It looks like you’re working on writing a detailed article in Finnish, using HTML tags for structure. Do you need assistance with a specific section of the article or guidance on creating more content with varied vocabulary? Let me know how I can help!

Here’s a detailed plan for your article on “Charity Commission Receipts and Payments Accounts Template” in HTML format, with three specific and practical headings:htmlEditCharity Commission Receipts and Payments Accounts Template

Begin by creating a clear structure for your article, addressing each section with practical, easy-to-understand headings. A good starting point is to outline the purpose of the Receipts and Payments Accounts template. Clarify that this template helps charities ensure accurate financial reporting, focusing on income, expenditure, and maintaining transparency.

Setting Up the Charity Receipts and Payments Accounts Template

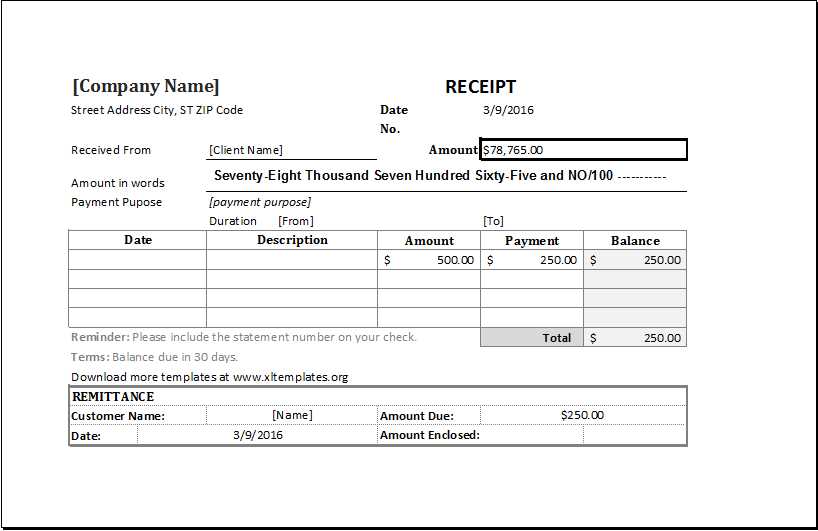

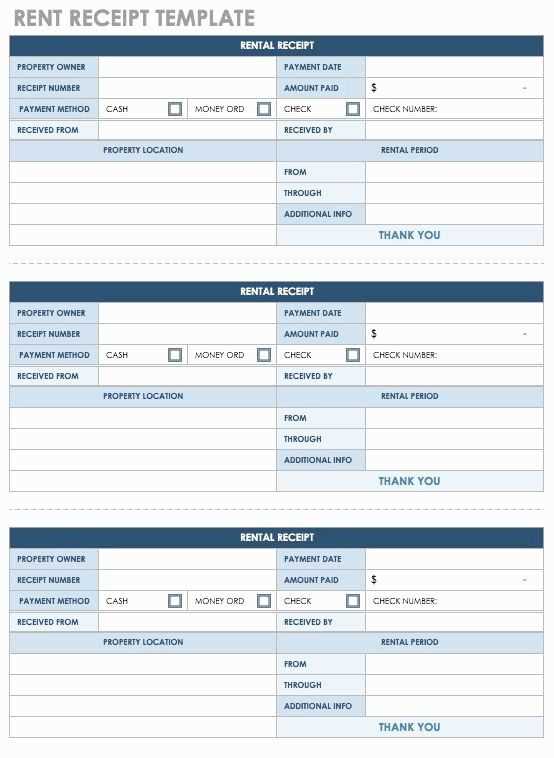

The first step is to focus on the setup of the charity’s accounts. The template should feature clearly defined sections for receipts, payments, and any specific adjustments. Break down the categories of income and expenditure–whether from donations, fundraising, or grants. Each section should be organized and easy to navigate, ensuring that every transaction is accounted for and matches relevant records.

Tracking Transactions and Recording Payments

Next, delve into the process of recording payments. For each transaction, include fields for the date, amount, and description. This provides clarity on where the charity’s funds are going. Include a section that allows for regular monitoring, such as a monthly or quarterly review. This will help with auditing and future planning. Ensure that the template accommodates all types of expenses, from operational costs to project-specific expenditures.

Review and Finalize the Accounts for Submission

Finally, emphasize the importance of reviewing and finalizing the accounts before submission to the Charity Commission. Double-check all figures and ensure accuracy. The template should allow for a summary page that consolidates receipts and payments, making it easy for stakeholders to quickly assess the charity’s financial position. Include clear instructions on how to fill out each section, ensuring compliance with Charity Commission requirements.

How to Fill Out the Receipts Section

List all income received by the charity during the period. Ensure that each entry is clear, accurate, and properly categorized. Include any donations, grants, and fundraising income. Specify the source and amount for each entry.

Steps to follow:

- Record all receipts individually, starting with the largest sums first for clarity.

- Provide the name or description of the donor or organization providing the funds.

- Note the date of each receipt to maintain a chronological order.

- Specify the type of income, whether it’s a one-time donation, recurring funding, or grants.

- Ensure the total amount matches the amount in your bank statements or financial records.

Key Points to Include:

- If the receipt is related to a fundraising event, note the total raised and any related expenses separately.

- Separate restricted funds from unrestricted ones, as they may have different usage restrictions.

- In the case of in-kind donations, ensure you provide an estimate of the value based on market standards.

Common Mistakes in Payments Recording

Ensure all payments are categorized correctly to avoid misreporting. Assign each payment to the appropriate expense or project. Incorrect categorization can lead to inaccurate financial statements and confusion during audits.

Failing to Keep Detailed Records

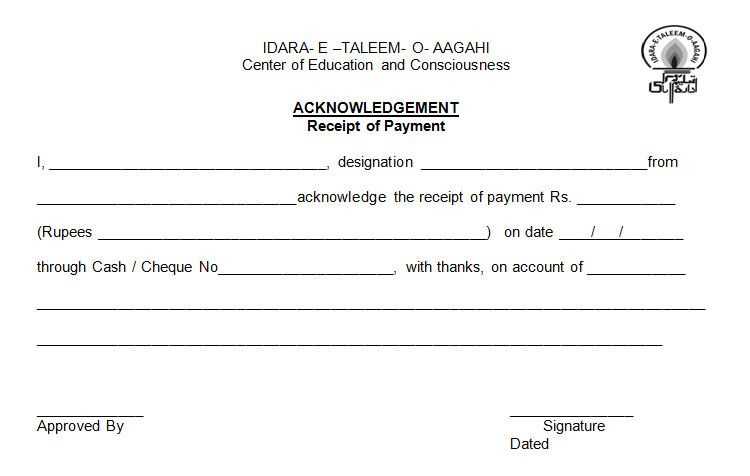

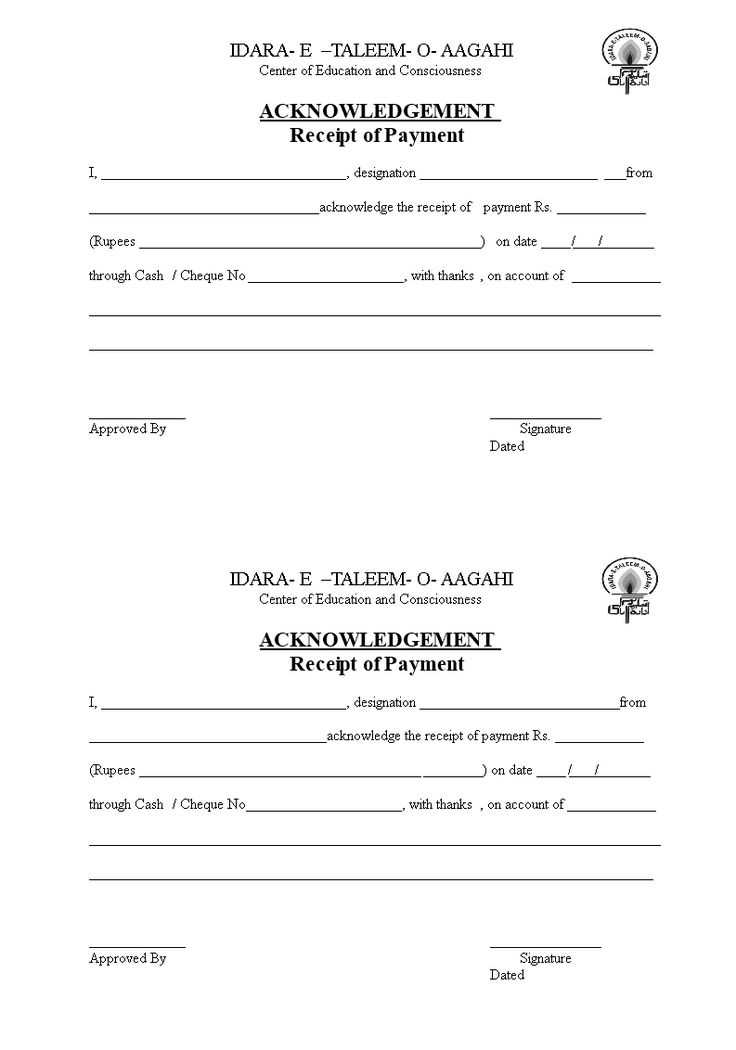

Neglecting to document payment details, such as invoices, receipts, and payment methods, can create gaps in your records. Always maintain comprehensive documentation for each transaction to verify payments and prevent errors in future reports.

Not Updating the Accounts Regularly

Delaying updates to your payment records can result in discrepancies. Consistently update your accounts as payments are made to ensure all transactions are accounted for and your records reflect the most accurate data.

Another common issue is the lack of a clear approval process. Without clear sign-offs, unauthorized payments may be recorded, creating confusion and potential financial mismanagement. Implement a strict approval procedure for all outgoing payments to maintain transparency.

How to Submit Your Accounts to the Charity Commission

To submit your accounts to the Charity Commission, first log in to your charity’s account on the Charity Commission website. Once logged in, navigate to the “Accounts and Annual Return” section. Ensure that your charity’s accounts are prepared in accordance with the Charity Commission’s guidelines, using the correct format and information for your charity’s size and income.

If your charity is required to submit the receipts and payments accounts, you will need to upload them as part of the annual return. Double-check the figures and supporting documents to confirm their accuracy before submission. If your charity’s income is under £25,000, you can opt for a simpler receipts and payments account rather than the full accruals accounts.

When submitting the accounts, ensure all fields are completed correctly. If there are any discrepancies or issues with your submission, the Charity Commission will notify you to resolve them. Once your accounts are submitted, the Charity Commission will review them, and you will receive confirmation that your submission has been processed.

If you have any questions about the process or need additional help, the Charity Commission provides guidance and support on their website. Reach out to them if you need assistance at any point during the submission process.