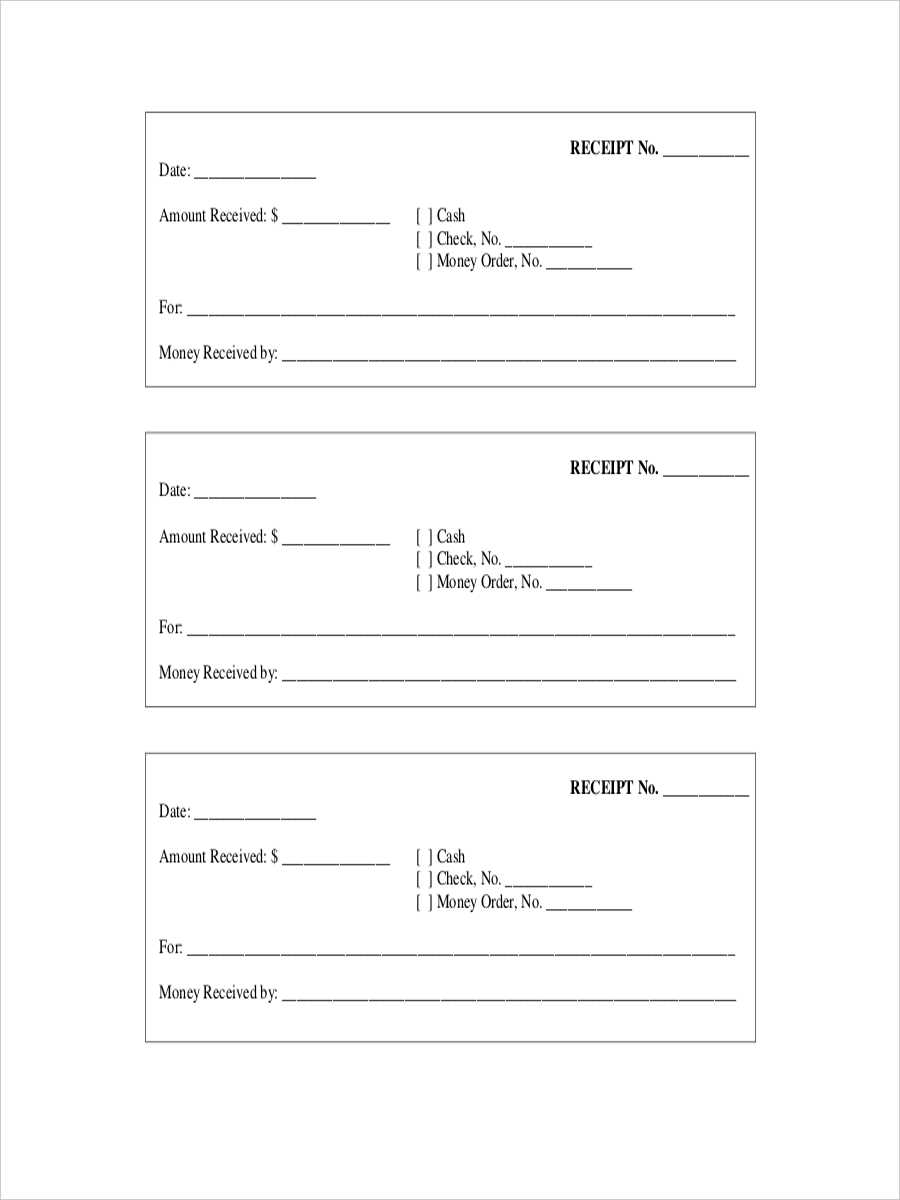

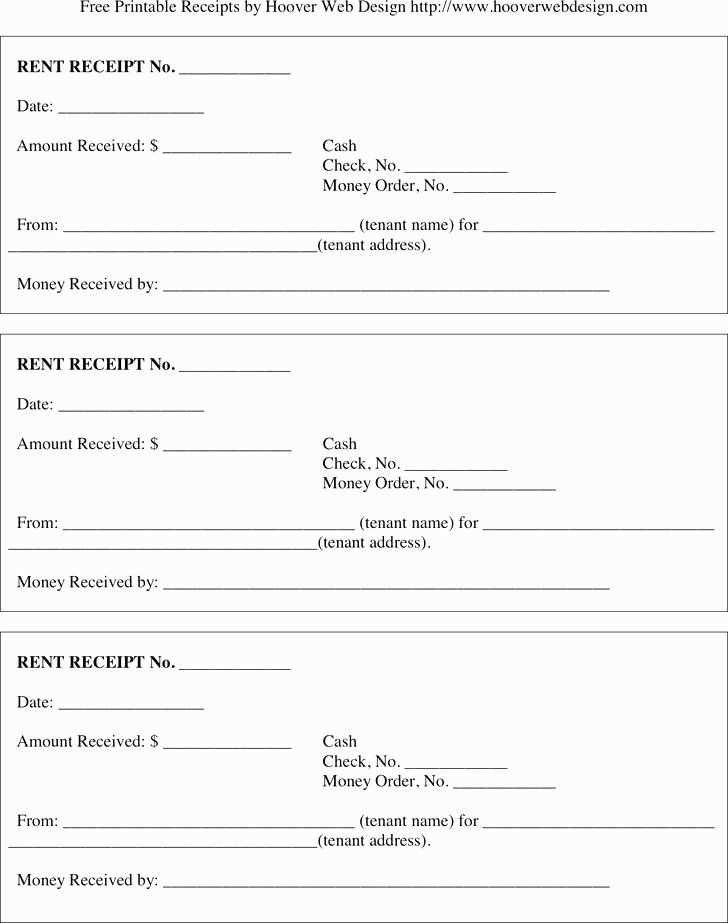

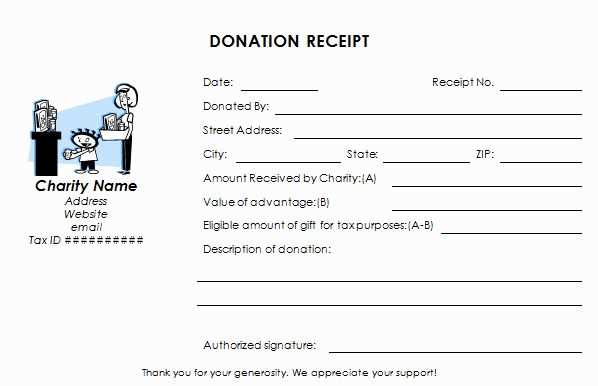

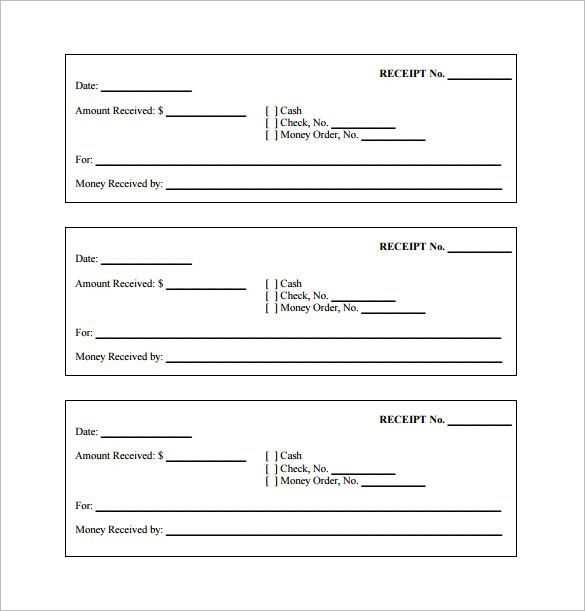

Creating a receipt template with a specific amount requires attention to detail and clarity. Ensure that the total sum is clearly stated, along with an itemized list of services or products. This way, recipients understand exactly what they are paying for and can easily reference it later.

Start by including key details: The date of the transaction, the name of the business or individual providing the goods or services, and the payment method should all be listed. These elements provide transparency and make the receipt a useful document for both parties involved.

Specify the amount: Clearly mention the total amount due, ensuring that it matches the itemized total. If there are any applicable taxes, discounts, or adjustments, list them separately so that they don’t cause confusion. The final amount should stand out, easily visible to the reader.

Double-check for accuracy: Ensure that the numbers are correct and that no details are omitted. This simple step helps avoid any disputes or misunderstandings down the line.

Here are the revised lines with minimized repetitions:

When crafting a receipt template, focus on concise language and direct communication. Avoid excessive repetition to ensure clarity and efficiency. Each line should serve a clear purpose, making the information easy to read and understand.

Key Recommendations:

First, combine similar details into single lines. For instance, if multiple items share the same cost or description, group them together instead of repeating each element.

Example: Instead of writing each item price separately, list the items in a grouped line like: “3 items, $10 each.” This method reduces redundancy and keeps the format clean.

How to Minimize Redundancy:

Use placeholders for repetitive information like dates or payment methods. Instead of restating the payment method in each section, include it once and refer to it when necessary.

For example: “Payment method: Credit Card. For each item, the payment method remains the same.” This keeps the receipt short and avoids unnecessary repetition.

- Receipt Template in the Amount of

Start by clearly stating the total amount on your receipt. This number should be easily identifiable and prominent, typically positioned near the end of the document. Use a clear label such as “Total Amount Due” or “Amount Paid” for clarity. Ensure that the figure is accurate and matches the sum of all listed items or services.

Next, break down the individual items or services that make up the total amount. Each line should list the item, quantity, and price. If applicable, include any taxes or additional fees. Providing a transparent breakdown helps avoid confusion and strengthens trust between you and the recipient.

Finally, include any payment method details. Whether it’s cash, credit card, or another form of payment, make sure it’s recorded to show how the total amount was settled. If you offer a receipt for an online payment, include the transaction ID for further reference.

Begin by including the transaction date and the name of the seller and buyer. A receipt should always feature the date of the transaction to avoid any confusion in case of future inquiries. The seller’s name or business should be clearly displayed, followed by the buyer’s details if applicable.

List the item or service purchased. Each item should be described briefly but accurately. Include the quantity, price per unit, and total price for each item. If multiple items are involved, format them clearly in separate lines to ensure the receipt is easy to read.

Include the payment method. Whether the payment is made in cash, by card, or through another method, specify this on the receipt. This helps clarify how the transaction was completed and can be useful for both parties in case of discrepancies.

Ensure the total amount paid is clearly marked. The sum should include all taxes, discounts, and any additional charges. Make sure the total amount is distinguishable from the rest of the receipt to avoid confusion.

If applicable, provide a space for a signature or stamp. This can help authenticate the transaction, especially for larger or important purchases.

Lastly, keep it concise. A small transaction receipt does not need to be lengthy but should include all relevant details to serve its purpose. Avoid unnecessary information, and keep the format simple to ensure it’s user-friendly for both parties involved.

Incorporating Tax Details into Your Receipt Template

Include tax breakdowns clearly to avoid confusion and ensure transparency. You should display the tax rate, the amount of tax charged, and the total tax amount on the receipt. This allows customers to see exactly how their payment is being allocated.

Steps for Including Tax Information

- Clearly label the tax section with a title such as “Sales Tax” or “VAT” based on your local tax requirements.

- Specify the tax rate applied to the items purchased. For example, “Tax Rate: 10%”.

- List the tax amount for each item or the total tax charged. If it’s a simple flat rate, state “Total Tax: $5.00”.

- Ensure the grand total reflects the tax amount added to the original subtotal.

Tax Information for Different Jurisdictions

- Research local tax laws to comply with regulations regarding tax display. Some regions require tax-exclusive pricing, while others need tax-inclusive pricing.

- If operating in multiple tax zones, consider adding tax breakdowns for different rates applied across locations.

- For international sales, ensure that the tax is clearly stated according to the tax laws in the customer’s country.

Adding tax information to your receipts will build trust and clarity with your customers while keeping your business compliant with local tax regulations.

Tailor your receipt template to accommodate various payment methods for a smooth and clear transaction experience. Each payment method has distinct requirements that should be reflected on the receipt.

Cash Payments

For cash payments, include the total amount received in cash and specify the currency. If applicable, note any change given back to the customer. A section for “Amount Paid” and “Change Returned” is useful here.

| Description | Details |

|---|---|

| Amount Received | $50.00 |

| Change Returned | $5.00 |

Credit/Debit Card Payments

For card payments, include the last four digits of the card number, the card type (Visa, MasterCard, etc.), and the transaction authorization code. This offers transparency without compromising security.

| Description | Details |

|---|---|

| Card Type | Visa |

| Card Number (Last 4 Digits) | **** 1234 |

| Authorization Code | XYZ12345 |

Mobile Payments (e.g., Apple Pay, Google Pay)

For mobile payments, display the transaction ID and the mobile wallet used. This ensures the customer has a clear reference to the payment method used.

| Description | Details |

|---|---|

| Transaction ID | ABCD5678 |

| Wallet Used | Apple Pay |

By specifying relevant details for each payment method, you create transparency and ensure your receipt provides complete and accurate information for any payment type used.

Break down each charge to enhance transparency for both you and the customer. This practice not only builds trust but also avoids confusion later. Be specific about what each item represents, and clearly show the quantity and price.

Key Elements for Itemization

- Item Description: Provide a brief but clear description of the product or service.

- Quantity: Indicate the number of units or hours involved, especially for time-based services.

- Unit Price: Show the price per unit for easy verification.

- Total Price: Ensure the total for each line item matches the sum of the individual charges.

- Taxes or Additional Fees: List any taxes, handling, or extra fees separately to prevent hidden costs.

Why This Matters

Providing a detailed breakdown makes the receipt more informative and prevents disputes. It helps your customers verify their purchases, and you can refer back to these specifics if any issues arise.

Ensure that your receipt template complies with local tax and business regulations. Most jurisdictions require specific details, such as the company’s registration number, tax identification number, and contact information, to be clearly visible on receipts. Failing to include this information could lead to fines or legal issues.

Be aware of the minimum requirements for transaction details. This typically includes the date of the transaction, a description of the goods or services, and the amount paid. Some areas may also mandate the inclusion of a breakdown of taxes or VAT.

Always check if digital receipts need to adhere to different rules compared to paper receipts, especially regarding storage and accessibility. In some regions, digital receipts may require an additional confirmation of receipt to ensure legal validity.

For businesses that deal with refunds or returns, clearly state your refund policy on the receipt. This can help avoid potential disputes and clarify terms to customers.

When designing a receipt, keep in mind consumer protection laws. Ensure that the language used on the receipt is clear and unambiguous. Avoid any misleading terms that could confuse the customer or potentially cause issues in legal contexts.

Store your receipt template in a cloud storage service like Google Drive, Dropbox, or OneDrive. This ensures easy access and secure storage. Once saved, you can share the template with your team or clients through a simple shareable link. Make sure the permissions are set so others can either view or edit the document based on your needs.

File Formats for Sharing

Choose a widely accessible format like PDF or Excel for sharing. PDFs maintain formatting, while Excel files allow others to edit the template as needed. Select the format based on the recipient’s preferences and the level of customization required.

Use Collaborative Tools for Team Editing

If you work with a team, use collaborative tools like Google Sheets or Microsoft Excel Online. These platforms allow multiple users to edit the template in real-time, making updates seamless. Set up notifications to track changes and ensure everyone stays on the same page.

To create a receipt template with a specific amount, begin by clearly stating the total sum due, followed by a breakdown of the products or services provided. Include the date of the transaction and the method of payment used. This will ensure clarity and prevent any confusion for both the seller and the buyer.

Key Information to Include

Make sure to display the amount at the top of the receipt, right after the header. This should be the sum after any taxes or discounts are applied. Below that, list the individual items or services along with their corresponding prices. Always provide clear and simple item descriptions so the customer can easily verify their purchases.

Final Touches

At the bottom of the template, add a footer for any additional information, such as refund policies or contact details. This helps establish trust and allows the customer to reach out in case of any issues. Double-check for accuracy to ensure a smooth transaction record.