Accessing a free cash receipts journal template can simplify the tracking of incoming payments. A well-organized template ensures accuracy in recording cash transactions and saves time for businesses managing their financial records.

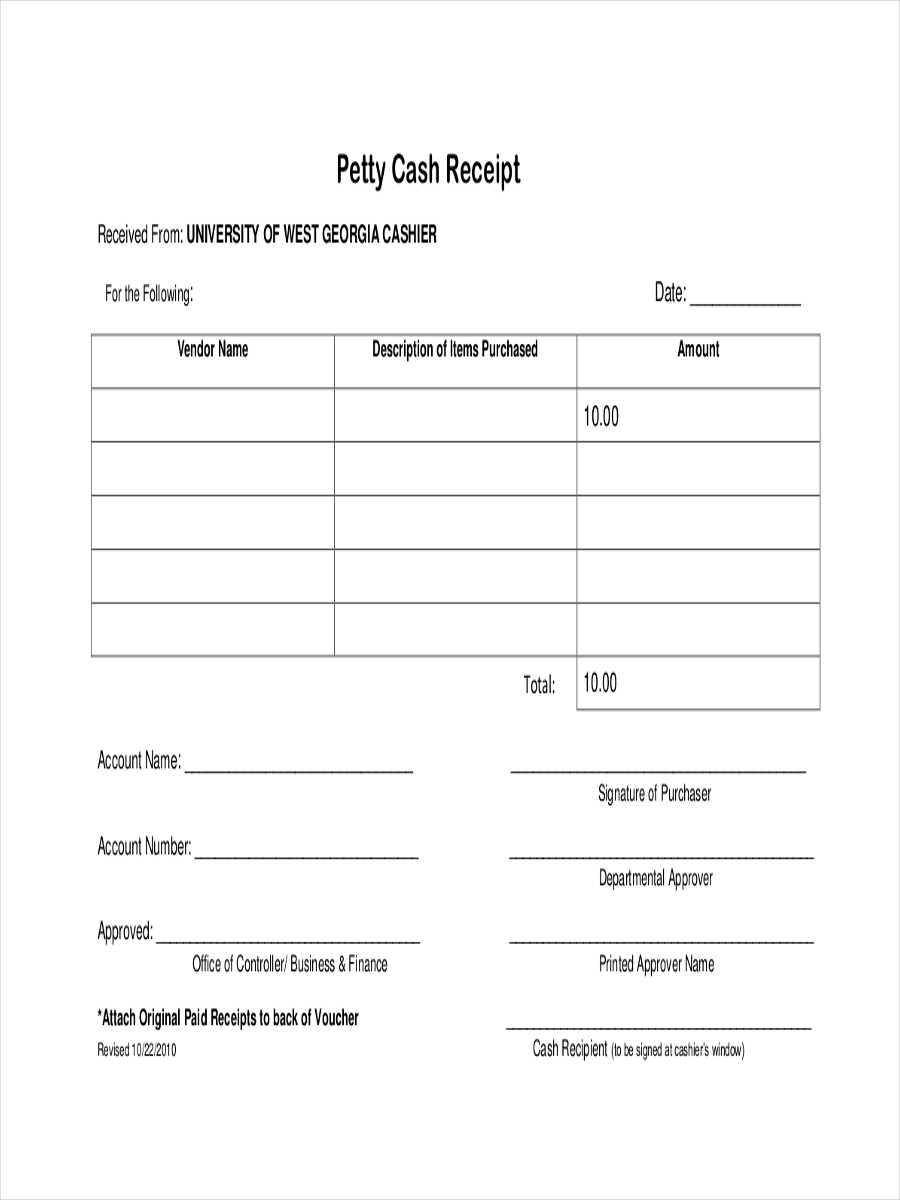

Make sure the template includes columns for the date, source of cash, amount received, and method of payment. These key details help maintain transparency and prevent errors in financial documentation. An intuitive layout allows for quick data entry and provides a clear overview of daily transactions.

Customize the template to fit specific needs, whether it’s for a small business or a larger enterprise. The ability to track cash receipts by categories, such as sales or loans, enhances visibility into revenue sources. Consider adding a column for the balance after each transaction to keep track of cash flow.

By using a cash receipts journal template, you ensure that records are well-structured and easy to reference during audits or tax season. Regular updates to the journal keep financial records up to date, avoiding discrepancies that could arise over time.

Here’s an improved version without repetition:

Organize your free cash receipts journal with a clear and simple format. Each entry should have a date, source of payment, amount received, and account credited. Use separate columns for the payment method (check, cash, or electronic transfer) and for the reference number, such as check number or transaction ID.

Key Fields to Include

Ensure the journal captures the following key information:

– Date of receipt

– Payment source (e.g., customer or donation)

– Payment method

– Amount received

– Reference number (to track transactions)

– Account credited (general ledger)

Track and Reconcile

After entering the receipt details, regularly reconcile the journal with your bank statement. This ensures accurate tracking and helps identify any discrepancies. Update your records immediately to avoid errors and maintain financial clarity.

- Free Cash Receipts Journal Template

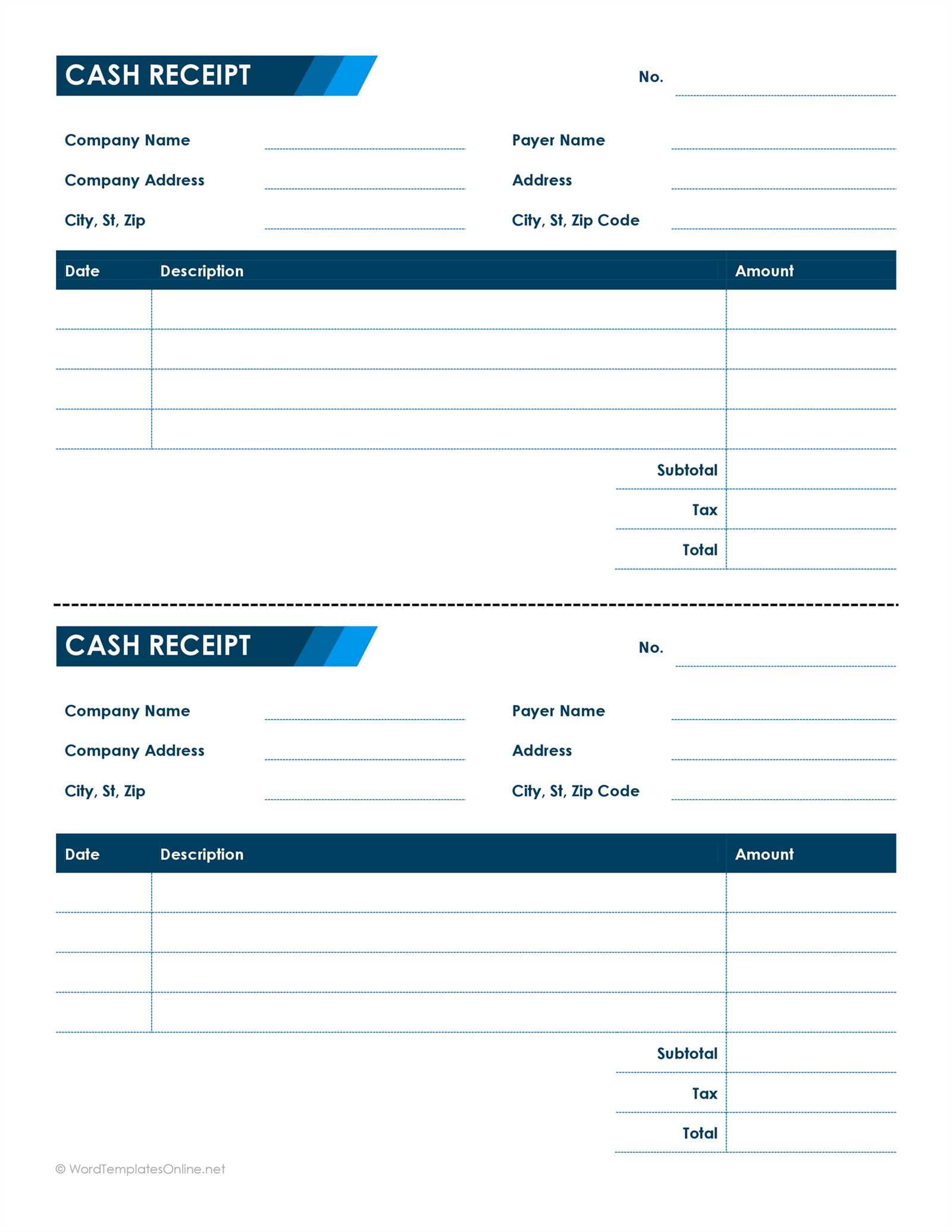

Use a free cash receipts journal template to track incoming payments easily and accurately. This template helps maintain clear financial records for businesses. Here’s how to structure your template:

- Date: Record the date of each transaction to ensure accurate timing of receipts.

- Receipt Number: Assign a unique number to each receipt to help with tracking and reference.

- Customer Name: List the name of the customer making the payment for easy identification.

- Payment Method: Specify whether the payment is made via cash, check, or another method.

- Amount Received: Note the total amount paid to keep track of funds received.

- Account Code: Categorize the payment by the relevant account for financial reporting.

- Notes: Include any additional details or clarifications about the transaction.

This template provides a quick and simple way to organize your receipts, helping you stay on top of cash flow. You can download a free template online or create one using spreadsheet software like Excel or Google Sheets. Customize it to suit your business needs, and update it regularly to avoid missing any payments. A well-maintained journal ensures that your financial records stay accurate and up-to-date.

To create a custom cash receipts journal in Excel, begin by setting up a simple spreadsheet with columns that track necessary details. Use the following categories for your columns: Date, Receipt Number, Customer Name, Description, Amount Received, Payment Method, and Account Debited. These fields will help you categorize and manage your cash receipts efficiently.

Next, format the columns for clarity. Ensure that the Date column uses a date format, and the Amount Received column is formatted as currency. This will make data entry easier and prevent errors. Consider adding drop-down menus for the Payment Method column, which can include options such as Cash, Credit Card, or Check.

For consistency, create a simple formula to automatically sum the Amount Received column. Place this sum at the bottom of the Amount Received column for easy tracking of the total amount received. If necessary, add conditional formatting to highlight any discrepancies or unusual entries in the journal.

Once the basic structure is in place, customize the template with additional categories relevant to your business needs, such as a customer ID or specific account categories. This allows for deeper tracking and organization.

Save the template for future use, ensuring it is easily accessible whenever you need to record a new cash receipt. By keeping the layout clean and organized, you’ll have a powerful tool that simplifies managing cash receipts.

A clear and organized cash receipts journal template helps streamline financial tracking. The key elements ensure accuracy and consistency in recording incoming cash transactions.

The first critical element is a date field. Every transaction must have a clear date of entry to maintain proper chronological order. This helps in reconciling cash flow with bank statements and other accounting records.

Source of funds should also be noted. This refers to where the cash is coming from–whether it’s from customers, sales, or other income sources. It’s vital for categorizing the type of transaction accurately.

Amount received is another important field. Always list the exact amount received for each transaction. Ensure that the amount is clear and matches the source of funds.

Payment method details allow for further clarity. Indicate if the payment was made via cash, check, bank transfer, or another method. This detail helps in tracking payment types and their reconciliation with the bank accounts.

The account to credit specifies which ledger account should be updated with the incoming cash. Whether it’s a revenue, liability, or another type of account, this ensures accurate financial records.

Reference number can be helpful, especially when cross-referencing with invoices, receipts, or other documents. This field ensures that every transaction can be traced back for audit or reporting purposes.

Lastly, a comments or description section can provide context, noting any specifics of the transaction that may not be immediately clear from the other elements.

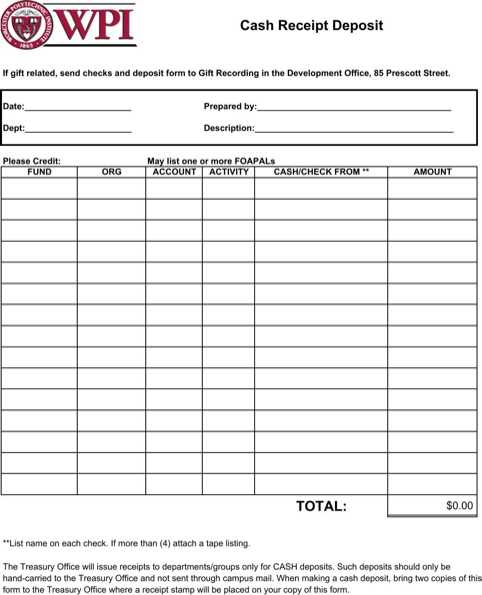

| Date | Source of Funds | Amount Received | Payment Method | Account to Credit | Reference Number | Comments |

|---|---|---|---|---|---|---|

| 2025-02-14 | Customer A | $500 | Cash | Revenue | INV12345 | Payment for invoice |

| 2025-02-14 | Customer B | $250 | Bank Transfer | Revenue | INV12346 | Payment for services |

One key mistake is failing to properly categorize receipts. Ensure each entry aligns with the correct account, whether it’s for sales, loans, or other sources. Misclassification can lead to inaccurate financial statements and complicate tax reporting.

Another issue arises from inconsistent entry dates. Always enter the date on which the cash was actually received. Using the wrong date can result in discrepancies, affecting financial period reporting and analysis.

Not Including Complete Payment Details

Incomplete payment descriptions, such as omitting the payer’s name or transaction purpose, lead to confusion later. Including all relevant details helps prevent errors and ensures transparency when reviewing the journal.

Neglecting Regular Reconciliation

Many forget to reconcile the cash receipts journal with the bank statements regularly. Without this step, it’s easy to overlook discrepancies and errors that could distort your financial position.

Inaccurate calculations or incorrect data entry are also common mistakes. Double-check amounts and ensure each transaction is recorded precisely, especially when adding multiple payments.

The free cash receipts journal template simplifies tracking and managing cash receipts in businesses. It’s crucial to set up your journal in a clear, structured way to ensure accuracy and transparency in financial reporting.

Steps to Set Up the Template

Begin by including essential columns: Date, Receipt Number, Customer Name, Description, Cash Amount, Payment Method, and Account. These fields will help you quickly identify and categorize each transaction. Use consistent formatting for each entry to minimize errors.

Organizing Cash Receipts

Use distinct categories to classify cash receipts, such as Sales, Loans, or Refunds. Each category helps streamline reporting and provides insight into your business’s cash flow. Be sure to update the journal immediately after each transaction to avoid missing any entries.

Periodically review and reconcile the journal with your bank statements to ensure the numbers align. This practice reduces the risk of discrepancies and provides a clearer financial picture.