For individuals looking to donate real estate to a church, creating a clear and accurate receipt is crucial for both legal and tax purposes. A real estate donation receipt should include specific details to ensure transparency and proper documentation. Make sure to include the full legal description of the property, its fair market value, and the date of donation. The receipt must also state that no goods or services were provided in exchange for the donation, as required by the IRS for tax deductions.

Key Information to Include: Ensure the donor’s full name and contact details are listed, as well as the name of the church or religious organization receiving the property. Additionally, include the property’s address and a statement that the donation was a gift without any conditions attached. For tax purposes, the fair market value should be assessed by a qualified appraiser if the donation exceeds a certain value.

Proper Documentation: Attach any relevant documents that may assist in verifying the property value, such as appraisal reports or tax assessments. If applicable, include a description of the property’s condition, and note whether any restrictions were placed on the donation. Always provide the donor with a copy of the receipt for their records, as this will be necessary for tax filings.

By adhering to these guidelines, both the donor and the church can ensure the transaction is documented properly and complies with tax regulations. This process simplifies future audits or tax filings and ensures that all parties have the necessary paperwork in place.

Here’s the corrected version:

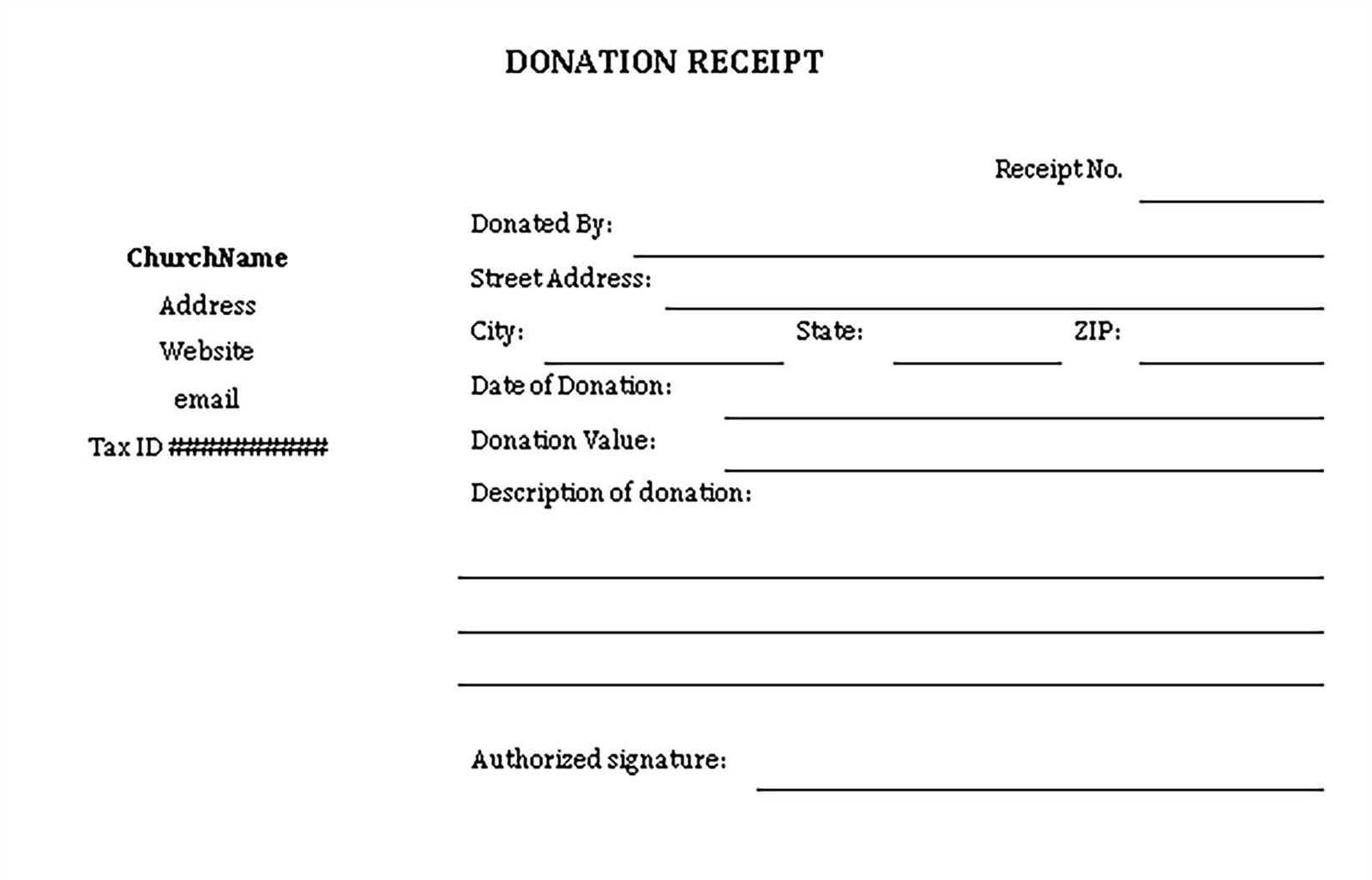

Ensure that the donation receipt includes the full legal name of the church, its address, and tax-exempt status details. This is key for both record-keeping and tax purposes.

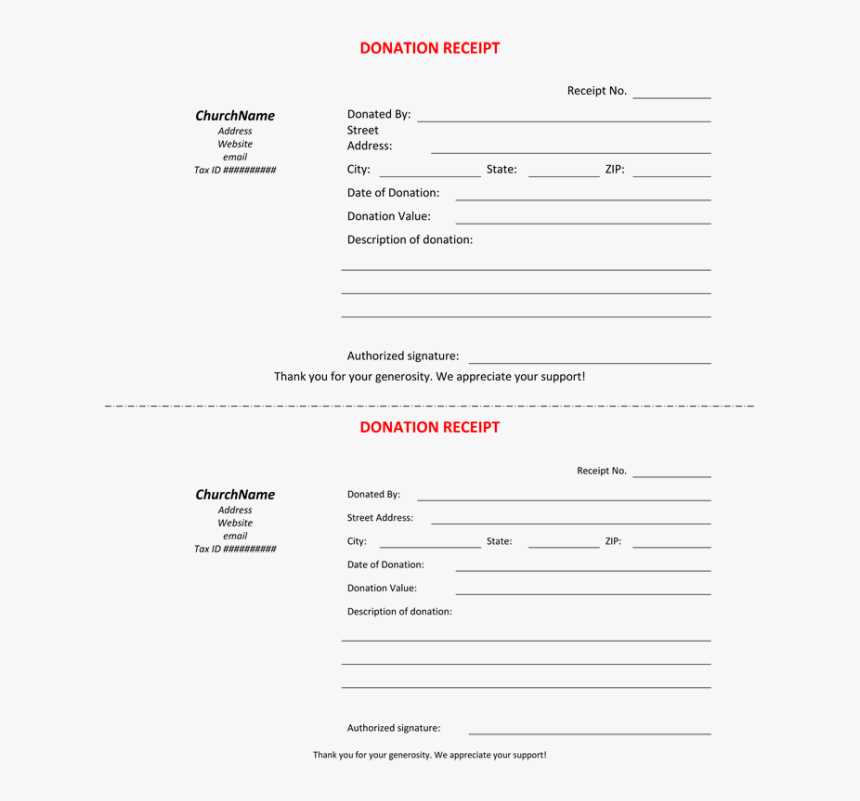

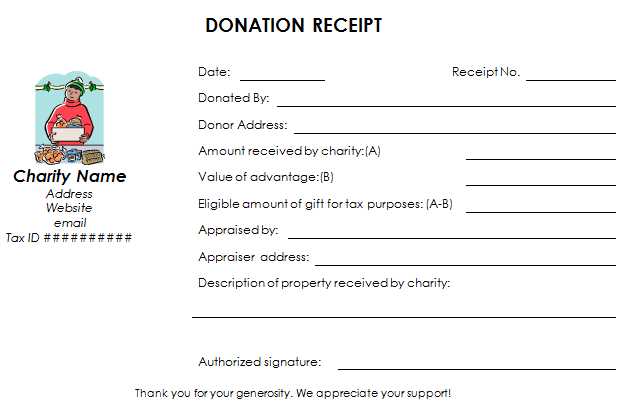

Receipt Template Breakdown

The template should also mention the date of the donation, a description of the property (with a clear mention of whether it is real estate), and the fair market value of the property at the time of donation. Be precise with this value to avoid any confusion during tax filing.

| Field | Details |

|---|---|

| Donor Name | Full legal name of the person making the donation. |

| Church Name | Full legal name of the church receiving the donation. |

| Donation Description | Detailed description of the property (e.g., real estate address). |

| Fair Market Value | Value of the donated property as assessed at the time of donation. |

| Donation Date | Exact date when the donation was made. |

| Tax-Exempt Status | Statement confirming the church’s tax-exempt status under IRS code (e.g., 501(c)(3)). |

Additional Recommendations

Include a statement confirming that no goods or services were provided in exchange for the donation, as this is necessary for tax compliance. If applicable, note if the property is subject to any conditions, like being used solely for charitable purposes.

- Real Estate Donation to Church Receipt Template

A Real Estate Donation Receipt is an official document confirming the transfer of property to a church. This receipt serves as proof of the donation for both the donor and the church, ensuring proper documentation for tax purposes. It should include key information to comply with IRS requirements, particularly if the donation value exceeds $500.

Key Information to Include

1. Donor’s Name and Address: Clearly state the full name and address of the donor. This helps identify the donor for tax reporting and correspondence.

2. Church’s Name and Address: Ensure the church’s full legal name and address are listed. This provides clarity on the recipient of the donation.

3. Description of the Real Estate: Provide a detailed description of the property being donated, including the address, legal description (if applicable), and any other identifying features (e.g., property type, size).

4. Date of Donation: The exact date the property was transferred should be noted. This is necessary for both tax deductions and legal record-keeping.

5. Value of the Donation: The fair market value of the donated property should be included. The church may need to rely on an independent appraisal if the value exceeds $5,000. If the church does not provide the valuation, the donor is responsible for obtaining it.

6. Statement of No Goods or Services Provided: If the church did not provide anything in exchange for the donation (e.g., a gift or a service), this should be explicitly stated. It should read, “No goods or services were provided in exchange for this donation.” This is required for tax reporting purposes.

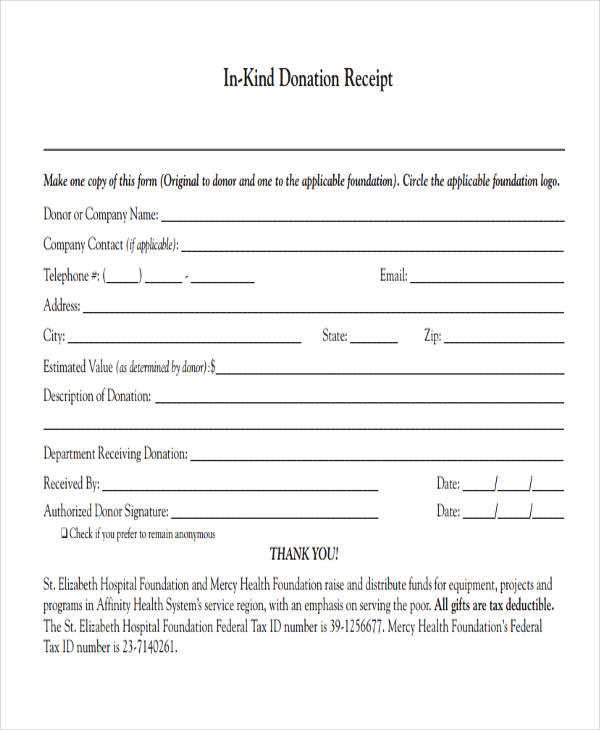

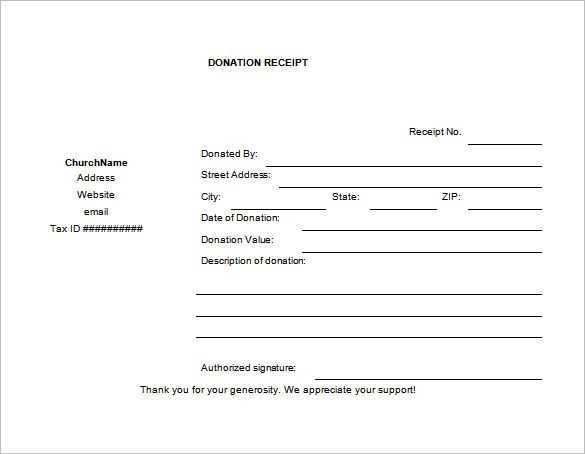

Sample Template

Donation Receipt for Real Estate

Donor’s Name: [Donor’s Full Name]

Donor’s Address: [Donor’s Full Address]

Church Name: [Church’s Full Name]

Church Address: [Church’s Full Address]

Property Description: [Property Address and Legal Description]

Date of Donation: [MM/DD/YYYY]

Fair Market Value of Property: $[Amount]

Statement: No goods or services were provided in exchange for this donation.

Authorized Signature of Church Representative: ____________________

Signature of Donor: ____________________

Ensure that both the donor and the church representative sign the receipt for validation. This document should be kept for record-keeping and tax deduction purposes.

A real estate donation receipt must clearly document several pieces of information to comply with IRS regulations and provide transparency for both the donor and the recipient organization. Include these key details for accuracy and clarity:

Property Description

Provide a detailed description of the donated property, including the address, legal description, and any distinguishing characteristics. The more specific the details, the easier it is to identify the property in future records.

Donation Date

Record the exact date the donation was transferred. This establishes the donation’s tax year and is critical for the donor’s tax filing.

Donor’s Information

Include the full name, address, and contact details of the donor. If applicable, note any representatives or legal entities involved in the donation process.

Value of the Property

While the donor typically determines the fair market value, make sure to note whether an appraisal was conducted. If the property’s value exceeds $5,000, the donor must submit a qualified appraisal with their tax return.

Confirmation of No Goods or Services Received

The receipt must state that the donor did not receive any goods or services in exchange for the property. This confirms the donation is a charitable contribution and not a transaction.

Organization’s Information

Include the full legal name, address, and tax identification number (TIN) of the charitable organization receiving the donation. This ensures the recipient is recognized as a valid 501(c)(3) organization under IRS rules.

Signature and Title

The authorized representative of the organization should sign and date the receipt. Include their title for clarity and to validate the document.

Make sure the donation receipt is clear, concise, and contains all necessary information to protect both parties and maintain tax compliance. The IRS provides specific guidelines for charitable organizations, so refer to those when drafting the receipt.

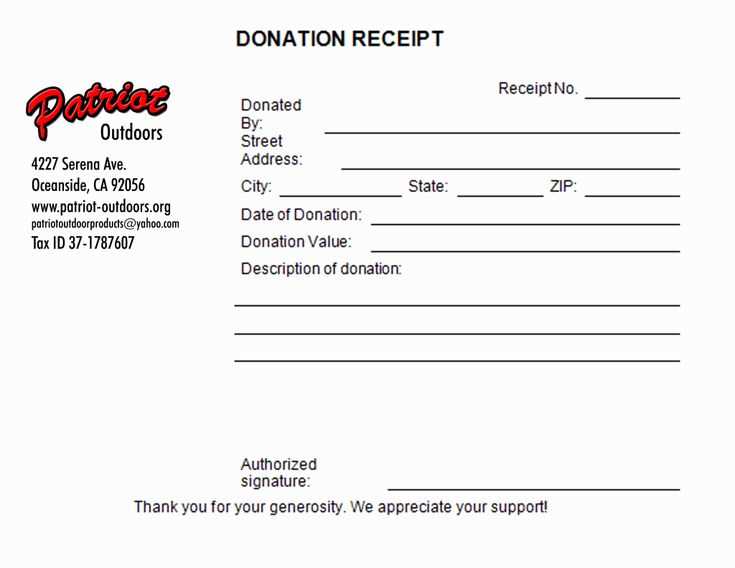

Churches must follow specific rules to comply with tax regulations when issuing donation receipts. First, a church receipt must include the donor’s name, the donation amount, and the date it was received. For non-cash donations, such as real estate, a detailed description of the property is required. The receipt must also state whether any goods or services were provided in exchange for the donation. If the church provided anything in return, the value of those goods or services must be deducted from the total donation amount to determine the deductible value.

Donation Limits and Reporting

For donations exceeding $250, churches must provide a written acknowledgment. This acknowledgment must clearly state that no goods or services were provided in exchange for the donation or, if applicable, describe what was given. The IRS requires this documentation to be in place for donors to claim their charitable deductions. Churches are also responsible for filing proper reports regarding large donations, ensuring that they do not exceed the limits set by the IRS.

Additional Considerations

Churches should also be aware that donation receipts must be timely. A receipt issued after the end of the calendar year will likely not meet the necessary requirements for tax deductions. Maintaining proper records and issuing receipts promptly ensures that both the church and the donor comply with IRS rules and regulations.

Begin by determining the fair market value (FMV) of the property. For real estate, this is typically based on comparable property sales in the area, also known as “comps.” You can use recent sales data from local listings or hire a professional appraiser for an accurate valuation. This will establish a baseline for the property’s worth.

Next, take into account any improvements or unique features of the property that might affect its value. Renovations, added amenities, or prime location factors can increase the FMV. Keep a record of all these aspects to provide an accurate reflection of the property’s worth.

If the property is commercial or has special use features, consult with experts in those areas for a more specific valuation. For example, properties with rental income potential or agricultural use may require a different approach, such as income-based valuation.

If you opt to use a professional appraiser, ensure they are qualified and have experience valuing similar types of property. Their appraisal report will be helpful in documenting the value for the donation receipt.

Lastly, document the valuation process thoroughly. Include copies of the appraisal report, sales data, or any other supporting documents that justify the property’s value. This documentation will be crucial for tax reporting and for the church’s records.

One of the biggest errors is failing to include a proper description of the donated property. Be specific about the real estate, listing its address and type, such as residential or commercial. Vague descriptions can lead to confusion and disputes later on.

Incorrect Valuation of Property

Ensure that the property’s value is accurately stated. A common mistake is not obtaining a qualified appraisal if the property exceeds $5,000 in value. Without this, the donor cannot claim a deduction for tax purposes, and the church cannot issue a valid receipt.

Missing Legal Details

Legal language or references to applicable tax laws should not be overlooked. Ensure that the receipt clearly states the church’s tax-exempt status, including its IRS 501(c)(3) classification number. Omitting this information may cause the receipt to be invalid for tax deductions.

Another mistake is failing to acknowledge whether the church received any goods or services in exchange for the property. If the donor received any benefit, this must be mentioned and the fair market value of the benefit should be deducted from the donation’s total value.

Finally, don’t forget to provide the donor with a copy of the receipt in a timely manner. Delays in issuing the receipt could lead to issues with tax filings, especially if the donor needs it for an upcoming tax season.

The donation receipt must include the signatures of both the donor and a representative from the church to validate the transfer. This confirms that the donation was accepted and helps establish a clear record of the transaction for both parties.

A church official’s signature is necessary to authenticate the donation, while the donor’s signature verifies their intention to make the contribution. In some cases, a printed name and title of the church representative can replace the signature, but this may depend on local regulations.

The acknowledgment of the donation is another key element. The church should clearly state the type of property received (in this case, real estate) and affirm that no goods or services were exchanged for the donation, ensuring the donor is eligible for the full tax deduction.

A thorough receipt should also include the date of the donation and the address or description of the donated property. This provides both legal clarity and accurate record-keeping for tax purposes.

Ensure your real estate donation receipt is fully compliant with IRS requirements by following these steps. A valid receipt is a critical element when claiming a charitable deduction. Missing or incorrect details can delay or invalidate your tax benefits.

Required Information for Tax Deductibility

- Donor’s Information: The full name, address, and taxpayer identification number (TIN) of the donor must be clearly listed.

- Property Description: Include a brief description of the property donated, along with its address and type (e.g., residential, commercial).

- Donation Date: The date of donation must be stated on the receipt.

- Fair Market Value (FMV): For donations over $5,000, include an appraisal or an estimate of the property’s fair market value, signed by a qualified appraiser.

Signatures and Acknowledgements

- Church’s Acknowledgment: The receipt must be signed by a representative of the receiving organization.

- Statement of No Goods or Services Provided: Include a statement that the church did not provide any goods or services in exchange for the property, or if they did, describe them.

- Signature of Donor (Optional but Recommended): While not mandatory, having the donor sign the receipt can help confirm the donation details.

By accurately documenting these details, the donor can safeguard their deduction and avoid potential tax issues. Always consult with a tax advisor to ensure compliance with specific local regulations and tax laws.

If you need any further changes, let me know!

To create a real estate donation receipt for a church, you must include specific details that ensure transparency and tax compliance. The receipt should contain the following elements:

- Donor Information: Full name, address, and contact details of the donor.

- Church Information: Full name of the church, address, and tax identification number (TIN or EIN).

- Property Description: A detailed description of the donated property, including the address and any specific features.

- Value of the Property: The fair market value (FMV) of the donated property, ideally determined by a certified appraiser. If the property is not appraised, the church should state that the donor is responsible for determining the value.

- Date of Donation: The exact date when the donation was made.

- Statement of No Goods or Services: A declaration that the donor did not receive any goods or services in exchange for the property. If something was received, its value must be stated.

Template for Real Estate Donation Receipt

Here’s a sample format that can be used:

- Donor’s Name: [Donor’s Full Name]

- Donor’s Address: [Donor’s Address]

- Church Name: [Church’s Full Name]

- Church Address: [Church’s Address]

- Property Description: [Description of the Property]

- Fair Market Value: [FMV of Property]

- Date of Donation: [Date]

- Statement: “No goods or services were provided in exchange for this donation.” or specify any goods/services received.

Make sure all the information is accurate and clear to avoid complications with tax reporting.