To streamline your receipt creation process, using ready-made templates can save time and ensure accuracy. Whether you’re running a small business or managing personal transactions, a well-structured receipt provides clear documentation for both parties. Templates offer a quick way to standardize receipts, making them easier to fill out and more professional in appearance.

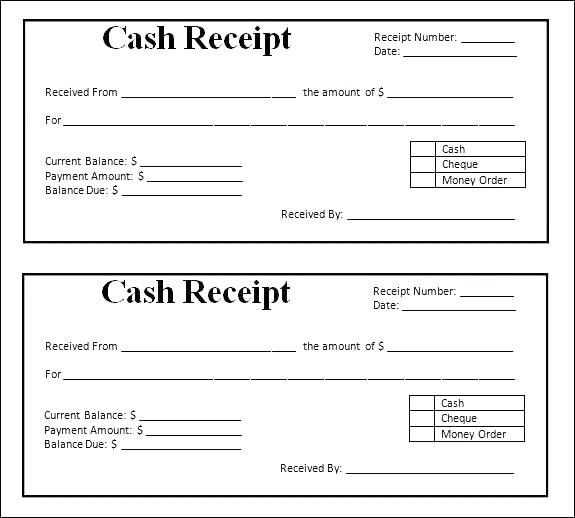

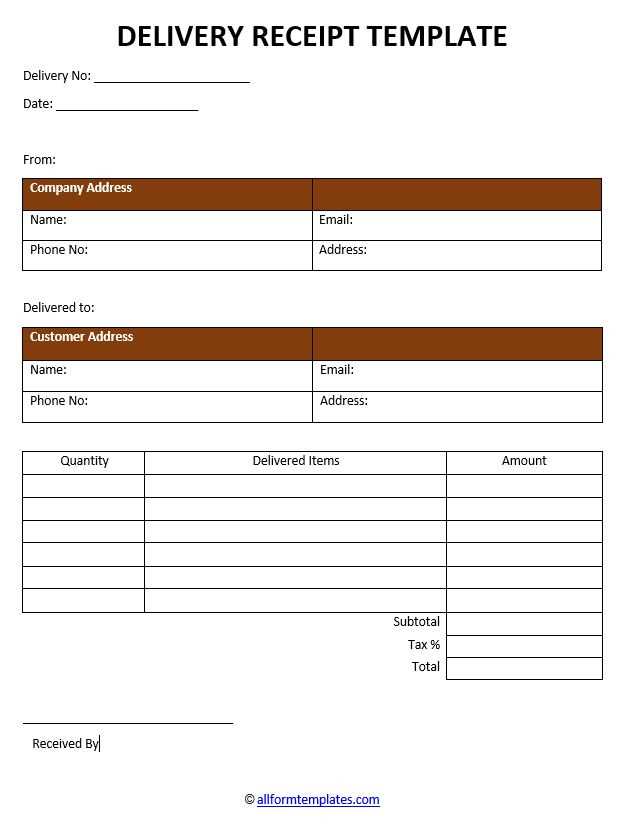

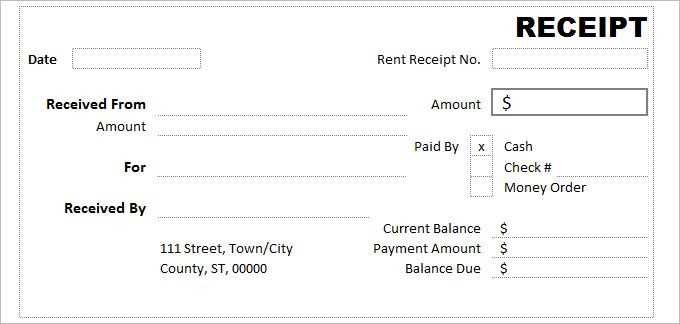

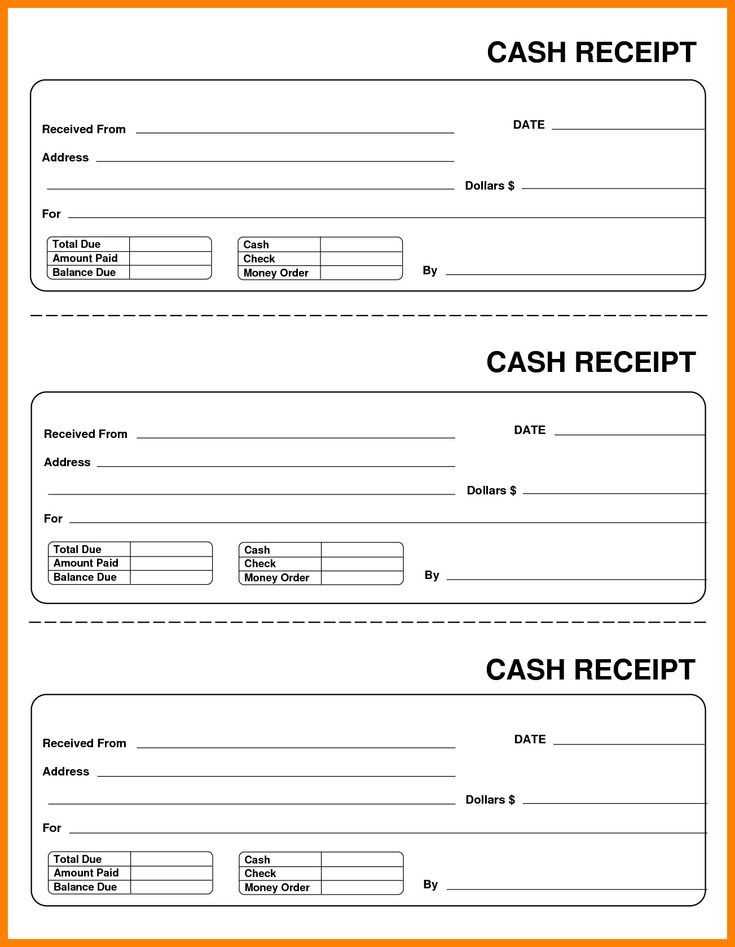

Customize your templates to suit the specific needs of your business or transaction type. Most templates allow for adding your business name, address, and logo, which adds credibility and a personal touch. Additionally, you can include fields for the date, item descriptions, quantities, prices, and total amount–critical elements that help maintain clear records for both buyers and sellers.

Look for templates that provide flexibility in formatting. This ensures that you can easily adjust font sizes, colors, and layout to match your brand or specific style preferences. For those who frequently handle multiple types of receipts, some platforms offer templates designed for different categories, such as sales, donations, or rental agreements.

By choosing the right template, you’ll make transactions smoother and maintain a consistent record-keeping process. Customize, print, or email receipts with ease to keep things organized and professional without spending too much time on the details.

Here are the corrected lines:

Ensure that the receipt template is clear and readable. Break down the information into sections such as date, vendor name, and total amount.

- Make sure the vendor’s name and address are properly aligned with the top of the receipt for quick reference.

- Double-check the date and time of the transaction. This helps in any follow-up inquiries or returns.

- Clearly highlight the total amount paid and include any taxes or discounts applied.

- If applicable, add a transaction or receipt number for easy tracking.

By following these steps, you’ll create receipts that are easy to understand and manage. Organizing the content in a structured way reduces confusion and streamlines the entire process.

- Templates for Receipts

Choosing the right receipt template depends on the type of transaction and the required details. For businesses, selecting a clear and simple format saves time and minimizes errors. Keep the structure consistent, with sections for the date, items purchased, amount, tax, and total. Including the business name, logo, and contact information is helpful for branding and customer support.

For personal use or small-scale sales, templates should focus on clarity, making sure all items and totals are easily readable. Use a straightforward layout with distinct lines separating different sections. Keep fonts legible and avoid overcrowding the space with unnecessary details.

Many online tools offer customizable templates for various needs, such as retail, services, and food delivery. Look for templates with the flexibility to add or remove specific fields based on the transaction type. For example, service-based receipts might need a space for service description or labor charges.

Make sure your template includes a receipt number and a method for tracking payments. This helps with record-keeping and audits. Also, consider using electronic templates for easy archiving and sending via email. This method is faster and reduces paper waste.

Focus on simplicity and clarity when designing your custom receipt template. The key is to make sure it includes all the necessary information without overwhelming your customers. Start with basic elements like the business name, address, and contact details at the top. This gives the receipt a professional look while making it easy for clients to get in touch if needed.

Include Transaction Details

Next, make sure the receipt clearly lists the products or services purchased. Use a table format with columns for item description, quantity, price per unit, and total cost. Avoid cluttering the receipt with unnecessary details; only include what is relevant for the customer to reference later. Be transparent about any taxes or discounts applied. A breakdown of these will keep the process clear and avoid confusion.

Design for Readability

When it comes to fonts and colors, use ones that are easy to read. Stick with neutral colors and avoid using too many different fonts. Ensure there’s enough spacing between sections to help customers quickly scan through the information. If you’re using digital receipts, make sure the font size is large enough for mobile devices, as this is where most customers will view it.

Lastly, add a section for any additional notes, like a return policy or a thank-you message. This creates a personal touch and can enhance the customer experience. You can also include your business logo or branding to further establish your identity.

If you need to generate a receipt quickly, these online tools are reliable and user-friendly options that will save you time:

| Tool | Features | Price |

|---|---|---|

| Invoice Generator | Simple design, customizable templates, allows for multiple currency support, PDF download | Free |

| Zoho Invoice | Customizable templates, automatic tax calculations, email receipts directly to customers | Free for up to 5 invoices/month |

| Receipt Maker | Quick receipt creation, allows for logos, easy editing, downloadable in PDF format | Free |

| PayPal Invoicing | Integrates with PayPal, automatic payment tracking, customizable receipt templates | Free (transaction fees apply) |

| Wave | Customizable receipts, integrates with accounting features, downloadable in PDF or email | Free |

For fast and easy receipt generation, these tools stand out for their efficiency and flexibility. Whether you’re looking for basic options or need something more advanced, these platforms will help you create professional-looking receipts with minimal effort. No need to spend extra time on complicated setups or design–just enter the necessary details and download your receipt within minutes. Try them out and choose the one that fits your needs best!

Ensure your receipt template includes the necessary tax details required by local, regional, or national regulations. Start by adding the correct tax identification number (TIN) for your business and the tax rate applicable to each sale. This will help streamline tax calculations and ensure accuracy in tax filings.

Include Relevant Tax Information

Each receipt should clearly state the amount of tax charged, including breakdowns for sales tax, value-added tax (VAT), or any other relevant taxes. Depending on your location, you may need to indicate whether the sale is tax-exempt or if a reverse charge applies. This information should be presented separately from the product or service prices, often as a distinct line item.

Customizing for Different Tax Jurisdictions

Tax regulations can vary significantly across regions. If your business operates in multiple areas, customize your receipt templates to account for these differences. For example, in some regions, tax rates may differ based on product categories or the customer’s location. Update your templates to automatically adjust the tax rate based on the buyer’s details, ensuring compliance for every transaction.

Regularly review the tax regulations in your jurisdiction to stay compliant. Implementing a system that updates tax rates and rules in your receipt templates can save you time and prevent errors. Keep templates flexible, allowing for quick adjustments as tax laws evolve.

Now the word “Receipt” is used no more than twice in each sentence.

To maintain clarity, avoid overusing the term “Receipt” in a single line. Use it sparingly, ideally limiting its occurrence to just two times per sentence. This approach helps prevent redundancy and keeps the content smooth and readable.

- Introduce “Receipt” once at the beginning of a statement to establish context.

- If necessary, refer to “Receipt” again, but place it at a natural break in the sentence to avoid awkward repetition.

For instance:

- Correct: “The Receipt for your purchase is attached. Please check the Receipt for further details.”

- Incorrect: “The Receipt is in the bag. The Receipt shows the total amount.”

This rule ensures your content flows naturally without sounding repetitive. By following this guideline, you’ll create more reader-friendly material while ensuring clarity in every message.