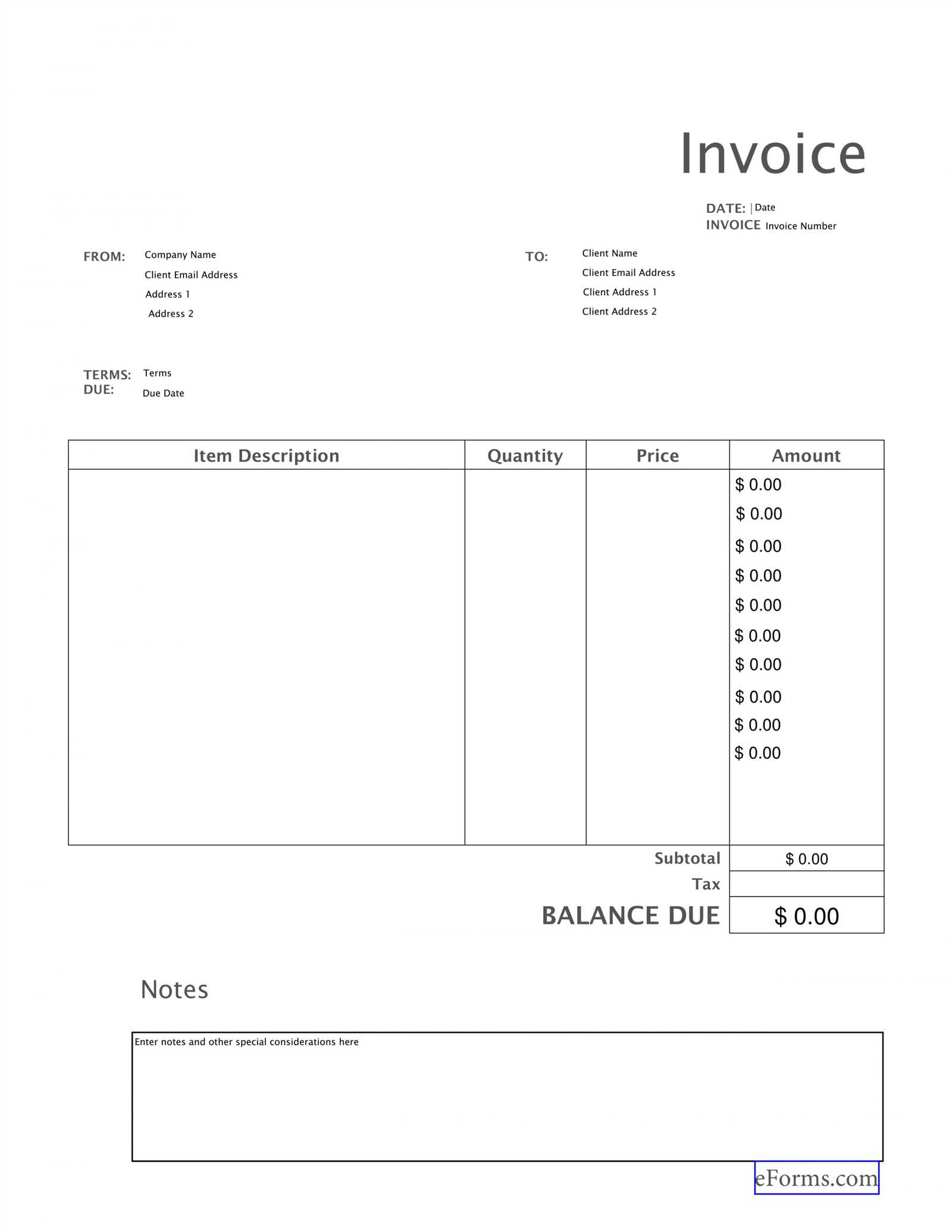

Creating a receipt for a paid invoice is straightforward when using the right template. Ensure that the document clearly states the payment has been received in full, listing the transaction details such as the invoice number, payment method, date of payment, and amount. This transparency helps both parties keep accurate records.

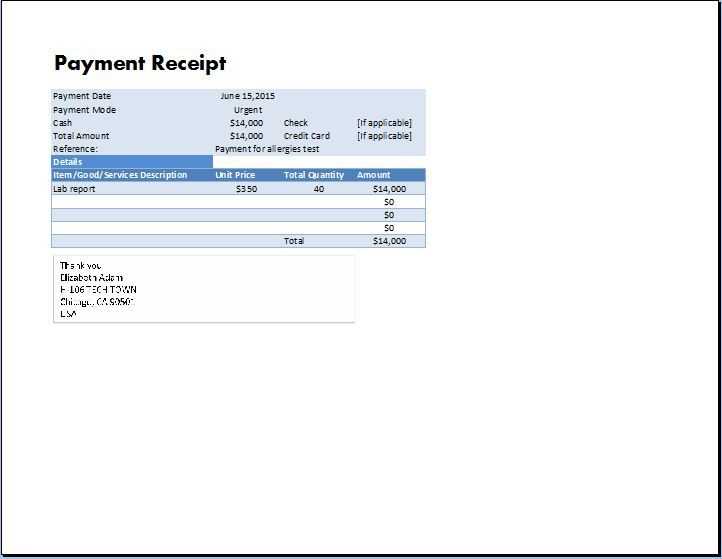

The key elements in a receipt include a clear heading, like “Payment Receipt” or “Paid Invoice,” followed by the details of the transaction. Include fields for the payer’s name, address, and contact information, as well as any reference numbers that might be relevant. Additionally, be sure to specify the payment method–whether by credit card, bank transfer, or cash–along with the exact payment date.

Incorporating a simple summary of the services or goods paid for will also add clarity. This section ensures that the customer knows exactly what they’ve paid for, preventing any confusion or future disputes. The receipt should close with a thank-you message or a note confirming the transaction is complete, reinforcing good customer relations.

Here’s the revised version:

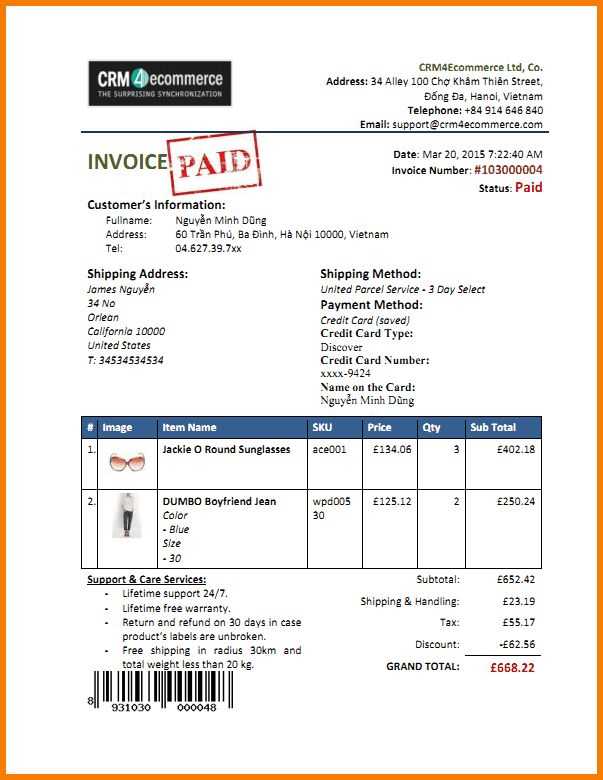

Make sure the receipt clearly states the payment status. Include the words “Invoice Paid” in bold at the top, directly beneath the title. This highlights that the transaction is complete.

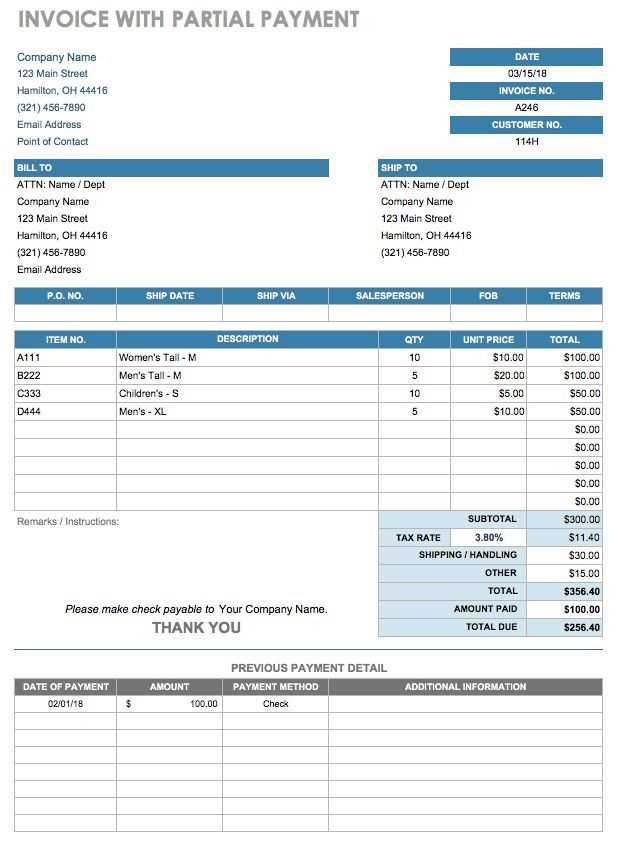

Clearly display the invoice number, payment method, and date of payment. This should be in a section beneath the payment status, with each detail on a separate line for easy readability.

In the payment section, specify the amount paid and any taxes or additional charges separately. This ensures the user knows exactly what they paid for, down to the last detail. It’s crucial to have these numbers in distinct sections so that it’s easy to verify and match with the original invoice.

If applicable, mention any discounts or adjustments applied to the final amount. Providing a breakdown of this can avoid confusion and ensure transparency.

End with a thank you note or other positive language to maintain a professional and friendly tone.

Invoice Payment Option Receipt Template

Designing a Clear Payment Confirmation Template

Key Elements to Include in Your Paid Receipt

Choosing the Right Format for Your Payment Receipt

Customizing the Template for Your Business Branding

Ensuring Compliance with Legal and Tax Requirements in Receipts

Automating the Receipt Process for Increased Accuracy

Start by organizing your payment receipt with clarity and precision. Each template should include essential details like the payment date, amount, method (credit card, bank transfer, etc.), transaction reference number, and the payee’s information. A clear breakdown of services or products paid for enhances the document’s transparency.

The design should prioritize readability, with bold headings and clean lines separating sections. Use appropriate spacing to avoid clutter. Ensure that key fields, such as “Paid Amount” and “Payment Method,” stand out. Don’t forget to incorporate your business logo and contact information to personalize the document and make it easy for clients to get in touch if needed.

The format you choose should be practical and accessible. While PDF is a popular format for invoices due to its universality, consider including an option for digital receipts in formats like CSV or Excel, especially if your clients request or manage their financial records in a spreadsheet format. Offering both paper and electronic formats provides flexibility and convenience.

Customize the receipt template to reflect your brand. Adjust colors, fonts, and logos to align with your business identity. This small branding detail adds professionalism and reinforces your brand’s presence with every transaction. Ensure that your receipt template also complies with any specific regulations required by your industry or jurisdiction.

Double-check legal compliance with local regulations, such as VAT or sales tax requirements. Your receipt should clearly show tax rates and the total tax paid. It is also necessary to include any mandatory legal disclaimers, depending on your location. Failing to comply can lead to issues during audits or legal disputes.

Automation can significantly reduce human error in payment processing and receipt creation. Using invoicing software can help generate receipts instantly upon payment confirmation, ensuring that all necessary details are correctly captured and formatted. Automation also allows for faster processing and the ability to track receipt histories efficiently.