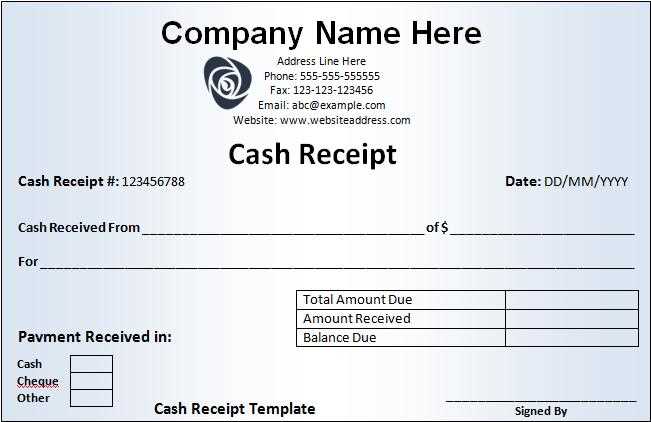

To create a clear and professional receipt voucher, start by structuring it with the following key elements: date, transaction details, amount, payer and payee information, and a unique voucher number. Each section must be easy to locate for quick reference and verification.

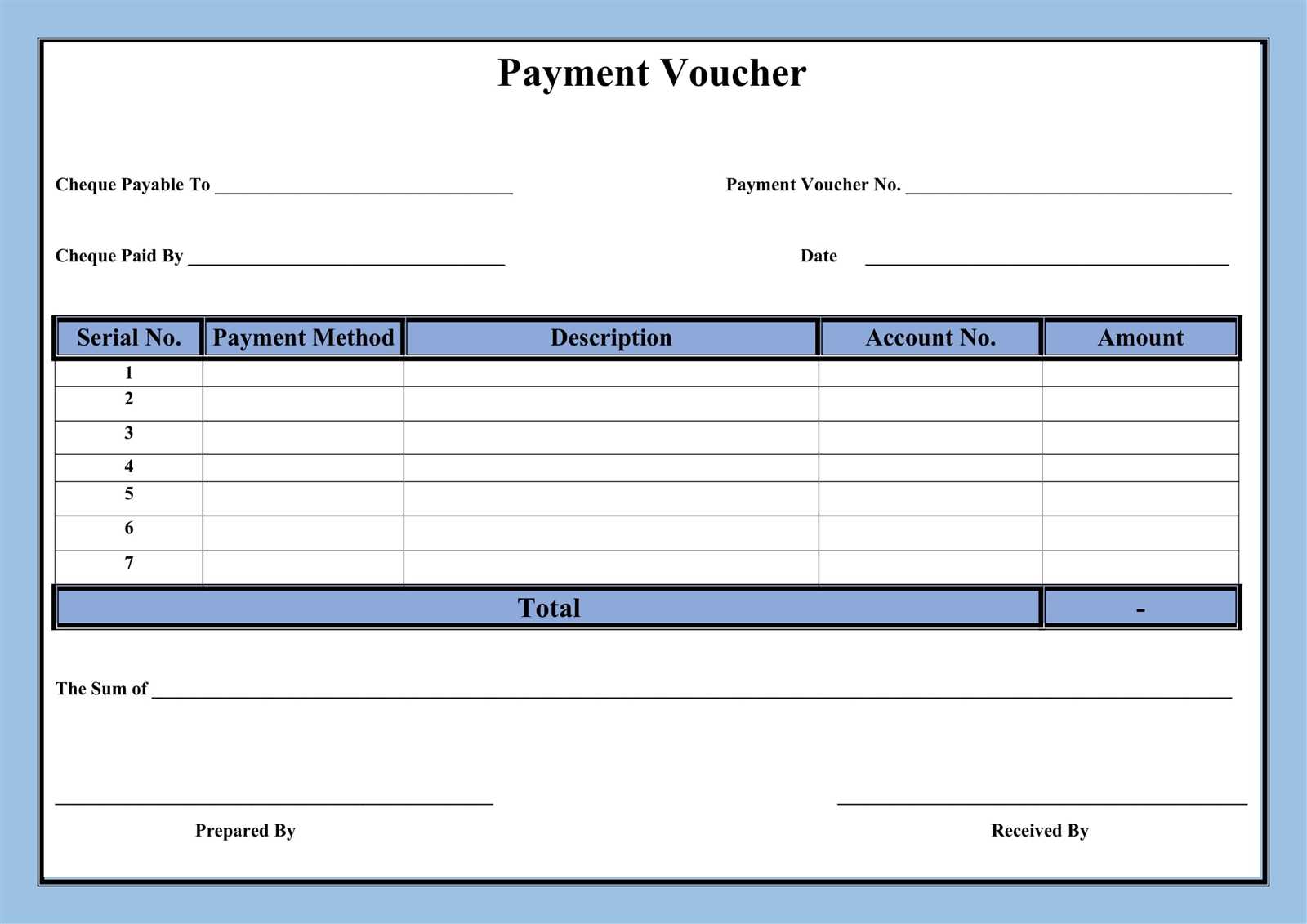

Transaction Details should include a description of the goods or services provided. Specify quantities, unit prices, and any applicable taxes or discounts. This ensures both parties are aligned on the nature of the exchange.

Amount should be prominently displayed and broken down into subtotal, taxes, and total. If applicable, include payment methods such as cash, card, or bank transfer. This transparency builds trust and helps prevent future disputes.

For payer and payee details, include full names, addresses, and contact information. This helps in case the receipt needs to be referenced for returns, exchanges, or accounting purposes. Use clean and simple formatting to ensure the information is easy to read and verify.

By following these guidelines, you create a receipt voucher that is both functional and professional, providing clarity for all involved parties.

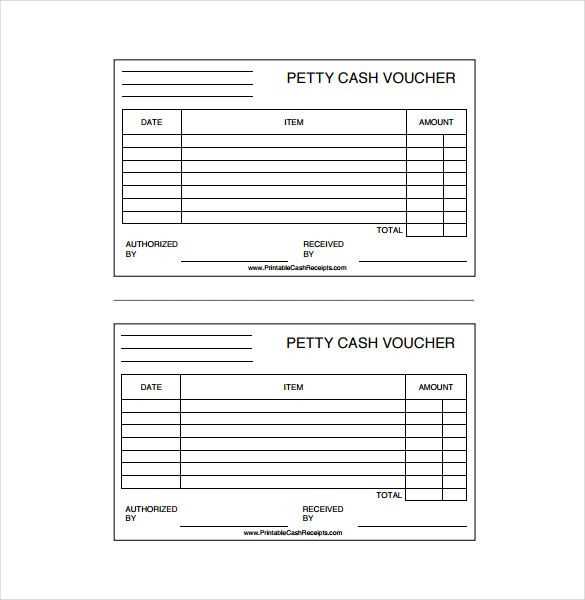

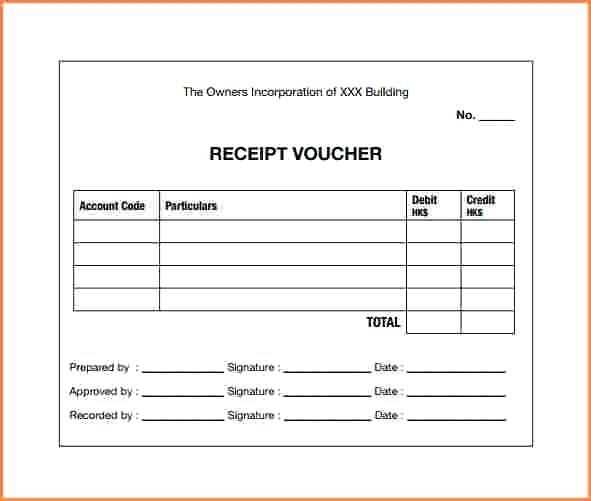

Template of Receipt Voucher

A receipt voucher template should clearly outline the transaction details in a simple, readable format. Begin with the title of the document, such as “Receipt Voucher,” at the top. Below it, include sections for the date, receipt number, and business details (name, address, and contact). This provides immediate context for the transaction.

Next, specify the payer and payee information. This section should clearly identify the buyer and the seller, including names, addresses, and contact numbers. Add a unique voucher number to ensure easy tracking of the transaction.

Include a breakdown of the transaction. List each item or service provided, along with their individual costs, quantities, and any applicable taxes. This ensures clarity for both parties and avoids any confusion about the total amount.

After the breakdown, clearly state the total amount paid and the payment method. If the transaction was made through a bank transfer, include the relevant bank details. If the payment was made by cash or card, specify the amount received and any change given, if applicable.

At the bottom of the voucher, include a signature section for both parties. This acts as confirmation of the transaction and ensures that both the payer and payee acknowledge the details. For added clarity, include a space for additional notes, such as terms and conditions or any special agreements.

Customizing Fields for Transaction Clarity

Adjust fields to reflect the specifics of each transaction for better understanding. Clear data labeling avoids confusion and enhances transparency.

- Transaction Date: Display the exact date and time of the transaction. This helps in tracking the flow of money and identifying time-sensitive issues.

- Customer Information: Include full details like name, contact number, and address. For refunds or follow-up actions, this ensures easy reference.

- Item Description: Provide precise descriptions for each product or service. Use short, clear terms to prevent ambiguity.

- Quantity and Price: Specify the quantity, unit price, and total cost. Highlight discounts or taxes separately for clarity.

- Payment Method: Indicate whether the transaction was made by cash, card, or another method. This creates an accurate financial record.

- Invoice Number: Assign a unique identifier to each voucher. This makes tracking and resolving issues more straightforward.

- Notes or Comments: Allow space for additional remarks. This section is useful for special conditions like delivery instructions or warranty information.

When fields are clear and easy to understand, you eliminate the risk of miscommunication. Customize the template to meet the needs of your transactions, ensuring a smooth process for all parties involved.

Choosing the Right Format for Different Business Needs

For businesses managing receipts, selecting the appropriate format ensures accuracy, compliance, and ease of use. If you handle large volumes of transactions, consider using templates that allow for quick data entry while ensuring each receipt contains all the necessary details, such as date, items purchased, and payment method. For businesses dealing with tax reporting or audits, templates that include tax breakdowns and legal information are highly recommended.

Smaller businesses might benefit from simple, customizable formats, focusing on flexibility. In these cases, templates with basic fields like customer name, amount, and payment type can streamline operations. Larger enterprises, on the other hand, require formats that support more complex requirements like multiple item entries, item categorization, and even automated calculations for discounts or taxes.

Consider the storage needs of your business as well. Digital formats such as PDFs or Excel files provide easy access, sharing, and archiving, while printed versions are still valuable for certain industries that require hard copies for legal or contractual reasons. Choose a format that aligns with your operational workflow, ensuring you can quickly locate, process, and file receipts as needed.

Incorporating Legal Requirements in the Template Design

Ensure the receipt voucher template complies with local laws by incorporating key legal elements. Include fields for tax identification numbers, business registration details, and invoice numbers. These are often required for both businesses and individuals to track and verify transactions. Some jurisdictions mandate specific language or terms for refunds, returns, or warranties; review relevant regulations to ensure these clauses are included if necessary.

Tax Compliance and Proper Documentation

Include sections for specifying the tax rate applied and the amount of tax charged. It’s also important to provide a clear breakdown of the total amount paid, including the subtotal, tax, and any applicable fees. By doing so, you help both the business and the customer clearly understand the financial details of the transaction, which is crucial for tax reporting purposes.

Data Protection and Privacy Statements

Include a short privacy statement or reference to your data protection policy if the receipt contains personal data. Some regions require businesses to inform customers about how their data will be used, stored, or shared. This ensures your template aligns with data privacy laws such as GDPR or CCPA, depending on your location.