Landlords in Ontario must provide tenants with rent receipts upon request. A well-structured yearly rent receipt template simplifies record-keeping and ensures compliance with the Residential Tenancies Act. It should include key details such as tenant and landlord names, rental address, payment dates, amounts, and payment methods.

A detailed template helps both parties track payments for tax purposes, dispute resolution, or proof of residency. Landlords can issue receipts monthly or consolidate them into an annual summary for convenience. Tenants benefit from a clear financial record, particularly when claiming deductions or benefits.

For accuracy, each receipt should feature the landlord’s signature or business stamp and be formatted consistently. Digital or paper versions are both acceptable, provided they include all required details. Using a structured template minimizes errors and saves time while meeting legal obligations.

Yearly Rent Receipt Template Ontario

In Ontario, landlords must provide a rent receipt for any payments made by tenants. A yearly rent receipt serves as proof of rent payments made during the year and can be useful for both tax purposes and record-keeping. When creating a yearly rent receipt, it is important to include certain details to ensure it meets the legal requirements in Ontario.

Key Information to Include

Your rent receipt should have the following information:

- Landlord’s Name and Contact Information – This should include the full name, address, and phone number of the landlord or property management company.

- Tenant’s Name – The full name of the tenant who made the payment.

- Address of the Rental Property – Include the address of the rental unit where the tenant resides.

- Payment Date – The specific date when the payment was made.

- Amount Paid – Clearly state the amount of rent paid during the year.

- Payment Period – Indicate the time period for which the payment applies (e.g., monthly, yearly, etc.).

- Signature of the Landlord – A signature of the landlord or an authorized representative, confirming the receipt of payment.

- Receipt Number – If applicable, include a receipt number for tracking purposes.

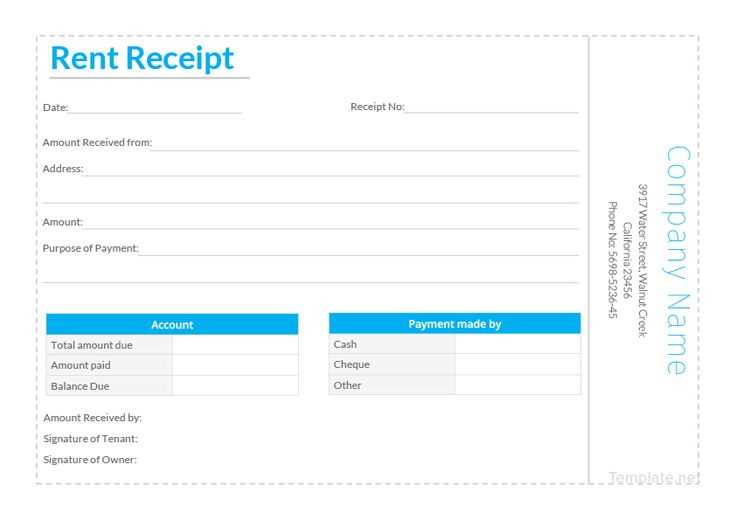

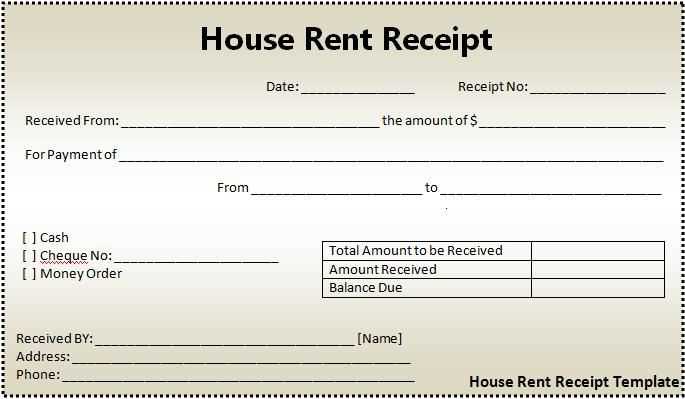

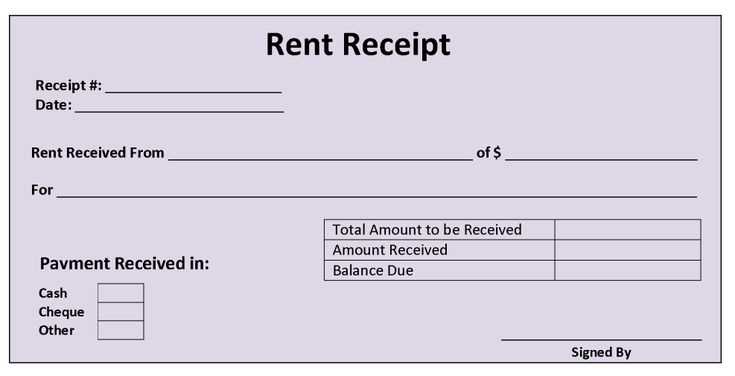

Template Example

Here’s a simple template you can use to create a yearly rent receipt:

Landlord Name: John Doe Landlord Address: 123 Main St, Toronto, ON, M1A 2B3 Landlord Phone: (416) 555-1234 Tenant Name: Jane Smith Rental Property Address: 456 Elm St, Toronto, ON, M2B 3C4 Payment Date: January 15, 2025 Amount Paid: $12,000.00 Payment Period: January 2024 - December 2024 Receipt Number: 2025-001 Signature of Landlord: ______________________

Ensure that all required fields are completed and accurately reflect the payment details. Both the tenant and landlord should keep copies of the rent receipts for future reference or any possible legal disputes.

Key Legal Requirements for a Rent Receipt in Ontario

A rent receipt in Ontario must include specific details to meet legal standards. The receipt must clearly state the date the payment was made and the amount paid. It must also include the address of the rental property, the landlord’s name, and the tenant’s name.

The receipt should specify the period for which the rent is being paid, such as the month or week. If any part of the payment is for something other than rent (e.g., utilities or parking fees), this must be clearly outlined to avoid confusion.

If the tenant requests a receipt, the landlord is legally required to provide it. The receipt must be signed by the landlord, or in the case of an electronic payment, the landlord must ensure that the receipt is available in an accessible format for the tenant.

Landlords can provide rent receipts in any format–paper or digital–so long as the information is accurate and clear. Tenants should keep these receipts for their records, especially if they are claiming deductions or rebates through tax filings or other legal procedures.

How to Create a Detailed Yearly Rent Receipt for Tenants

Begin by including the tenant’s name, address, and the rental property address at the top of the receipt. Make sure the information is accurate to avoid any confusion.

Next, specify the rental period. Clearly state the start and end dates of the rental agreement for the year. This helps both the landlord and tenant keep track of payments.

Include the total amount paid by the tenant during the year. Break down the payments if applicable–monthly rent amounts, additional charges for utilities, late fees, or other costs. If the tenant made any partial payments, list these as well.

Be specific about the payment method. Whether the rent was paid by cheque, bank transfer, or in cash, indicate how the payment was made. This adds a layer of transparency to the receipt.

Provide a section that details any outstanding amounts, if applicable. If the tenant owes any unpaid rent or fees, include these amounts with a clear breakdown.

End the receipt with the landlord’s signature and the date of issuance. This provides a formal acknowledgment that the payment has been received and processed for the year.

A well-structured rent receipt offers both parties a clear record of payments and prevents any future disputes. Make sure to keep a copy for your records and provide one to the tenant for their own documentation.

Printable and Digital Templates: Choosing the Right Format

Printable templates are ideal when a physical record is needed, such as for filing or hand-delivering a receipt. They provide a tangible copy of the rental agreement or transaction. Choose a printable template when you want to create a hard copy for your tenant or landlord.

- Benefits of Printable Templates: Easy to sign and hand over, reliable for storage in physical records.

- Best Use Cases: When you need a signed receipt in person or for legal documentation where physical evidence is necessary.

On the other hand, digital templates offer the flexibility of quick edits and immediate sharing. They are well-suited for those who prefer storing documents electronically or need to send receipts without delays.

- Benefits of Digital Templates: Quick sharing through email, cloud storage, and simple to edit for future use.

- Best Use Cases: Sending receipts via email or storing them digitally for easy access and organization.

Choosing between printable and digital templates depends on your specific needs. Consider the context of the transaction and whether the document needs to be physically signed, filed, or simply shared electronically. Both formats are practical but serve different purposes depending on your situation.