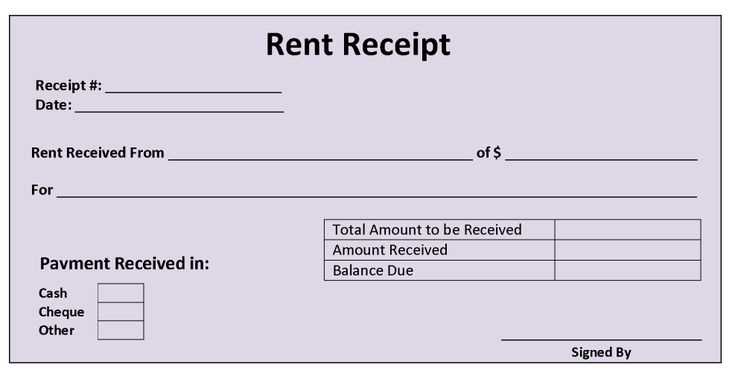

For clear and professional documentation, using a signed receipt template helps formalize the acknowledgment of goods or services received. This template provides a simple structure that ensures both parties have a written record of the transaction.

Include key details such as the recipient’s name, date of receipt, a description of the items or services received, and the signature of the recipient. These elements make the receipt legally binding and useful for both parties if any disputes arise later.

Customize the template to fit your specific needs, adding or removing sections depending on the nature of the transaction. You can incorporate a section for payment details if necessary, or specify conditions of delivery or returns.

Once you’ve filled out the template, ensure the recipient signs it to confirm the receipt of goods or services. This signed document can then be used for record-keeping, tax purposes, or as proof of agreement.

Here is the revised version with minimized repetitions:

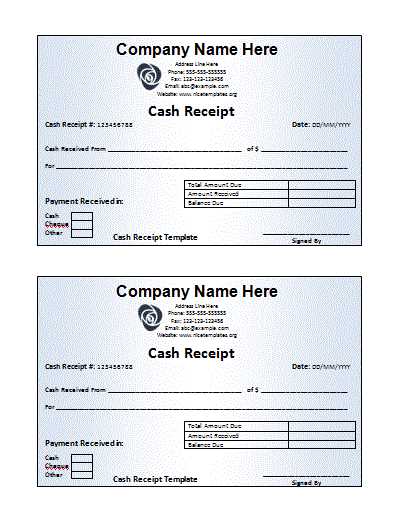

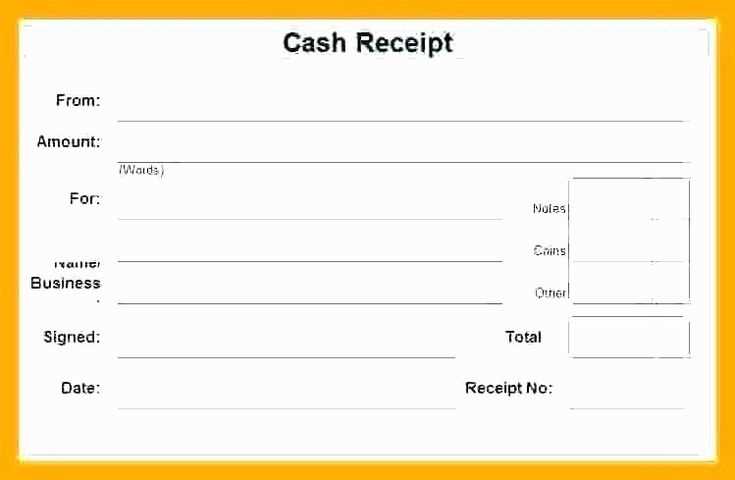

To create a concise and clear signed receipt template, include only the most necessary elements. Start with the full names of both parties involved, along with their addresses or other relevant identifiers. Specify the transaction amount, date, and any items or services exchanged. It’s helpful to state the mode of payment (e.g., cash, credit card) for clarity. Ensure that both parties sign and date the document, providing space for each signature. Keep the layout simple and avoid cluttering the template with unnecessary details or redundant phrases. This approach ensures that the receipt is both professional and easy to read.

- Detailed Guide on Signed Receipt Templates

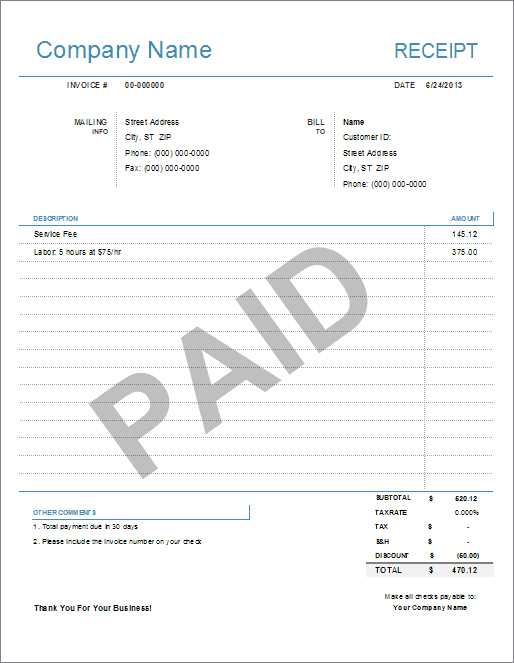

A signed receipt template is a straightforward tool for documenting transactions and confirming receipt of goods or services. These templates can be customized to suit various business needs, offering a clear format for both the sender and the recipient. The key elements to include are the date of the transaction, description of items or services received, amount paid, and the signature of the recipient.

Choose the right format: Select a format that aligns with your business requirements. For instance, if the receipt is used for transactions involving physical goods, include fields for item descriptions, quantity, and condition upon receipt. For service transactions, focus on the service provided, hours worked, or deliverables completed.

Include all necessary details: Ensure the template covers all critical details. This includes the transaction date, recipient’s name, total amount paid, and any relevant order or invoice numbers. The signed section should also have a space for the recipient’s signature to confirm receipt.

Design considerations: The layout should be clean and easy to read. Avoid cluttering the receipt with unnecessary information. Prioritize the most important details such as the date, items or services, and payment. Provide enough space for the recipient’s signature and any notes they might add regarding the condition of the goods or services received.

Digital versus paper: Depending on your business type, decide whether you need a digital or paper version of the receipt. Digital receipts can be sent via email or through an online platform, while paper receipts are printed and signed on-site. For both, ensure a clear and easily accessible method of archiving the signed receipts for future reference.

Legal considerations: Check if there are any specific legal requirements for receipts in your country or industry. Some regions require certain information to be included for tax or compliance purposes. Ensure that your template meets these standards to avoid legal complications.

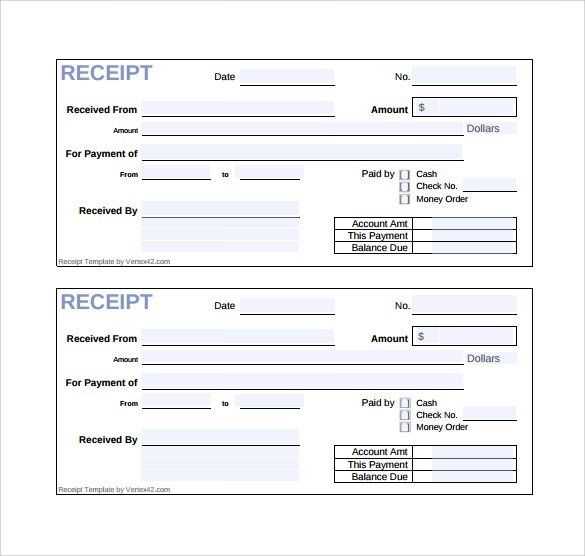

To create a legally binding receipt, include the following key details:

- Parties involved: Clearly state the names and addresses of both the buyer and the seller.

- Date of transaction: Include the exact date the transaction took place.

- Transaction amount: Clearly specify the total amount paid, including taxes, fees, and any discounts.

- Payment method: Indicate how the payment was made (cash, check, credit card, etc.).

- Description of goods or services: Provide a brief, detailed description of the goods or services exchanged.

- Signature: Both parties should sign the receipt, acknowledging the completion of the transaction.

Ensure the receipt is clear and readable. Both parties should keep a copy for their records. By including these elements, the receipt will serve as a legal document that protects both buyer and seller in case of disputes.

Ensure you clearly state the names and roles of all parties involved. This allows each individual to be properly identified in the context of the agreement.

Include the date of signing. This establishes the timeline and ensures that all parties know when the document becomes effective.

Specify the purpose or nature of the agreement. Be concise yet precise in describing the document’s intent, so everyone understands the terms and responsibilities.

Clearly outline the terms and conditions. Every detail regarding obligations, payments, timelines, and any other relevant clauses must be stated unambiguously.

Incorporate a clause for dispute resolution. Specify how disputes will be handled, such as through mediation or arbitration, to avoid ambiguity in case of disagreements.

Lastly, don’t forget to include a space for signatures. It is vital that each party signs the document, acknowledging their understanding and acceptance of the terms.

| Information | Details |

|---|---|

| Parties Involved | Names and roles of all parties |

| Signing Date | The date when the document is signed |

| Purpose | Short description of the agreement’s intent |

| Terms and Conditions | Obligations, payments, deadlines, etc. |

| Dispute Resolution | Process for resolving conflicts |

| Signatures | Space for parties to sign |

Ensure all required information is included before obtaining a signature. Missing details like date, transaction amount, or recipient name can lead to disputes later. Double-check everything is filled out correctly before asking for the signature.

Don’t rush through the process. Allow the signer enough time to review the receipt carefully. This helps avoid any misunderstanding or errors in the document.

Avoid using unclear or vague language. Ensure all terms are specific and unambiguous. This prevents confusion about the terms of the transaction or agreement.

Make sure the signer’s signature is legible and consistent. A messy or illegible signature can create issues when verifying the document later on.

Never forget to keep a copy of the signed receipt. Store it securely to avoid losing important records that may be needed for future reference.

Don’t skip the step of confirming the signature is genuine. If possible, verify the identity of the person signing to prevent fraud or errors.

To properly format a signed receipt template, ensure it includes clear sections for the transaction details and the acknowledgment of receipt. Begin with the name and address of both parties involved. Follow with the date and amount of the transaction, ensuring the currency is specified. Provide a space for the buyer’s signature and the seller’s acknowledgment.

Transaction Details

The transaction details should include a concise description of the goods or services purchased, including quantities and any applicable reference numbers. This ensures both parties have a clear understanding of what was exchanged. Avoid ambiguity by keeping the description specific and to the point.

Signature Section

Leave enough space for the buyer to sign and date the receipt. A separate line for the seller’s signature or acknowledgment may be included to confirm that the transaction was completed. This section should be at the bottom of the template, making it easy for both parties to finalize the document. Ensure that the signatures are legible and that the format is consistent with the rest of the receipt.