A security deposit receipt is a crucial document for landlords and tenants, outlining the terms of a security deposit. It confirms the amount paid, the purpose of the deposit, and the conditions for its return at the end of the tenancy. Having a clear and well-organized receipt helps prevent disputes between landlords and tenants. It serves as proof of the payment and can be used in case of disagreements about deductions or refunds.

Ensure your receipt includes the tenant’s details, the landlord’s name, the rental property address, and the amount of the security deposit. Include a statement clarifying the purpose of the deposit, such as covering potential damages, unpaid rent, or cleaning costs. It’s important to specify whether the deposit will be held in a government-approved tenancy deposit scheme, as required by UK law.

To avoid future misunderstandings, the receipt should also outline the conditions under which the deposit may be withheld. These conditions might involve damage beyond normal wear and tear, unpaid rent, or failure to meet cleaning standards. It’s helpful to include the date the deposit was paid and a reference to the tenancy agreement to make the receipt easily traceable.

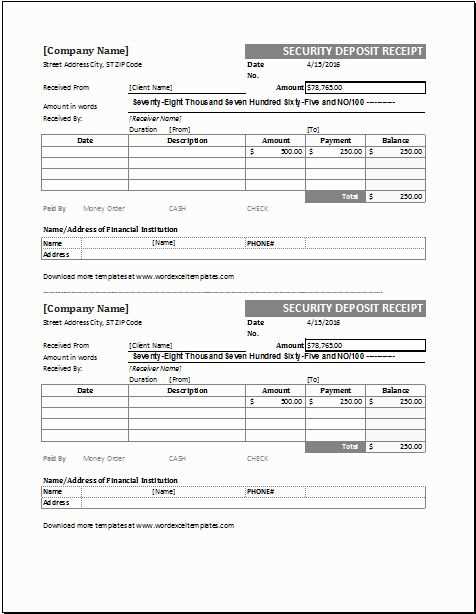

Security Deposit Receipt Template UK

To create a clear and concise security deposit receipt in the UK, make sure to include essential details such as the tenant’s name, the amount paid, and the property address. A well-structured receipt ensures both parties are protected and avoids future disputes. Below is a template that covers the necessary components:

Template Structure

Begin by stating the full name of the tenant and the landlord. Include the property address, along with the rental period. Specify the amount of the security deposit and how it was paid, whether in cash, cheque, or bank transfer. Don’t forget to mention the date the payment was received and the purpose of the deposit. Always include a statement noting that the deposit will be held in a secure account, if applicable, and explain the conditions under which it may be refunded.

Example Receipt

Tenant Name: John Doe

Landlord Name: Jane Smith

Property Address: 123 Green Street, London, N1 5DX

Rental Period: 1st January 2025 to 31st December 2025

Deposit Amount: £1,000

Payment Method: Bank Transfer

Date of Payment: 10th February 2025

Purpose of Deposit: To secure rental property and cover potential damages

Refund Conditions: Subject to property inspection at the end of the tenancy. Deposit will be returned within 30 days after inspection if no damages are found.

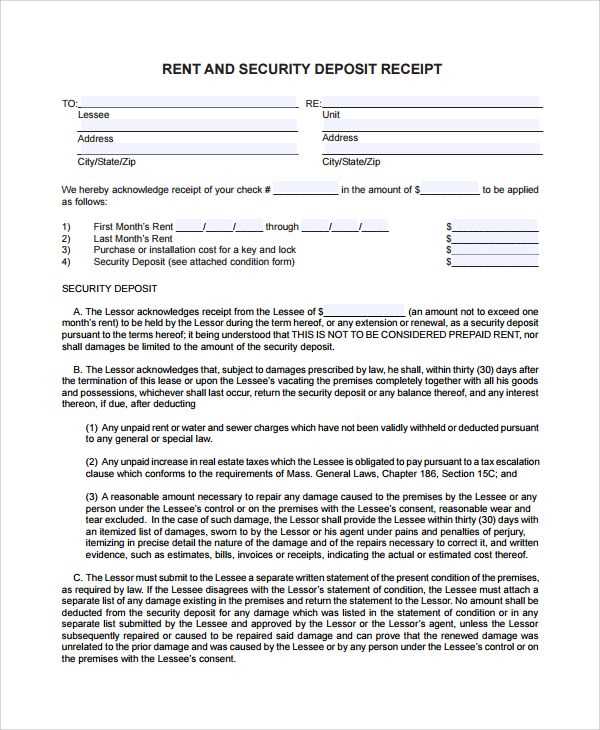

How to Create a Legal Security Deposit Receipt

Begin by including the full names and addresses of both the landlord and the tenant. This ensures that both parties are clearly identified. Include the date the deposit is received, and specify the amount paid by the tenant.

Details of the Deposit

Indicate whether the deposit is refundable or non-refundable. Specify any conditions under which deductions may be made, such as damages or unpaid rent. If applicable, outline the timeframe for the return of the deposit after the lease ends.

Property Information

Provide the address of the rental property where the deposit is being held. This ensures there’s no confusion about which property the deposit relates to.

Clearly state the method of payment used for the deposit (e.g., bank transfer, cheque, or cash). This helps confirm the exact payment process and can prevent disputes later on.

Finally, both parties should sign the receipt to confirm agreement on the terms laid out. Keep a copy of the receipt for your records, and provide one to the tenant for their reference.

Key Information to Include in the Template

Ensure the receipt clearly identifies the landlord and tenant, including full names and contact details. This helps establish accountability for both parties.

Deposit Amount and Purpose

List the exact amount of the security deposit and specify its purpose, such as covering damage or unpaid rent. This avoids any confusion later on.

Property Details

Provide a brief description of the rented property, including the address and any distinguishing features that clarify which property the deposit applies to.

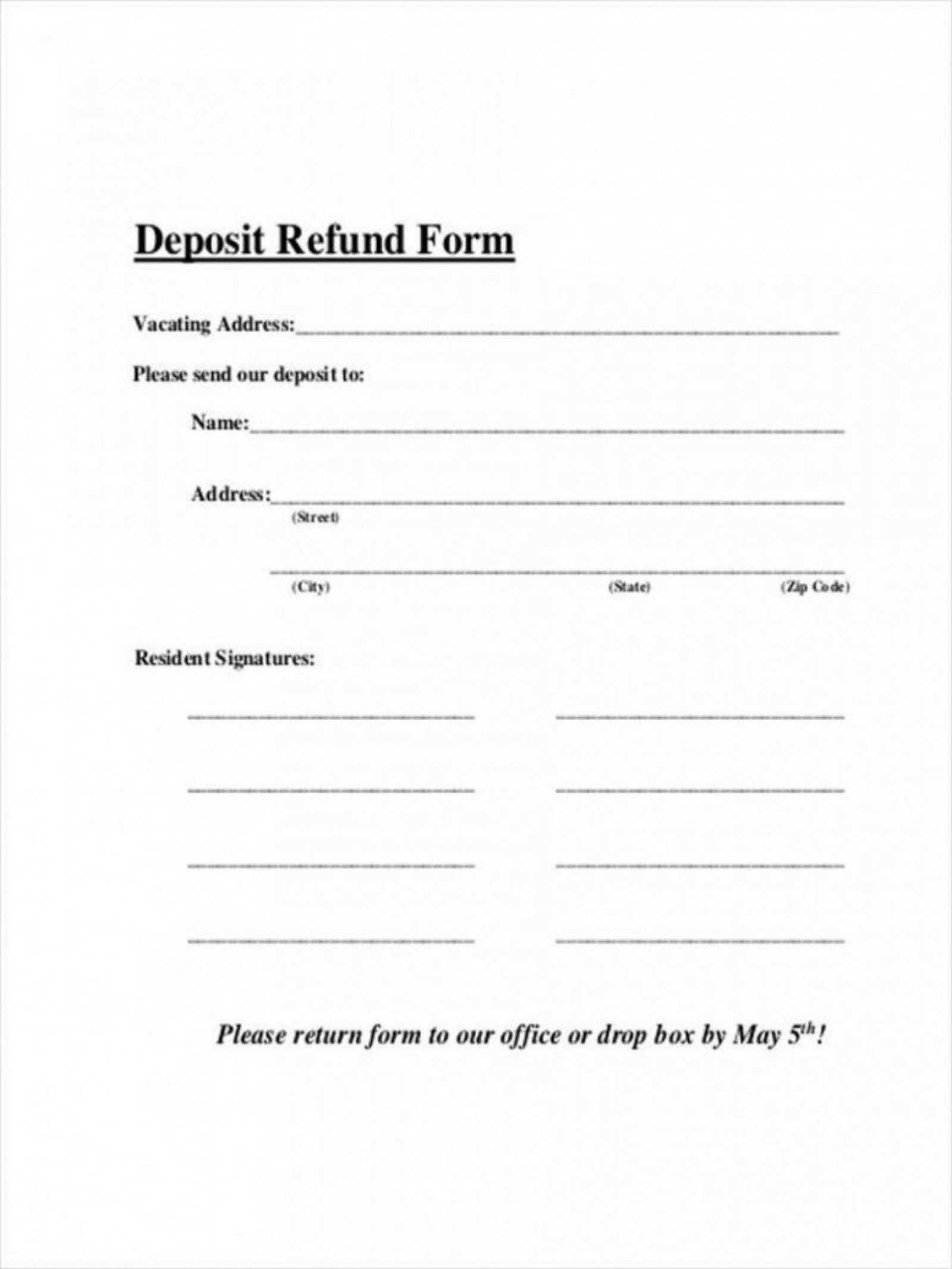

Conditions for Return

State the conditions under which the deposit will be returned, including any deductions that may be made. Specify the timeframe for the return of the deposit, typically within 10 to 30 days after the tenancy ends.

Signatures

Both the landlord and tenant should sign the receipt, confirming that the terms are understood and agreed upon. This serves as legal proof of the transaction.

Dispute Resolution

Include information on how disputes regarding the deposit will be handled, such as through a formal mediation or arbitration process.

Common Mistakes to Avoid When Issuing a Receipt

Ensure all information is correct and legible. Double-check the date, the amount, and the recipient’s details before finalizing the receipt. Mistakes here can create confusion and lead to disputes.

Incorrect or Missing Information

Always include the full name of both parties and a clear description of the transaction. If the security deposit is part of a larger agreement, be specific about the amount and terms. Missing or vague information can cause problems later.

Not Providing a Receipt Copy

Offer the recipient a copy of the receipt. Failure to do so can result in misunderstandings, as the tenant or client might claim they did not receive the deposit or may dispute the transaction.

Clear and concise documentation is key to avoid unnecessary complications. A proper receipt ensures both parties understand the agreement and protects everyone involved.