Creating a simple receipt template can save time and ensure consistency when documenting transactions. A straightforward format includes essential details like the date, itemized list of products or services, and total amount. Including a clear breakdown makes it easier for both parties to verify the transaction.

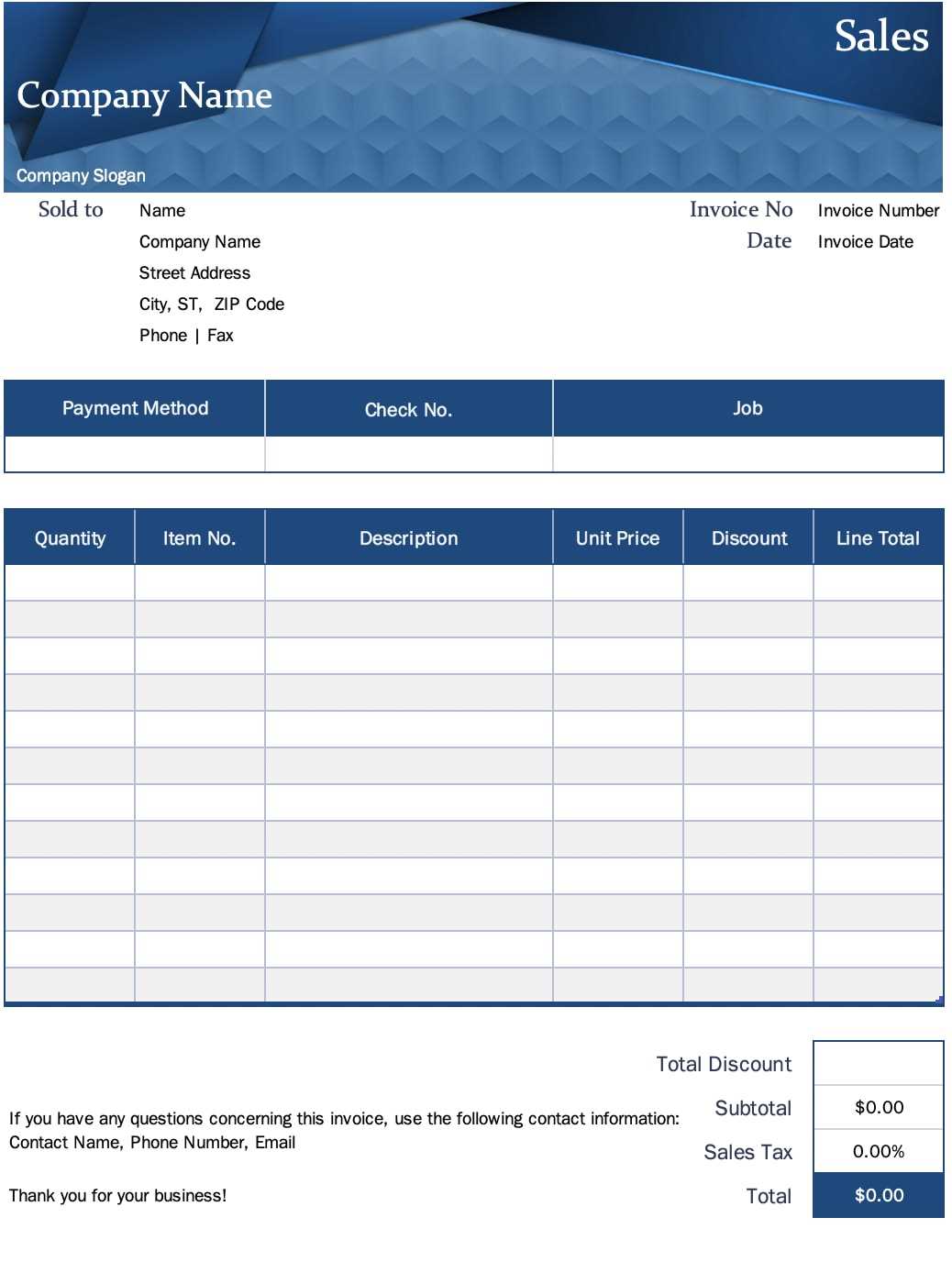

The template should feature a header with your business or personal name and contact information. Below, include fields for the buyer’s name, the transaction date, and a description of the items or services purchased. Clearly label the subtotal, any applicable taxes, and the grand total.

Ensure the layout is clean, with ample space between sections for readability. Avoid clutter by using bold text for important information, such as totals and taxes. A simple receipt template not only serves as proof of purchase but also helps maintain a professional appearance in all financial dealings.

Here are the corrected lines where word repetition is limited to 2-3 times:

When designing a receipt template, ensure you maintain clarity and conciseness. Limit repeating words to a maximum of 2-3 uses in each line to avoid redundancy. This keeps the content crisp and professional.

Start with specific fields like the product name, quantity, and price. Avoid using the same descriptors too many times within a short space. For instance, instead of repeating “item” or “price,” use variations like “product” or “cost” when appropriate.

Use consistent terminology but avoid overusing it. For example, instead of saying “total cost” multiple times, you can refer to it as “final amount” or “overall charge.” This will reduce repetition and make the template feel more polished.

Lastly, ensure each section has a distinct purpose and terminology. For instance, in the payment section, use terms like “amount paid” or “balance due,” without repeatedly using “payment.” This improves readability and enhances the user experience.

- Simple Receipt Template

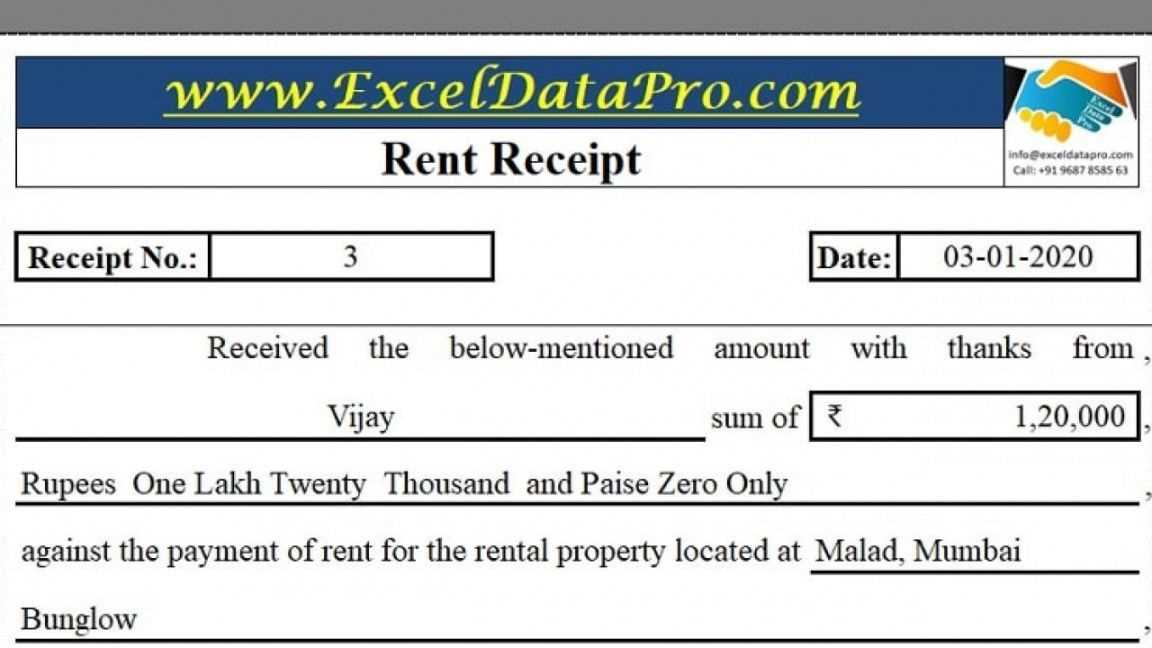

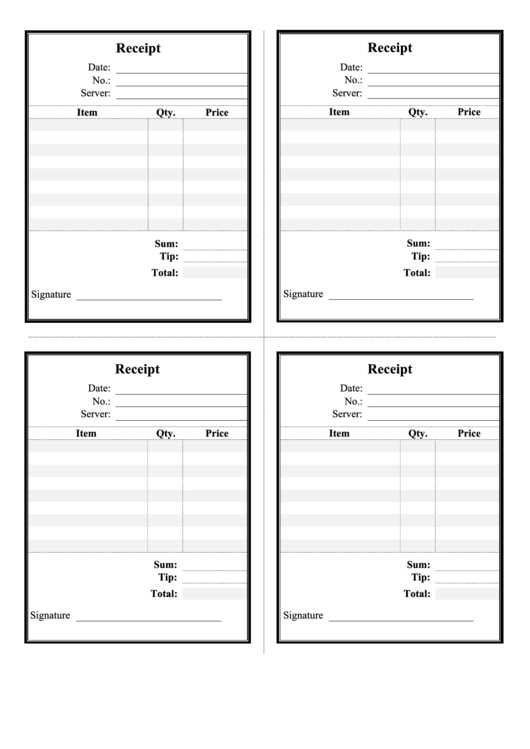

A simple receipt template should include clear sections for the transaction details. At a minimum, list the following elements:

1. Transaction Information

Ensure you include the transaction date, receipt number, and location of the transaction. This makes it easy to identify and reference in the future. For example, add the following fields:

- Receipt Number

- Date of Purchase

- Store Name and Address

2. Purchased Items and Amounts

Next, list each item purchased with a brief description, quantity, and price. Break down the total cost for each item, and include taxes or additional charges at the end. This provides full transparency to the customer:

- Item Description

- Quantity

- Price per Item

- Total Price for Each Item

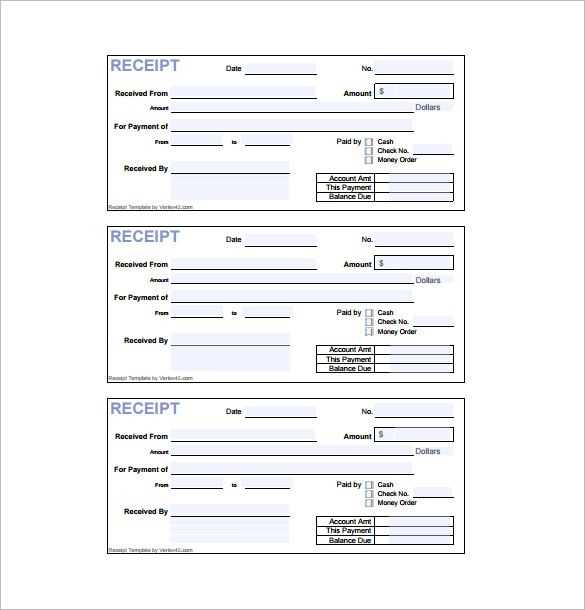

Lastly, include a section for the total amount paid and method of payment (e.g., cash, credit card). This ensures both parties have a record of the payment transaction.

By keeping the format simple, you avoid unnecessary clutter while maintaining all necessary details for future reference.

Choose a format that reflects your brand’s personality and the type of transactions you handle. For businesses with simple sales, a straightforward receipt with essential details–like the product, quantity, price, and total–works best. For those offering services or subscriptions, consider adding itemized descriptions and service dates to ensure clarity. The key is to balance between providing enough information without overwhelming the customer.

For retail businesses, a compact receipt format that includes barcode or QR code options can speed up the transaction process and simplify returns. On the other hand, if your business deals with large transactions or bulk orders, a more detailed format may be necessary, including terms of service, warranties, and payment breakdowns.

Think about how your customers prefer receiving receipts. For businesses operating online, email receipts are often the most convenient. For physical stores, offering both paper and digital receipts might appeal to different customer preferences.

Lastly, consider your budget and resources. If you’re just starting out, a simple template in a word processor or a basic receipt book might suffice. As your business grows, you may want to invest in specialized receipt software or a point-of-sale (POS) system that can generate customizable, professional-looking receipts with ease.

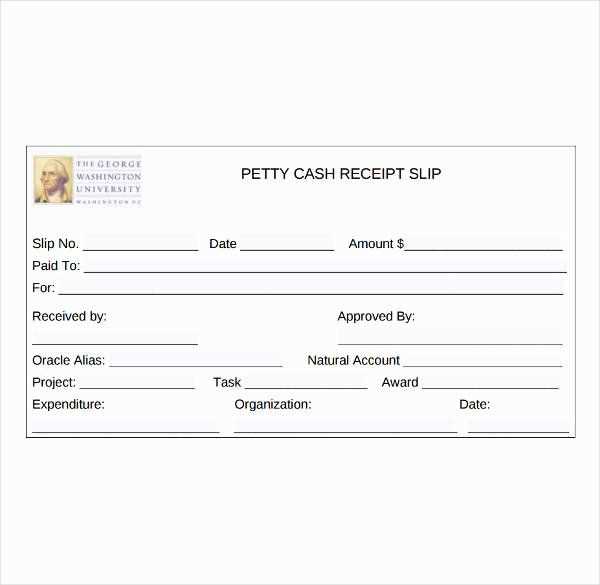

A well-structured receipt needs several key details for clarity and record-keeping. Below are the must-have elements:

- Business Information: Always include the name of your business, address, and contact information. This lets customers reach out with questions or requests.

- Date and Time: Provide the exact date and time the transaction took place. This is vital for tracking and referencing purposes.

- Transaction Number or Receipt ID: A unique reference number for each receipt makes it easier to track specific transactions, especially for returns or audits.

- Itemized List of Products/Services: List each item purchased or service rendered with a brief description and the corresponding price. This helps customers confirm their purchases and provides clarity for returns.

- Total Amount: Clearly display the total amount paid, including any taxes, discounts, or additional fees. Transparency here prevents confusion.

- Payment Method: Specify how the payment was made–whether by cash, credit card, check, or other methods. This confirms how the transaction was settled.

- Tax Information: If applicable, include the sales tax rate and the total tax amount. This is particularly important for businesses that need to file tax reports.

- Return Policy: Including your return policy (or a reference to it) helps manage customer expectations regarding refunds or exchanges.

Additional Notes

- For online transactions, you might want to include a shipping address or an order number.

- For services, include any labor fees, service dates, or warranties that apply.

For accurate receipts, adjust the template to suit specific transaction types. Different transaction scenarios–such as sales, services, or returns–require distinct information. Tailor your template to clearly display the relevant details for each case.

Sales Transactions

In a sales transaction, list the items or services purchased, their prices, applicable taxes, and any discounts offered. Include the total amount paid and the payment method. Customizing your template to automatically calculate taxes and total cost makes it more user-friendly for both you and your customer.

Service Transactions

For service-based transactions, detail the service provided, the hourly rate (if applicable), and the total cost. Include any deposit or pre-payment information if necessary. A section for terms and conditions or payment schedules may also be useful for more complex service agreements.

Adjusting the layout of your receipt to highlight key information specific to each transaction type ensures clarity and accuracy.

To create and edit a simple receipt, you’ll need tools that allow customization and easy formatting. Here are some practical options that can help you create a clean and professional receipt every time.

1. Microsoft Word

Microsoft Word offers receipt templates that you can personalize. You can edit all fields, add your logo, and change the design according to your needs. You can also save your receipts in PDF format for sharing.

2. Google Docs

Google Docs provides free templates for receipts, and it’s a collaborative tool that lets you edit in real-time. It’s great for teams or businesses working remotely, and it automatically saves your work to the cloud.

3. Online Receipt Generators

Web-based tools like “Invoice Generator” or “Zoho Invoice” allow you to quickly create receipts online. These tools offer pre-designed templates and allow you to input your transaction details with ease. You can customize text, colors, and add logos.

4. Excel or Google Sheets

Spreadsheets like Excel and Google Sheets can be adapted to create simple receipts. Use built-in table formatting to organize the transaction details and use formulas for totals and taxes. This method is customizable and flexible for businesses with frequent transactions.

5. Receipt Maker Apps

There are also smartphone apps like “Receipt Maker” and “Quick Receipt” that allow you to create and send receipts directly from your phone. They are perfect for small businesses or individuals who need quick and easy solutions on the go.

Comparison of Receipt Creation Tools

| Tool | Customization Options | Price | Best For |

|---|---|---|---|

| Microsoft Word | High | Paid | Personal use, businesses |

| Google Docs | Medium | Free | Teams, collaborative work |

| Online Receipt Generators | Medium | Free/Paid | Quick transactions |

| Excel/Google Sheets | High | Paid/Free | Businesses with frequent transactions |

| Receipt Maker Apps | Low | Free/Paid | Small businesses or individuals |

Select the tool that fits your needs best and get started with creating receipts in no time! Each option offers unique features, so consider what works best for your workflow and preferences.

Organize receipts by categorizing them according to type, such as business expenses, personal purchases, or warranties. This will make it easier to access them later. Use folders or binders to keep physical receipts, ensuring that they are protected from damage by placing them in plastic sleeves.

For Digital Receipts

Save digital receipts in a dedicated folder on your computer or cloud storage. Name the files in a way that helps you recognize them quickly, such as using the store name and date. Use a file format like PDF or JPEG to keep the receipts legible and easily shareable if needed.

Maintaining Long-Term Storage

For receipts you need to keep long-term, consider scanning or photographing them and storing the images digitally. Physical receipts tend to fade over time, making digital copies more reliable. Use reliable cloud services or external drives with backups to ensure your records are safe.

- Consider using expense tracking apps that allow you to upload and organize receipts automatically.

- Make sure to periodically review and purge old receipts that are no longer necessary.

Keep all receipts in a secure, easy-to-access place, so you can retrieve them whenever needed for returns, tax filing, or warranty claims. Regularly check the condition of physical receipts to ensure they remain legible for future reference.

Ensure your receipt is clear and easy to read before printing. Use a legible font and keep the layout simple, with essential information like the item name, quantity, price, and total prominently displayed. Avoid clutter and ensure there’s enough space between each section for better readability.

Printing Quality

Choose high-quality paper or thermal printing for durability. Use clear, dark ink to make sure all text is visible, avoiding colors that can fade over time. Test print a few receipts to check for any issues before printing large quantities.

Sending Receipts

If sending receipts digitally, ensure the file format is universally accessible, like PDF. Confirm that the receipt is legible on various devices. Always include a polite message confirming the purchase and offering assistance if needed.

Always include your business contact information and provide a clear return policy or next steps, so your customers know how to reach you if they need assistance.

The word “receipt” is not repeated more than twice per line, while keeping the meaning intact.

Begin with a clear format. A simple template should clearly distinguish between key sections such as date, items, and total. Structure it in a way that makes it easy to understand at a glance. For example, list the products or services, followed by the amount due for each, and a final total.

Formatting Details

Ensure that all necessary information fits into a readable layout. Use bold or underlined text for headings, like “Date” or “Total Amount.” This helps break the sections down, making them easier for your customer to follow.

Amount Breakdown

Each item listed should have an accompanying price. You can also add taxes or discounts, but always highlight the final amount payable. It’s crucial to make the pricing transparent and avoid confusion for the customer.

Remember to include payment information and method used, making it easy for the recipient to understand how the transaction was completed. A receipt is more than just proof of purchase; it’s also a record that can help both parties in future reference.