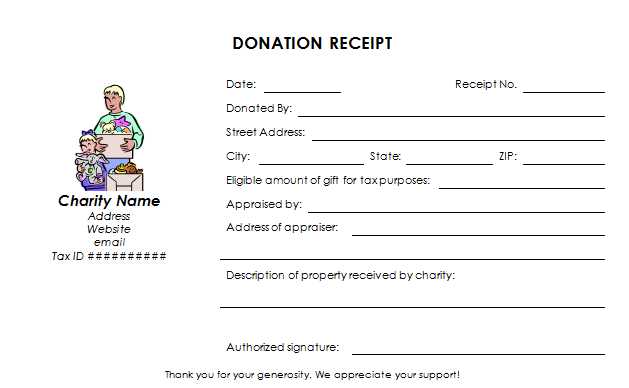

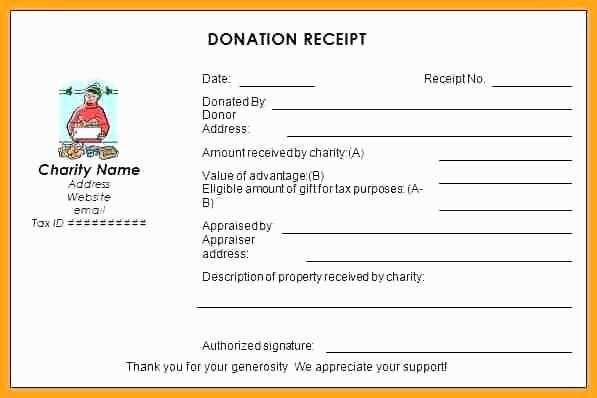

Use a clear and concise tax receipt template for documenting donations. This receipt serves as a key record for both the donor and the recipient organization, helping ensure proper tax reporting. Ensure the template includes the donor’s name, donation amount, date, and organization details.

Include the following elements:

1. The donor’s full name and address.

2. A description of the donation, including its nature (cash, goods, services, etc.).

3. The donation amount or estimated value, depending on the type of contribution.

4. The date of donation.

5. A statement confirming that no goods or services were exchanged for the donation, if applicable.

Make sure the organization’s details are clearly listed:

1. The organization’s name and address.

2. A statement of the organization’s tax-exempt status, if relevant.

3. Contact information for any further inquiries.

Ensure this template is updated annually to comply with tax regulations and remains clear for the donor’s tax filing purposes.

Here’s a detailed plan for an informational article on the topic “Tax Receipt Template for Donation” in HTML format, using

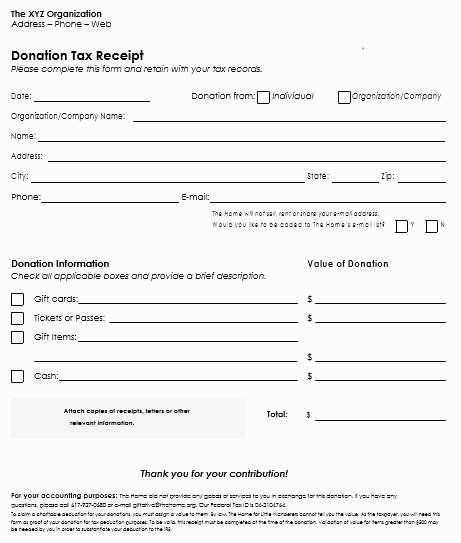

To create an accurate and legally compliant tax receipt for donations, follow these key steps:

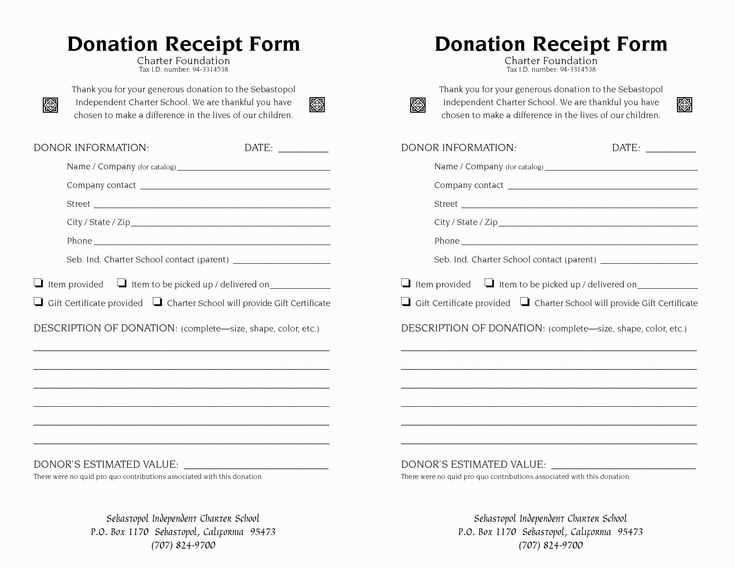

1. Donation Details

Include the name of the donor, the date of the donation, and the donation amount. If applicable, specify whether the donation is monetary or in-kind. If the donation is in-kind, provide a description of the items donated and their estimated fair market value.

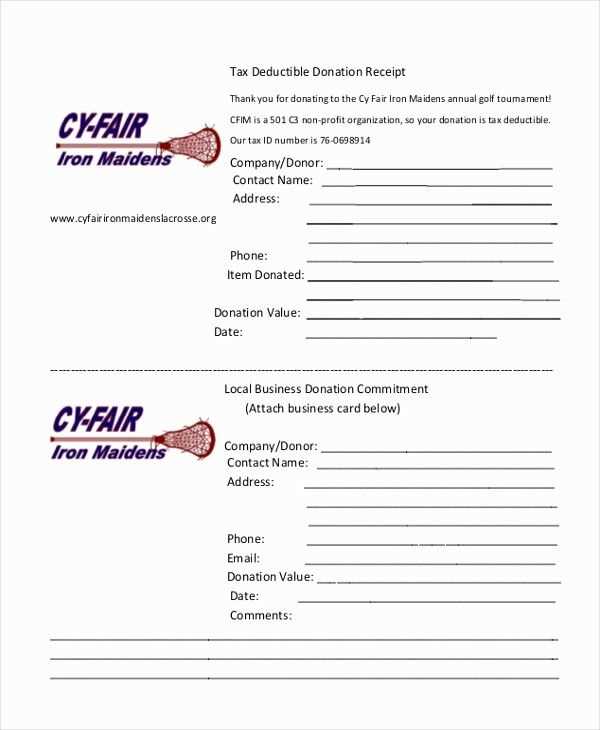

2. Charitable Organization Information

List the name, address, and contact information of the charity or nonprofit. Include the charity’s tax identification number (TIN) or EIN (Employer Identification Number) to confirm the legitimacy of the organization. This is essential for the donor’s records and for tax filing purposes.

3. Acknowledgment of No Goods or Services Received

If the donation is fully tax-deductible, explicitly state that the donor did not receive any goods or services in return for the donation. If the donor received something in exchange (such as a gift), note its value to ensure the donor can claim the correct deduction.

4. Signature and Date

Include a section for the signature of an authorized representative of the charitable organization. This should be followed by the date the receipt is issued. The donor may need this signed receipt when claiming their deduction on tax forms.

5. Clear Format

Ensure the template is easy to read and follow. The information should be organized in a structured format with clear headings. The use of bullet points for key details like the donation amount, date, and donor’s name will enhance clarity.

6. Legal Compliance

Ensure the receipt meets the legal requirements of your local tax authority. The IRS, for example, has specific guidelines for tax receipts for charitable donations in the United States. Familiarize yourself with these rules to ensure the template is compliant.

How to Create a Tax Receipt for Donations

To create a tax receipt for donations, include the donor’s name, the date of the donation, and the donation amount. Specify whether the donation was cash, property, or services. If it was property, provide a description of the items and their estimated value.

Required Information

The receipt must include the name of the charity or nonprofit, the organization’s tax identification number, and the amount of the donation. For non-cash donations, provide a brief description of the items donated. Ensure the receipt is dated and signed by an authorized representative of the charity.

Form and Format

Use a clear, formal layout that lists all necessary details. Templates can be found online or through accounting software, and should be customized with the charity’s branding for consistency. Double-check all information before sending the receipt to avoid errors.

Key Legal Requirements for Tax Receipts

Tax receipts for donations must include specific information to meet legal standards and ensure they are valid for tax purposes. Here’s what must be included:

- Donor’s Information: The name and address of the donor should be clearly stated. Some regions may also require the donor’s tax identification number.

- Organization’s Information: The full name, address, and tax identification number of the organization receiving the donation must be included. This helps confirm the legitimacy of the organization.

- Donation Amount: Clearly state the exact amount of the donation, whether monetary or in-kind. For non-cash donations, a description of the donated items is required, including their estimated value.

- Date of Donation: The date on which the donation was made is necessary to validate the deduction for the correct tax year.

- Statement of No Goods or Services Provided: If no goods or services were exchanged for the donation, the receipt should include a statement confirming this. If any benefits were given, their value must be stated.

- Charitable Purpose: The receipt should clearly identify the charitable purpose for which the donation is made, ensuring compliance with tax-exempt status regulations.

- Signature: Some jurisdictions require the signature of an authorized individual from the charitable organization to validate the receipt.

By including these details, the tax receipt will be legally valid and ensure that the donor can claim their charitable tax deduction. Failure to include required information can lead to complications during tax filing.

Best Practices for Managing and Distributing Receipts

Use an organized system for tracking and issuing donation receipts. A reliable database or donation management software can help store donor information and generate receipts automatically. This reduces human error and ensures accurate records.

Ensure Accuracy and Consistency

Verify that each donation receipt includes the correct donor details, donation amount, and date of contribution. A mistake in any of these areas can lead to confusion and potentially cause issues during tax filing. Keep your records consistent across all receipts.

Distribute Receipts Quickly and Securely

Send receipts as soon as a donation is received. Use secure methods like email with encryption or trusted physical mail to ensure confidentiality. For email, include a clear subject line indicating it’s a tax receipt and attach a PDF version for the donor’s records.

For donors who prefer physical receipts, ensure the printing and mailing process is swift. Consider offering online receipt access to streamline distribution for those who prefer digital versions.

Make the process seamless for your donors while protecting their sensitive information.