When managing boat rentals or transactions, a boat deposit receipt serves as a clear acknowledgment of a security deposit received. This document outlines the amount paid, the terms under which the deposit was made, and any conditions for its return. It’s essential to use a standardized format to avoid confusion and ensure both parties are protected.

Ensure the receipt includes the date of payment, the amount deposited, and details about the rental agreement. Specify if the deposit is refundable, and under what circumstances it may be withheld. This provides transparency for both the business and the customer, ensuring everyone knows their rights and responsibilities. A well-crafted receipt also helps prevent disputes over return conditions.

Consider including fields for the names of both parties involved, a brief description of the boat or rental agreement, and any additional notes or special conditions. This ensures all relevant information is recorded, making it easier to resolve any future issues. Having a reliable template to fill out quickly can save time and effort during each transaction.

Boat Deposit Receipt Template Guide

Ensure your boat deposit receipt includes key details such as the customer’s name, boat model, deposit amount, and the date of payment. This information confirms the transaction and protects both parties. Keep the format simple yet thorough.

Key Elements of a Boat Deposit Receipt

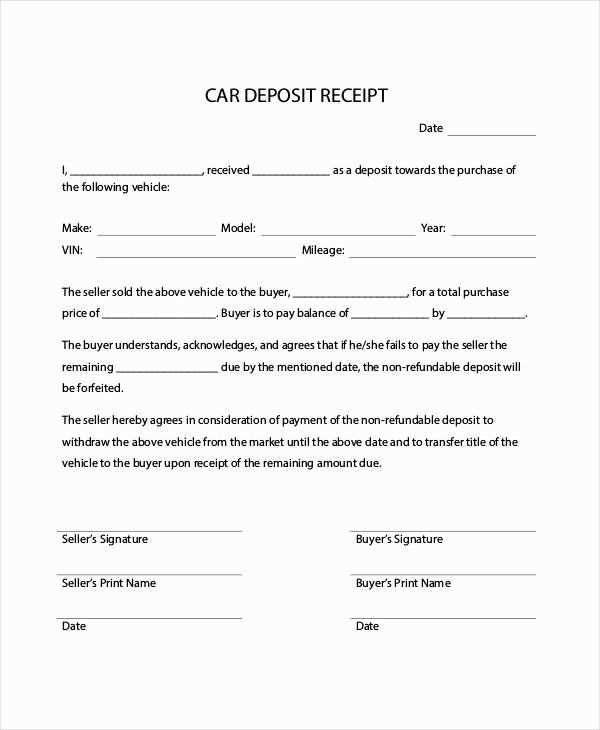

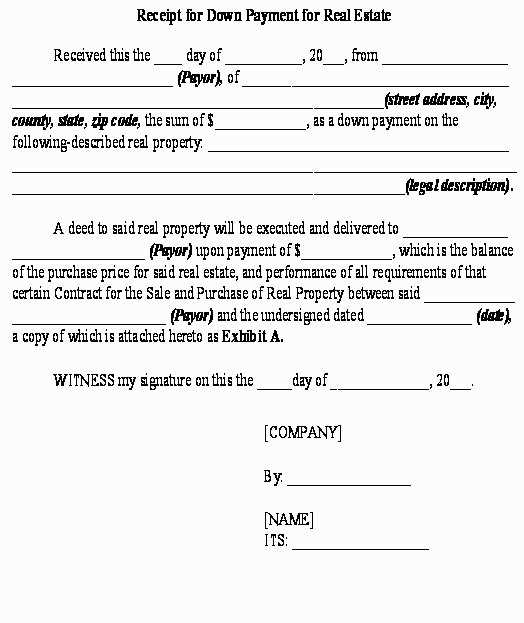

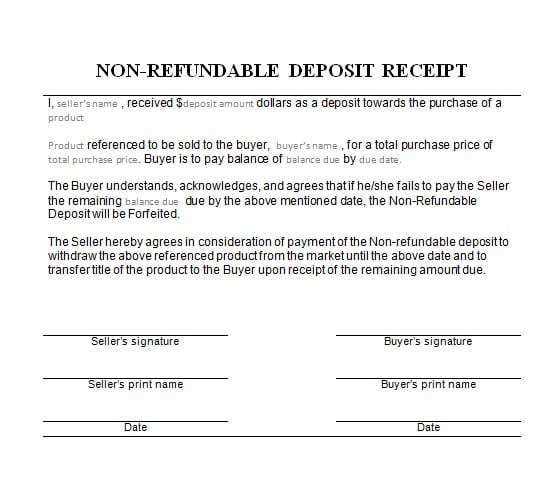

The receipt should clearly state the purpose of the deposit, whether it’s for a rental, purchase, or service. Include the boat’s identification details like its make, model, and registration number. A reference number or receipt number helps track the transaction. Be sure to list the deposit amount, the total cost of the boat, and any remaining balance. Specify the payment method–cash, card, or check–and any conditions related to the deposit, such as refund policies or deadlines.

Tips for a Clear and Professional Receipt

Double-check the accuracy of all numbers and personal information to avoid misunderstandings. Use a clear, legible font and consistent formatting to make the receipt easy to read. Acknowledging the receipt with a signature line from both the payer and the receiver adds legitimacy. If the deposit is refundable, include the exact terms under which the deposit will be returned. This keeps the agreement transparent for both parties.

How to Create a Boat Deposit Receipt

To create a boat deposit receipt, begin by including the date of the transaction at the top of the document. Clearly state the amount of the deposit received, specifying the currency used. Make sure to include both the boat’s identification details (such as model or registration number) and the name of the person making the deposit.

Key Information to Include

The receipt should list the full name of the person or entity who paid the deposit, as well as the business name if applicable. Also, specify the purpose of the deposit, such as reservation, purchase, or rental. Add any relevant terms, such as refund policies or deadlines for the remaining balance. If the receipt is for a rental, include the rental period and the terms of use.

Additional Tips for Clarity

Always include a unique receipt number to ensure tracking and avoid confusion. A clear signature space should be added at the bottom to confirm the receipt of payment. Optionally, add a space for the method of payment, whether by cash, credit card, or bank transfer. Make sure all amounts are clearly listed to prevent any misunderstandings.

Key Information to Include in the Template

Clearly outline the key details to avoid confusion. Start with the name of the boat and the owner’s information. Include the deposit amount, payment method, and due date to ensure transparency. Specify the terms of the deposit, such as whether it is refundable or non-refundable, and outline any conditions for refunding the deposit.

- Boat Name: Include the full name of the boat or vessel for identification.

- Owner’s Details: List the owner’s name, address, and contact details for clear communication.

- Deposit Amount: State the exact amount being paid and the currency used.

- Payment Method: Specify how the deposit was paid (e.g., credit card, cash, bank transfer).

- Payment Date: Record the date the deposit was made to avoid misunderstandings.

- Refund Terms: Define if the deposit is refundable, and the conditions under which it can be refunded.

- Deposit Expiry Date: Mention if the deposit has an expiration date or if there’s a deadline for final payment.

- Rental or Sale Agreement: Reference any agreements or contracts the deposit pertains to for full context.

By including these key elements, the template ensures all parties are on the same page and protects both the boat owner and the individual making the deposit.

Common Mistakes to Avoid in Boat Deposit Receipts

Inaccurate details are one of the most frequent errors. Always verify that the boat’s make, model, and registration number are correct. Any mistake can lead to confusion or disputes later.

Another common issue is missing signatures. Both the buyer and the seller should sign the receipt. This ensures that both parties acknowledge the terms and the agreed deposit.

Failure to include deposit amount is a mistake that can cause problems. Make sure the deposit amount is clearly listed. Without this, there’s no clear record of the agreed terms.

Some receipts lack a payment method. Specify whether the deposit was made by cash, check, or electronic transfer. This helps clarify the nature of the transaction and avoids any future misunderstandings.

Ambiguous terms regarding the refund policy can create unnecessary disputes. Clearly state the conditions under which the deposit is refundable or non-refundable. Ambiguity in these terms can lead to confusion.

Finally, missing dates can lead to problems with record-keeping. Always include the exact date the deposit was paid. This helps establish a timeline in case any issues arise later.