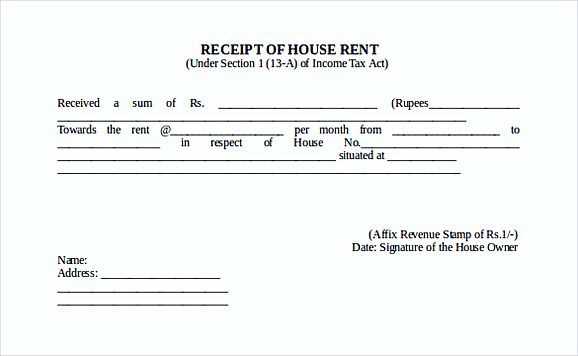

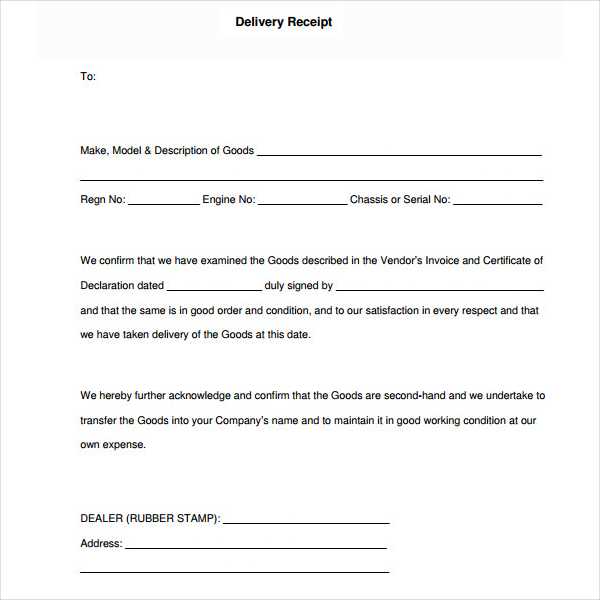

To create a clear and reliable receipt of goods, structure it with precise information that can easily be verified. Include the name of the supplier, the buyer, and detailed descriptions of the goods delivered. Ensure the receipt includes the date of delivery, quantity, and condition of the items. This format will help prevent confusion and make the document legally binding.

Specify the payment terms, such as the amount paid or any remaining balance, and include reference numbers or purchase order identifiers. It’s also important to mention the delivery method and any additional services involved, like installation or assembly. Always include a space for signatures to confirm both parties’ agreement to the terms laid out in the receipt.

Keep the layout simple and readable. This ensures that all relevant details are easy to find. Including a clear breakdown of items, prices, and any discounts or taxes can also help make the transaction transparent. By following these guidelines, you can ensure that your receipt serves as both a proof of purchase and a useful reference for both parties in the future.

Here is the corrected version:

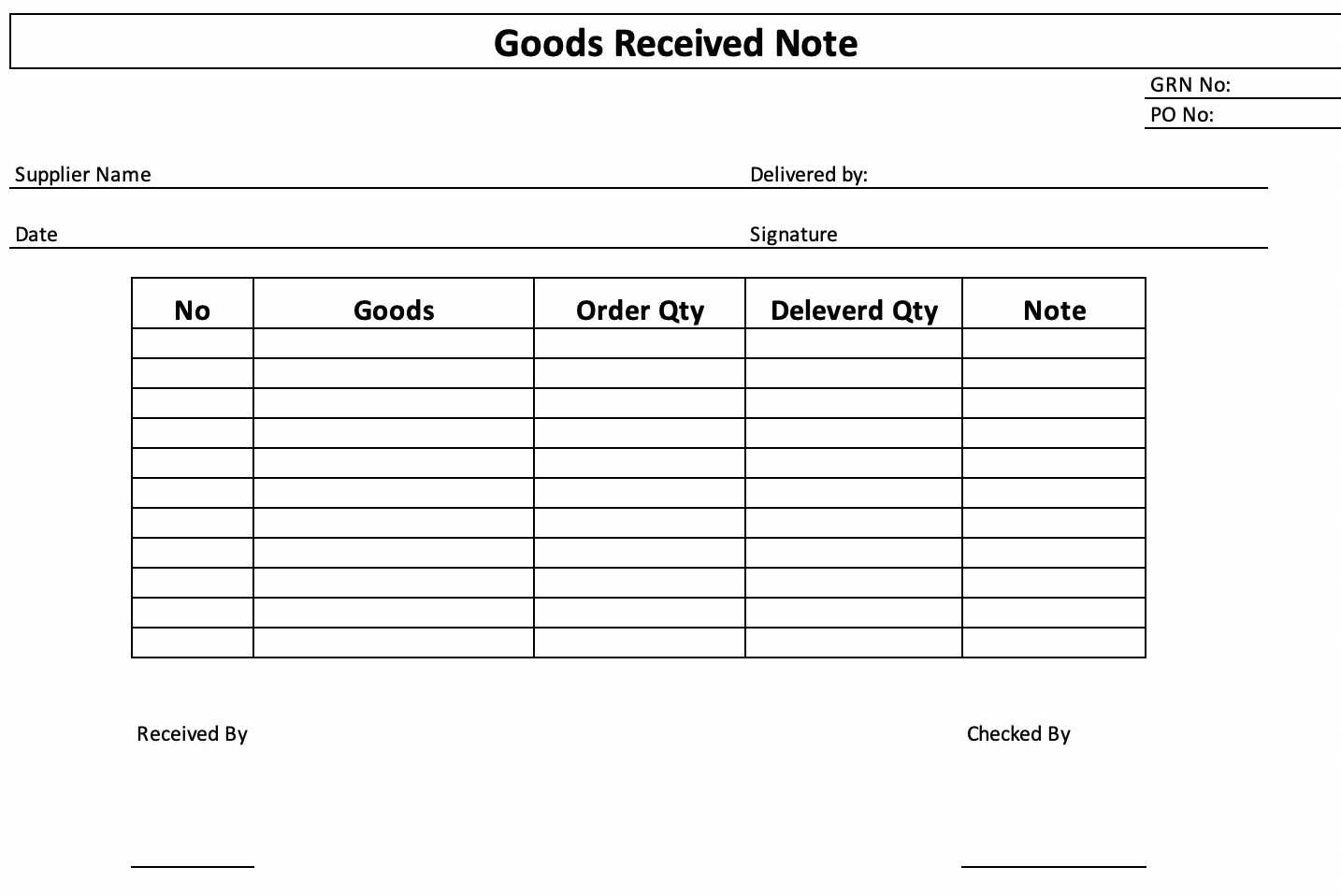

When preparing a goods receipt template, ensure the following details are clearly listed:

Header Information

Start with the company name, address, and contact information at the top of the template. Make sure the date of receipt and the unique document number are included for easy reference.

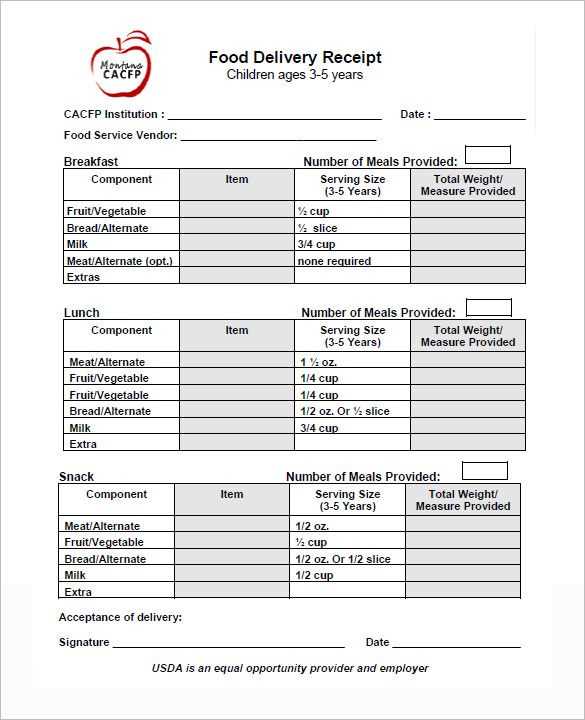

Item Details

List each item received with a description, quantity, unit of measurement, and the price or cost associated with the item. It’s important to cross-check these details against the order form to prevent discrepancies.

Additional Notes: If the goods are part of a larger shipment or belong to different departments, indicate this clearly. Also, if the goods require inspection or further action, note it in a special section to avoid oversight.

- Receipt Template for Goods

Create a detailed receipt template to document goods received. This ensures both parties have clear records and helps resolve any future issues efficiently.

Key Elements to Include

- Receipt Number: Assign a unique identifier for easy tracking.

- Date of Receipt: Specify the exact date the goods were received.

- Supplier Information: Include the name, address, and contact details of the supplier.

- Recipient Information: List the name, address, and contact details of the recipient.

- Itemized List of Goods: Provide a clear description of each item, including quantity and any relevant identifiers (e.g., serial numbers).

- Condition of Goods: Indicate whether the items were in good condition or if there were any damages.

- Signatures: Space for both the supplier and recipient to sign, confirming the transaction.

Additional Considerations

- Invoice Reference: Include the invoice number if applicable to link the receipt with a specific purchase.

- Return Instructions: If relevant, specify details on how to return goods.

- Remarks: Provide space for additional notes or special instructions regarding the delivery or items.

Ensure the layout is clear and organized to avoid confusion. A well-structured receipt not only provides clarity but also simplifies record-keeping for both parties.

A clear and complete receipt must include specific details to ensure both buyer and seller are on the same page. Below are the key elements you should always include.

Transaction Details

The receipt should list the date of purchase and the exact time, as this clarifies the transaction period. Include a unique receipt number for reference, which will make it easier to track or return the item later.

Buyer and Seller Information

Provide the seller’s name, business name, and contact information. For the buyer, a name or account number might be helpful, depending on the type of transaction.

Detail the purchased items with clear descriptions, quantities, and unit prices. This gives transparency and allows for quick verification of the transaction.

To tailor a receipt for specific goods, include relevant details that help both the customer and the business track the transaction effectively. Begin by listing the exact description of the items purchased, specifying model numbers, sizes, or other identifiers that distinguish the products. This level of detail ensures clarity and reduces the chance of confusion in future interactions.

Specify the unit of measurement for each product. Whether it’s weight, volume, or count, clearly mention how the goods are measured. For instance, if you’re selling bulk items, specify whether it’s per kilogram, meter, or unit. This not only adds transparency but also helps when calculating any possible refunds or exchanges.

Incorporate pricing breakdowns for each item. For example, if a customer buys multiple quantities of the same product, show the individual price and total price clearly. This helps avoid miscommunication and provides a transparent view of the transaction for the customer.

Include applicable taxes directly on the receipt. If your goods are taxable, the receipt should show the tax rate applied to each item and the total amount. Make sure the tax is clearly separated from the base price to ensure accuracy in financial records.

Finally, if applicable, add any warranty or return policy details for the specific goods sold. For example, if the goods are covered under a manufacturer’s warranty or have a time-limited return policy, specify this on the receipt to inform the customer of their rights and deadlines for returns.

Ensure accuracy: A goods receipt document must reflect the exact quantity, description, and condition of the items received. Any discrepancies can lead to disputes, which could escalate into legal issues if not addressed in a timely manner.

Verify the recipient’s authority: The person signing the receipt should have the legal authority to do so. Unauthorized individuals may expose your company to risks if they sign on behalf of others without proper authorization.

Include key details: The receipt must include clear details such as the delivery date, item descriptions, and signatures from both the supplier and the recipient. Inadequate information may weaken the document’s validity in case of disputes.

Protect against fraud: Be cautious about any alterations to the goods receipt. Signed receipts can serve as proof of delivery and receipt, so tampering with the document can lead to fraud charges. Implementing a verification process reduces this risk.

Compliance with contracts: Cross-check goods receipts with the terms of the purchase or sale contract. Non-compliance or failure to meet contractual obligations, such as delivering goods in the right condition, can result in claims and penalties.

Ensure storage and accessibility: Keep a record of all goods receipts in a secure and accessible manner. Stored properly, receipts can serve as vital evidence in case of legal proceedings or audits.

Provide a clear and concise structure when creating a goods receipt template. Each item listed should include specific details such as item name, quantity received, and any identifying codes like product numbers or barcodes. This helps to avoid confusion and makes verification quicker.

Use bullet points to organize each section of the receipt for better readability. This makes it easier to cross-check items during inventory audits and eliminates errors. Keep the format consistent to ensure that all entries follow the same layout for simplicity.

Include dates and times in the template. Recording the exact time and date of receipt not only adds clarity but also helps track the timing of shipments in case discrepancies arise later. Always ensure these fields are easy to find and clearly visible.

Space for signatures should be included for both the receiving party and the sender. This confirms that both parties acknowledge the transaction and that the goods match the order. Having this signed copy ensures accountability on both ends.

Consider automatic data fields to speed up the process. When possible, use software or systems that auto-fill repetitive information, such as supplier details or delivery addresses. This minimizes human error and speeds up document processing.

Specify the condition of the goods on the receipt. If any items are damaged or incomplete, note this immediately. This helps to resolve any issues quickly and provides a reference point for future claims.