Creating a reliable income tax receipt template ensures that your documentation is clear and professional. A well-structured template helps both businesses and individuals maintain accurate records for tax purposes.

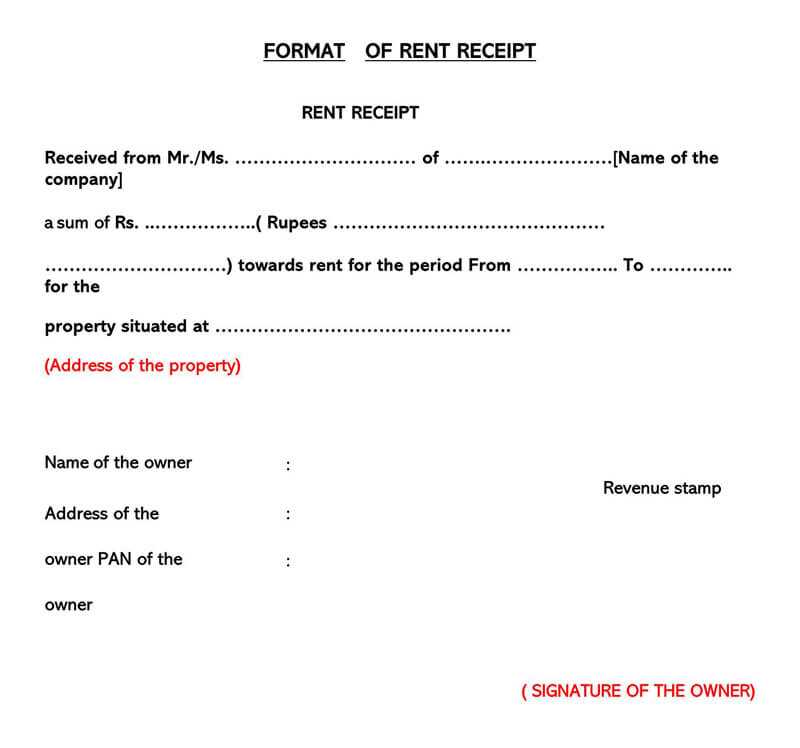

Start by including the full name and contact details of the payer, along with a clear description of the income received. Specify the amount and date of payment, as well as the method of payment, such as cash, check, or bank transfer.

For greater clarity, ensure that the tax rate and any deductions are indicated separately, if applicable. This will make it easier for both parties to understand how the final amount was calculated. Adding a reference number can also help track receipts for future reference.

Finally, provide space for the signature of the payer and the payee to verify the transaction. This adds an extra layer of authenticity to the document and confirms that both parties acknowledge the receipt.

Here are the corrected lines with reduced repetition:

To streamline your income tax receipt template, remove redundant phrases and focus on clarity. Use simple, direct wording to avoid confusion and improve readability.

Be Clear and Direct

For example, instead of saying “The payment was made and received,” you can simply say “Payment received.” This eliminates unnecessary repetition and maintains a professional tone.

Consolidate Information

Combine related details into a single sentence. Instead of “The amount is $500 and the payment was made on January 15,” say “A payment of $500 was made on January 15.” This makes your template more concise and to the point.

- Income Tax Receipt Template

To create a clear and accurate income tax receipt, follow these straightforward steps:

Key Information to Include

- Receipt Number: Unique identifier for each receipt.

- Taxpayer’s Name: Full legal name of the individual or business.

- Recipient’s Name: Name of the entity or person receiving the payment.

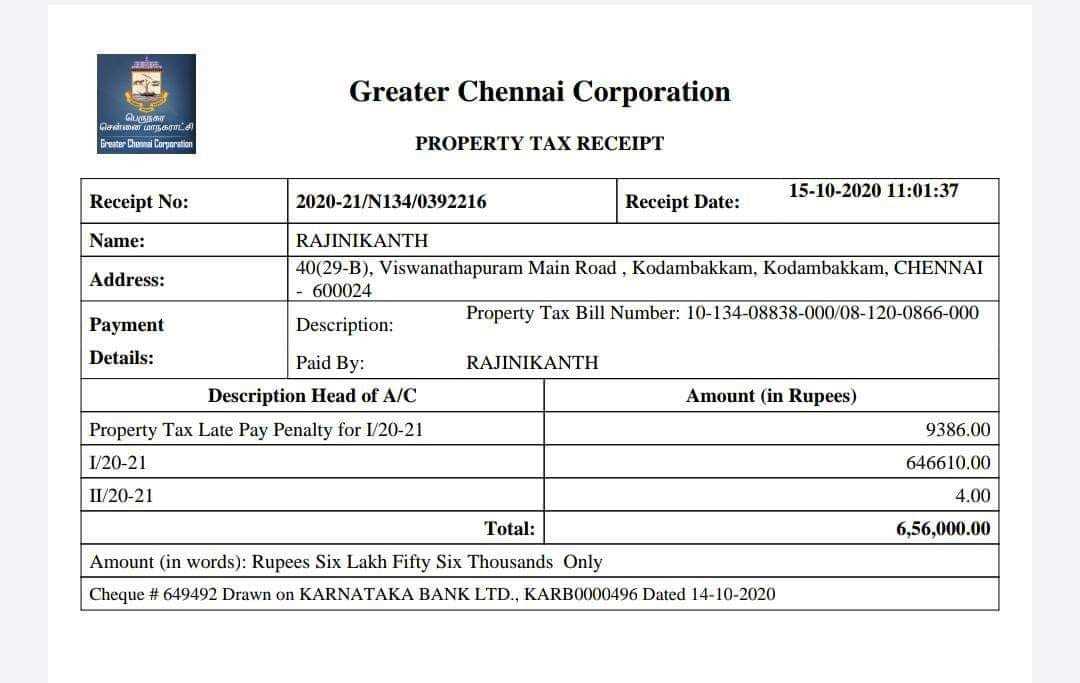

- Payment Amount: Exact amount paid, clearly stated in both numbers and words.

- Payment Date: Specific date of the transaction.

- Tax Period: The period the payment relates to (e.g., tax year or quarter).

- Description of Payment: Purpose of the payment, such as income tax, business taxes, etc.

- Signature or Seal: Authorized signature or company seal to validate the receipt.

Format Guidelines

Use a simple and clean format. Begin with the header “Income Tax Receipt” in bold. Clearly display the payment details in a structured table or list format. Ensure that the payment details are easy to read and organized.

By following these steps, you ensure that the receipt is professional, clear, and ready for tax filing purposes.

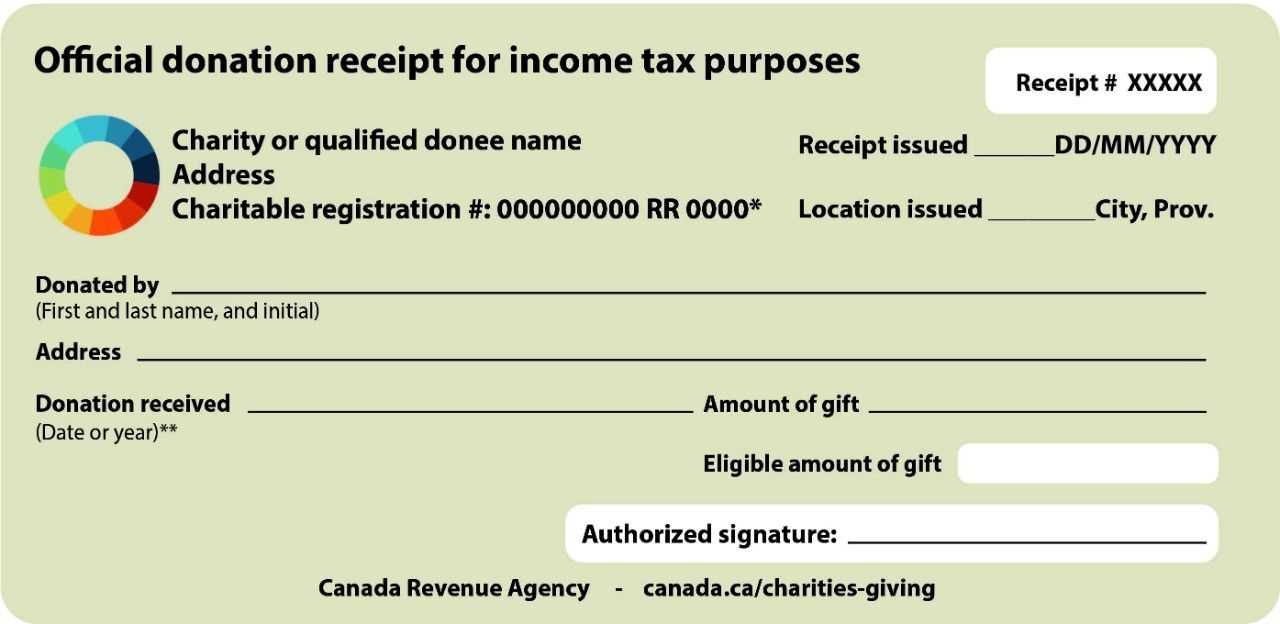

Begin by clearly defining the information that must appear on the tax receipt. Include your business name, contact details, and tax identification number. Ensure the format is straightforward for both your team and customers to read easily.

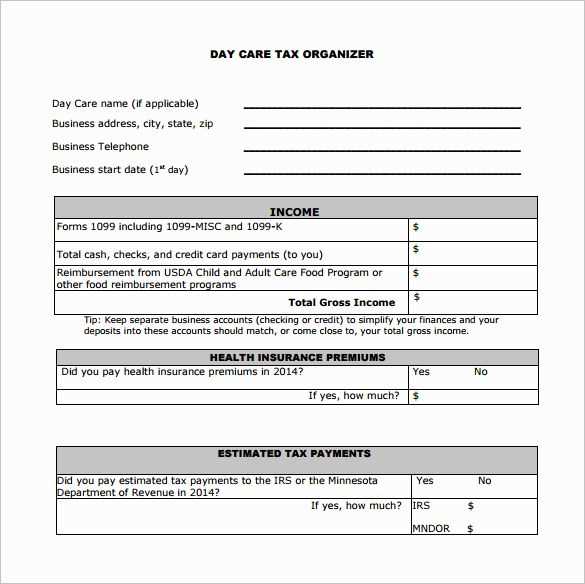

Include specific fields like the date of transaction, the goods or services purchased, the total amount paid, and the applicable tax rate. Each of these should be well-labeled for clarity.

Design the layout to be clean and professional. Avoid clutter by organizing information logically: business details at the top, transaction specifics below, and a clear total at the bottom. Use sufficient white space to make the receipt easy to follow.

Make sure the font is legible and consistent throughout. Using a standard font such as Arial or Helvetica ensures readability. Avoid using too many different font styles or sizes.

Incorporate your business logo or branding if applicable. This helps with identification and adds a touch of professionalism to the receipt.

Test the template before using it with actual customers. Check for alignment issues, readability, and that all required fields are present. It’s important that the document reflects your business accurately and maintains legal compliance.

Finally, save your tax receipt template in a format that can be easily accessed and printed, or made available digitally. This makes it more convenient for both your team and your customers to access when needed.

Adjust the format and details of the receipt based on the specific requirements of the tax jurisdiction. Each region or country may have unique guidelines on the information that needs to appear on tax receipts.

Include the proper tax identification numbers or registration details for your business. This is particularly important for jurisdictions that require businesses to include their tax ID to verify the legitimacy of the transaction.

Ensure that the tax rates are clearly defined according to local laws. For instance, certain areas may have multiple tax categories such as federal, state, or municipal taxes, and each rate should be accurately reflected on the receipt.

Make space for any specific tax exemptions or deductions relevant to the jurisdiction. Some areas may offer exemptions for certain types of purchases or services, so ensure these are detailed appropriately on the receipt.

Incorporate the jurisdiction’s preferred currency format. Some regions use specific symbols or decimal placements, so aligning with local standards will make the receipt more accurate and official.

If the jurisdiction requires a specific format for dates, addresses, or other information, adapt the receipt to follow these rules. Standardization ensures compliance with local laws and helps avoid any misunderstandings.

For regions with VAT or other consumption taxes, clearly indicate the tax breakdown, showing both the taxable amount and the tax applied separately. This transparency helps both businesses and customers track taxes accurately.

Finally, review any local rules about digital or paper receipts. Certain jurisdictions may require a specific method of delivery or additional authentication steps for receipts issued electronically.

Consider using QuickBooks to create and manage tax receipt templates. It offers customizable receipt templates that automatically generate accurate tax information, saving time and effort. With its integrated features, you can easily track transactions and generate tax receipts for your clients.

Another excellent option is FreshBooks. This cloud-based accounting software provides various templates for receipts, including tax receipts. It’s ideal for freelancers and small businesses. FreshBooks also integrates seamlessly with other accounting tools, making tax management simpler.

If you need more control over design, Microsoft Word or Google Docs are useful for creating personalized templates. Both tools offer free access to templates, and you can edit them according to your needs. With Google Docs, you can also share your templates easily and collaborate in real time.

Zoho Invoice provides another reliable solution for generating tax receipts. The platform’s customizable templates allow you to tailor the appearance of receipts while also ensuring the necessary tax information is included. It also includes automatic currency and tax calculations, making it a convenient option for global businesses.

Wave is a free accounting software option for small businesses, and it includes tools to create tax receipt templates. You can customize your receipts and track payments directly within the platform, simplifying the whole process.

Lastly, Adobe Acrobat gives you the flexibility to design tax receipt templates in a PDF format. It’s perfect for businesses that need professional-looking, secure receipts. You can use Acrobat’s form tools to ensure that all required tax fields are included.

Ensure your income tax receipt template is clear and accurate. It should include all the relevant details such as the taxpayer’s name, address, and the amount paid. Having this information well-organized will help prevent confusion when the document is reviewed or submitted.

Key Components of a Tax Receipt Template

Your template must include the following fields to ensure it’s compliant with most tax systems:

- Taxpayer’s Full Name

- Taxpayer’s Address

- Date of Payment

- Payment Amount

- Tax Period Covered

- Taxpayer Identification Number (TIN)

- Receipt Number

- Signature of the Tax Authority

Sample Income Tax Receipt Template

| Field | Details |

|---|---|

| Taxpayer Name | John Doe |

| Address | 1234 Elm Street, Springfield |

| Date of Payment | 2025-02-10 |

| Payment Amount | $1,500.00 |

| Tax Period | 2024-2025 |

| TIN | 987654321 |

| Receipt Number | TXR-123456 |

| Signature | Authorized Tax Official |

Be sure to adjust the template for the specific requirements of the tax authority in your region. Missing details can lead to delays or rejection of the receipt.