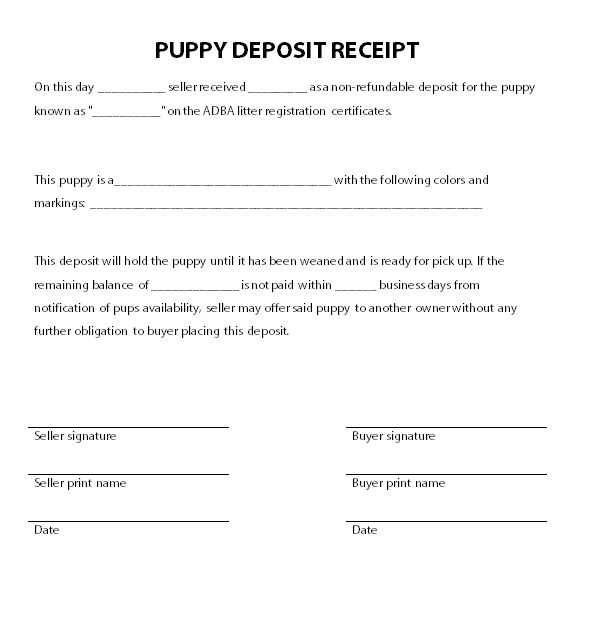

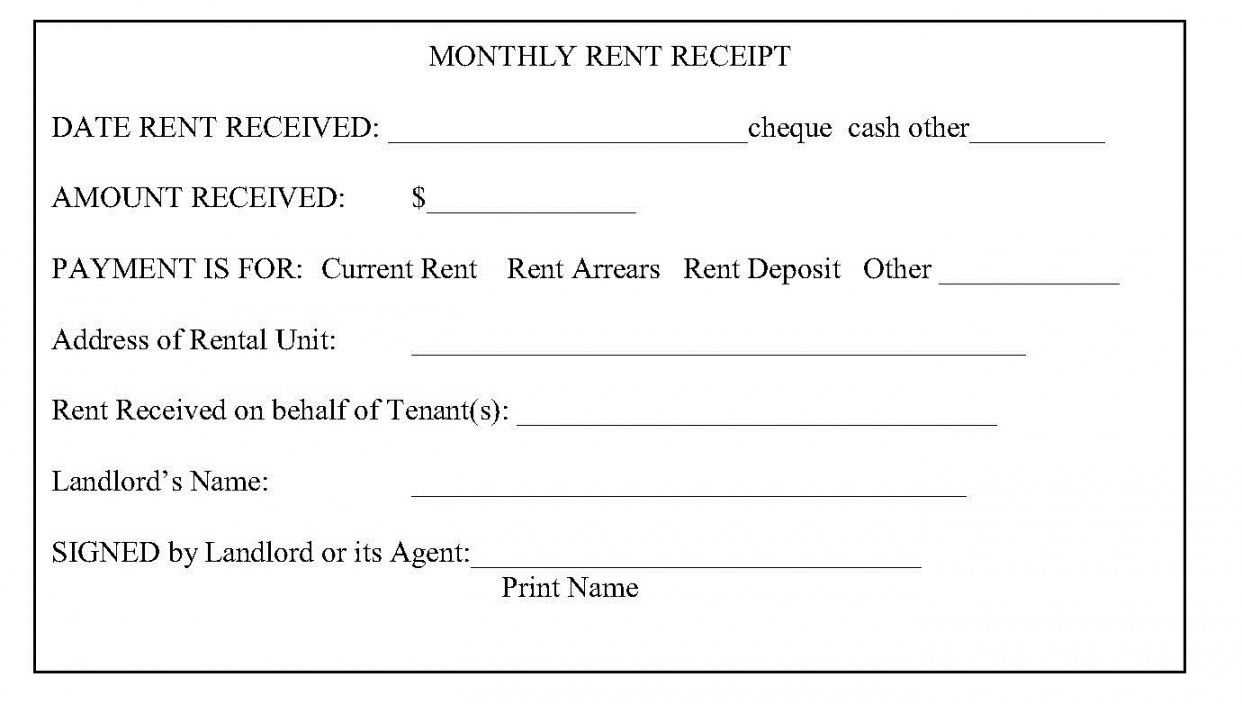

Creating a receipt for a deposit is a simple yet critical task for maintaining clear financial records. With a free template, you can quickly generate a professional-looking document that captures all necessary details. This will help both you and your clients keep track of transactions without hassle.

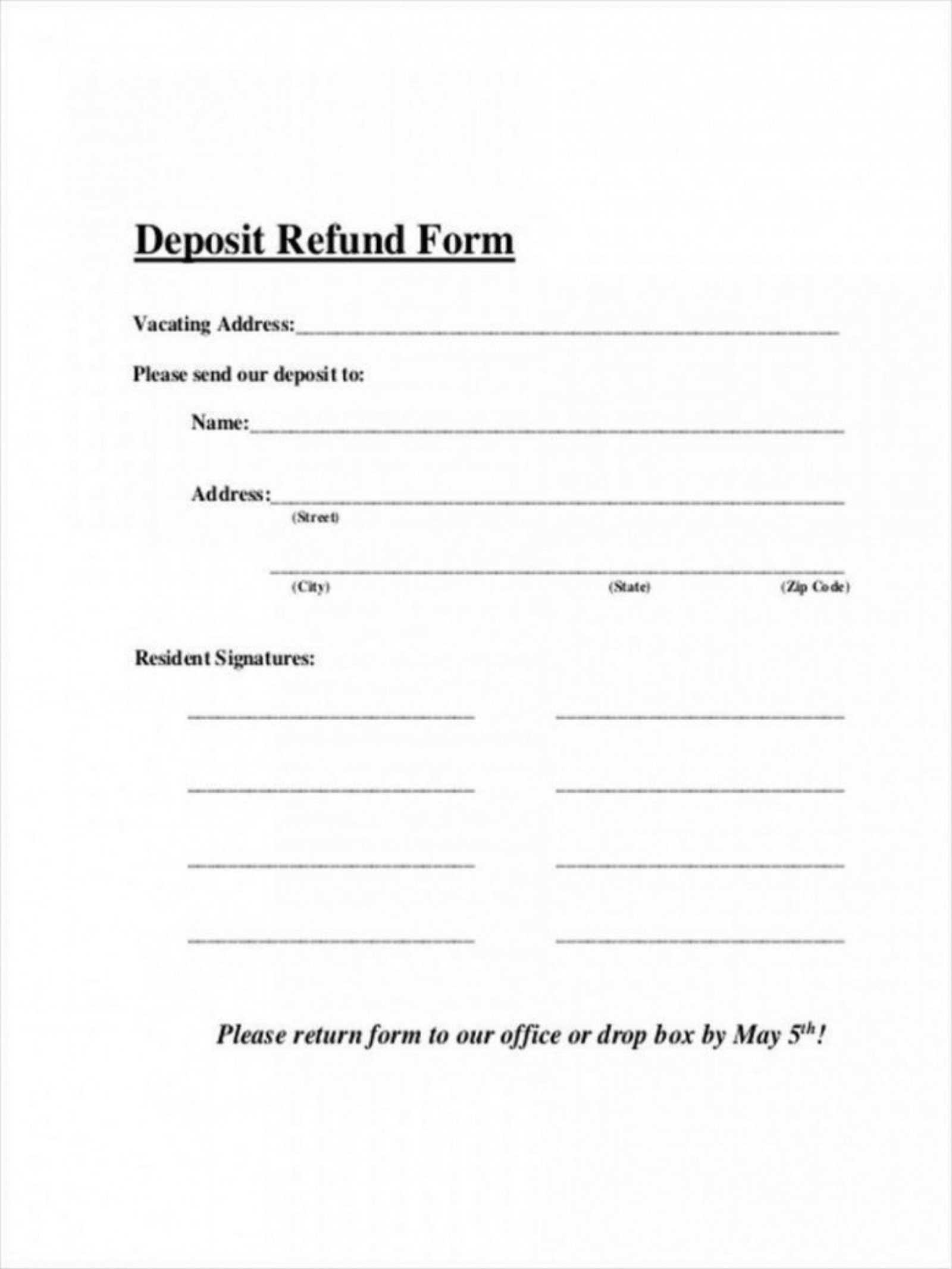

The template should include key information such as the depositor’s name, the amount deposited, the date, and the purpose of the deposit. By filling in these fields, you ensure accuracy and transparency in your financial dealings. You may also want to add a unique reference number to track each transaction effectively.

Using a free template saves you time and ensures consistency in your receipts. A well-structured template can also be customized to suit your specific needs, whether you’re running a small business, managing a rental property, or dealing with personal transactions.

When filling out the receipt, always double-check the information before sharing it with the other party. Providing a clear, detailed record can prevent confusion later on and build trust between you and your clients or customers.

Here are the corrected lines:

Ensure that each section of your receipt clearly indicates the amount deposited. Avoid vague wording–state the exact value in a straightforward manner. It’s a good idea to provide the date of the deposit and the method used for clarity. If applicable, include a reference number for tracking purposes.

Receipt Details

Each receipt should have a unique identifier. Include fields for the sender’s name, recipient’s name, and the deposit purpose. Make sure to format the amount clearly, using a consistent currency format. Double-check all amounts before finalizing.

Finalizing the Receipt

After inputting all necessary data, review the document for accuracy. If anything seems off, correct it before providing the receipt to the customer. Make sure there is a section for the signature, as this adds validity to the receipt.

- Free Receipt for Deposit Template

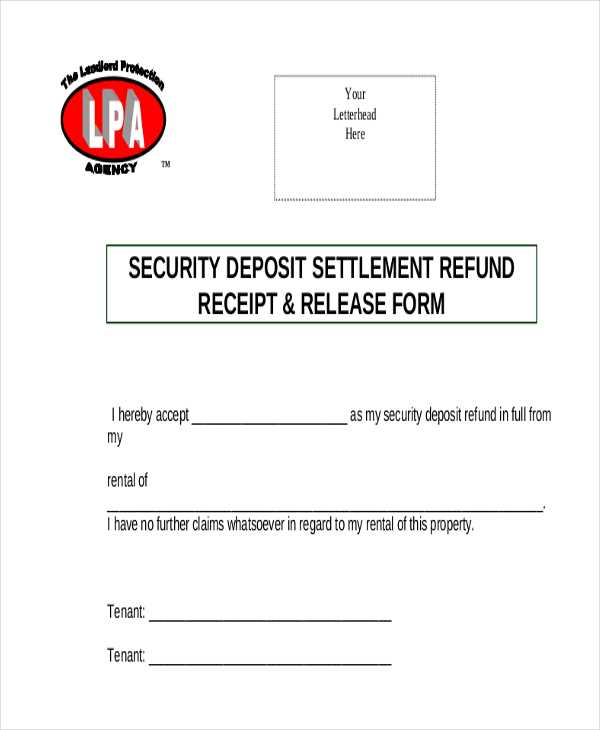

A free receipt template for deposits can simplify record-keeping for both individuals and businesses. This document serves as confirmation of a payment made in advance, often for services or products. A clear template should include essential details such as the date, amount deposited, the payer’s name, and a brief description of the transaction.

Key Elements to Include

To ensure accuracy, a deposit receipt should feature the following sections:

- Date: The exact date of the deposit.

- Amount: The total amount deposited.

- Payer’s Details: The name and contact information of the person or entity making the deposit.

- Purpose: A description of what the deposit is for.

- Receipt Number: A unique reference number for tracking purposes.

Customization Tips

While using a template, personalize it to match your specific needs. Adjust the format to include any other relevant details, such as payment method or contract terms, to enhance clarity. Keep the design simple and readable to ensure the document serves as a clear and useful record for both parties involved.

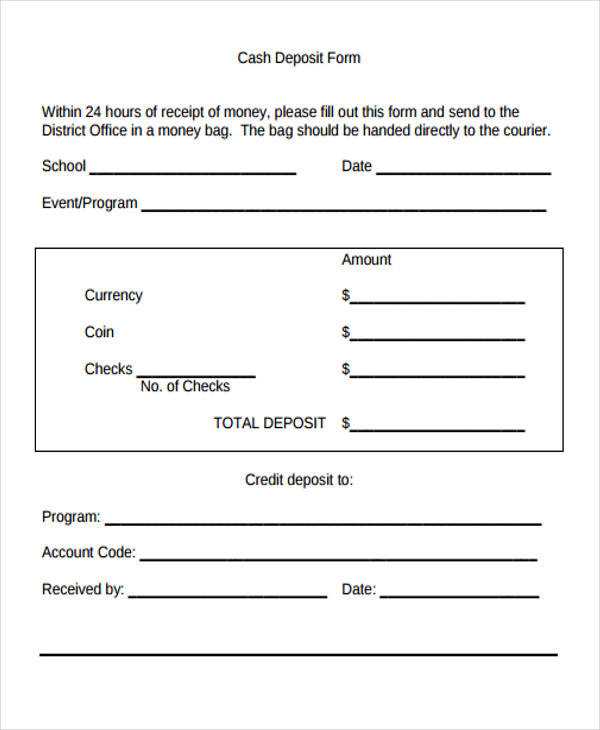

To create a simple receipt template for deposits, begin by including key details such as the depositor’s name, the amount deposited, and the date. These are the core elements for any receipt.

- Depositor’s Information: Include the full name of the person or entity making the deposit.

- Deposit Amount: Specify the exact sum being deposited, including the currency.

- Date of Deposit: Always include the date of the transaction to maintain accurate records.

Next, include a reference number for easy tracking of deposits. This can be either a manual or auto-generated number that links the receipt to a specific transaction.

- Reference Number: Assign a unique identifier for each deposit, which will help both parties locate the transaction easily.

To ensure clarity, add a brief description of the deposit, such as the reason for the deposit or the account it was made to. This can help prevent confusion in the future.

- Description of Deposit: Describe the nature of the deposit briefly (e.g., “security deposit,” “payment for service,” etc.).

Finally, include a section for signatures. This confirms that both parties have agreed to the transaction details.

- Signature Line: Provide spaces for both the depositor and the receiver to sign the receipt.

Include the deposit amount clearly. Specify the total sum that the customer has deposited, ensuring no ambiguity. Include the currency to avoid confusion, especially in international transactions.

Transaction Date

Always add the exact date of the deposit. This will help both parties keep track of their records and ensure that the transaction can be referenced later if necessary.

Depositor’s Information

Record the name of the individual or business making the deposit. If applicable, include additional details like contact information for verification purposes.

Ensure that any reference number or transaction ID is included to make it easier to trace the deposit in your system or for future inquiries.

If the deposit is for a specific purpose (e.g., rent, service payment), note that purpose on the receipt. This makes it easier for both parties to understand the context of the transaction.

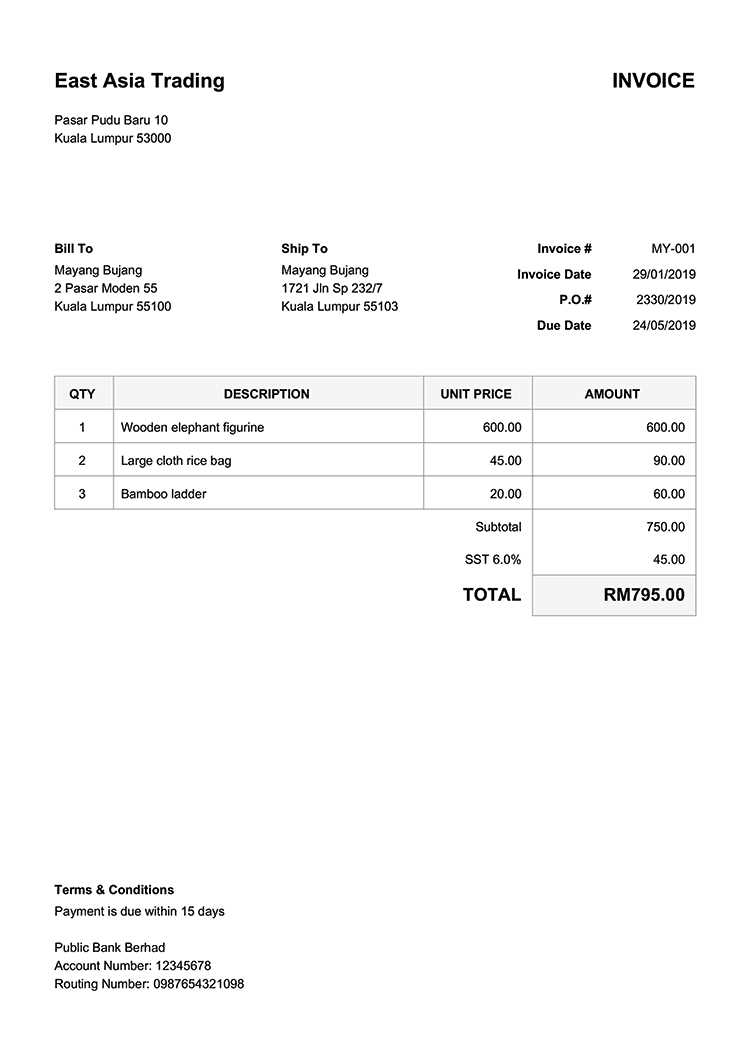

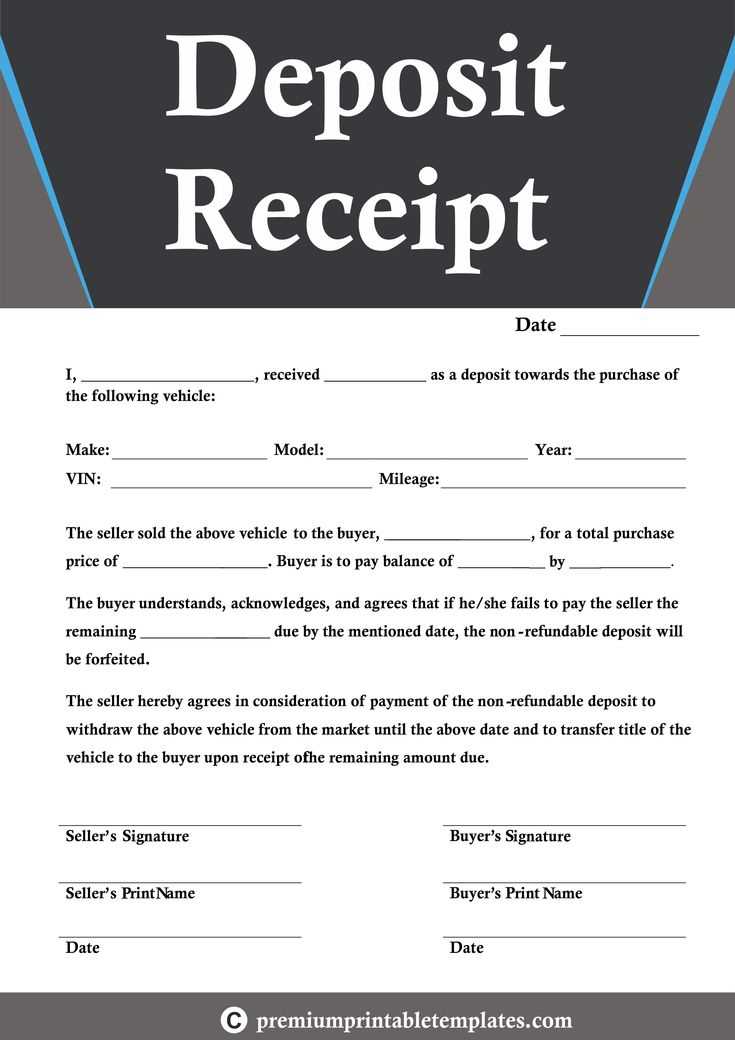

Customizing receipts for different transactions helps create clear and relevant documentation for both you and your customers. Start by adjusting the fields to match the specifics of each type of transaction, whether it’s a product sale, a service payment, or a deposit. Below are key modifications to consider:

1. Include Transaction-Specific Details

For each transaction type, add relevant details that highlight the purpose. For example, a product sale receipt should list item names, quantities, and prices, while a deposit receipt might focus on the amount and terms of the deposit. Use dynamic fields to capture transaction-specific data, such as item codes for sales or due dates for deposits.

2. Adjust Tax Information

Ensure tax details reflect the correct rates based on the transaction. If the transaction is taxable, include the applicable tax rate and amount. If the transaction involves exempt items or services, indicate the tax exemption clearly.

| Transaction Type | Tax Rate | Amount |

|---|---|---|

| Product Sale | 10% | $50 |

| Deposit | 0% | $100 |

For international transactions, adjust the tax rates based on the location and include any necessary currency exchange rates. Make sure to clearly indicate if the amount is in a foreign currency.

By customizing these elements, you ensure that each receipt is tailored to the transaction’s nature, helping avoid confusion and keeping the records straightforward for both parties involved.

To create a receipt for deposit, start by clearly marking the purpose at the top of the document. Include the date of the transaction and the name of the party receiving the deposit. List the amount deposited in both numeric and written form. Be sure to provide the method of payment, such as cash, check, or electronic transfer. Include any additional relevant details, such as the purpose of the deposit or a reference number.

Key Details to Include

- Date and time of the transaction

- Name and contact information of the deposit receiver

- Amount deposited

- Payment method

- Purpose of the deposit (if applicable)

- Any applicable reference numbers or transaction IDs

Additional Recommendations

Make sure both parties sign the receipt, confirming the details of the transaction. A clear breakdown of the deposit amount or any related fees will help maintain transparency. Store a copy of the receipt for both the depositor and the recipient for future reference.