A deposit receipt template in PDF format provides a straightforward and standardized way to document financial transactions. It is particularly useful for businesses, individuals, or organizations handling deposits for goods, services, or rent. The template ensures that both parties involved in the transaction have a clear, written record of the deposit details, including the amount, date, and purpose of the payment.

Using a ready-made deposit receipt template in PDF format saves time and avoids errors compared to creating one from scratch. The PDF format is secure and easy to share, allowing recipients to save or print the receipt without issues. To make the template work for you, simply fill in the necessary fields such as payer details, deposit amount, and any reference number related to the payment.

When customizing the template, keep it clear and concise, ensuring all critical information is included. This will help both parties refer back to the document whenever needed. You can adjust the design and content to meet specific needs, making it suitable for various industries or personal transactions. With a PDF deposit receipt template, you maintain professionalism and transparency in your financial dealings.

Here’s the revised version:

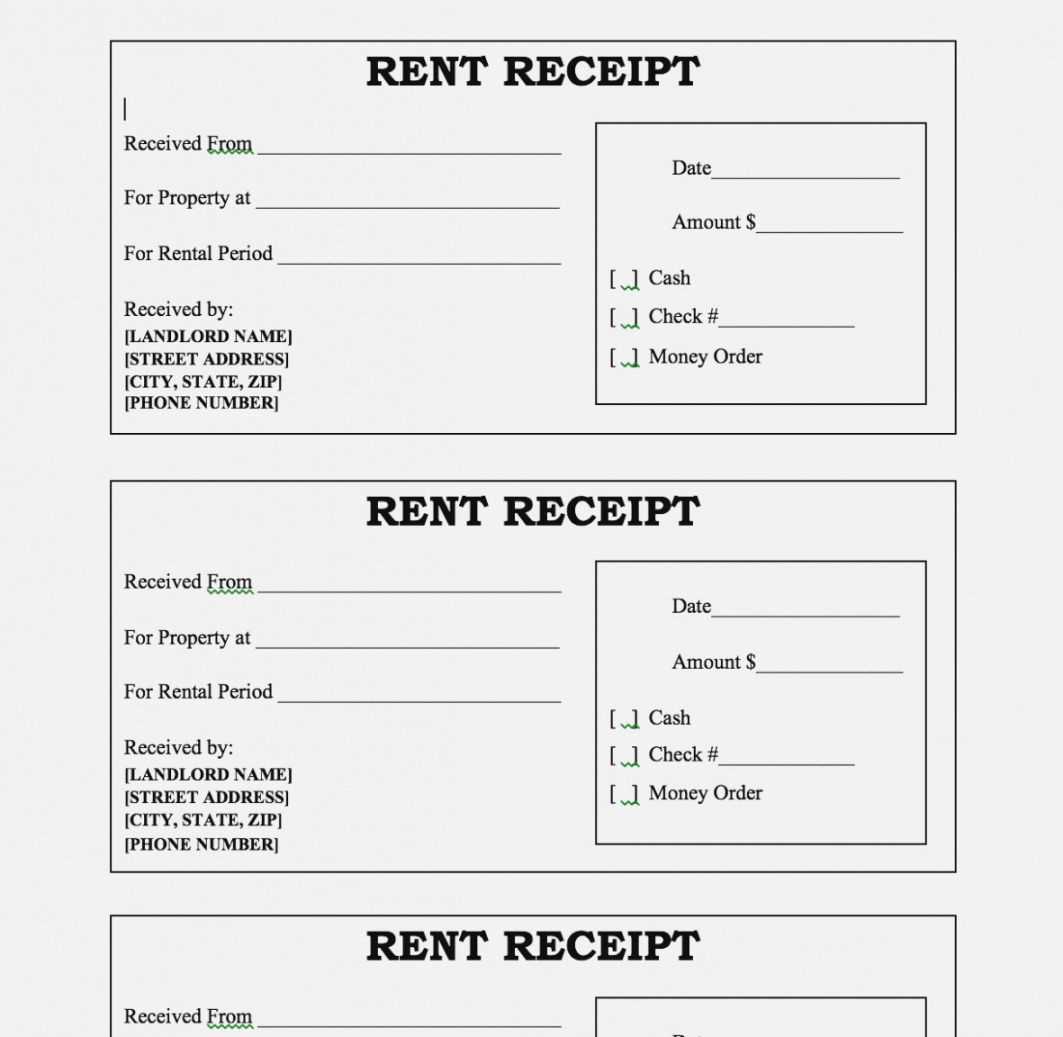

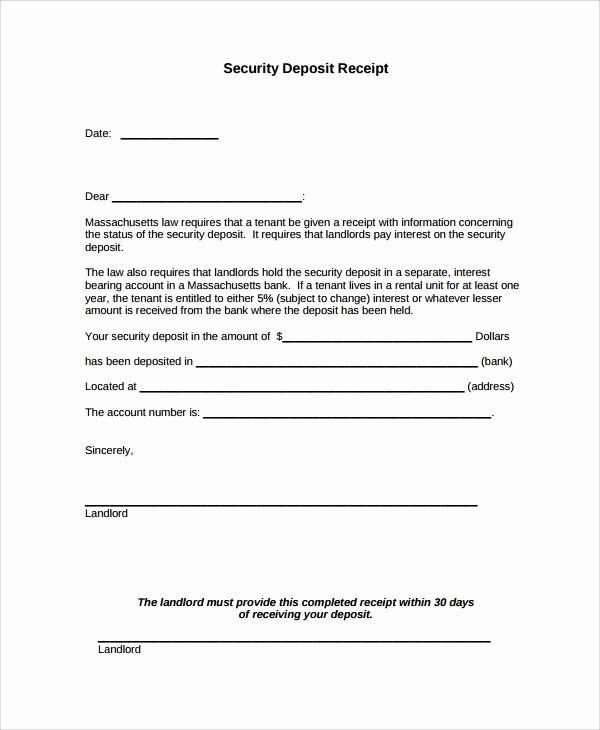

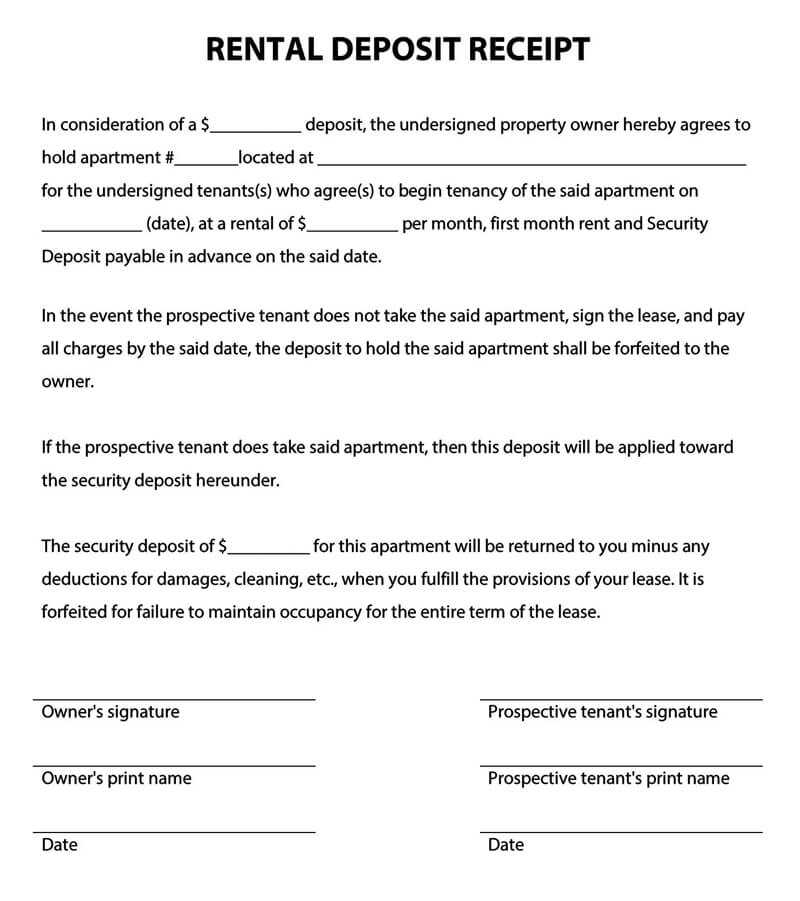

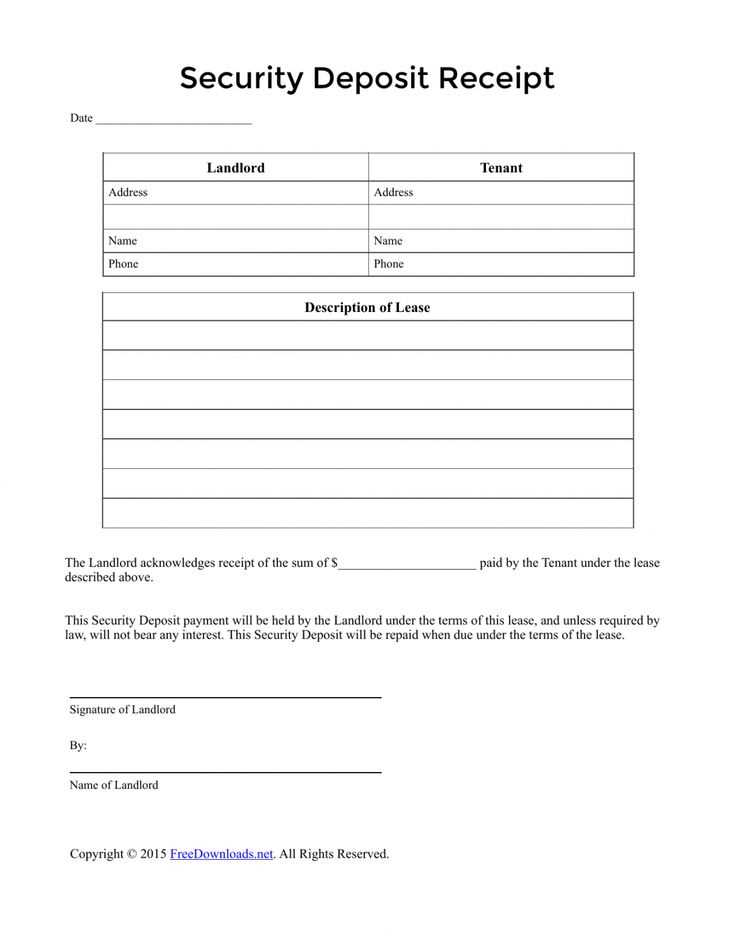

Ensure the deposit receipt template is clear and includes the necessary details for both parties. Begin by specifying the transaction amount, followed by the payer’s name and contact information. The template should also highlight the recipient’s details, including the organization or individual receiving the deposit. Add a section for the payment method and any relevant reference number, which helps in tracking the transaction. Include a date field to mark the time of payment. Make sure the terms of the deposit are outlined, including conditions for refunds or cancellations, if applicable. Finally, provide a signature area for both parties, confirming the agreement.

By structuring the document this way, you create a transparent and reliable record of the deposit, reducing confusion in future interactions.

- Deposit Receipt Template in PDF Format

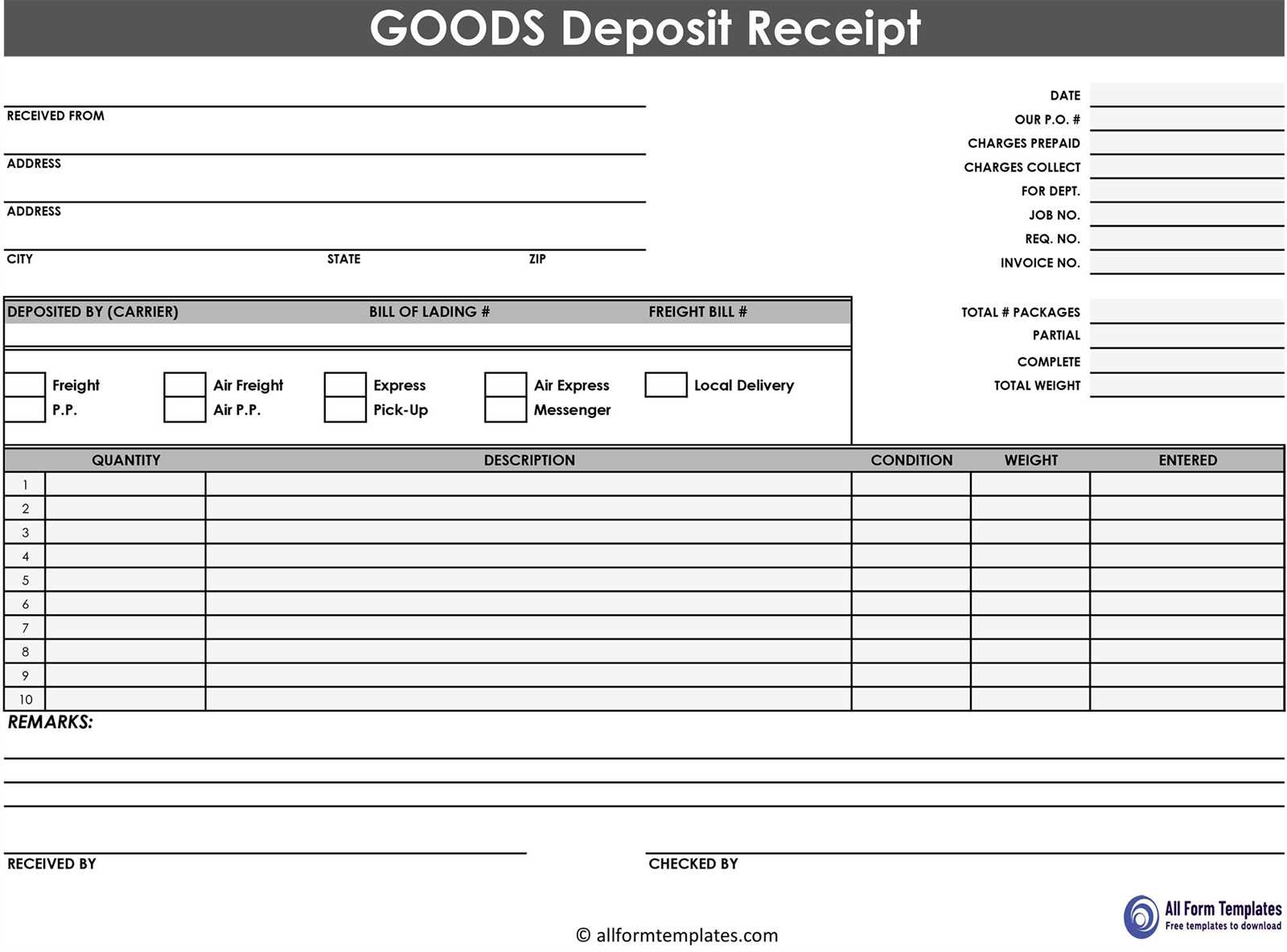

To create a deposit receipt template in PDF format, focus on including key details that ensure clarity and ease of use. Begin with a clear title, such as “Deposit Receipt” at the top of the page. Include the depositor’s name, date of deposit, amount, and method of payment (e.g., cash, check, bank transfer). Provide space for both the depositor’s and recipient’s signatures to confirm the transaction.

For a professional design, use a simple table to organize the information, separating each data point into distinct columns. You may also want to include the transaction ID or reference number for tracking purposes. Use a clear and legible font to ensure that all the information is easily readable.

Consider offering an option to include additional details such as the purpose of the deposit or any relevant notes. This can help both parties keep a detailed record of the transaction. Make sure the template is easily fillable and can be customized to suit different types of deposits.

Once you’ve created the template, save it as a PDF to ensure it’s easily shareable and can be printed without losing formatting. This format is ideal for businesses, financial institutions, or any other organization that requires receipts for deposits.

Creating a deposit receipt in PDF format is straightforward. Follow these steps for a smooth process:

- Choose a PDF creation tool: Select a PDF editor or generator like Adobe Acrobat, Google Docs, or an online tool such as PDFescape or Smallpdf. These platforms allow you to create and save documents directly in PDF format.

- Design your receipt layout: Start by structuring the receipt. Include essential details such as:

- Deposit amount

- Date of transaction

- Depositor’s name

- Bank account or reference number

- Deposit method (e.g., cash, check, transfer)

- Confirmation number (if available)

- Input the data: Fill in the fields with the relevant deposit details. You can either manually input this information or use a template with placeholders for easy completion.

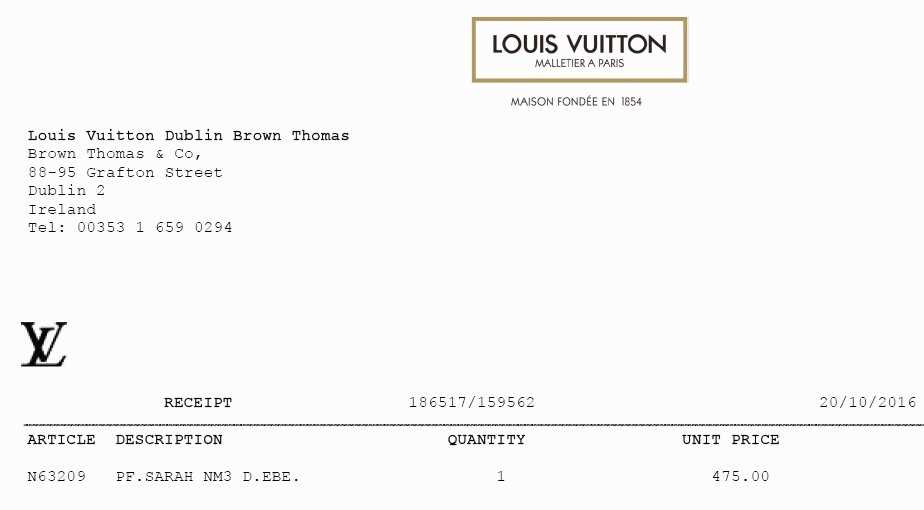

- Customize your receipt: Add a header with the name of your business or financial institution, and optionally, include a logo. You may also want to include your contact information and terms related to the deposit, such as policies or conditions.

- Convert to PDF: After completing the design and filling out the necessary details, save or export the document as a PDF. Most PDF editors or word processors have an option to “Save As” or “Export” to PDF.

- Review the document: Before finalizing, double-check the accuracy of all the information. Ensure there are no typos or missing details. Consider using the preview feature in your PDF editor to check how it looks.

- Share or print the receipt: Once satisfied, you can email the receipt directly to the depositor or print it for physical distribution.

This method allows you to create professional and accurate deposit receipts in PDF format for any financial transaction.

Ensure the receipt includes the date of the transaction. This helps both the payer and the recipient keep track of when the deposit occurred. Make sure it’s displayed clearly at the top of the document.

Include the name of the payer and the recipient’s name or company name. This allows both parties to verify the identities involved in the transaction.

The amount deposited should be listed in both numerical and written formats. This reduces any chance of confusion and provides clarity for future reference.

Include a unique transaction ID or receipt number. This will help both the payer and the recipient easily identify the deposit if there is ever a need to reference it later.

Incorporate the method of payment, such as whether the deposit was made through a bank transfer, credit card, or other means. This gives further clarity about how the deposit was processed.

The reference number from the transaction should also be listed. It can be helpful for both parties in case any questions arise or if there’s a need to verify the deposit.

Make sure to include any applicable fees that were deducted from the deposit, especially if it involves a service or transaction fee. This transparency will prevent any confusion or disputes later on.

If the deposit is related to a specific invoice or agreement, make sure to note that. Providing a reference to the contract or invoice number makes it clear what the deposit pertains to.

Finally, provide contact information for both parties involved. This can include phone numbers or email addresses, which ensures a direct line of communication if needed.

For quick access to free deposit receipt templates in PDF, visit reliable online platforms offering pre-designed forms. Websites like PDFEscape, JotForm, and Template.net have a wide range of free PDF templates for deposits. These templates can be easily customized to fit your specific needs without requiring advanced software.

Top Websites for Free Deposit Receipt Templates

Template.net offers various free options that are user-friendly and printable. You can download them directly in PDF format and fill them out electronically or by hand. Another useful resource is PDFEscape, which not only provides templates but also lets you edit the PDF files before saving them.

Additional Resources for Customizing Your Templates

If you need to tailor your deposit receipt, consider using online PDF editors like Smallpdf or Adobe Acrobat Reader. These platforms allow you to modify pre-existing templates with ease, adding details such as date, amount, and payer information. Once edited, you can download the updated document as a PDF for storage or printing.

To create a functional and clear deposit receipt template in PDF format, use a simple structure that captures all necessary details without clutter. Focus on the essentials: transaction date, payer and payee details, amount, and purpose. This ensures that the receipt serves its primary purpose effectively and is easy to understand for all involved parties.

Basic Elements to Include

| Field | Description |

|---|---|

| Transaction Date | Record the exact date of the deposit. This provides a clear timeline of the transaction. |

| Payer Information | Include the name, address, or other identifying information of the person or entity making the deposit. |

| Payee Information | Detail the recipient’s name or company receiving the funds. |

| Amount | Clearly state the amount of money deposited, preferably in both numerical and written formats. |

| Purpose | Indicate the reason for the deposit, whether it’s for rent, loan repayment, or other purposes. |

Formatting Tips

When designing the template, make sure the layout is straightforward. Align the fields properly for easy reading. Use standard fonts and sizes, and leave enough white space to separate each section. A clean, professional look will make the template more usable and reliable for both parties.