Hey! How’s it going?

Here’s the corrected version:

The donation tax credit receipt must include specific details to ensure compliance and facilitate tax deductions. Begin by including the name of your organization, followed by its official registration number. This helps validate its tax-exempt status. Next, clearly state the amount of the donation and the date it was received. Be specific about whether the donation was cash, property, or goods.

If applicable, include the fair market value of any goods or services provided in exchange for the donation. This is important to avoid inflating the value of the charitable contribution. Also, if the donation exceeds a certain threshold, mention whether the donor has received any special benefits as a result.

For donors claiming a tax credit, provide a detailed breakdown of the tax credit amount eligible for use, and explain how it applies to their specific tax situation. This section ensures that donors have the necessary information for easy reference when completing their tax returns.

Lastly, include a statement confirming that the organization did not provide any goods or services in exchange for the donation, unless this was stated earlier. This will assure donors that they are fully entitled to the tax credit.

Donation Tax Credit Form Receipt Template

To create a donation tax credit form receipt, ensure it contains the necessary elements for both the donor and the organization. This ensures compliance with tax regulations and provides clarity for all involved.

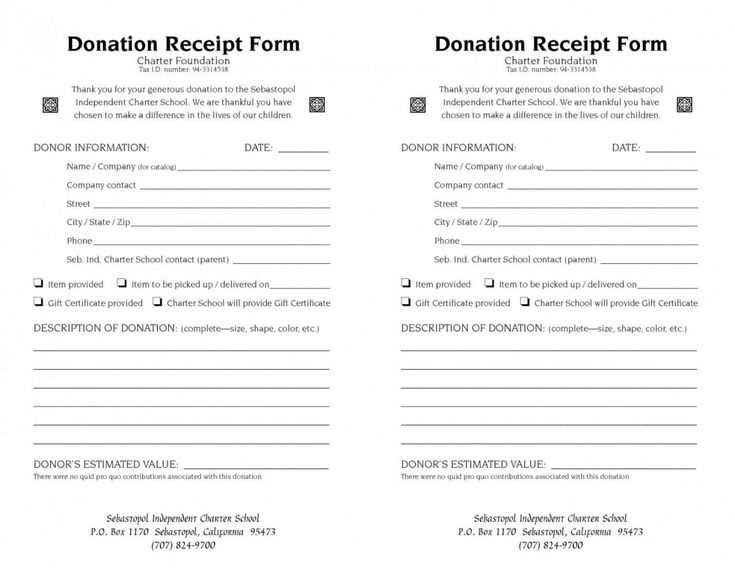

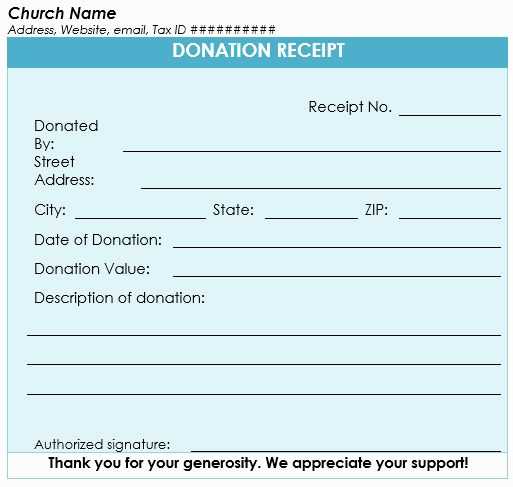

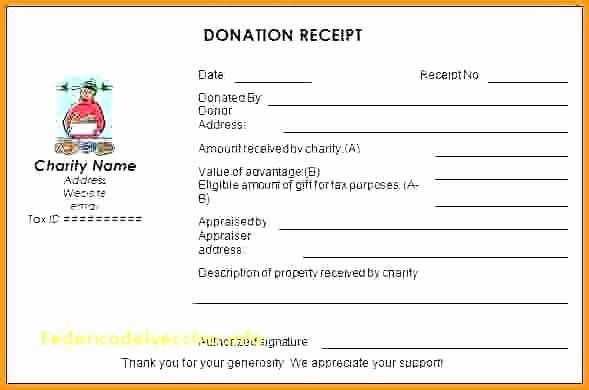

Receipt Header: Include the full legal name of the charity, address, phone number, and website. This helps verify the legitimacy of the donation for both the donor and tax authorities.

Donor Information: Clearly list the donor’s name and address. If applicable, include the donor’s tax identification number to avoid confusion during tax filing.

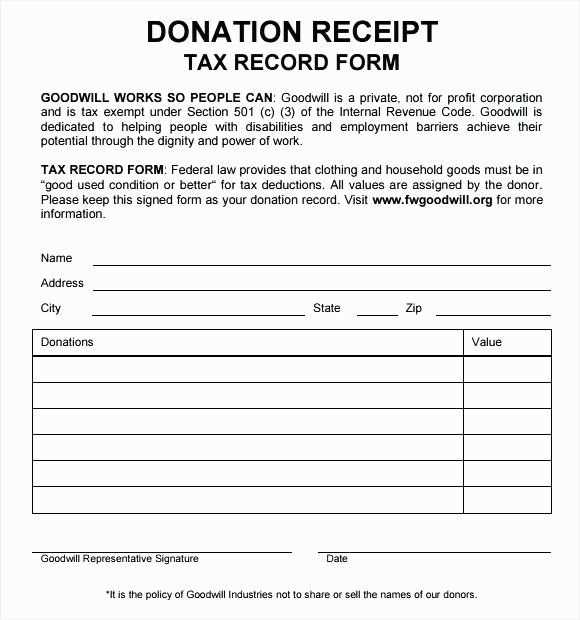

Donation Details: Specify the date of the donation, the amount given, and the method of donation (e.g., cash, check, credit card). If the donation is in-kind, describe the donated items and their estimated fair market value.

Tax Credit Statement: Add a statement confirming that no goods or services were provided in exchange for the donation, or provide details of any goods or services, if applicable. This ensures the donor knows the value of the tax-deductible portion of the gift.

Charity Registration Number: If applicable, include the organization’s tax-exempt registration number. This helps validate the nonprofit status of the organization and confirms the donation’s eligibility for tax credit.

Receipt Number: Assign a unique receipt number for tracking purposes. This number will make it easier for both the donor and the organization to reference the donation.

Signature: Depending on local regulations, you may need a signature from an authorized person within the organization. This adds an extra layer of authenticity to the receipt.

Ensure all information is accurate and complete to avoid issues during the donor’s tax filing process. Keep a copy for your records and provide one to the donor promptly. This will help ensure a smooth experience for both the nonprofit and the donor when claiming the tax credit.

To create a tax-eligible donation receipt template for your charity, include the necessary details that comply with tax laws. The receipt must include the charity’s name, address, and registration number, which are essential for the donor’s tax records.

The donation receipt should also specify the amount or the fair market value of non-cash gifts. For in-kind donations, list the description of the donated items. Avoid placing an estimate of value for non-cash gifts; this is the responsibility of the donor.

The template must state whether the donation was tax-deductible and mention if anything of value was given in exchange for the donation. If a donor receives goods or services in return, indicate the fair market value of those goods or services.

| Required Information | Details to Include |

|---|---|

| Charity Information | Name, Address, Tax-Exempt Status, Charity Registration Number |

| Donor Information | Donor’s Name and Address |

| Donation Details | Donation Amount (for cash donations), Description of Items (for non-cash donations) |

| Tax Deductibility | Statement on whether the donation is tax-deductible, any goods/services received in exchange |

| Receipt Date | Date of Donation |

| Signature | Authorized signature from the charity |

Ensure the receipt contains the date of the donation and a signature from an authorized charity representative. If donations are in the form of goods, mention that the donor is responsible for valuing them. For cash donations, no further value need be assigned.

After creating the template, double-check for accuracy to make sure the charity meets all legal obligations. Offering a well-organized and clear donation receipt builds trust with donors and helps them during tax filing.

To ensure accuracy and compliance when submitting a donation tax credit form, include the following key information:

- Donor’s Full Name and Address: Clearly list the donor’s complete name and contact details, including the full mailing address. This information is vital for matching the donation to the correct individual in the tax records.

- Donation Amount: Specify the exact monetary value of the donation. If the donation involves goods or property, provide an estimated market value.

- Donation Date: Include the exact date the donation was made. For property donations, ensure that this reflects the date of transfer of ownership or receipt.

- Recipient Organization Details: Provide the name, address, and tax identification number of the organization receiving the donation. This helps verify the legitimacy of the organization and its status as a qualified charity.

- Receipt Number or Confirmation: Include a unique reference number or confirmation code for the donation, which can assist in tracking and verifying the donation.

- Non-Cash Contributions Description: If the donation includes non-monetary items such as goods, property, or services, list them in detail, including an accurate description and condition, along with the estimated fair market value.

- Tax Credit Eligibility: Clarify whether the donation qualifies for a tax credit under applicable laws, and provide any necessary legal references or notes regarding the donor’s eligibility for such credits.

Important Notes

- Separate Donations: If the donor made multiple donations, ensure each donation is documented separately with its own form or entry. This avoids confusion and supports accurate recordkeeping.

- Charity’s Authorization: Make sure the receipt is signed or stamped by the recipient charity, confirming the donation’s acceptance and the details provided are accurate.

Ensure the donation receipt includes the donor’s full name and address. Without this, the receipt may not be valid for tax purposes. Double-check the accuracy of this information before finalizing the receipt.

Do not forget to specify the date of the donation. Omitting the date can lead to confusion when donors need to claim their tax credits. Include both the day the donation was made and the date the receipt is issued.

Avoid vague descriptions of the donated item or amount. Be clear and specific, whether the donation was cash, property, or services. If a non-cash donation is made, describe it in detail, including its fair market value at the time of the donation.

It’s essential to indicate whether the donation was made with any conditions or restrictions. If the donation was designated for a specific purpose, this must be noted on the receipt to ensure compliance with tax regulations.

Make sure to provide the organization’s legal name and registration number, if applicable. This ensures transparency and helps the donor verify that the organization is qualified to issue tax receipts.

Double-check the tax-deductible status of donations. For example, certain types of donations, such as gifts of time or personal services, are not tax-deductible. Ensure the receipt reflects only eligible donations.

Avoid using generic or outdated templates. Customize each receipt to fit the specific donation made, as generic forms may not meet legal requirements for tax deductions.

Don’t neglect to sign the receipt. An unsigned receipt is incomplete and may be considered invalid for tax purposes. Ensure it is signed by an authorized representative of the organization.

To create a donation tax credit form receipt, include the donor’s name, address, and tax identification number. Clearly state the donation amount, date of receipt, and the charity’s details, such as its name and address. Ensure the receipt includes a statement confirming whether the donation was monetary or in-kind. If the gift was in-kind, specify the items or services donated and their estimated value. Make sure to include a thank you note and remind the donor to retain the receipt for tax purposes.