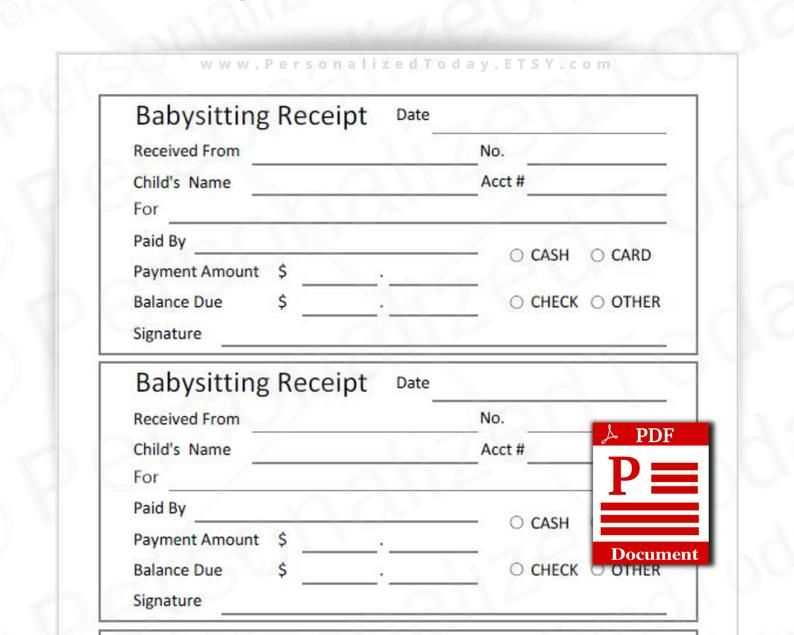

Use a child care receipt template to simplify the process of documenting payments for child care services. This template helps both parents and providers keep track of expenses for tax purposes or other financial needs. It ensures that all necessary details are included, reducing the chance of mistakes and ensuring clear communication between all parties involved.

Make sure the receipt includes the provider’s name, the date of service, the total amount paid, and a brief description of the services provided. You should also list any payment methods used, whether by cash, credit card, or other means. This level of detail makes it easy to reference payments and can be especially useful for annual tax reporting.

Another important detail is providing both parent and provider contact information. Including this ensures the receipt is linked to the right parties and can help resolve any potential issues quickly. Keeping an organized record of these receipts can be a great asset when managing finances or preparing for tax season.

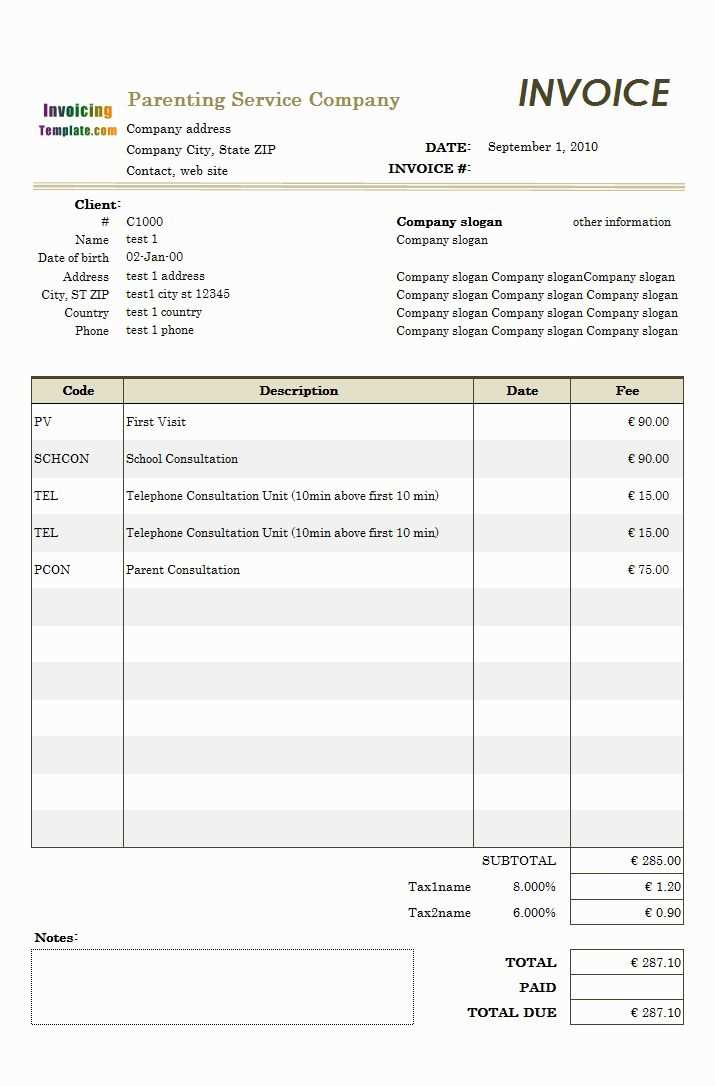

Child Care Receipt Template

Provide clear and concise details when creating a child care receipt. Include the following key information:

- Child Care Provider’s Name and Contact Information: Ensure the provider’s full name, business name (if applicable), address, and phone number are listed.

- Parent’s Name and Contact Information: Include the parent’s name, address, and phone number.

- Child’s Name: Clearly state the child’s name being cared for.

- Date of Service: List the exact date or range of dates for which child care was provided.

- Hours of Care: Specify the total number of hours of care provided on each date.

- Rate: State the hourly rate or flat fee for the service, and any applicable discounts or extra charges.

- Total Amount Due: Clearly display the total amount due, broken down by service date and hours worked.

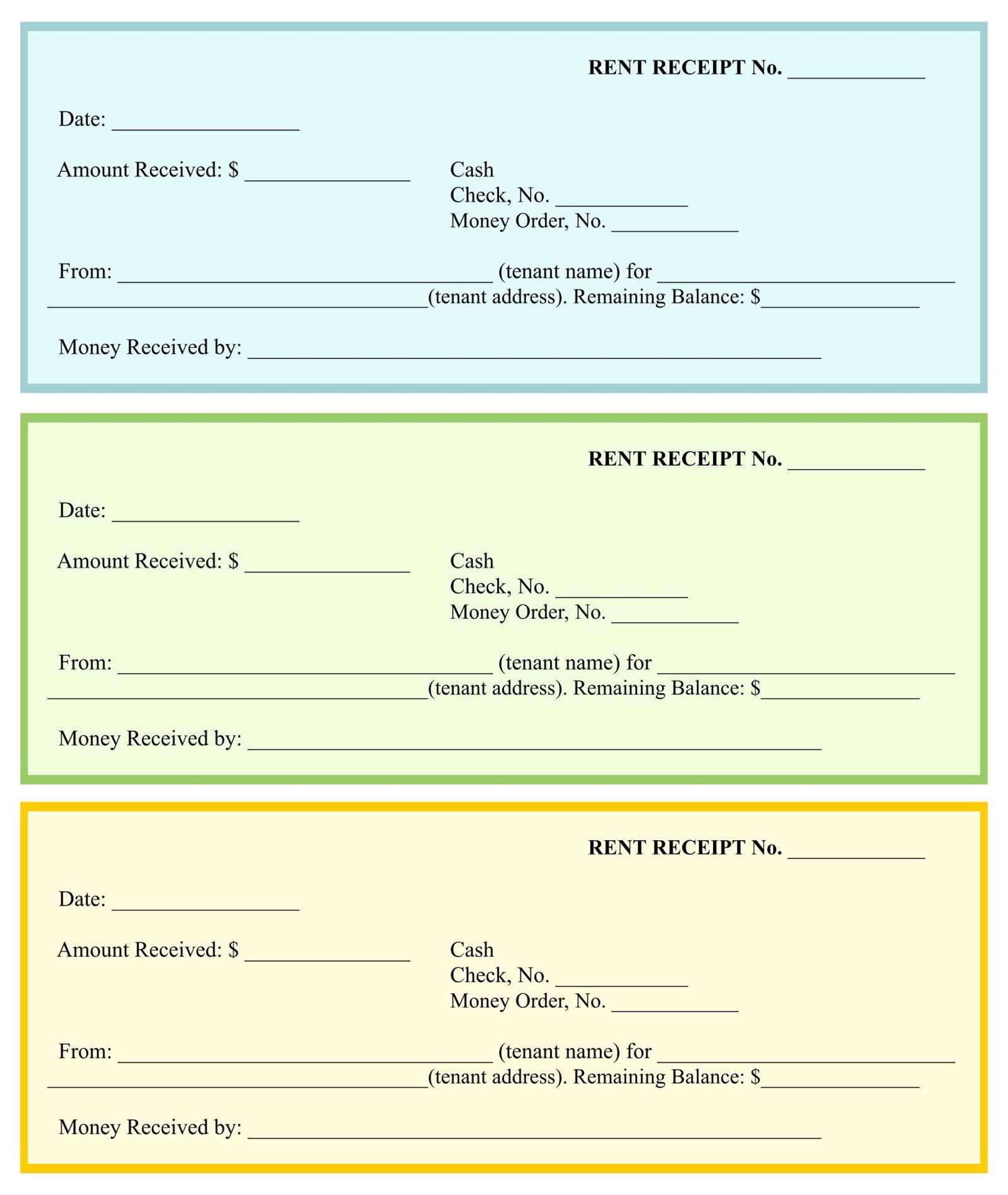

- Payment Method: Indicate whether the payment was made by cash, check, or another method, along with any transaction references if applicable.

Make sure the receipt is clear, simple, and easy to read, helping both the parent and provider keep accurate records of payments and services rendered.

How to Create a Clear Child Care Receipt

Begin by including the full name and contact details of both the caregiver and the parent or guardian. This ensures that the receipt is identifiable and the transaction can be traced if needed.

List the Date and Time of Service

Clearly state the date(s) of care provided. If the care covered multiple days or times, break them down into specific sessions. This adds transparency to the record and helps both parties track the care period accurately.

Detail the Amount Charged

Specify the hourly or daily rate for child care services and the total cost for the time period worked. If there are any additional charges, such as for special services or materials, include those as separate line items.

Always include the total amount due at the bottom of the receipt for easy reference. This is especially helpful for parents who may need to submit the receipt for reimbursement or tax purposes.

Finally, make sure to sign the receipt or provide a space for digital acknowledgment. This helps confirm that both parties agree on the transaction and the services rendered.

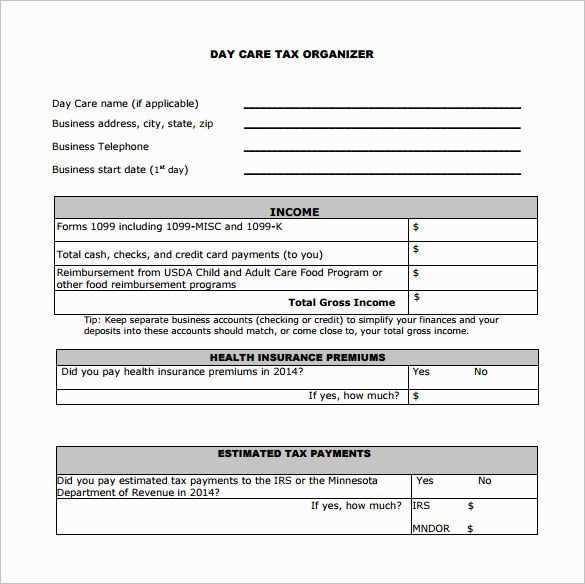

Important Information to Include for Tax Deductions

Make sure to list the full name, address, and Taxpayer Identification Number (TIN) of the child care provider. This information is needed to claim the child care tax credit. Ensure the receipt specifies the total amount paid during the year and includes dates for services rendered. The receipt should clearly state that the services are for child care and not for other types of care, such as educational services. If the provider is a daycare center, include the license number of the facility. If you’re using in-home care, indicate whether the provider is a relative or not. The IRS requires this level of detail for eligibility verification. Without this information, you may risk missing out on valuable tax savings.

Best Practices for Keeping Accurate Child Care Receipts

Keep your receipts organized by labeling them with clear dates and amounts. Store them in a designated folder or digital file for easy access. This ensures you can quickly locate any receipt when needed.

Record any specific details on the receipt, such as the child’s name, dates of care, and the type of service provided. This will help to avoid confusion later.

Ensure that receipts contain clear breakdowns of costs. Look for providers that offer detailed invoices, including hourly rates, sessions, or any extra fees charged.

Use a consistent method for tracking payments. Whether you choose to use a spreadsheet or a receipt management app, stay consistent to avoid discrepancies.

Always ask for receipts immediately after each payment. Don’t wait until you need them, as this may lead to missing or incomplete records.

If you receive receipts via email, save them in a well-organized digital folder. Ensure that the digital copies are clear and legible to avoid future issues.

Regularly check for discrepancies between receipts and your payment records. By doing so, you can identify any errors early and resolve them promptly.