For a seamless experience in documenting your taxi rides in Malaysia, using a reliable taxi receipt template is a must. A good template ensures that all necessary details, such as date, time, fare, and vehicle information, are clearly listed, minimizing errors and confusion.

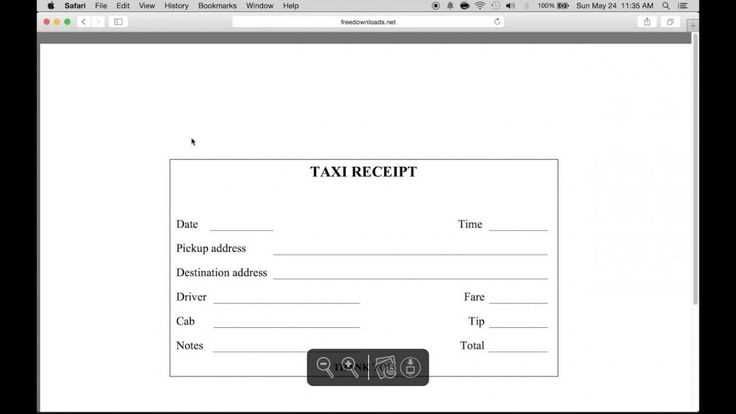

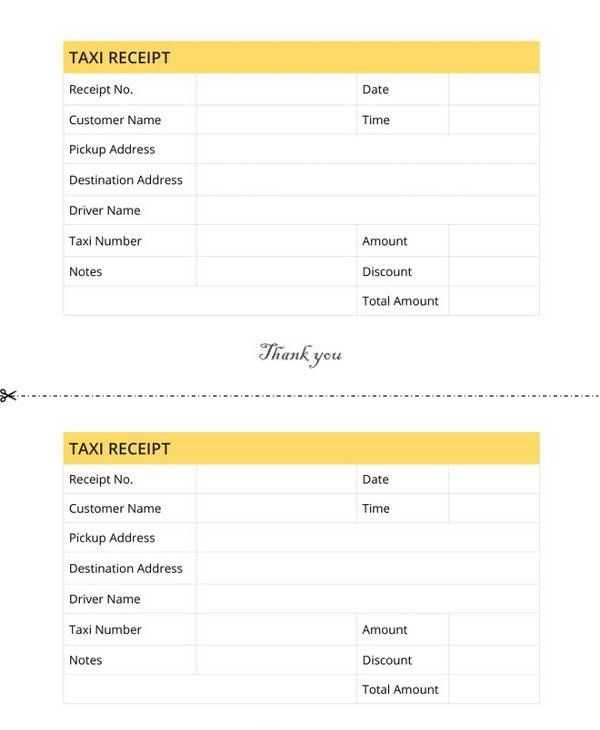

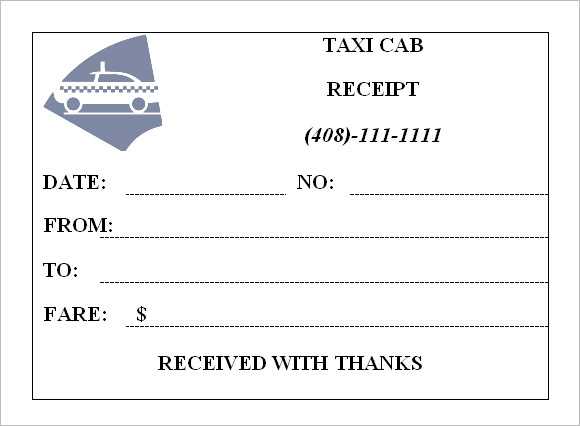

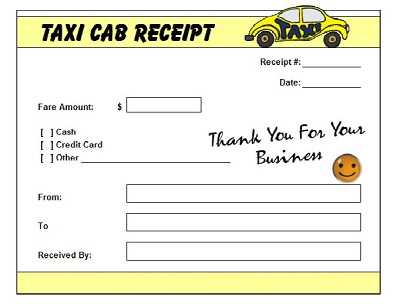

To create or choose the right template, ensure it includes sections for the driver’s name, taxi registration number, and the total fare. Customizing it to include additional fields like pick-up and drop-off locations can enhance its usefulness for record-keeping or business purposes. Make sure to include a unique receipt number for easier tracking of each ride.

Having a standardized format makes it easier to comply with accounting or reimbursement processes. Whether for personal use or corporate travel expenses, this straightforward tool helps to maintain organized and accurate records. Make sure the template is designed for quick completion and is printable for convenience.

Here’s a detailed HTML plan for an informational article on “Taxi receipt template Malaysia” with practical and specific headings: htmlEdit Taxi Receipt Template in Malaysia

Creating a taxi receipt template in Malaysia requires attention to local standards and details that can streamline your process. A good template should be clear, concise, and compliant with the regulations. Here’s a straightforward structure to follow for your template.

Key Components of a Taxi Receipt

Make sure your template includes these key elements:

- Taxi Company Information: Include the name, registration number, and contact details of the taxi company.

- Driver Information: Add the driver’s name and ID number to ensure traceability.

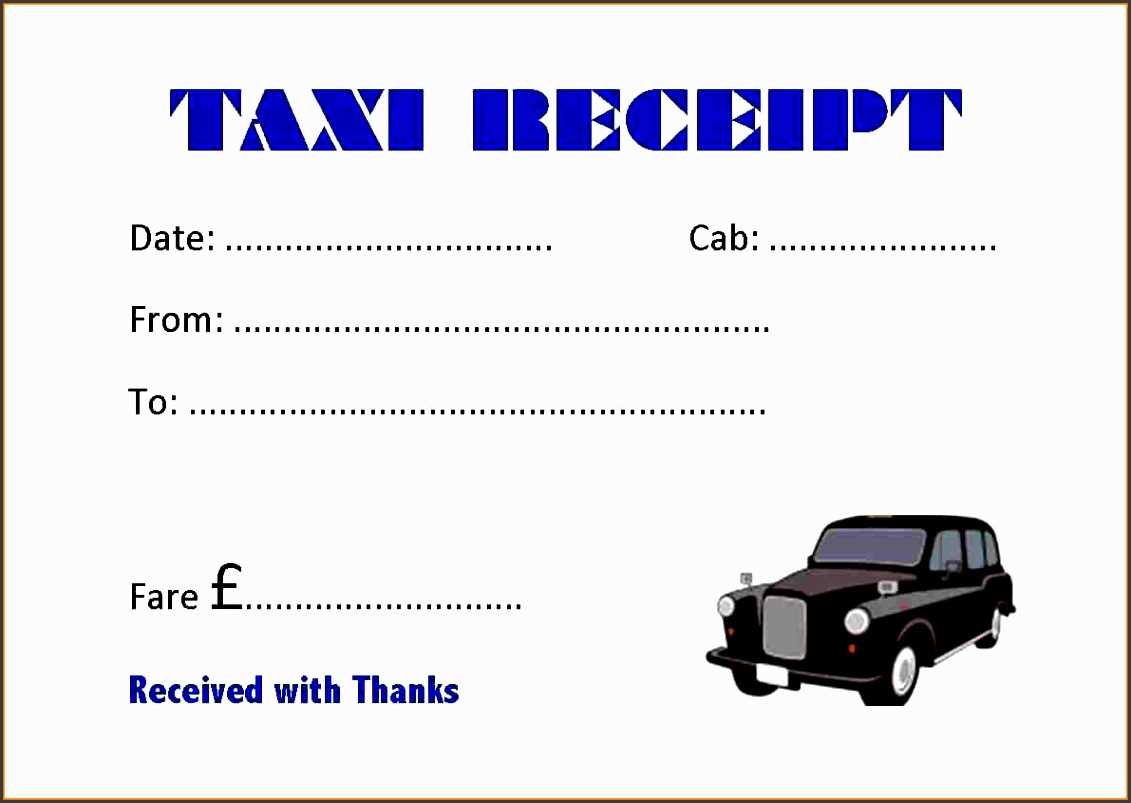

- Journey Details: Clearly list the date, time, and route details of the trip.

- Fare Breakdown: Break down the total fare, including base fare, additional charges (e.g., tolls, surcharges), and taxes.

- Payment Method: State how the payment was made (cash, card, etc.).

- Receipt Number: Use a unique identifier for each receipt.

Designing the Layout

When designing the receipt, prioritize readability and simplicity. Here are some tips:

- Font and Spacing: Use a clear, legible font. Avoid overly decorative fonts. Ensure there is enough spacing between sections to make the information easy to scan.

- Alignment: Align text to the left for consistency and ease of reading. Avoid cluttering the receipt with excessive graphics or borders.

- Size and Dimensions: Standard receipt size is typically A6 or A7. Keep the design compact but functional.

By following these practical steps, you can create a functional and professional taxi receipt template suitable for Malaysia’s regulatory standards.

Key Information to Include on Taxi Receipts

Include the taxi company name and contact information. This ensures passengers can reach the company for any inquiries or issues.

Show the date and time of the ride. This allows for proper tracking of the journey and helps avoid misunderstandings.

Display the fare amount clearly. Break down the total cost into base fare, additional charges, and any applicable taxes. This provides transparency and accountability.

List the driver’s name and identification number. This helps passengers identify the driver and ensures safety during the ride.

Provide a unique receipt number. This helps in case of disputes or for record-keeping purposes.

Ensure the vehicle registration number is visible. It adds an extra layer of security and allows passengers to confirm they are in the correct taxi.

If payment was made via card, include the transaction reference number. This is useful for any follow-up or inquiries about payments.

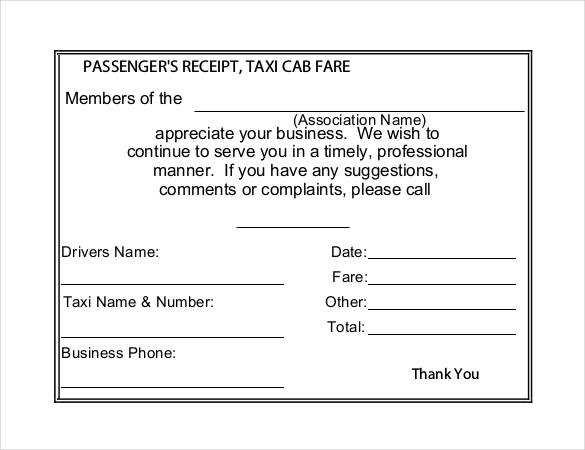

Customizing Taxi Receipt Templates for Business Use

Start by incorporating your business logo and contact details at the top of the receipt. This helps build your brand recognition and provides customers with easy access to your information for future rides.

Next, ensure your receipt includes key trip details such as the date, time, origin, and destination. This information helps clarify the service provided, which can be useful for both customers and your accounting records.

Incorporating Tax Information

If your business operates in Malaysia, including tax information is a must. Customize the template to include the tax percentage applied to the fare. This transparency will build trust with your customers and keep you compliant with local regulations.

| Item | Price (MYR) |

|---|---|

| Base Fare | 10.00 |

| Distance Charge | 15.00 |

| Tax (6%) | 1.50 |

| Total | 26.50 |

Adding Payment Methods

List the types of payment accepted, whether it’s cash, card, or e-wallet. This clarity helps customers choose their preferred payment method. You can even add QR codes for mobile payments to streamline the process.

Lastly, always include a space for driver and passenger signatures, especially if the service involves a longer trip or special requests. This ensures both parties agree on the details and the fare.

Legal Compliance for Taxi Receipts in Malaysia

Taxi receipts in Malaysia must comply with specific legal requirements to ensure transparency and accountability. Here’s what needs to be included:

- Taxi Operator Information: Include the name, address, and contact details of the taxi operator or company.

- Taxi Details: Clearly display the vehicle registration number and the type of service (e.g., normal taxi, airport transfer).

- Fare Breakdown: List the fare, including the base rate, distance charges, surcharges, and any other applicable fees.

- Date and Time: Ensure the receipt includes the exact date and time of the ride.

- Receipt Number: Provide a unique receipt number for tracking and auditing purposes.

Specific Legal Requirements for Taxi Operators

Under Malaysian law, taxi operators are obligated to provide a receipt upon passenger request. This ensures consumer protection and enables passengers to claim any discrepancies or overcharges. It is mandatory for operators to issue receipts for both cash and card payments.

Compliance with GST Regulations

As of recent updates, taxi receipts must reflect GST charges when applicable. The receipt should clearly display the GST rate and the total amount charged, which helps in maintaining accurate tax records.