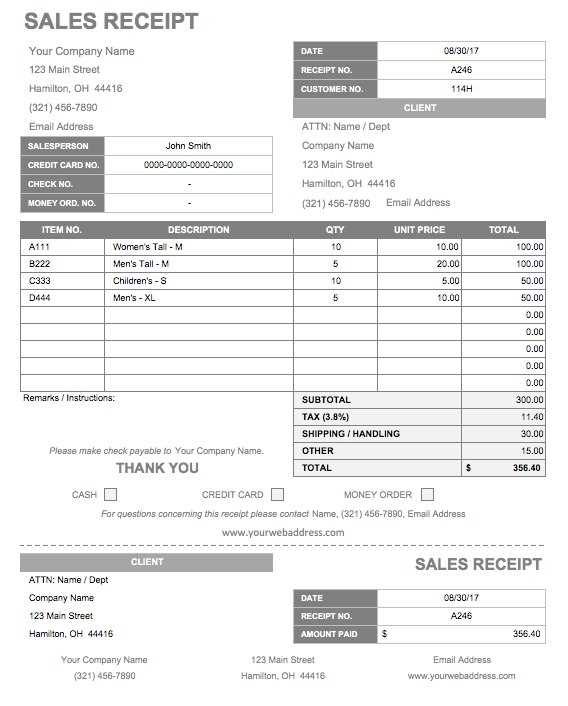

For smooth transactions, use a sales receipt template that includes a built-in sales tax feature. This ensures accuracy in calculating the total cost and helps avoid manual errors. A well-designed template automatically applies tax rates, saving you time and effort.

The template should allow easy input of item details, quantities, and prices. Sales tax should be calculated automatically based on your location’s tax rate. Customizing the tax percentage ensures that it aligns with local regulations and avoids mistakes in tax calculations.

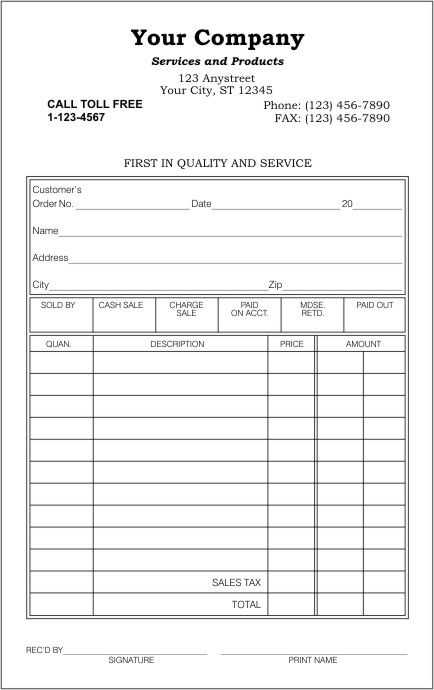

Look for a template that also provides fields for buyer information, transaction date, and payment method. This level of detail ensures both parties have a clear record of the sale. With the tax feature, you can confidently track your sales and maintain accurate records for accounting purposes.

Here’s the corrected version:

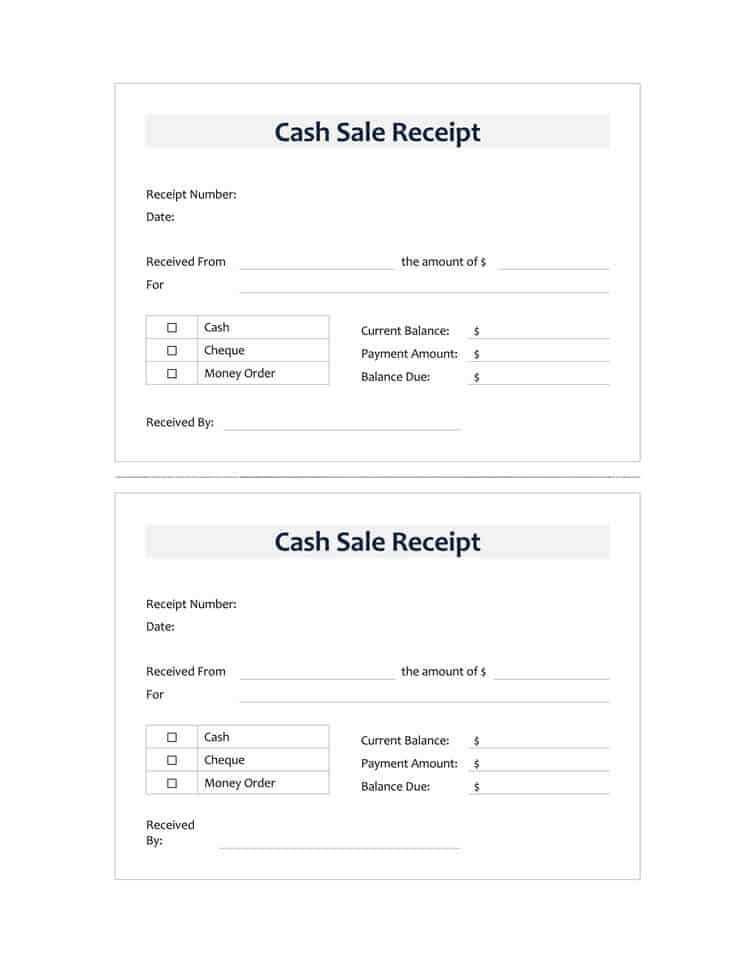

Use a table in your template to calculate sales tax directly. Add a row for the item cost, another for tax rate, and a final row for the total amount including tax. Set formulas in the table to automate tax calculations based on the entered values. This ensures accuracy and saves time when creating receipts.

Example: For a product priced at $50 and a sales tax rate of 10%, the total price would automatically update to $55 when you enter these values. This simple setup keeps the process streamlined and error-free.

Make sure to specify the correct tax rate for your region. Adjust the formula to reflect any changes in tax regulations. Customizing your template like this will enhance its usability and accuracy for everyday transactions.

- Sales Receipt Template in Word with Tax Feature

Utilize a Word template with a built-in tax feature to calculate and display sales tax automatically. Simply enter the sale amount and the applicable tax rate. The template will update the total cost with the tax added, reducing errors and time spent on manual calculations.

Customizing the Tax Rate

Adjust the tax rate in the designated field to match local tax laws. Once updated, the template will recalculate the subtotal and total amounts, ensuring tax is applied correctly to each sale.

Benefits for Businesses

The tax feature streamlines receipt creation and ensures compliance with tax regulations. It also makes it easier to maintain accurate financial records and provides clarity for customers, avoiding confusion over tax calculations.

Open Microsoft Word and create a new document. Use a table to structure your receipt layout, ensuring you have separate columns for item descriptions, quantities, unit prices, subtotal, tax rate, and total amount. This helps keep all necessary information clear and organized.

Next, input the basic receipt details like business name, contact information, and the date of the transaction. You can adjust the table size to fit these details along with the tax calculation fields.

To include tax calculations, use Word’s formula feature. In the tax rate column, enter the formula that multiplies the subtotal by the tax rate. For example, if the subtotal is in cell D2, enter the formula “=D2*0.07” (for a 7% tax rate). The result will show the tax amount based on the subtotal.

In the total column, use a similar formula to add the subtotal and the tax. For instance, “=D2+E2” where D2 is the subtotal and E2 is the tax amount. This will automatically calculate the final total including tax.

Finally, save the template for future use, and you now have a sales receipt template that includes automatic tax calculation, ready to be customized for different transactions.

To adjust tax rates in a Word receipt template, follow these steps:

1. Open your receipt template in Microsoft Word.

2. Locate the tax field where the sales tax is calculated. This may be a cell in a table or a text box, depending on the template.

3. Highlight the tax field and enter the new tax rate as a percentage. For example, if the sales tax rate is 8%, enter “8%” in the tax calculation field.

4. If your receipt includes multiple tax rates (e.g., local and state taxes), create separate fields for each rate. You can add these fields by inserting new rows in the table or new text boxes, then calculating the taxes accordingly.

5. Update the total amount to reflect the new tax rate. Word’s formula feature can help with this if your template includes automatic calculations. To do so, select the cell where the total appears, go to “Table Tools” > “Layout,” and use the “Formula” option to recalculate based on the new tax rate.

6. Save the updated template. If you need to use this modified version frequently, save it as a new template to ensure you always have the correct tax rate applied.

Here’s an example of a tax table with customizable rates:

| Item | Price | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

| Item 1 | $50.00 | 8% | $4.00 | $54.00 |

| Item 2 | $30.00 | 8% | $2.40 | $32.40 |

| Total | $6.40 | $86.40 |

Adjusting the tax rate in Word receipts ensures accuracy in your documentation and helps maintain consistency across transactions.

Display the tax amount clearly on the receipt, ensuring it is easy to identify. Separate the tax from the total price to avoid confusion.

- Include the applicable tax rate next to the tax amount, specifying whether it is a sales tax or another type of tax.

- Indicate the tax amount with a distinct label such as “Sales Tax,” “VAT,” or “GST” for clarity.

- Ensure the total amount, including tax, is clearly distinguished from the subtotal for transparency.

- Provide a breakdown of the tax calculation, especially if multiple tax rates are applied.

Position the tax information near the bottom of the receipt for easy review. Use bold or larger font sizes to make tax details stand out. This reduces the chance of errors or confusion for both the customer and the business.

- Check if local regulations require specific formatting for tax information and ensure compliance.

- Offer additional tax details like the tax registration number or jurisdiction, if necessary.

Sales Receipt Template Word with Sales Tax Feature

Include the sales tax directly in your Word sales receipt template to provide clear, transparent pricing for your customers. Start by adding a tax section below the itemized list of products or services. Calculate the tax by applying the relevant percentage to the total price of the items. Use formulas or manual input for accurate calculations.

Example: If your total before tax is $100 and your local sales tax rate is 8%, the tax amount will be $8, bringing the total to $108. Clearly display both amounts in the receipt template, labeling them as “Subtotal” and “Sales Tax.” The final amount due should be easily distinguishable.

To make the template more flexible, ensure that the sales tax field can be updated easily based on varying rates. This allows the template to stay relevant across different locations or as tax laws change.

Tip: Use a table structure to align the items, subtotal, sales tax, and total amount for better organization. Customize the layout to suit your business’s branding and needs, while keeping the focus on clarity and precision.