections for the depositor’s name, date, deposit amount, and the relevant transaction details.

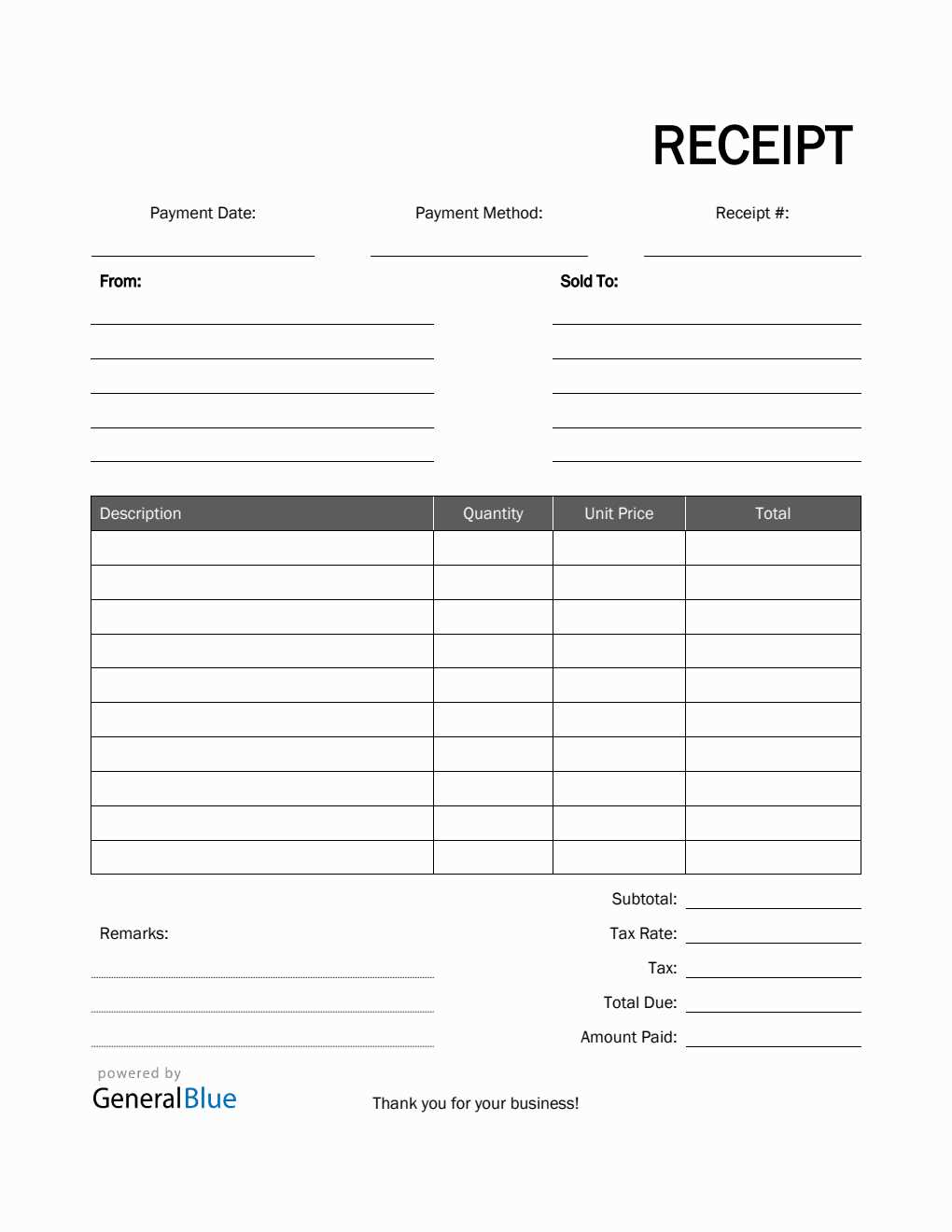

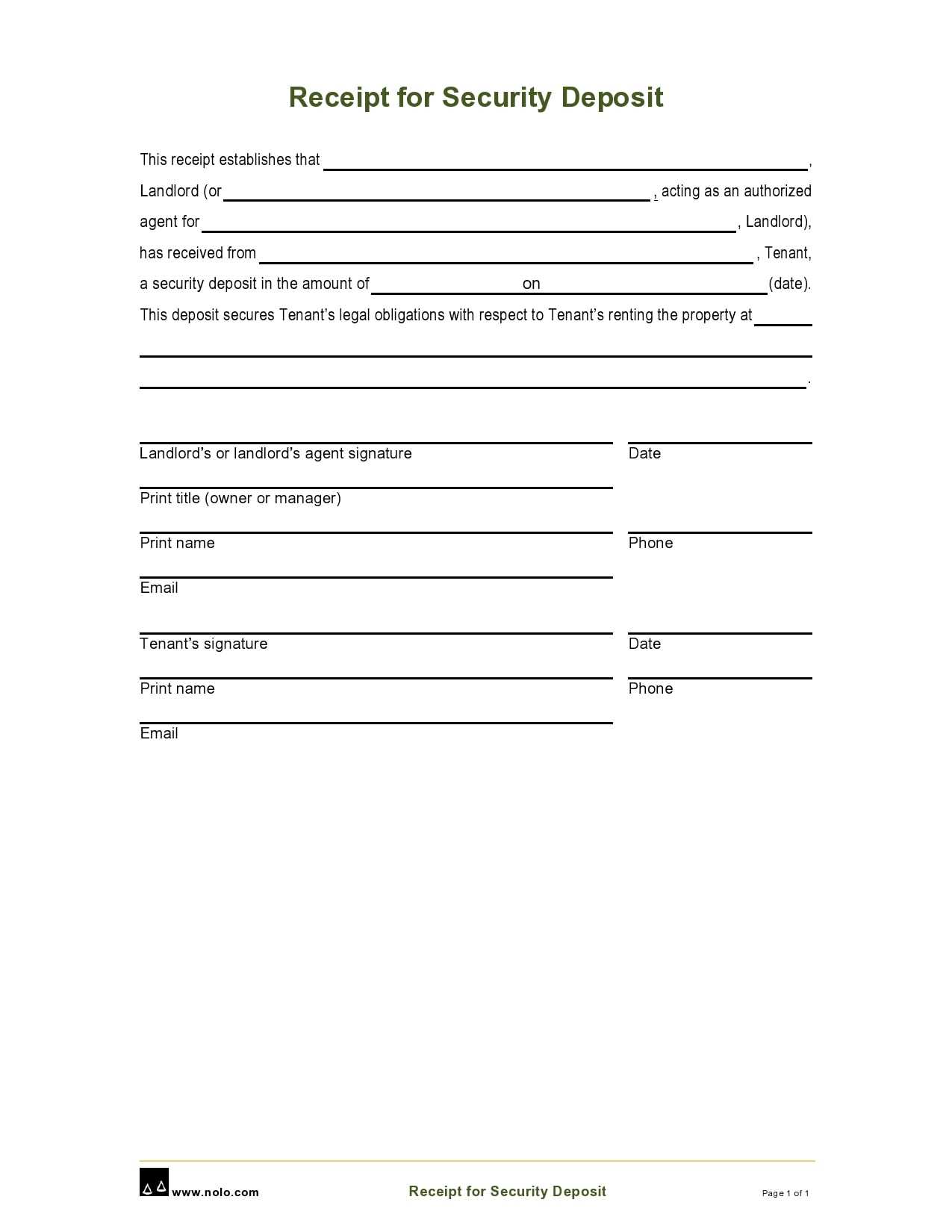

When selecting a deposit receipt template, look for one that includes space for both the payer and the receiver’s information, as well as a unique receipt number for easy tracking. A well-organized template also simplifies record-keeping, making it easier to access deposit information in the future for reference or audit purposes.

Printing these receipts directly from a template allows for customization, so you can include any specific requirements your business might have. Whether it’s a simple design or a more detailed layout, ensure the template is clear and easy to read to guarantee smooth transactions.

Here’s the corrected version with fewer repetitions:

To create a printable deposit receipt template, prioritize clarity and readability. Focus on including the necessary transaction details without cluttering the design. Ensure that the template is structured logically: start with the depositor’s name, followed by the date, deposit amount, and the account to which funds were transferred. Keep the font size legible, and avoid overwhelming the user with excessive information.

Use clear headings and separate sections for easy navigation. For example, a section for the depositor’s information, another for the deposit summary, and a final section for confirmation. This layout enhances usability and helps prevent confusion. Also, provide space for signatures or additional notes if necessary.

Lastly, ensure that the template is compatible with different printing formats. Test it on various paper sizes to ensure everything fits neatly and is easy to read when printed. With these guidelines, you’ll create a professional and functional deposit receipt template.

- Printable Deposit Receipt Template

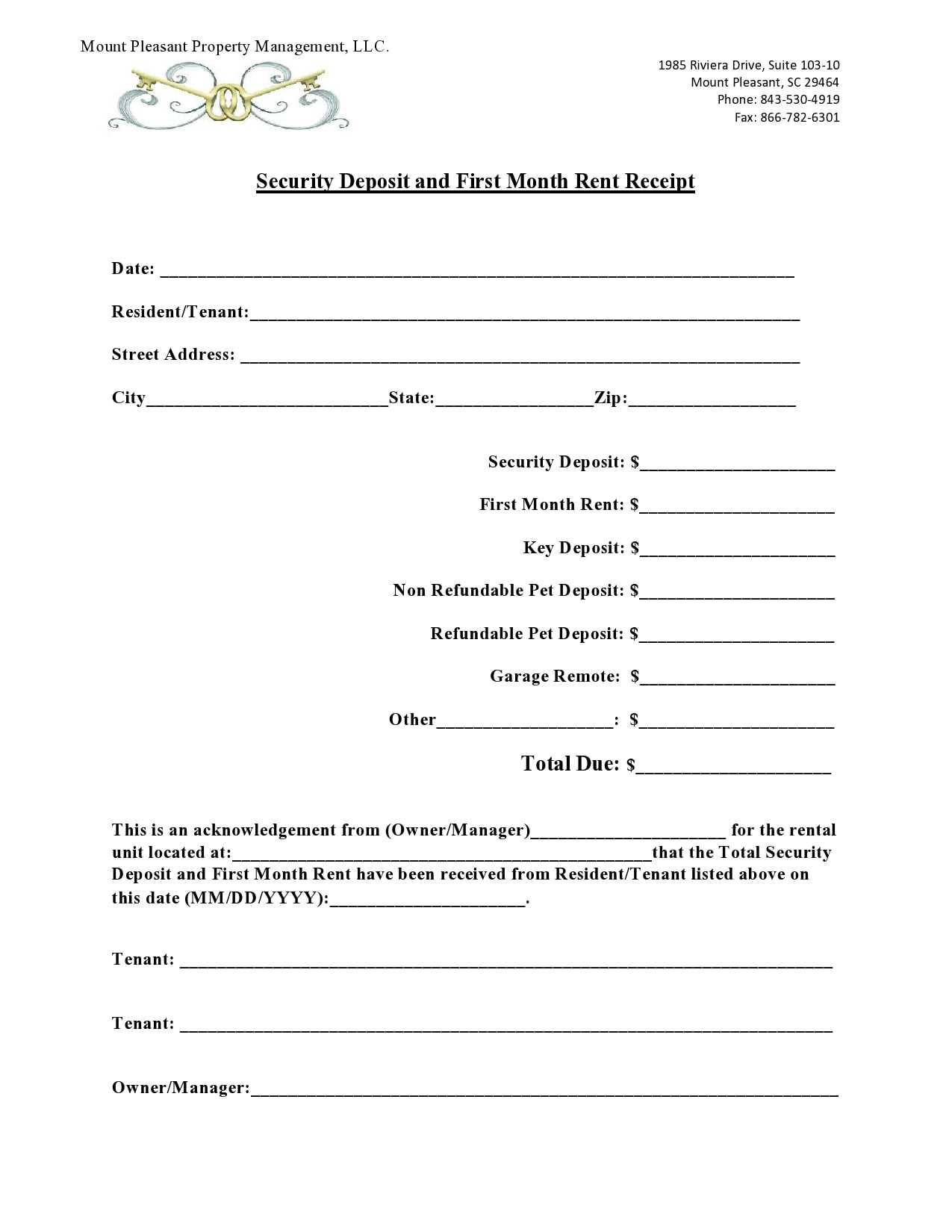

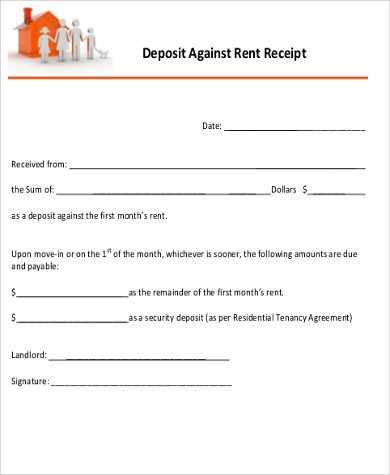

Ensure the receipt includes key details: the deposit date, the amount, and the depositor’s name. Be clear about what the deposit is for–whether it’s for a service, item, or other purpose. Include the account or transaction number for easy reference. This will help both the business and customer keep track of transactions accurately.

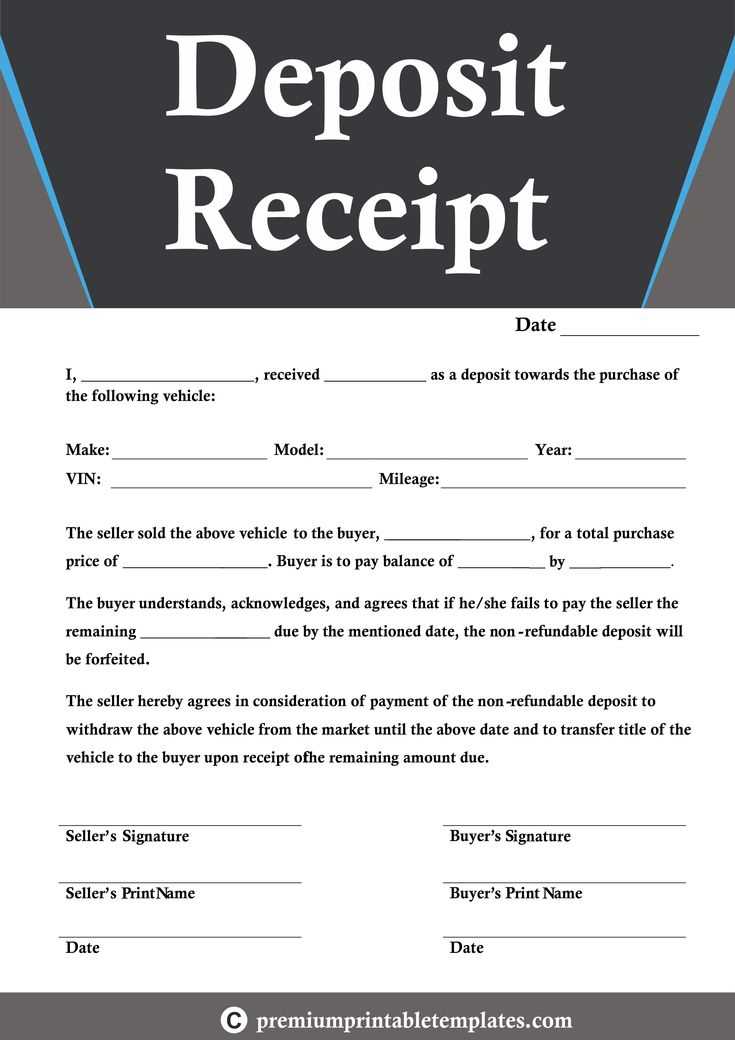

Use a clean layout with separate sections for each piece of information. Start with the heading that reads “Deposit Receipt” followed by a space for the depositor’s name and address. Then, include a box or line for the deposit amount, the date, and a short description of what the payment is for. The receipt should also have a place for the signature of the person receiving the deposit.

Consider adding a unique receipt number or code for organization and record-keeping. Make sure the font is legible and the design is simple to avoid any confusion. The receipt should be printable on standard-sized paper for easy storage.

Provide space for any additional notes, such as payment terms or future deposit details. Be sure the format supports clarity and does not overwhelm the user with excessive information. Once completed, it can be printed for both parties to keep a copy.

Choose a format that ensures clarity and simplicity for both parties involved. A well-organized deposit receipt helps avoid confusion and provides accurate documentation. Here are key factors to consider when selecting the best format:

- Clear Section Headers – Divide the receipt into distinct sections like date, amount, payer, and receiver. This enhances readability and ensures no detail is overlooked.

- Legible Font and Size – Use a simple font such as Arial or Times New Roman, with a readable size (11–12 points). This makes the receipt easily understandable and accessible.

- Include Necessary Details – Ensure all pertinent information is included: payment method, reference numbers, and any transaction notes. This prevents future disputes or misunderstandings.

- Choose Between Paper or Digital – Decide if you need a physical copy or a digital one. Digital formats (PDF or email) are convenient, while printed receipts offer immediate physical proof.

Consider Your Audience

Take into account whether the recipient prefers a hard copy or an electronic version. If the deposit involves a business transaction, a printed receipt might be more appropriate for filing. On the other hand, a digital receipt suits casual or smaller transactions for easy storage and quick access.

Keep It Simple

Avoid unnecessary details that could complicate the receipt. Stick to the basics to provide the recipient with a straightforward record of the transaction.

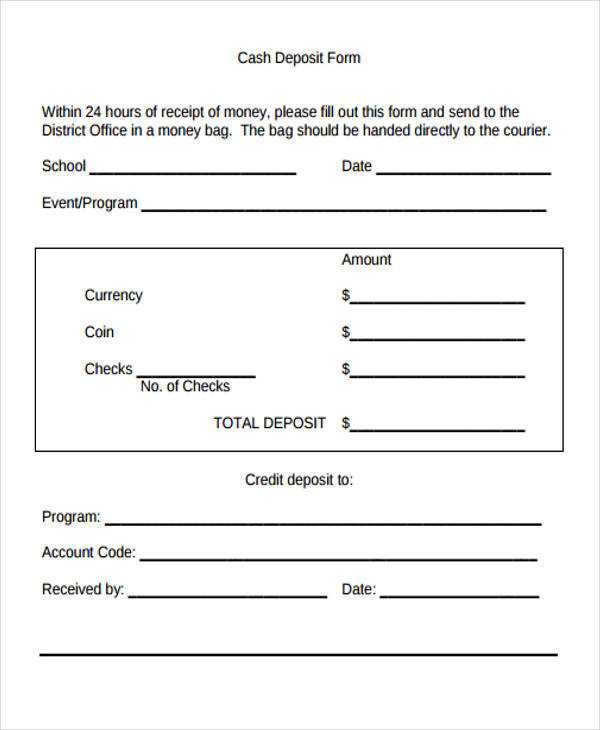

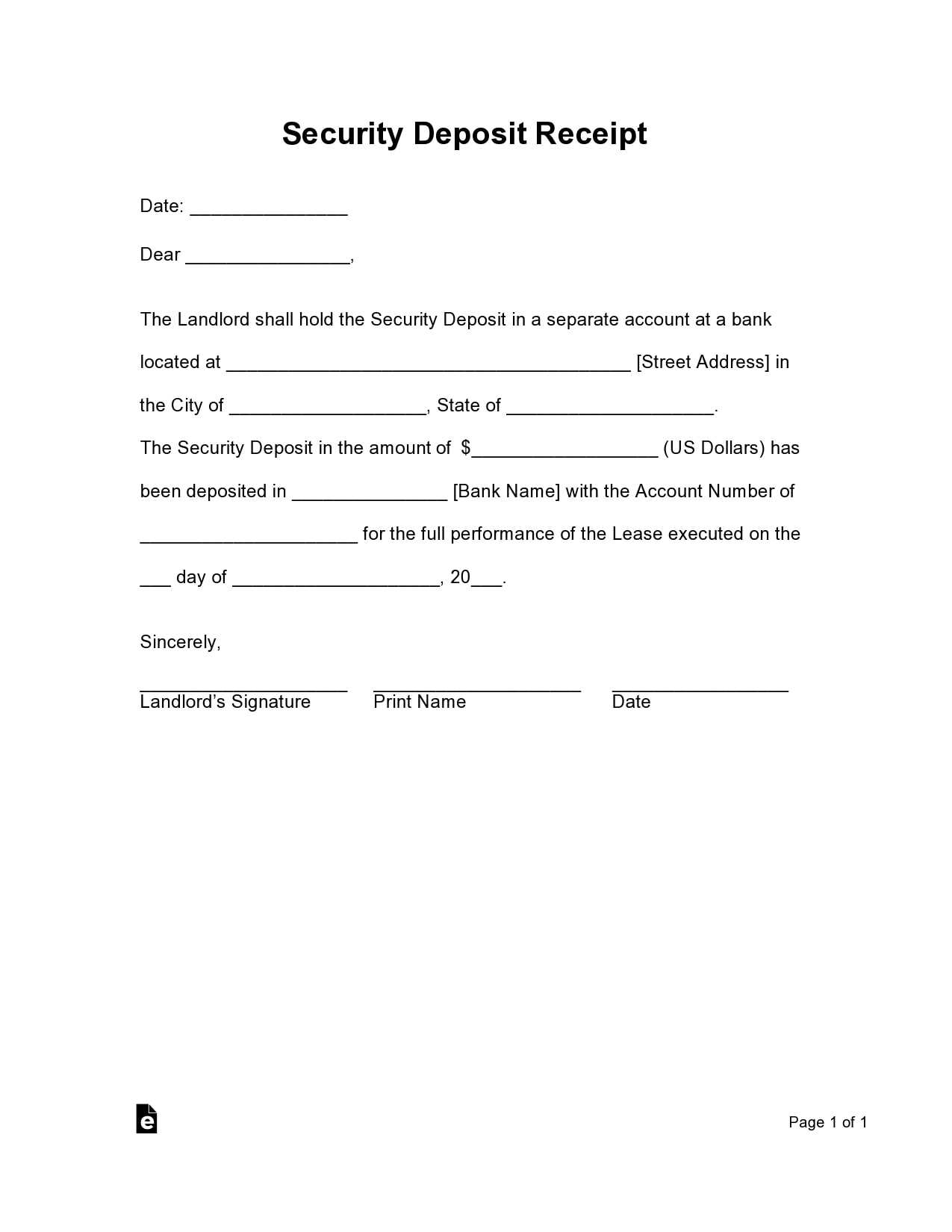

For deposits, include the deposit amount, date, payment method (cash, check, or wire transfer), and the depositor’s details. Make sure the template includes a unique transaction reference number for tracking purposes.

For sales transactions, list the product or service, quantity, unit price, any discounts applied, taxes, and the total. It’s helpful to include a clear breakdown of each cost element for easy understanding.

Refund templates should specify the original purchase details, the refund amount, and the reason for the refund. If the refund method differs from the original payment (e.g., credit card to cash), make sure to note this change.

For partial payments, include the total amount, paid amount, and remaining balance. If there are any additional fees or interest due to partial payments, display these clearly to avoid confusion.

For online transactions, include the payment processor’s name, transaction ID, and a confirmation number. This ensures that customers can verify the payment if needed.

To make your templates more user-friendly, use a clean layout. Prioritize key transaction details, such as amounts and payment methods, so they stand out and are easy to locate.

Ensure all details on the receipt template are correct before printing. Double-check the deposit amount, date, and other necessary information to avoid errors.

Select the right printer and paper size for the template. Typically, A4-sized paper is ideal, but adjust based on your specific needs. Make sure the printer settings match the selected paper size.

Preview the receipt on your computer to ensure proper formatting and alignment. If needed, adjust margins, font size, and spacing for a clean and readable layout.

Proceed to print the receipt. Choose the best quality print option to ensure all text and details are clear and legible on the page.

After printing, carefully review the receipt for any errors. If any issues arise, correct them and print a new copy as needed.

If sharing digitally, scan the printed receipt or save it as a PDF file. This makes distribution through email or other digital platforms simple and quick.

Store the printed receipts safely. For easy retrieval, organize them either in physical folders or digitally in well-labeled files.

Reduce Redundancy while Maintaining Clarity in Deposit Receipts

To improve the readability of a printable deposit receipt template, focus on reducing repetitive terms without losing clarity. Keep the language simple and to the point. For instance, replace long phrases with concise wording that still conveys the necessary details. Here’s how to streamline the text:

Key Sections to Optimize

Consider the following sections when formatting a deposit receipt template:

| Section | Improved Wording |

|---|---|

| Deposit Details | Specify the exact amount and any applicable fees in a straightforward manner, avoiding unnecessary qualifiers. |

| Recipient Information | Instead of repeating “Name of the recipient” and “Recipient’s full name,” use a simple “Recipient’s Name.” |

| Date and Time | Use “Date” and “Time” alone instead of “Date and time of deposit” to simplify the phrasing. |

Practical Tips

Incorporate these practices for greater efficiency:

- Limit descriptive words that don’t contribute significant meaning.

- Ensure all essential details are clear and visible without overwhelming the reader.

- Test readability by having someone unfamiliar with the form review it for comprehension.