Download a free, ready-to-use 501c3 donation receipt template for Word. This template is designed to simplify the process of acknowledging charitable contributions for tax purposes. It includes all the necessary details for compliance with IRS requirements.

The template provides fields for the donor’s information, donation amount, date of donation, and the nonprofit organization’s details. It is fully customizable, allowing you to adapt it to your organization’s specific needs while maintaining the necessary legal requirements for receipts.

Ensure you include a statement confirming whether the donor received anything of value in exchange for their donation. This information is required for your receipt to be valid for tax deduction purposes. The template also allows you to add a thank-you message, showing appreciation for the donor’s generosity.

By using this simple template, you can efficiently generate accurate donation receipts and stay organized. Customize it in Word to match your organization’s branding, and ensure your donors have all the necessary documentation for their tax returns.

Here’s the revised text with minimized repetitions:

When creating a donation receipt for a 501(c)(3) organization, ensure the template includes the following key details:

- Donor’s Name – Clearly state the name of the individual or entity making the donation.

- Donation Date – Specify the exact date the donation was made.

- Donation Amount – Include the monetary value of the donation or the fair market value of donated goods or services.

- Organization’s Name – Include the legal name of your 501(c)(3) nonprofit organization.

- Tax-Exempt Status – Explicitly state that the organization is a tax-exempt entity under section 501(c)(3) of the Internal Revenue Code.

- Purpose of Donation – Optionally, describe how the donation will be used, or specify if it was a general donation.

- Value of Goods/Services – If applicable, indicate the estimated value of any goods or services provided in exchange for the donation.

Make sure the template complies with IRS requirements, especially for donations over a certain threshold, which may require additional documentation or acknowledgment letters.

Use a clear and professional format, ensuring all fields are easy to fill in and understand for both the donor and the nonprofit.

Here’s a detailed plan for an informational article in HTML format, focusing on the topic “Free 501c3 Donation Receipt Template Word” with three practical and specific headings:

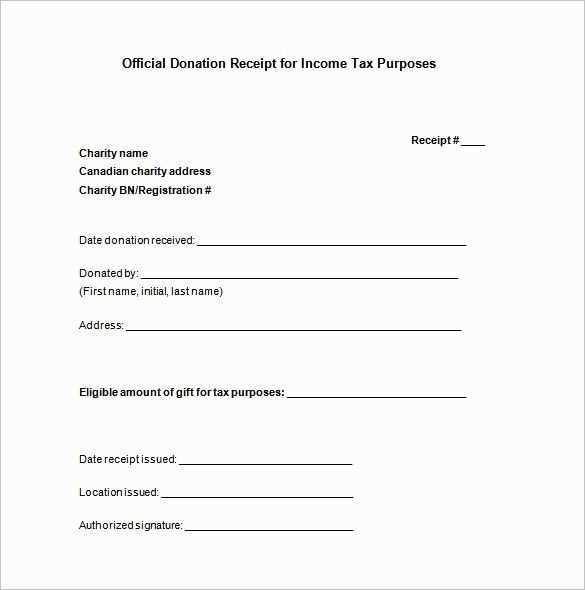

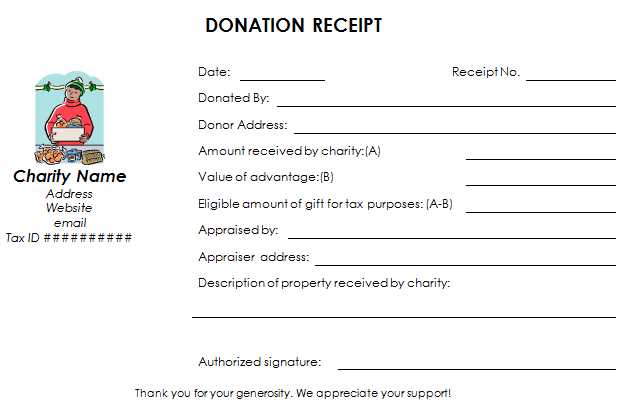

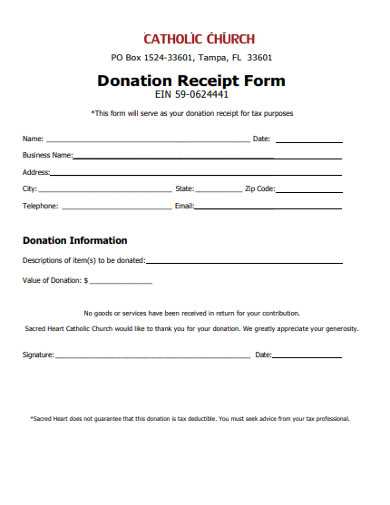

Start by using a clean, simple format that includes the donor’s full name, the donation amount, and the date of the contribution. Include the name of your 501(c)(3) organization, its address, and your federal tax ID number (EIN). Be sure the document clearly states whether the donation was cash or property, and specify any goods or services provided in exchange for the donation.

Include Specific Donor and Donation Information

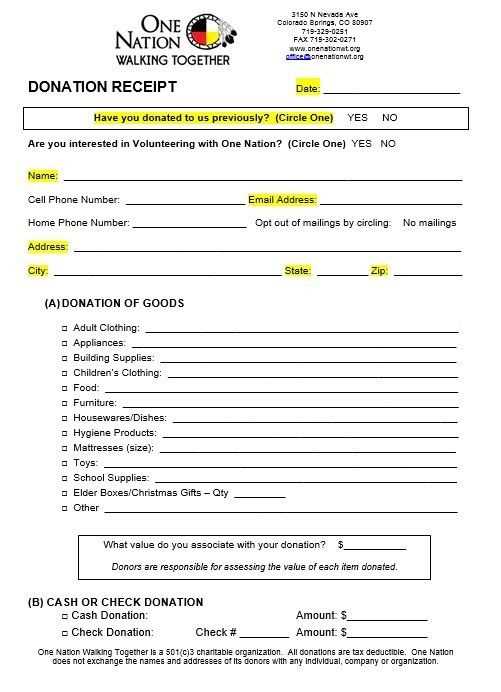

Accurate donor and donation details are the foundation of your receipt. Along with basic contact info for both the donor and the nonprofit, clearly state the value of any non-cash contributions. If the donation includes physical goods, describe them and include a fair market value. This is critical for tax purposes, as the IRS requires nonprofits to verify and acknowledge donations properly.

Include a Statement of Tax Deductibility

Ensure that your receipt includes a statement that your organization is a registered 501(c)(3) nonprofit and that donations are tax-deductible to the fullest extent allowed by law. This lets the donor know the receipt can be used for their tax records. It’s recommended to avoid stating any specific value of the donation, as only the donor can assign value to non-cash gifts.

- How to Create a Custom Receipt in Word

Open a new Word document and begin by selecting a blank template. You can easily customize a standard template or design your own from scratch. First, set up your header with your organization’s name, address, and contact details. Use a larger font size to make this section stand out.

Step 1: Add the Donor’s Information

After the header, include the donor’s details. Include fields for the donor’s name, address, and the donation date. Align the text left for a clean look. You can also add a specific reference number to make the receipt easier to track.

Step 2: List the Donation Details

Below the donor’s information, list the donation amount and specify whether it was cash, check, or another form of contribution. Make sure to include any other relevant details, such as the item donated or the donation type (one-time or recurring). This provides clarity for both the donor and your organization.

Next, insert a thank-you message. This is important for acknowledging the donor’s generosity and reinforcing a positive relationship. Place this message towards the bottom of the receipt, right before the footer.

Finally, save your document and print it out or send it electronically as needed. Customizing your receipt in Word ensures it’s professional and aligned with your nonprofit’s branding.

A 501(c)(3) acknowledgment must be clear and precise to comply with IRS regulations and ensure that donors can claim their contributions for tax purposes. Here’s what needs to be included:

Donor Information

Provide the donor’s name and address. This confirms the identity of the person or entity contributing the donation.

Contribution Details

Clearly state the date of the donation and the amount or description of the property given. If the donation is in-kind, describe the item and its estimated value, if possible.

Non-Exchange Statement

Include a statement confirming that no goods or services were provided in exchange for the donation. If something was exchanged, disclose it with a fair market value.

Organization’s Tax-Exempt Status

Specify your 501(c)(3) status and include the organization’s EIN (Employer Identification Number). This helps the donor verify your nonprofit’s tax-exempt status.

Signature

A representative of the organization must sign the acknowledgment, ensuring it is legitimate and valid for the donor’s tax records.

Nonprofits looking for donation receipt templates can easily access a variety of free options online. These templates are designed to meet IRS guidelines for 501(c)(3) organizations, making it easier to track donations for tax purposes. Below are some recommended sources for downloading reliable and customizable templates.

Template Sources

Several websites offer free templates tailored to nonprofit needs. These platforms provide a range of designs, from simple receipts to detailed statements, ensuring your nonprofit can select the most suitable format.

| Website | Description | Download Link |

|---|---|---|

| Nonprofit Ally | Offers a free, easy-to-use donation receipt template that meets IRS requirements. | Visit |

| Template.net | Provides multiple donation receipt options for different nonprofit needs. | Visit |

| Microsoft Office Templates | Free donation receipt templates in Word format, compatible with all versions of MS Word. | Visit |

Customization Tips

Although these templates are ready to use, customize them to align with your nonprofit’s branding and policies. Add your logo, contact information, and mission statement to personalize the receipts. Ensure each template includes all the required elements for tax compliance:

- Organization’s name and address

- Donor’s name and address

- Date and amount of the donation

- Statement of goods or services provided (if any)

- Tax-exempt status declaration

Customizing your templates ensures clarity for both donors and the IRS, helping to maintain transparent records for your nonprofit.

For creating a simple and accurate donation receipt template for a 501(c)(3) organization, focus on the following key elements:

- Donor Information: Include the name, address, and contact information of the donor. This is critical for tax reporting purposes.

- Donation Details: Clearly state the donation amount and date. If the donation is in-kind, describe the item and its estimated value.

- Organization Information: Your organization’s name, address, and EIN (Employer Identification Number) should be listed for verification.

- Non-Refundable Clause: Add a note indicating that the donation is non-refundable and that no goods or services were exchanged for it.

- Signature: The receipt should include the signature of an authorized representative of the organization, verifying the donation.

These details ensure compliance with IRS requirements and provide donors with the necessary information for their tax deductions.