To create a small cash receipt template, focus on simplicity and clarity. Begin by including the date of the transaction at the top, followed by the details of the buyer and seller. List the purchased items with their prices, ensuring the amounts are easy to read and well-organized. A clear subtotal followed by the final amount is key for transparency.

Next, include a space for the method of payment, whether it’s cash or another form. This ensures both parties have a record of how the payment was made. It’s also useful to provide a receipt number or reference for easy tracking in case of future inquiries.

For the final touch, add a section for both the seller and the buyer to sign or initial, confirming the transaction. This will help in case of any disputes later. Keep the format clean, so that it’s quick to fill out, and the information stands out clearly at a glance.

Here’s the revised version with minimal word repetition:

Use a clean and straightforward format for your small cash receipt. Start with your business name and contact information at the top. Clearly indicate the transaction details, including the date, amount, and description of goods or services purchased. Always include a unique receipt number for tracking purposes.

Key Components to Include

Incorporate the buyer’s details, such as name or address, if necessary for your records. Ensure that the payment method is clearly stated (e.g., cash, card, etc.). If applicable, add any taxes or discounts separately for transparency.

Simple and Legible Layout

Keep the layout easy to read. Avoid clutter by using sufficient spacing between sections. Consider using a clean font and a legible size. Conclude with a thank you note to enhance customer experience.

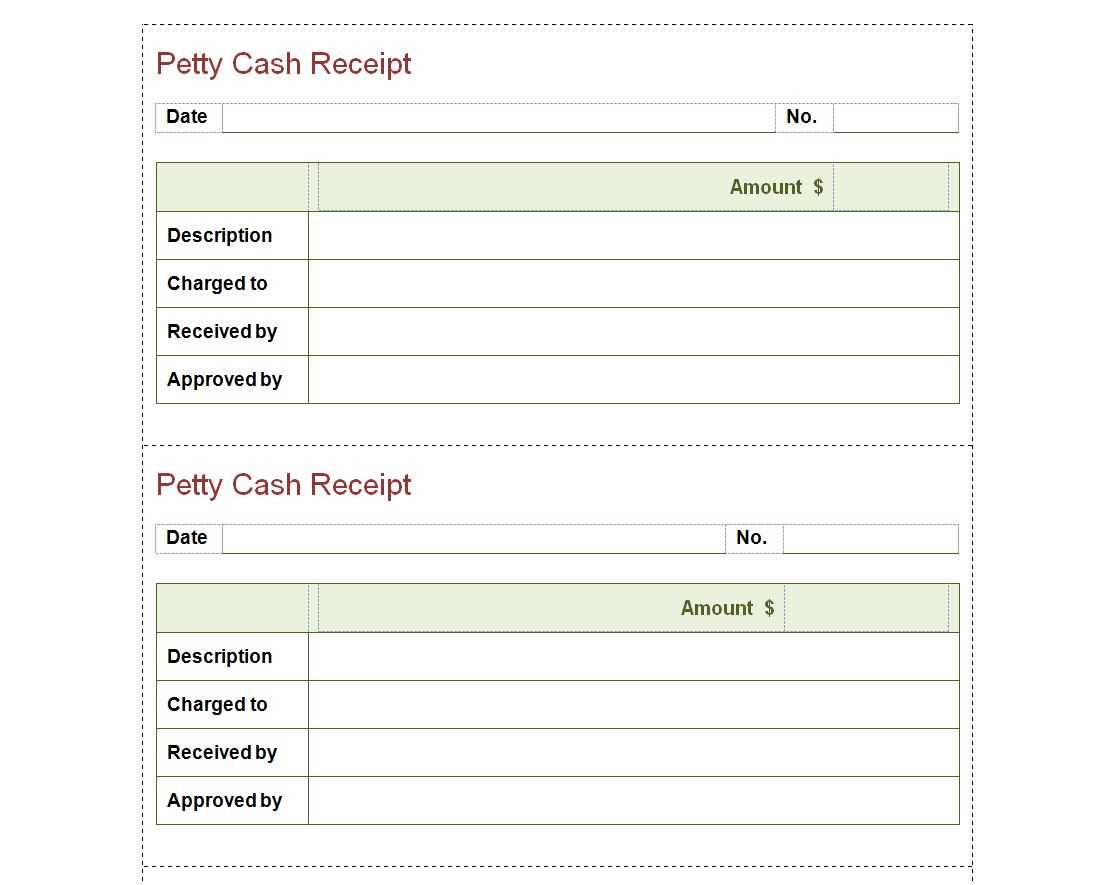

- Small Cash Receipt Design Template

A well-designed small cash receipt template should include clear sections for the transaction details. Start by incorporating the date and time of the transaction, followed by the name of the buyer and seller. Ensure the itemized list of purchased goods or services is easy to read, with columns for quantity, description, unit price, and total cost.

Keep the layout simple and organized. Use a clean font with sufficient spacing between rows to prevent clutter. Include a subtotal, tax, and total amount due at the bottom of the receipt, along with any payment method details like cash, card, or digital transfer.

For enhanced clarity, use a bold font for headings and a smaller font size for item descriptions and totals. If applicable, leave space for a signature or a stamp to authenticate the receipt. Providing this clear, concise structure ensures that both parties can quickly verify the transaction details.

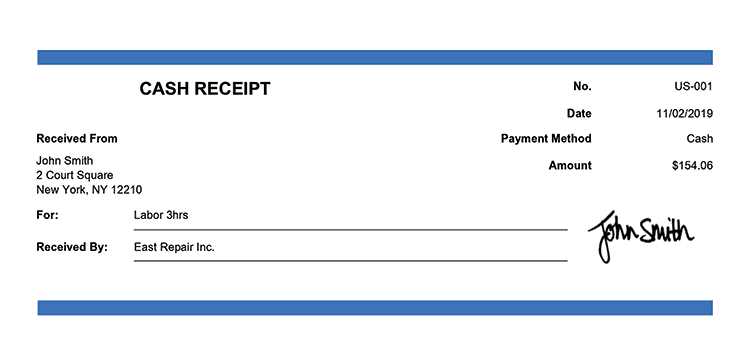

Creating a cash receipt is straightforward. Follow these steps to ensure clarity and accuracy in documenting transactions:

- Choose a Template: Select a clean and simple receipt template, either from a software tool or a printed form. Include spaces for the necessary details.

- Include Receipt Number: Assign a unique number to each receipt for easy tracking. This helps maintain a proper record of all transactions.

- Enter Date and Time: Clearly state the date and time of the transaction. This is essential for accurate documentation.

- Document Buyer Information: If applicable, include the buyer’s name and contact details. This may not be required for every transaction but is useful for future reference.

- List the Amount Paid: Specify the exact amount of money received. Break down the payment if necessary (e.g., cash, check, card). Be precise to avoid any confusion.

- Provide a Description: Add a short description of the product or service purchased. Keep it concise but clear enough to identify the item or service.

- Include Payment Method: Mention the method of payment used (e.g., cash, credit card, debit card, or check). This step helps clarify how the transaction was completed.

- Sign and Acknowledge: Both the payer and the recipient should sign the receipt, confirming that the transaction took place.

By following these steps, you ensure that your receipt is clear, professional, and legally sound. Keep a copy for your records and provide one to the payer. This helps with transparency and record-keeping.

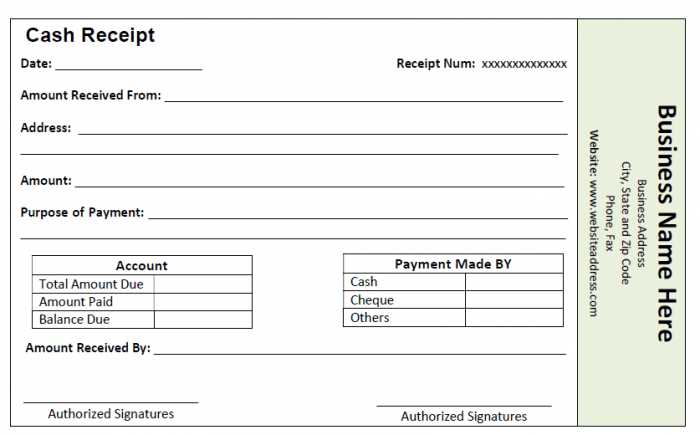

A cash receipt should include the following key details:

Date of transaction: Always specify the exact date when the payment was made. This helps in tracking and confirming transactions accurately.

Receipt number: Assign a unique number to each receipt. This ensures that every transaction is properly documented and can be referenced later if needed.

Amount received: Clearly state the amount of cash paid. Double-check the figures to prevent any mistakes that could cause confusion later.

Payee information: Include the name or business name of the person or company who made the payment. This helps in identifying who made the payment and serves as a record for both parties.

Payer’s signature: While not always mandatory, having the payer sign the receipt can provide extra security and verify that they made the payment.

Purpose of payment: Briefly describe the reason for the payment, such as “payment for invoice #123” or “deposit for service.” This clarifies the transaction’s context for both the payer and recipient.

Method of payment: Specify whether the payment was made in cash, check, or other methods. This helps in distinguishing between different types of receipts and payments.

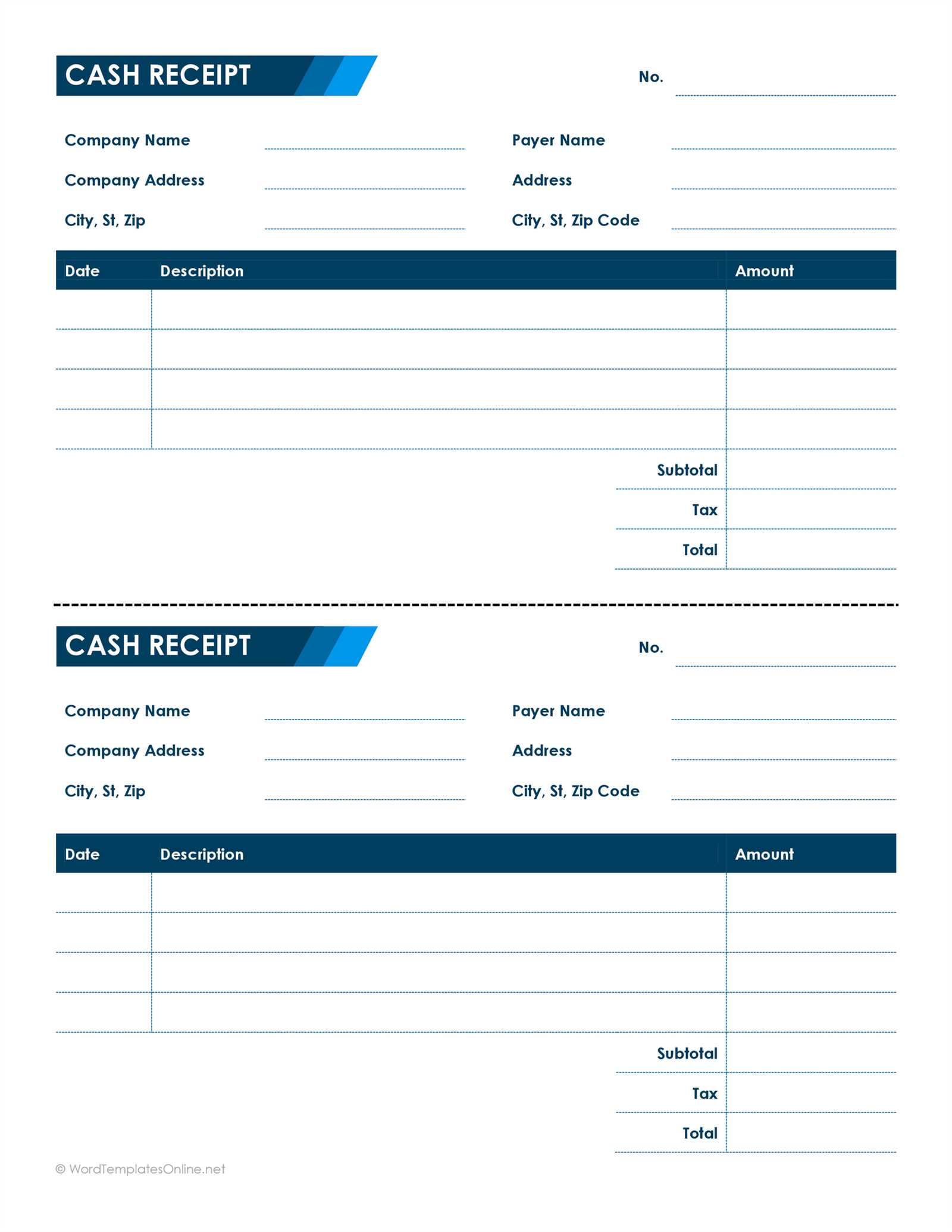

Choose a clean and simple layout. Make sure the receipt clearly highlights the necessary details like the date, total amount, and payment method. Avoid cluttering the template with unnecessary graphics or excessive information.

Customize each template to fit your business needs. If you regularly provide discounts or offer multiple payment options, add fields that allow for easy input of these details. Flexibility ensures that the receipt can serve various purposes, from product sales to service payments.

Ensure readability by using legible fonts and an appropriate size. A font that’s too small may make it difficult for customers to read, while a font that’s too large can waste space and look unprofessional.

Incorporate a unique identifier, such as a receipt number or order code. This will make it easier for both you and the customer to track the transaction if necessary.

Provide a clear breakdown of the costs. If your receipt includes taxes, fees, or discounts, display them in separate lines for transparency. This allows customers to see exactly what they are paying for and avoids confusion.

Always include contact information, including your business address, phone number, and email. This makes it easy for customers to reach out in case of any issues or inquiries about the transaction.

Ensure your template is adaptable to both digital and printed formats. Whether customers receive their receipt via email or as a paper copy, consistency is key. Ensure that the layout remains clear and easy to read on all devices.

Small Cash Receipt Template

A simple cash receipt template is key for quick and clear transactions. When designing a receipt, focus on clarity and readability. Include the essential information such as the date, amount paid, and the purpose of the payment.

Key Elements to Include

- Date: Always include the date of the transaction.

- Amount: Clearly state the total amount paid. Use a currency symbol and ensure the amount is easy to spot.

- Payer Information: Add the name of the person or business paying.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Description: Provide a brief description of the transaction or the goods/services involved.

How to Customize Your Template

Choose a layout that suits your business needs. If you are handling many transactions, include space for both the payer’s and payee’s contact information. For small businesses, a minimal design with essential fields will work best.

Use clear and legible fonts to avoid confusion. Keep your template clean and simple–focus on the transaction details rather than decorative elements.