A reliable and clear end-of-year payment receipt template can help you keep your financial records organized and ensure smooth year-end processes. Whether you are a freelancer, small business owner, or part of a larger organization, having a structured template simplifies tax filing and auditing. It’s essential that each receipt includes key details like the payment amount, date, and services or products provided, ensuring transparency and accountability for both parties.

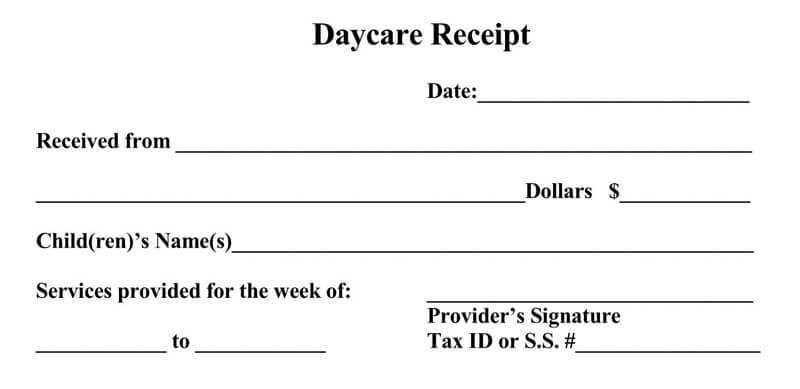

Using a template helps avoid mistakes by providing a standardized format. You can customize it to fit your needs, but it should always include the payer’s name, contact information, and the breakdown of services or items paid for. This clarity will prevent misunderstandings and make it easier to track financial transactions over the year.

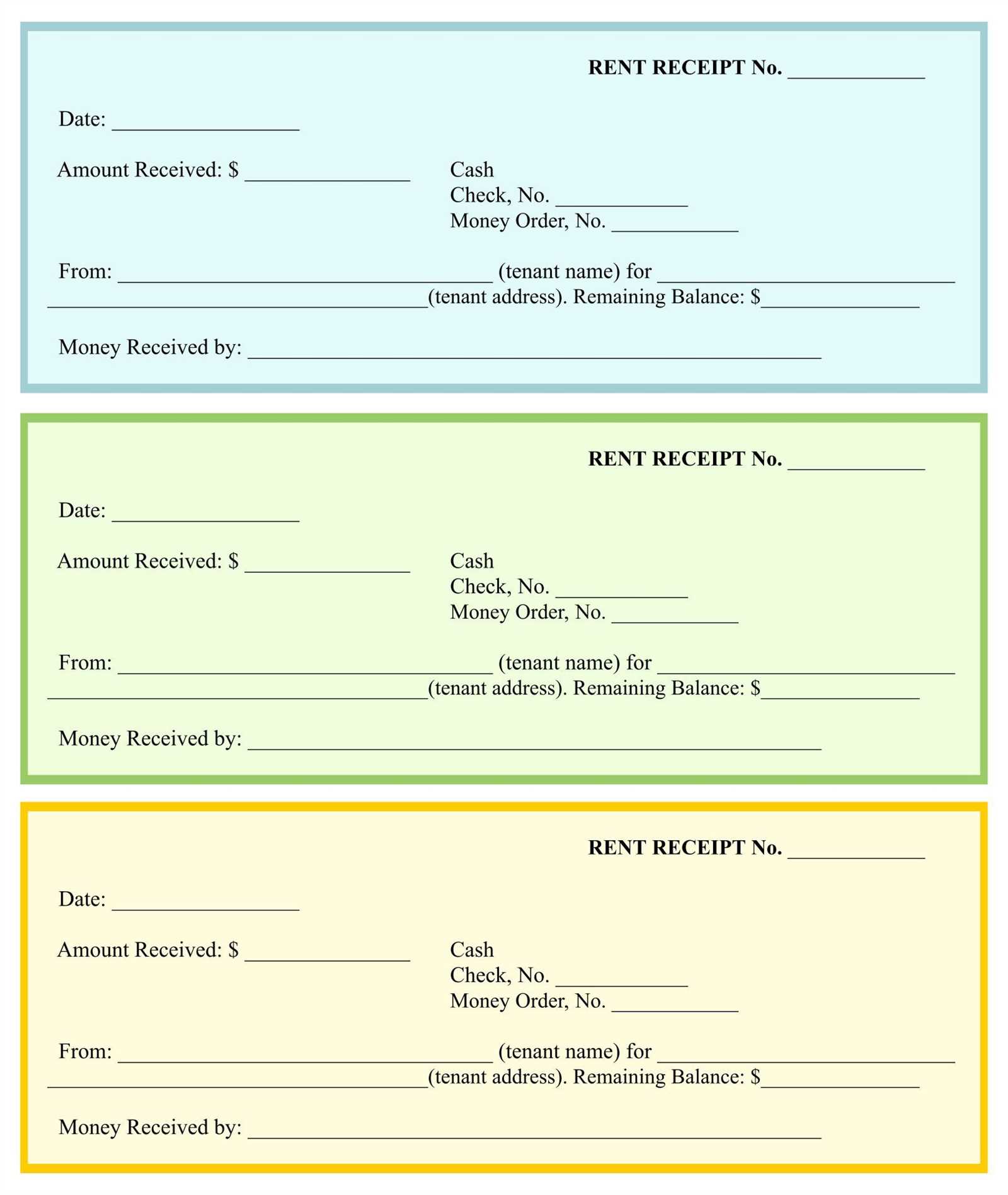

In addition to the basic payment details, a clear description of the payment method (e.g., cash, bank transfer, credit card) is necessary. Providing this information helps both the payer and payee have a clear reference point for their financial records. A well-structured receipt also shows professionalism and builds trust with clients or customers.

Here’s the corrected version:

Make sure to include the employee’s name, position, and payment period at the top of the document. Specify the exact date of payment and the total amount received. If there are deductions or bonuses, clearly list them along with their respective amounts. Itemize each component to avoid confusion. It’s also helpful to include the employer’s name and contact information at the bottom. Lastly, always ensure the receipt is signed by the appropriate person, confirming the transaction.

- End of the Year Payment Receipt Template

Ensure your year-end payment receipts contain key details for clarity. Include the following sections:

- Receipt Number: Assign a unique number for tracking and referencing.

- Date of Payment: Indicate the exact date the payment was made.

- Payer Information: List the payer’s name, address, and contact details.

- Payee Information: Provide your business or personal name, address, and contact details.

- Amount Paid: Clearly state the total payment amount in both numerals and words.

- Payment Method: Specify whether the payment was made via cash, check, credit card, or bank transfer.

- Services or Goods Provided: Briefly describe the products or services for which the payment was made.

- Additional Notes: Include any relevant information, such as discounts or payment terms.

Ensure all fields are accurate and clearly presented to avoid any misunderstandings. Using a template for this can save time and help maintain consistency in your records. Consider adding a signature line or approval if necessary, especially for larger transactions.

To create a payment receipt for year-end financial records, include key details such as the date of payment, the payer’s information, the payee’s details, and the payment amount. Ensure the receipt reflects the transaction accurately, as it will be critical for accounting and tax purposes.

The receipt should also provide a brief description of the payment purpose, whether it’s for services rendered, goods purchased, or other reasons. Make it clear and concise. Organize the information in a way that it can be easily referenced during audits or tax filing. Here’s a simple structure you can follow:

| Field | Details |

|---|---|

| Date of Payment | [Enter payment date] |

| Payer Information | [Payer’s full name, address, contact information] |

| Payee Information | [Payee’s full name, business name, contact information] |

| Payment Description | [Brief description of the goods or services provided] |

| Amount Paid | [Exact payment amount] |

| Payment Method | [Cash, Credit Card, Bank Transfer, etc.] |

| Transaction ID (if applicable) | [Unique transaction number or reference] |

Additionally, if the payment is part of a larger contract or agreement, make sure to reference that agreement number or any related contract details. This will help in case there are any discrepancies or questions about the transaction later on. Once the receipt is complete, it should be stored for future reference, either digitally or physically, depending on your record-keeping preferences.

Make sure to include the payer’s full name and contact information. This ensures clear identification of both parties involved in the transaction.

The date of the payment is crucial for record-keeping and tax purposes. Be specific about the exact date when the transaction took place.

Amount paid should be clearly listed, along with the currency used. If applicable, include the breakdown of the payment, such as taxes or additional fees, to clarify the total amount paid.

Indicate the payment method, whether it was by check, bank transfer, cash, or credit card. This helps in reconciling financial records later.

Include a unique transaction reference number. This can be used for future reference in case there are any disputes or inquiries regarding the payment.

Include a clear description of the services or goods provided during the period. This provides transparency and avoids confusion for both parties.

If the payment relates to an ongoing contract or agreement, reference the contract or invoice number to link the payment to the respective contract.

Any applicable tax details, such as tax rate and total tax amount, should also be included. This is especially important for tax filing and auditing purposes.

Lastly, include a thank you message or statement of appreciation, as this adds a personal touch and maintains a professional relationship with the payer.

Tailor the receipt template to match the unique needs of the industry. For instance, restaurants should include detailed information about items ordered, including special requests or modifiers. Ensure it shows tax, service charges, and tips in a clear format. Meanwhile, in retail, receipts should display product descriptions, quantities, and pricing breakdowns, with the option for returns and exchanges if relevant.

Service Industry

For businesses in the service industry, such as salons or repair services, including detailed descriptions of services rendered is key. Specify any packages or add-ons purchased, alongside clear pricing for each item. A section for payment method (credit card, cash, etc.) helps with clarity and organization. Ensure the receipt reflects any discounts or promotions applied to the services provided.

Online Businesses

When designing a receipt template for e-commerce or online businesses, include shipping details, order numbers, and tracking links. Highlight return policies and customer service contacts for easy follow-up. Online businesses may also want to integrate automated email receipts, ensuring the template matches the branding and layout of their website for a consistent customer experience.

Provide a clear breakdown of payment details. Make sure each element is easy to find and understand. Use a bullet list to itemize payments, deductions, and any additional fees. Here’s how you can organize it:

- Payment Date

- Gross Amount

- Deductions (e.g., taxes, insurance)

- Net Amount

- Bonus or Incentives

- Outstanding Payments

Offer transparency by including the breakdown in your year-end summary. A straightforward approach makes reviewing past payments easy for employees and clients.