Use this Letter of Receipt of Money Paid template to formally acknowledge a payment received. It provides clear details on the transaction and serves as proof for both parties involved. Make sure to include essential information such as the payer’s name, the payment amount, the date of transaction, and the reason for the payment.

In this template, you’ll find a simple format that includes all necessary components. Start by clearly stating the receipt and acknowledging the payment. Then, provide specifics about the transaction like the payment method used and any reference number if applicable. End the letter with a polite thank you or acknowledgment of the transaction’s completion.

Be sure to tailor the template according to your situation, whether it’s for personal or business purposes. Adjust the tone as needed, keeping it professional and straightforward. This receipt can be issued in physical or digital form, depending on your preference or the transaction’s nature.

Here is the revised version with minimized repetition:

To create a clear and professional letter of receipt for money paid, focus on providing the key details concisely. Begin with the date of the transaction, followed by the payer’s name and the amount received. Specify the payment method (e.g., cash, check, wire transfer) to avoid any ambiguity. Clearly state the purpose of the payment and mention any relevant invoice or reference numbers, if applicable.

Structure and Clarity

Use simple and direct language to avoid unnecessary complexity. Each section should be clearly labeled, with a concise description of the payment details. Keep the tone polite but to the point. A brief closing statement expressing gratitude can help maintain a positive tone.

Sample Template

Here’s an example of a letter structure:

- Date: [Insert Date]

- Paid By: [Insert Payer’s Name]

- Amount: [Insert Amount]

- Payment Method: [Insert Payment Method]

- Purpose: [Insert Purpose or Invoice Number]

- Thank you for your payment.

Here’s a detailed plan for an informational article on the topic “Letter of Receipt for Money Paid Template” with three practical and specific headings:

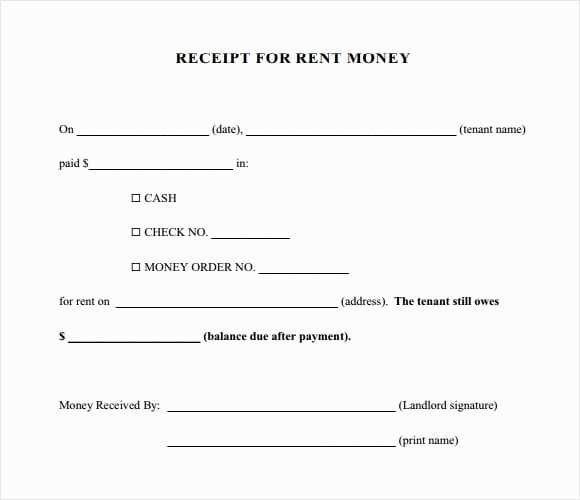

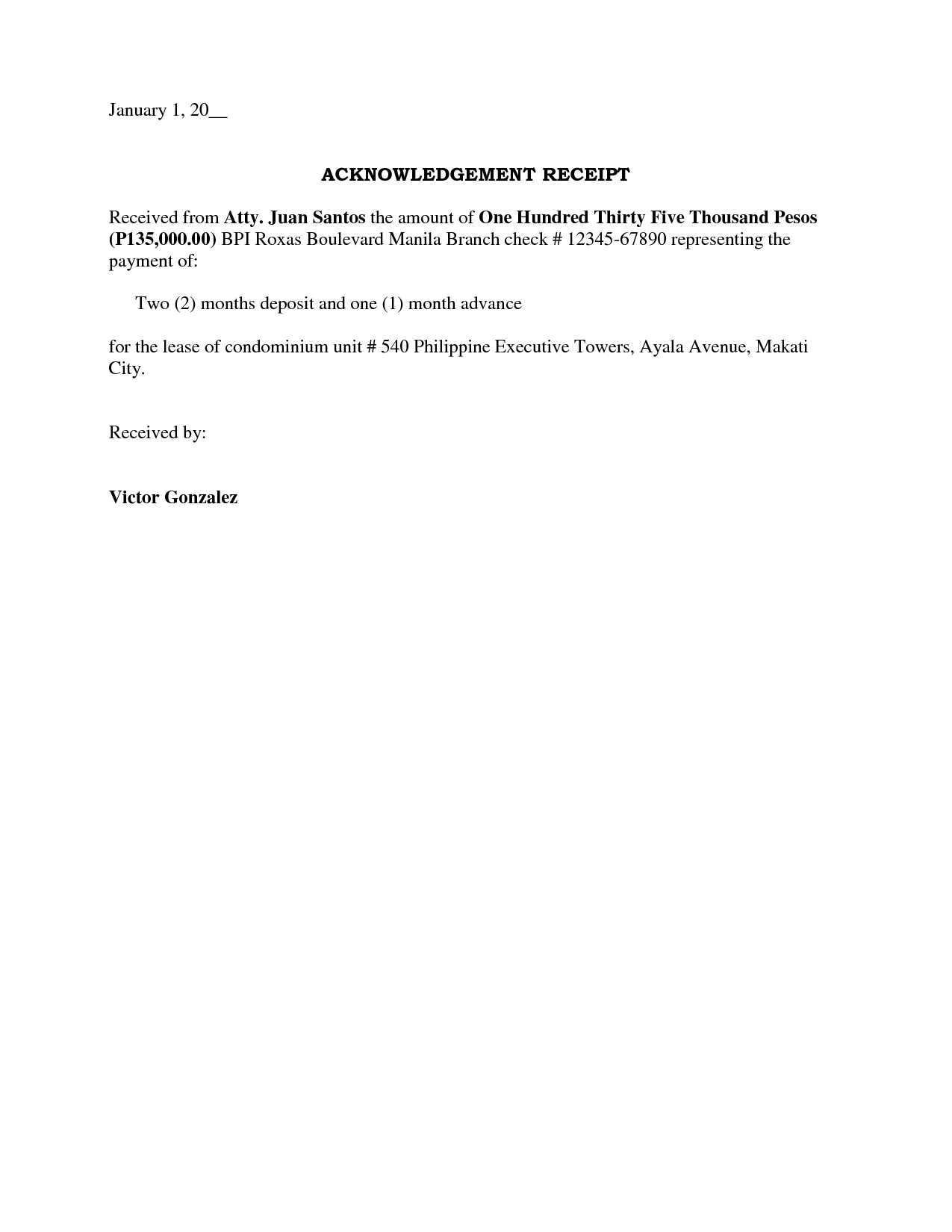

A “Letter of Receipt for Money Paid” serves as confirmation that a transaction has occurred. It’s an essential document in business and personal transactions, ensuring that both parties are clear about the payment details. Here’s how to structure such a letter:

1. Basic Information to Include

Begin with the date of the transaction. This helps establish a timeline. Clearly state the amount of money paid and specify the payment method (e.g., cash, check, wire transfer). Include the name and address of the payer and payee for reference. If applicable, mention the invoice number or any relevant agreement linked to the payment.

2. Acknowledgment of Payment

In this section, acknowledge the payment by confirming receipt. You can use a direct statement such as “I hereby acknowledge receipt of [amount] paid on [date].” This ensures that the payer knows their payment has been received and logged properly.

3. Closing and Contact Information

End the letter by offering your contact information for any follow-up questions. A simple closing like “Please feel free to reach out if you have any questions or need further clarification” works well. If required, include a signature for official purposes. Always ensure that the tone remains professional but friendly.

- How to Properly Format a Payment Receipt Letter

To create a clear and professional payment receipt letter, structure it logically. Start with the basic details that identify both parties and the transaction itself.

Include Key Information

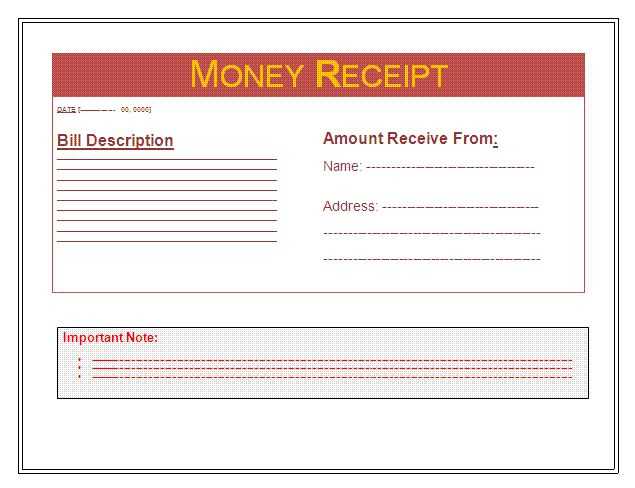

- Header: Include your business name, logo, and contact details at the top of the letter.

- Date: Ensure the date the payment was received is clearly stated.

- Recipient Details: List the recipient’s full name and contact details.

- Payment Details: Mention the amount paid, method of payment (cash, check, bank transfer), and the invoice number, if applicable.

- Transaction Reference: Add any relevant transaction or reference numbers to help track the payment.

Be Clear and Concise

Provide a straightforward statement confirming the payment received, such as: “This is to acknowledge receipt of $X for invoice #12345.” This removes ambiguity and helps both parties keep track of the transaction.

- Signatures: If possible, have both parties sign the document, either digitally or manually, to verify the payment was completed.

- Additional Notes: If needed, include any extra terms, such as when the next payment is due or if there are any other relevant conditions.

Always ensure the document is easy to read and free of errors, providing a professional impression and making future reference simpler for both parties.

Issuing a money receipt is an important task in various financial transactions. Below are common scenarios where issuing a receipt is necessary:

Payment for Goods or Services

When a customer purchases goods or services, a receipt serves as proof of the transaction. It details the amount paid, the items or services received, and any applicable taxes. For businesses, issuing receipts helps maintain transparency and ensures proper accounting records.

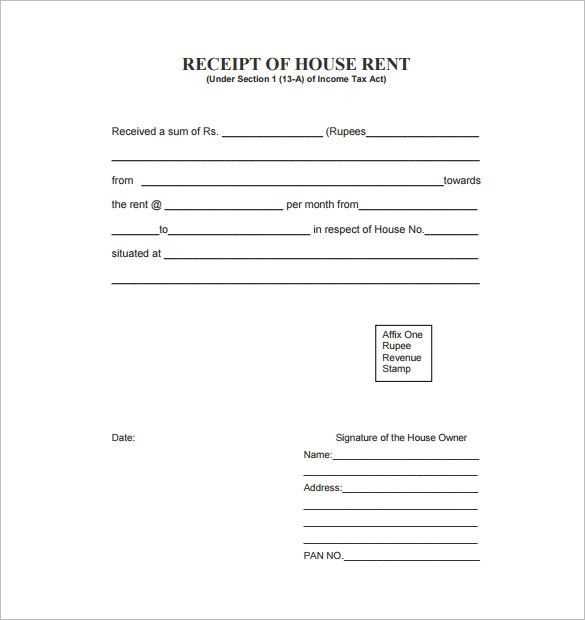

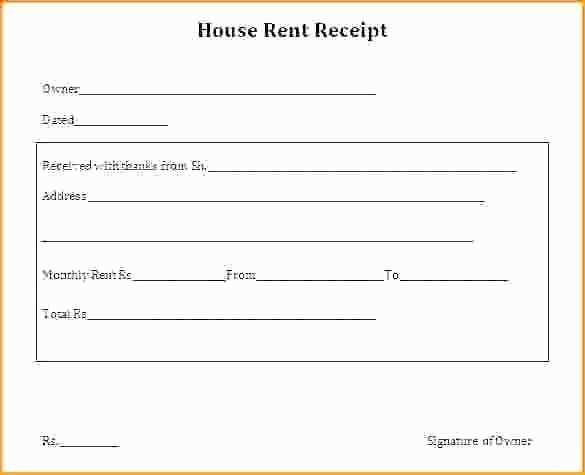

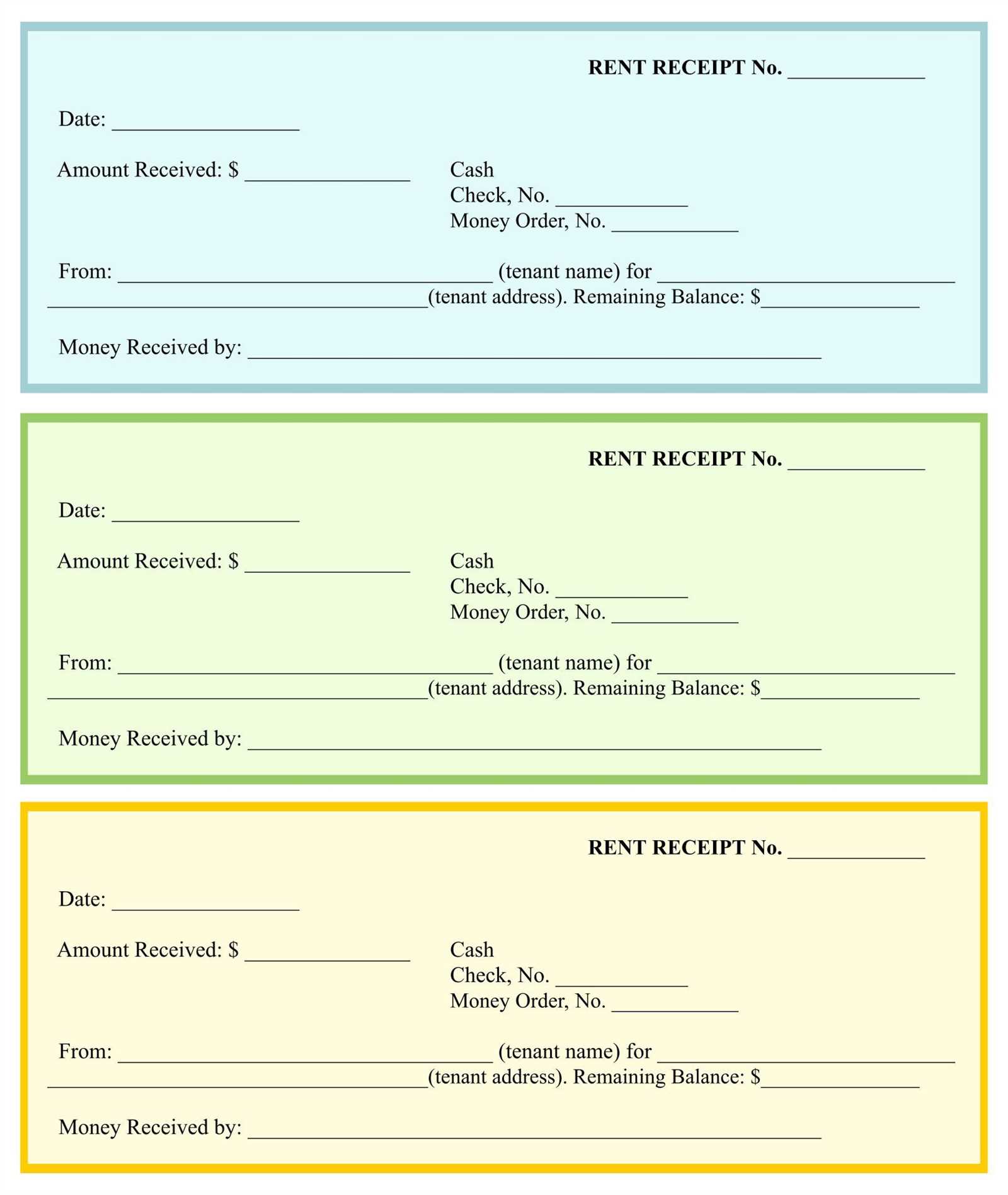

Rent Payment

In rental agreements, landlords issue receipts to tenants after receiving rent payments. This confirms the payment was made and helps prevent any disputes regarding the amount or the timing of the payment.

Loan Repayments

If a person repays a loan, the lender should provide a receipt for the amount received. This establishes a clear record of the transaction and helps both parties track the repayment schedule.

Donations

Charitable organizations typically issue receipts for donations, which donors can use for tax deductions. These receipts include details such as the donor’s information, the donation amount, and the date of the donation.

Event Fees

When someone pays for attending an event, such as a conference or seminar, issuing a receipt verifies the payment and confirms the participant’s registration. Event organizers use these receipts for financial record-keeping.

Ensure that your receipt contains the correct legal details, including the names and addresses of both parties involved, the transaction amount, and the date of payment. This establishes a clear and transparent record of the transaction for any future disputes or inquiries. The receipt must also specify whether the payment is for goods or services, as this can affect tax liabilities.

Understand local tax laws to determine if VAT or sales tax should be included on the receipt. In many jurisdictions, businesses are required to charge sales tax on certain goods or services, and failure to include this tax on the receipt may lead to penalties. Keep in mind that tax rates can vary based on location and type of transaction.

For businesses, receipts are considered official records and may be requested during tax audits. Accurate and detailed receipts are necessary for reporting income and expenses, as well as for tax deductions related to business operations. It’s advisable to keep copies of all receipts in an organized manner for the required retention period.

If issuing a receipt as a business entity, be aware that tax authorities may require specific information to be included. This may include your business registration number, VAT ID, or other identifiers. Including these details ensures compliance with tax regulations and helps avoid potential fines or audits.

For personal transactions, while receipts are not always legally required, they can still serve as proof of payment in case of disputes. It’s a good practice to provide one, especially for larger amounts or long-term agreements, such as loan repayments.

Letter of Receipt of Money Paid: Clear and Concise Template

Use this simple template to confirm the payment received. It is direct and to the point, making it clear to both parties that the transaction has been successfully processed. Make sure to include the date, the amount, and a brief acknowledgment of the payment.

Example:

Receipt Confirmation

I hereby confirm the receipt of $500 on February 14, 2025, for the purchase of goods/services as per our agreement. The payment has been successfully processed.

This format ensures that all necessary details are communicated without unnecessary repetition, providing both clarity and simplicity in the transaction record.

Always double-check the payment amount and date before sending the receipt to avoid any confusion.