When selling an item with no guarantees, a well-structured sold as seen receipt protects both parties from disputes. This document confirms that the buyer accepts the item in its current state, with no obligation for the seller to offer refunds or repairs. To ensure clarity, include precise wording that defines the sale as final.

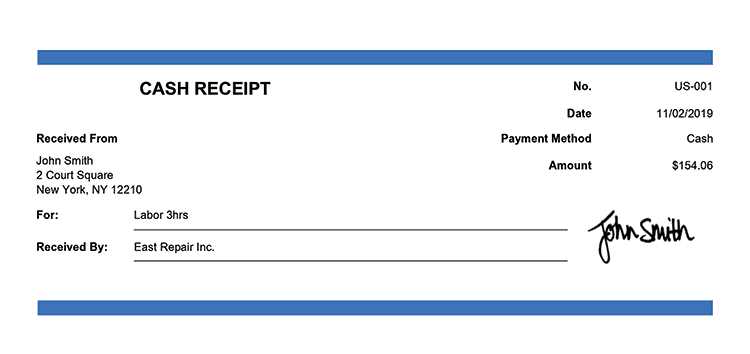

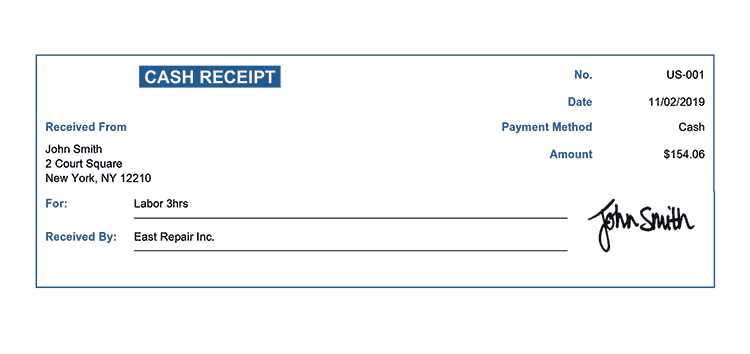

A proper receipt should list the date of purchase, buyer and seller details, item description, and a statement confirming the buyer’s acceptance of its condition. Adding phrases like “sold as seen, no warranty given or implied” strengthens the legal standing of the transaction.

Signatures from both parties finalize the agreement, preventing misunderstandings. A printed or handwritten version is acceptable, but a signed copy should be retained for reference. Structuring the receipt correctly ensures transparency and avoids potential disputes.

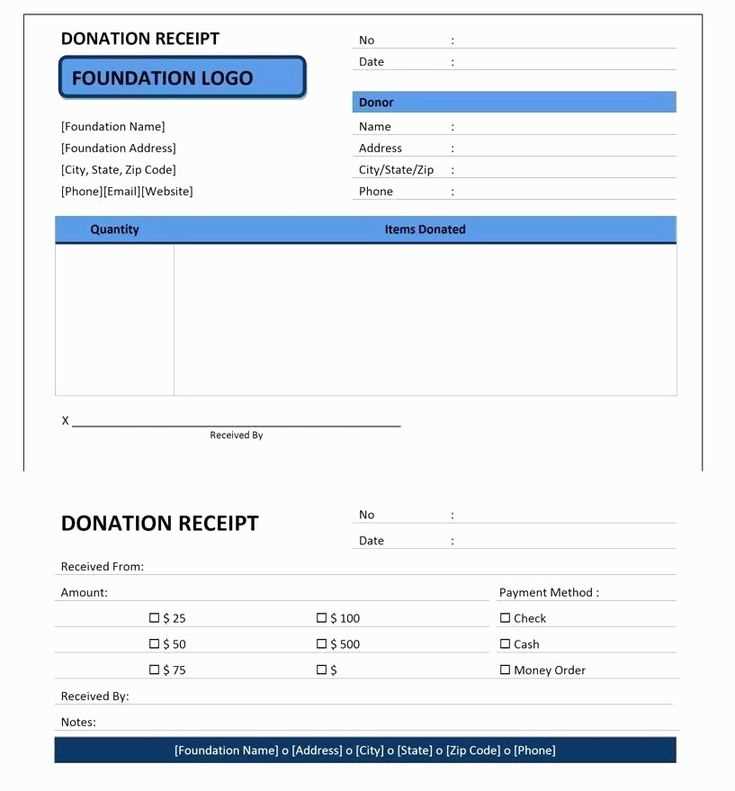

Sold as Seen Receipt Template

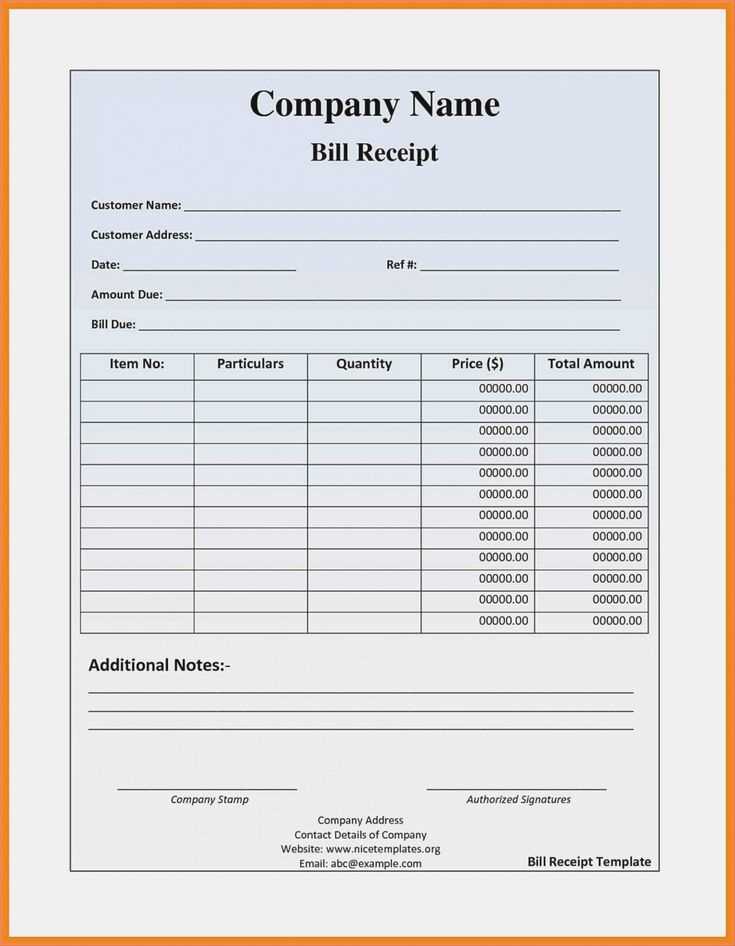

Specify the item description with as much detail as possible. Include the make, model, serial number, and any known defects. This prevents disputes and ensures both parties understand the item’s condition at the time of sale.

Clearly state that the sale is final and the item is sold without guarantees or returns. Use direct wording such as “Sold as seen, no refunds or exchanges.” This eliminates ambiguity and sets clear expectations.

Include the names and signatures of both buyer and seller, along with the date of the transaction. This adds legal weight and confirms mutual agreement on the terms outlined in the receipt.

Key Clauses to Include in the Document

Ensure the receipt covers all necessary terms to prevent disputes and clarify the sale conditions. Missing details can lead to misunderstandings, so structure the document carefully.

- Item Description: Clearly specify the product, including make, model, serial number (if applicable), and any distinguishing features.

- Sale Condition: Explicitly state that the item is sold in its current state without warranties or guarantees.

- Price and Payment: Include the total amount paid, payment method, and date of transaction.

- Buyer and Seller Details: List full names and contact information of both parties.

- No Returns or Refunds: Clarify that the sale is final and the buyer accepts the item as is.

- Signature and Date: Both parties should sign and date the document to confirm agreement.

Adding these clauses ensures transparency and protects both parties from potential disputes.

Legal Considerations and Buyer Acknowledgment

Specify in the receipt that the item is sold without warranties or guarantees. Clearly state that the buyer accepts the item in its current condition, acknowledging any visible defects or missing parts. If possible, list key details such as model, serial number, and any included accessories to avoid disputes.

Request the buyer’s signature and date to confirm understanding of the terms. This prevents later claims of misrepresentation and ensures both parties agree to the transaction terms. For added security, include a clause stating that no refunds or exchanges will be provided once the sale is complete.

Use direct language to outline any legal responsibilities. If local laws impose specific requirements, reference them briefly while keeping the receipt simple and clear. A concise, well-structured receipt minimizes misunderstandings and protects both parties from future conflicts.

Formatting and Structuring the Receipt

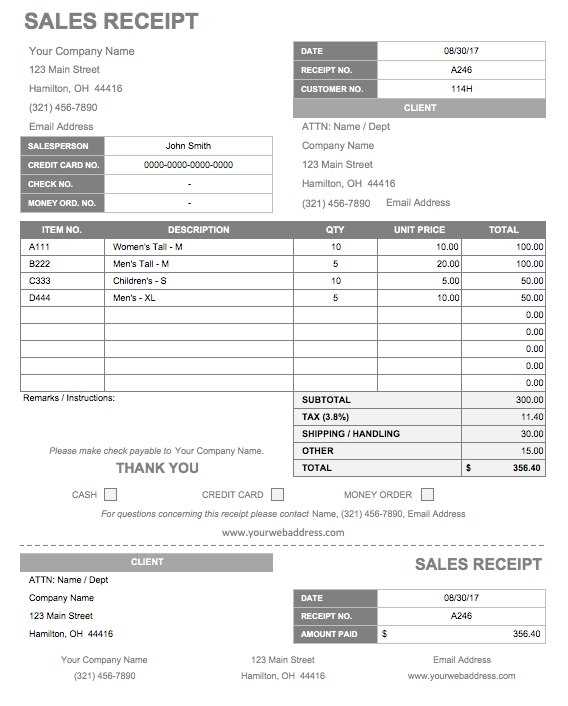

Use clear sections to break down the details of the receipt. The header should feature the company’s name, logo, and contact information. Follow with the transaction date and a unique receipt number for identification. This helps to quickly locate and reference the receipt when needed.

Transaction Details

Under the transaction details, list each purchased item along with the quantity and price. Group items by category if applicable, such as products, services, or taxes. Use a clean, readable font, and ensure the alignment of amounts is consistent across the document.

Total and Payment Information

At the bottom, provide a clear breakdown of the total amount due, including taxes, discounts, and any additional fees. If the payment method is relevant, include it to clarify the mode of payment. Avoid cluttering this section with unnecessary details; focus only on what directly relates to the transaction.