If a payment has not been received as agreed, sending a clear, formal letter is crucial. The letter should outline the details of the transaction, the payment terms, and the action expected from the recipient. Make sure to keep the tone firm yet polite to maintain professionalism while addressing the issue.

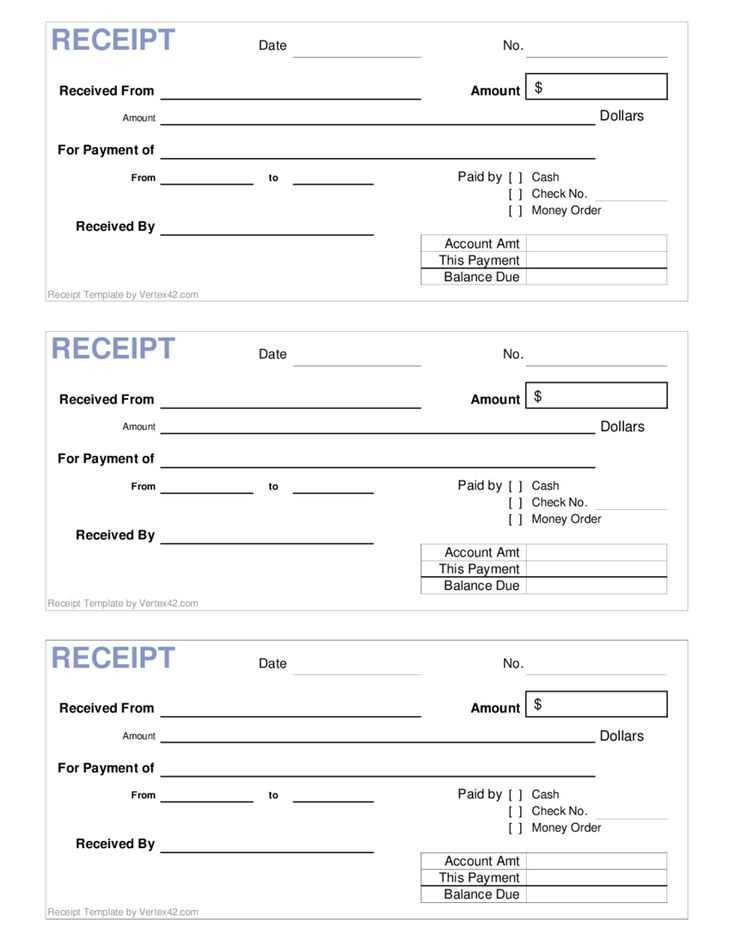

Start by including the relevant information: the original invoice number, the due date, and the amount that remains unpaid. It is essential to state these facts explicitly. Include any late fees or interest that may have accumulated based on the agreement, ensuring that the recipient understands the financial implications of the delay.

Be sure to offer a final opportunity for payment within a specific time frame, such as 7 or 14 days. Specify the payment methods accepted and include contact details for any questions or concerns. Close with a reminder of the potential consequences if payment is not made within the given time period, such as legal action or service suspension.

Here is the corrected version:

Ensure that the letter clearly states the date and the amount due. Include the recipient’s full name and address to confirm the identity of the person being contacted. Specify the outstanding amount, referencing any relevant invoice or account numbers. State the payment due date, as well as the current overdue status, if applicable. A polite reminder of the consequences of further delay can be included, such as additional fees or legal action. Keep the tone courteous but firm to maintain professionalism. Include contact details for resolving the issue quickly. Lastly, make sure to have a clear call to action, such as requesting payment or arranging a discussion if necessary.

- Letter Template for Nonpayment Acknowledgment

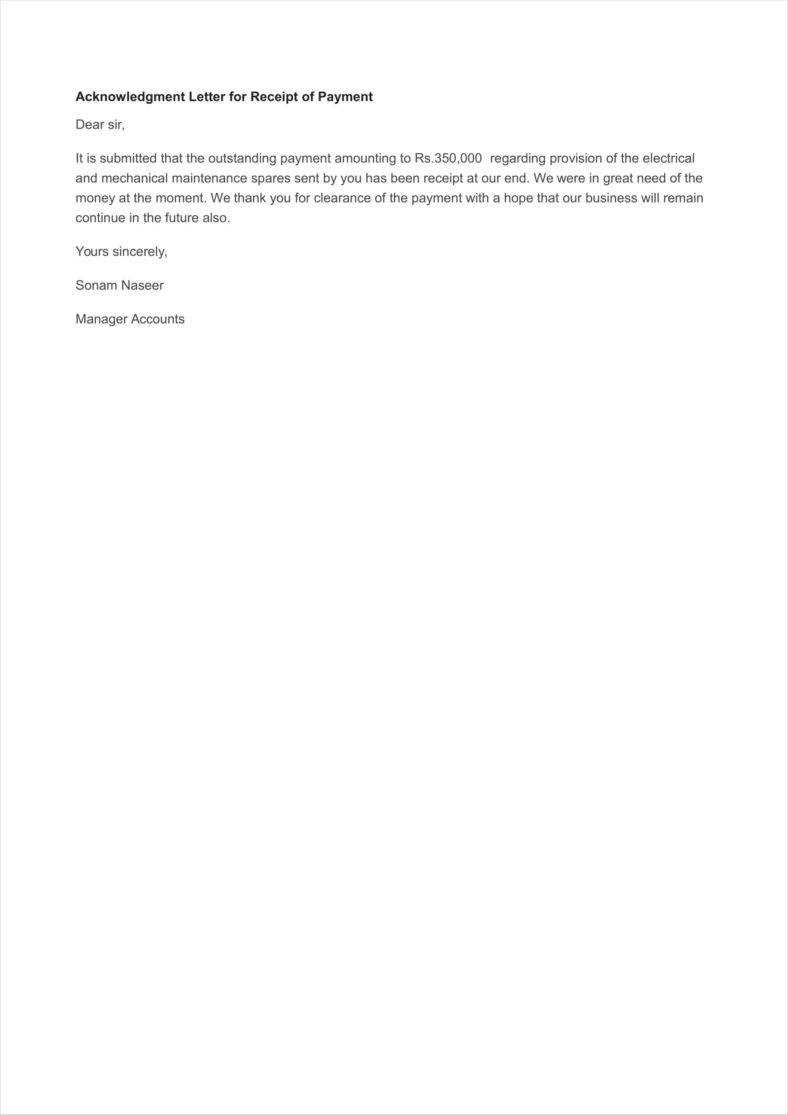

When a payment hasn’t been made on time, acknowledging the issue with a clear and professional letter is important. Use the following template to inform the recipient about the nonpayment in a straightforward manner.

Subject: Nonpayment Acknowledgment – [Invoice Number]

Dear [Recipient’s Name],

We are writing to bring your attention to the outstanding payment for invoice [Invoice Number], which was due on [Due Date]. As of today, we have not yet received the payment of [Amount Due].

We kindly request that you process the payment as soon as possible. Please note that a delay in payment may result in [mention any consequences, e.g., service interruption, late fees, etc.]. If you have already made the payment, please disregard this notice, and we would appreciate it if you could share the payment details with us for confirmation.

If there are any issues or concerns regarding the payment, please don’t hesitate to contact us directly at [Phone Number] or [Email Address]. We’re happy to assist you in resolving any difficulties you may be facing.

Thank you for your immediate attention to this matter. We look forward to your prompt payment.

Sincerely,

[Your Name]

[Your Position]

[Your Company]

[Contact Information]

Begin by clearly stating the purpose of the letter. Acknowledge that a payment is overdue and provide specific details about the amount due. Avoid vagueness and be direct in your communication.

Next, outline the payment terms. Mention the due date and any grace periods, if applicable. This helps to clarify expectations and sets a clear timeline for the recipient to act upon.

Include any relevant references to the original agreement or invoice. This serves as a reminder of the terms both parties agreed to and adds context to the letter.

If applicable, specify any consequences for continued nonpayment. For example, late fees or potential legal action. This can encourage prompt payment while remaining professional and courteous.

Finally, conclude with a polite request for immediate payment. Offer a clear method for payment, such as bank details or an online payment portal, to make the process as easy as possible for the recipient.

| Section | Details |

|---|---|

| Opening Statement | Clearly state the payment is overdue and the amount due. |

| Payment Terms | Include the original due date and any grace periods. |

| Reference to Agreement | Reference the original invoice or agreement. |

| Consequences of Nonpayment | Outline any late fees or legal actions if necessary. |

| Closing Request | Polite request for immediate payment with clear payment instructions. |

Ensure your letter is clear and specific about the reason for nonpayment. Avoid vague language, as it can confuse the recipient and make the situation unclear. Address the issue directly without using ambiguous terms that could be misinterpreted.

Don’t forget to include all relevant payment details. Including the invoice number, payment due date, and the amount owed helps provide context and ensures that the recipient understands exactly what payment is being referenced.

Avoid excessive legal jargon. While it is important to maintain professionalism, overly complex language can create misunderstandings. Keep the tone respectful but straightforward, making sure the recipient can easily comprehend the message.

Don’t ignore the importance of a clear deadline for payment. A common mistake is failing to specify a clear due date for payment. Including a specific date for payment helps prevent further delays and sets clear expectations.

Do not make it sound overly harsh or threatening. While nonpayment is frustrating, keeping a neutral tone is crucial for maintaining a professional relationship. Be firm but polite in requesting payment, as harsh language can damage the relationship and lead to further complications.

Don’t omit contact information. Always provide a clear method for the recipient to reach out for clarification or to discuss the matter. This shows your willingness to resolve the issue and prevents unnecessary delays due to lack of communication.

Avoid generalizing the situation. Every payment issue is unique. Treat each case with attention to detail, and avoid using generalized statements that don’t address the specifics of the transaction. Personalize the letter to reflect the individual circumstances of the nonpayment.

Don’t forget to proofread your letter. Small mistakes can undermine your message’s professionalism. Ensure the letter is free from typos and errors that might detract from its effectiveness or lead to confusion.

After sending a nonpayment acknowledgment letter, the next step is to take swift action in following up. Begin by establishing a clear timeline for when you expect a response or payment. This ensures that both parties understand the urgency and expectations.

Set a Follow-Up Date

Give a specific date for when you will follow up, typically 7-10 days after sending the acknowledgment letter. This lets the recipient know you are serious about the matter and have set a reasonable timeframe for resolution.

Methods of Follow-Up

- Phone Call: A phone call can be an effective way to establish a personal connection and quickly gauge the recipient’s intentions. Prepare to refer to the original letter and discuss the next steps.

- Email Reminder: If a phone call isn’t possible, follow up with a polite email reminding them of the outstanding payment and the consequences of further delays.

- In-Person Visit: For businesses or individuals with local presence, consider an in-person visit. It often carries more weight and can lead to quicker action.

When following up, remain calm and professional, avoiding any confrontational language. It’s important to maintain a constructive approach, which helps ensure the matter is resolved without causing unnecessary tension.

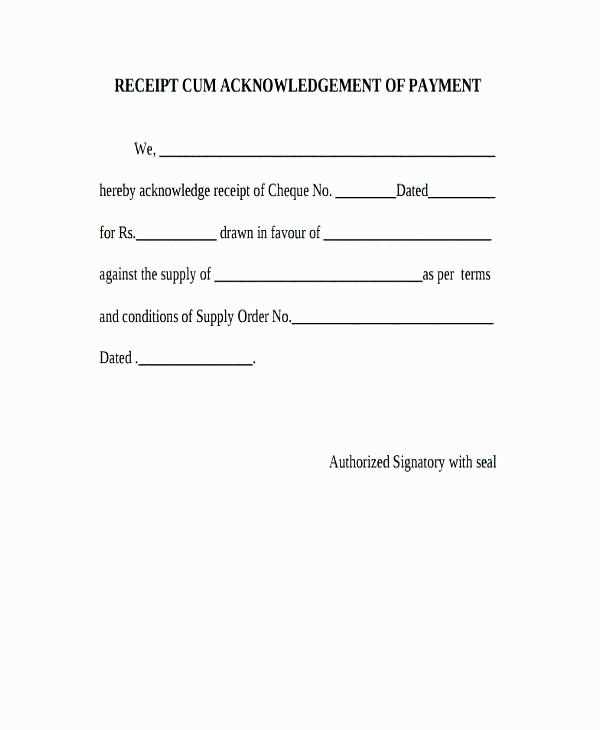

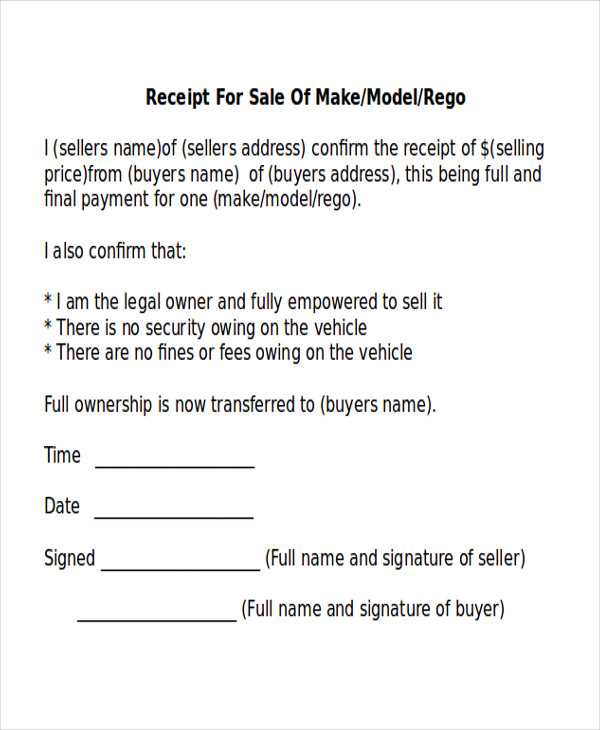

Rewording “Receipt” with Synonyms in Letter Templates

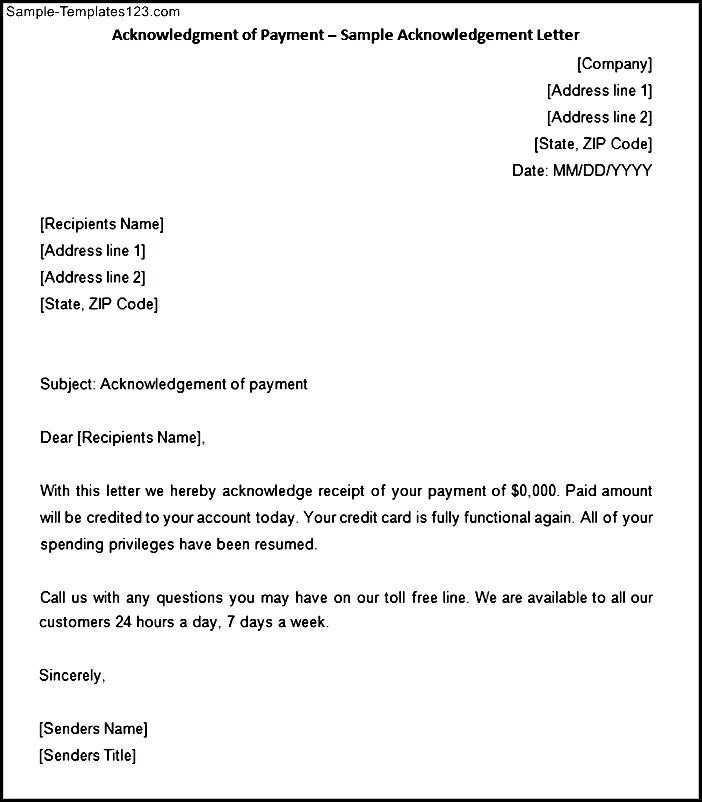

To avoid redundancy in your letter template, substitute the word “receipt” with suitable synonyms while maintaining the original meaning. For instance, you can replace it with “acknowledgment,” “confirmation,” or “proof.” These words serve the same purpose but add variety to the content.

Example 1: “We acknowledge the receipt of your payment” can be rephrased as “We confirm the acknowledgment of your payment.” This slight adjustment prevents repetitive use of the word “receipt.”

Example 2: “Please find the receipt enclosed” can be changed to “Please find the proof of payment enclosed,” which still conveys the same message, but with a more varied vocabulary.

By using different expressions, your letter template sounds more professional and keeps the reader engaged while still conveying all necessary details clearly.