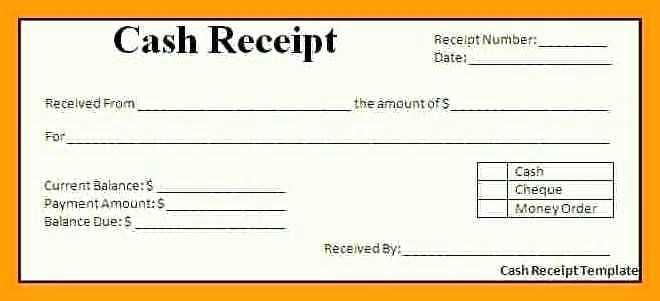

To create a clear and concise money receipt form, focus on including all the necessary details. Start by specifying the recipient and payer’s names, the amount paid, and the payment method. This ensures transparency and prevents any confusion in financial transactions.

A simple format can help make the receipt easy to understand. Include a section for the transaction date, a unique receipt number, and a brief description of the purpose of the payment. This makes tracking payments easier and ensures you have a proper record for future reference.

For added clarity, ensure the form allows space for both parties to sign, acknowledging the transaction. This helps in cases where a dispute may arise or when verification is needed. Creating a consistent template saves time and guarantees that your receipts always contain the required details, making them more reliable and professional.

Here is the revised text:

Ensure the money receipt form is clear and detailed. Each section should serve a specific purpose, avoiding unnecessary elements. Here are the key points to keep in mind:

Key Sections

- Title: Include a clear title such as “Money Receipt” or “Payment Receipt” at the top of the form.

- Receiver’s Information: List the name and address of the recipient. This should be clear and accurate.

- Payer’s Information: Include the name and contact details of the person making the payment.

- Amount Received: Specify the exact amount of money received, including the currency type.

- Date: Ensure the date of the transaction is included. This is crucial for reference.

- Purpose of Payment: Briefly state the reason for the payment. This helps track transactions effectively.

Additional Considerations

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Signature: Both the receiver and payer should sign to confirm the transaction.

- Payment Method: Indicate whether the payment was made by cash, check, or electronic transfer.

By organizing the form with these sections, you’ll create a transparent and functional receipt that provides all necessary details for both parties involved in the transaction.

- Money Receipt Form Template

The money receipt form should include the following key sections: the name of the recipient and payer, the date of the transaction, and the amount received. Specify the payment method, such as cash, check, or bank transfer, and include a reference number if applicable.

Provide a brief description of the transaction’s purpose, for example, “payment for services rendered” or “purchase of goods.” Leave space for both the payer and recipient to sign, confirming the transaction.

Ensure the form is clear and easy to complete, with each section clearly labeled. This format will help maintain proper records for accounting and tracking purposes.

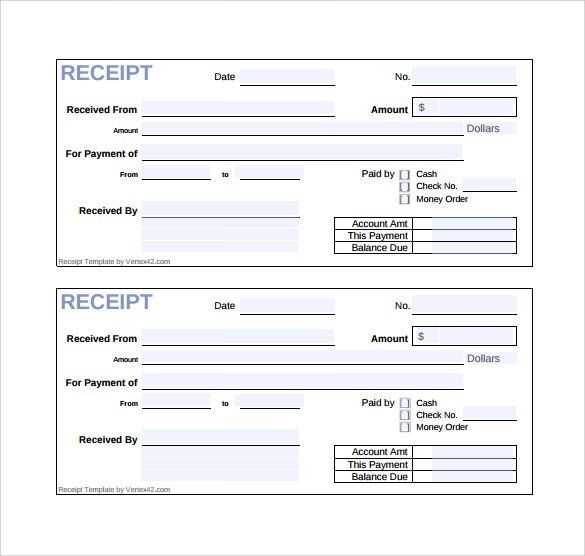

To create a basic receipt form, focus on key elements that ensure clarity and usefulness. Here’s how you can get started:

1. Include Basic Information

- Title: Label the form as “Receipt” or “Payment Receipt” at the top.

- Date: Always include the transaction date to keep records organized.

- Receiver’s Name: Mention the name of the person receiving the payment.

- Payer’s Name: Include the name of the person making the payment.

2. Detail the Payment Information

- Amount: Clearly state the amount paid, including both the number and the currency symbol.

- Description: Provide a brief description of the service or goods exchanged.

- Payment Method: Note whether the payment was made by cash, check, or another method.

3. Add a Signature Section

Leave a space at the bottom of the form for both the payer and receiver to sign. This confirms the transaction was completed.

4. Optional Fields

- Transaction Number: Adding a unique reference number helps track receipts.

- Address or Contact Details: Including this information can be helpful for future communication or verification.

With these elements, your receipt form will be both practical and easy to understand. It’s simple, yet covers everything necessary for personal use without added complexity.

Include the date of the transaction at the top of the form. This helps in tracking payments and organizing records over time. Specify the amount of money received, including the currency type, to avoid confusion. Clearly state the purpose of the payment–whether it’s for a service, product, or donation.

Provide the name of the payer and their contact information. This is important for communication in case of discrepancies or follow-ups. Include the name of the payee as well, as it confirms who is receiving the funds.

Document the payment method, such as cash, check, credit card, or bank transfer. This provides clarity on how the payment was made and can be referenced if needed for future verification.

Include a unique receipt number for easy identification and tracking in case of returns, refunds, or disputes. Ensure that the form is signed by both the payer and the payee, acknowledging the transaction details and agreement.

Finally, note any additional terms or conditions related to the payment, such as late fees or refund policies, to avoid misunderstandings later.

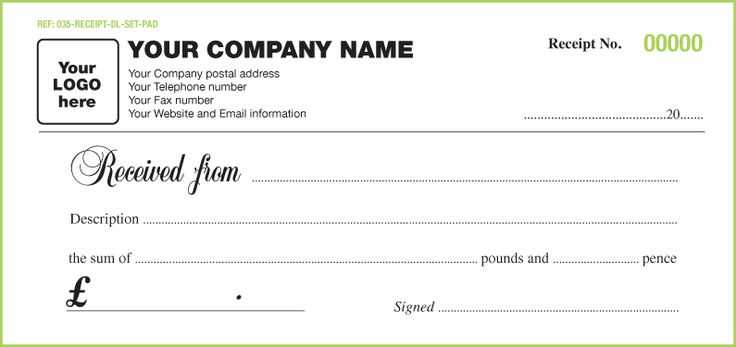

Customizing your receipt template is straightforward and will help you align it with your business style. Follow these steps to personalize it:

1. Choose Your Template

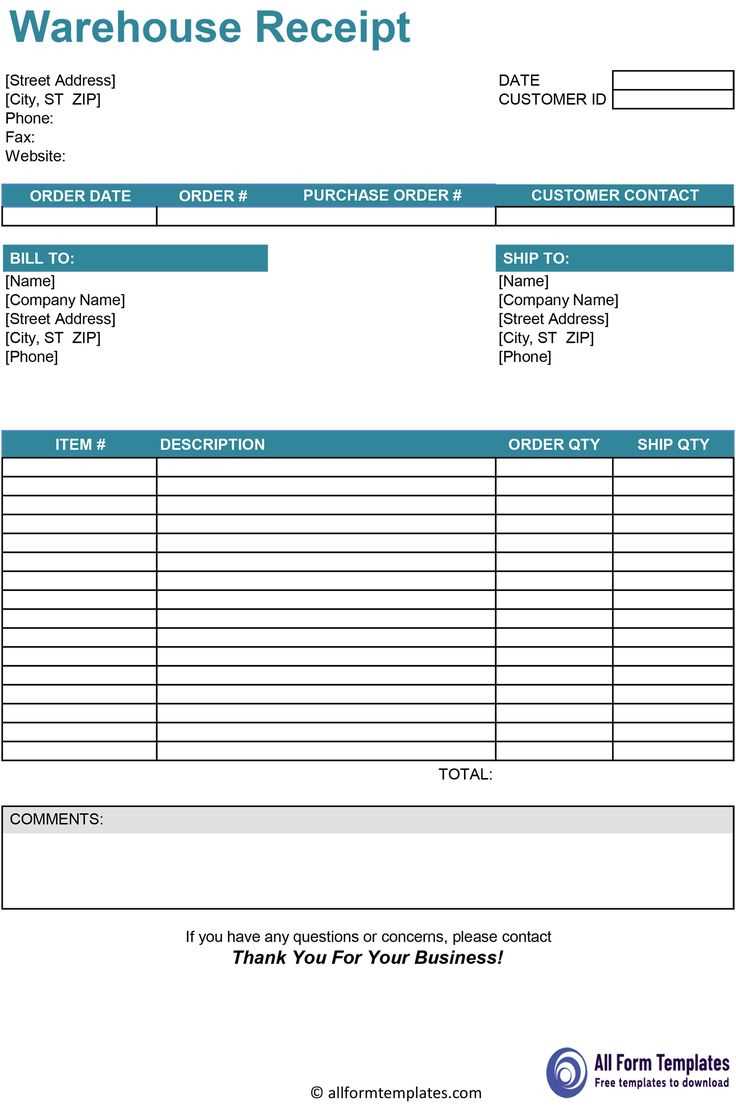

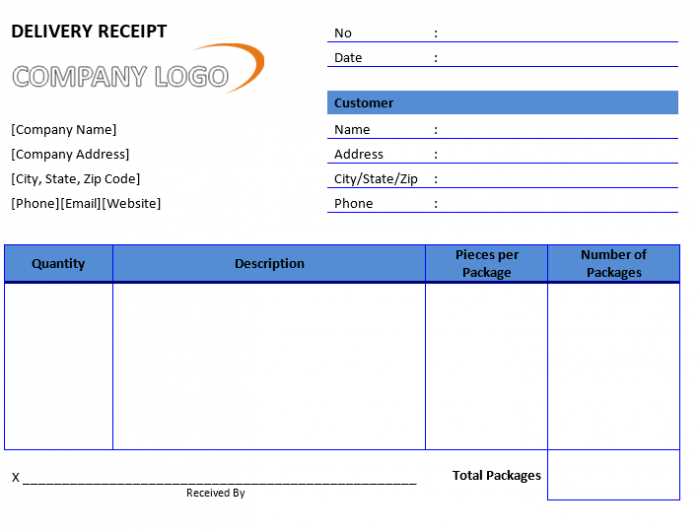

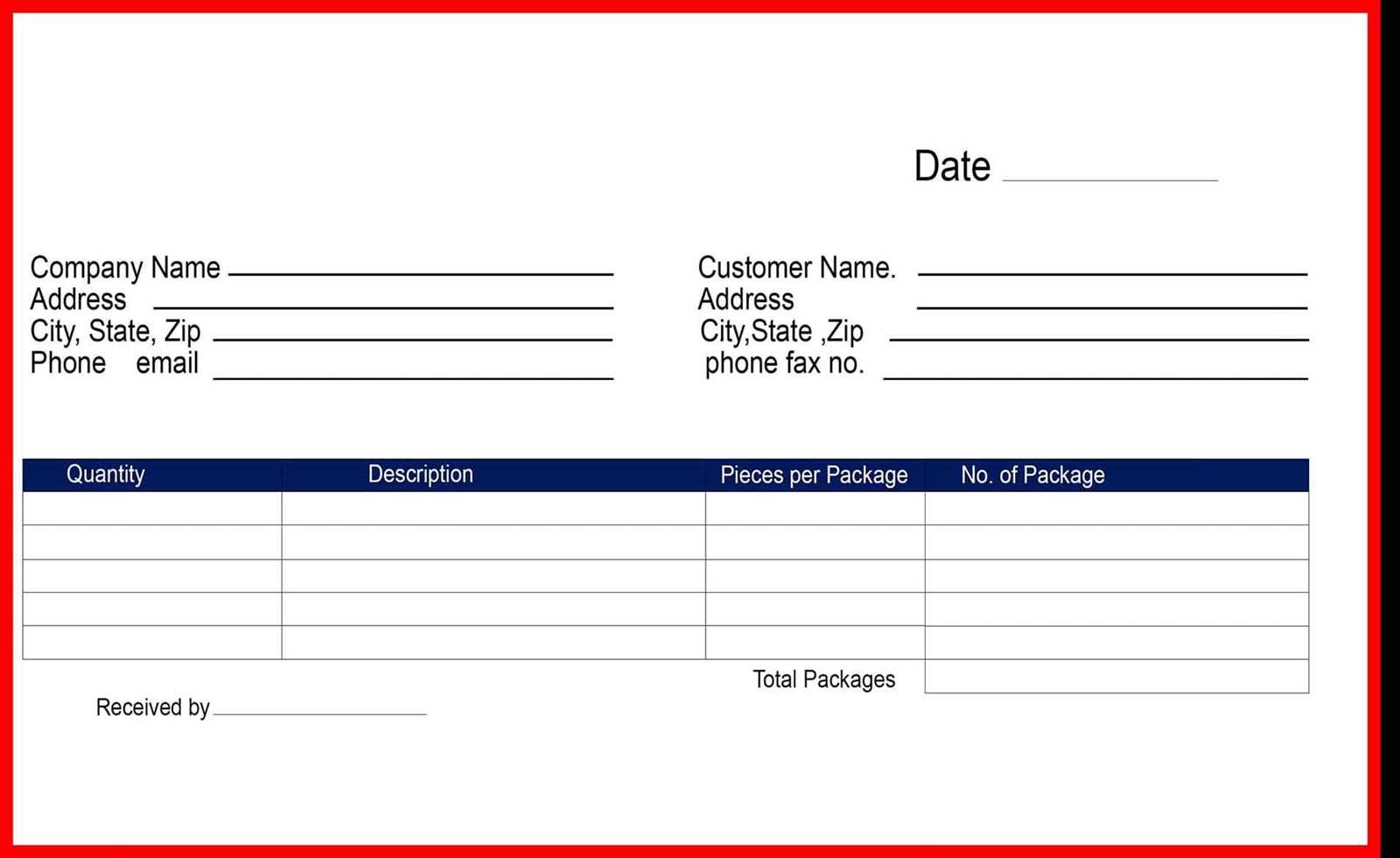

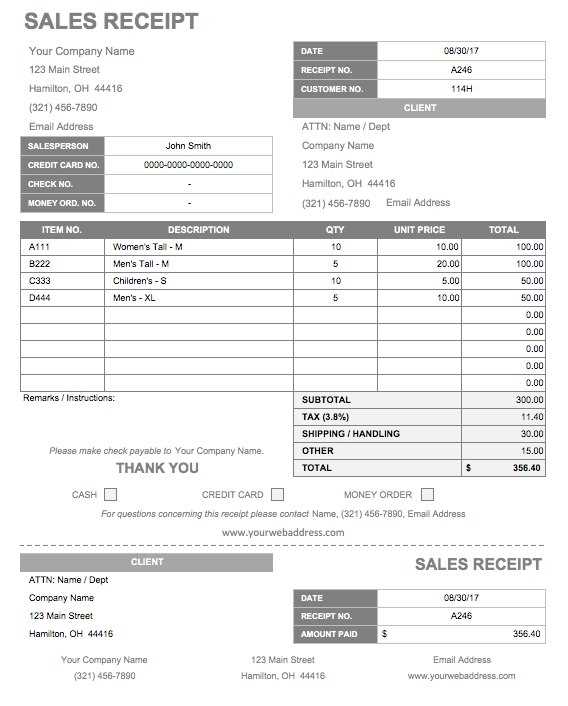

Select a base template that suits your needs. There are various styles, including simple text-based ones and more detailed templates with logos. Find one that best represents your brand and supports the information you need to include.

2. Add Your Company Information

Include your business name, address, phone number, and email at the top of the receipt. This helps your customers easily contact you in case of any inquiries or returns. Don’t forget to add your business logo for a professional touch.

3. Customize Payment Details

Make sure the template has sections for payment method, transaction amount, and any taxes or discounts applied. This is where you add specifics like credit card payments, cash transactions, or promotional offers. Adjust the layout to ensure clarity and readability.

4. Set Date and Time Formatting

Ensure the template has space for the transaction date and time. You can also adjust the format according to regional preferences, such as day/month/year or month/day/year. Consistency in formatting is key.

5. Include Additional Notes

If needed, add a section for custom notes, terms and conditions, or return policies. This is useful for communicating important details like warranties, service agreements, or refund policies.

6. Organize the Layout

Arrange the sections in a way that flows naturally. Typically, the header includes your company info, followed by a list of items or services provided, then payment details and total cost. Ensure there’s enough spacing between each section for easy reading.

7. Test and Save

Before using the customized template, test it with a few mock receipts to ensure all the fields are visible and formatted correctly. Make any necessary adjustments and save the template in a format that can be easily accessed and printed.

| Field | Details |

|---|---|

| Business Name | Enter your official business name. |

| Contact Info | Add address, phone number, and email. |

| Payment Method | Specify whether the payment was by credit card, cash, or another method. |

| Date & Time | Ensure date and time are correctly formatted. |

| Additional Notes | Include warranty info, return policies, or other custom details. |

With these simple steps, your receipt template will reflect your business’s professionalism and clarity, making transactions smooth and transparent for your customers.

To create a receipt form for business transactions, first, determine what details are necessary for both parties. A well-structured receipt provides clarity and helps prevent any confusion. Begin by including your business name, address, and contact information. Follow with the date and time of the transaction, which is important for tracking purposes.

Include the Transaction Details

Next, list the items or services purchased. Include descriptions, quantities, unit prices, and the total amount. If applicable, specify any taxes or discounts applied. This makes the receipt both informative and accurate. After this, add a payment method section–whether the transaction was made in cash, by card, or another method. This detail can be useful for accounting and verification.

Offer a Unique Receipt Number

Assign each receipt a unique number for tracking and organizational purposes. This number should be sequential to avoid confusion. Keeping this system in place ensures that you can easily reference a specific transaction later if needed.

Lastly, include any terms or conditions that may apply to the transaction. If refunds or exchanges are permitted, clarify the process on the receipt. This simple addition can help prevent misunderstandings down the line.

If you need a receipt template, the first decision is whether to choose a printable or digital format. For physical records, printable templates are a clear choice. They allow you to hand out receipts during face-to-face transactions, ensuring customers have a tangible proof of purchase. Printable receipts are also ideal for situations where a signature or stamp is required, as they can be easily filled out manually.

On the other hand, digital receipt templates suit businesses focused on online sales or those wanting to minimize paper use. Digital receipts are more environmentally friendly and cost-effective. They are easily stored, accessed, and shared via email or cloud platforms. Customers appreciate the convenience of receiving a digital copy, especially for online purchases or subscription services.

Consider your specific needs: If you’re running a brick-and-mortar store, printable templates might be more practical for quick transactions. However, if your business operates online or requires easy record-keeping, digital templates will save time and resources. Choose the format that aligns with your workflow, customer preferences, and business model.

Ensure the format is consistent. Avoid changing fonts, colors, or text sizes across different sections. This creates confusion and makes the receipt look unprofessional.

Don’t skip including key information. Missing details such as the company’s name, address, or the transaction date can cause legal issues and complicate future references.

Don’t overcrowd the template. Keep the layout clean and readable. Overloading it with unnecessary information or graphics can distract from the important details.

Don’t forget to include proper tax information. Omitting tax breakdowns can lead to misunderstandings and affect the accuracy of the receipt for both the customer and your records.

Ensure all numbers are accurate. Double-check amounts and totals, especially after applying discounts or taxes. Simple arithmetic errors can lead to disputes and undermine trust.

Avoid inconsistent naming conventions. Use clear and uniform terms for products, services, and payment methods. Inconsistencies create confusion and hinder easy reference in the future.

Do not neglect security features. If your receipt template includes sensitive data like credit card numbers, consider adding features to protect that information from unauthorized access.

Don’t forget to test the template. Ensure it prints or displays correctly on all devices and systems to avoid any formatting problems that could affect its readability.

How to Customize a Money Receipt Form

To create a functional money receipt form, start by organizing the necessary fields. These should include: the payer’s name, the recipient’s name, the date of the transaction, the amount received, the method of payment, and a short description of the transaction.

Key Sections to Include

The first section of the form should clearly state the title “Money Receipt” at the top for easy identification. Next, add a space for the receipt number, ensuring it’s unique for every transaction. This helps with future tracking and reference.

Formatting Tips

For clarity, use distinct sections with labels like “Payer Information” and “Recipient Information.” Include checkboxes or dropdowns for payment methods like cash, bank transfer, or cheque. Ensure there’s enough room for signatures at the bottom to confirm the transaction.