For businesses in the UK, using a clear and well-structured sales receipt template is key to maintaining accurate financial records. A proper receipt not only helps customers keep track of their purchases but also ensures that your business complies with tax regulations.

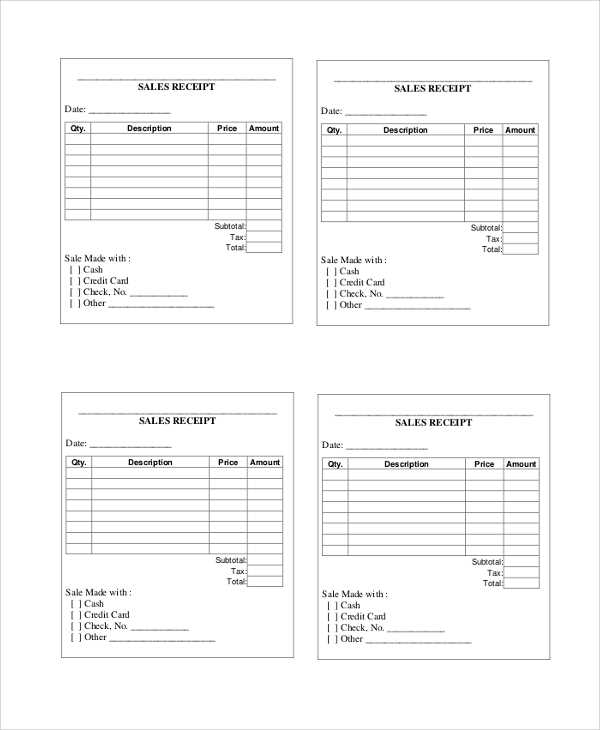

A good template should include essential details such as the transaction date, business name, items purchased, total amount, VAT information (if applicable), and payment method. This helps both the business and customer understand the transaction fully. If your business is VAT registered, make sure the VAT breakdown is clearly visible on the receipt.

It’s advisable to customise the template to match your branding. Adding your logo and business contact details can give the receipt a professional touch while reinforcing your brand’s presence. Depending on your needs, you can choose from simple text-based receipts or more detailed, visually structured designs.

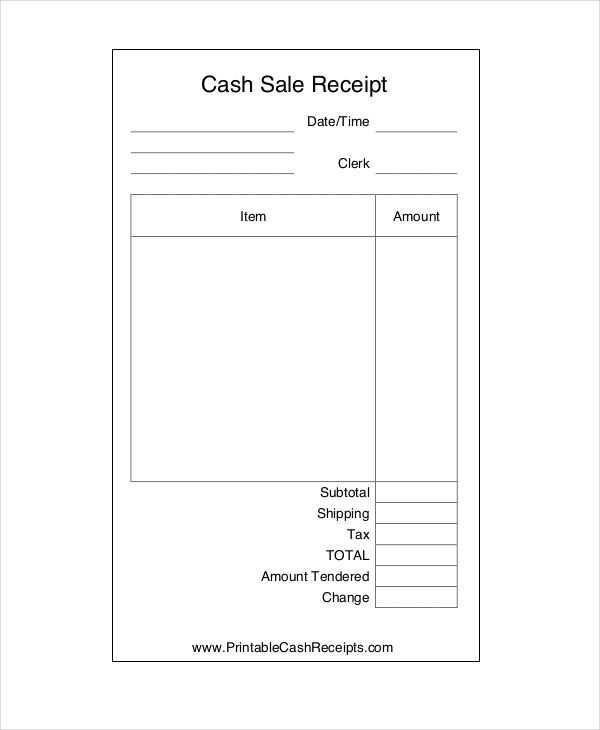

Tip: If you frequently handle cash payments, make sure the template includes a section for change given to customers, ensuring everything is accounted for correctly. The more details you can capture, the easier it will be to manage accounting and prevent misunderstandings with clients.

Here’s the revised version, without repetition:

Ensure your sales receipt template is clear and concise. Avoid duplicating information, and focus on key details. Here’s what should be included:

- Date and time: Include the exact time of the transaction to avoid any confusion later.

- Seller details: List your business name, address, and contact information.

- Buyer information: If applicable, add the buyer’s name or company, especially for large transactions.

- Itemized list: Clearly outline the purchased items, with descriptions and individual prices.

- Total amount: Always highlight the final price, including taxes and discounts.

- Payment method: Indicate whether the transaction was made by cash, card, or another method.

- Receipt number: Provide a unique identifier for each transaction for easy tracking.

This simple structure helps avoid clutter and ensures all essential information is clear to both parties.

- Sales Receipt Template UK

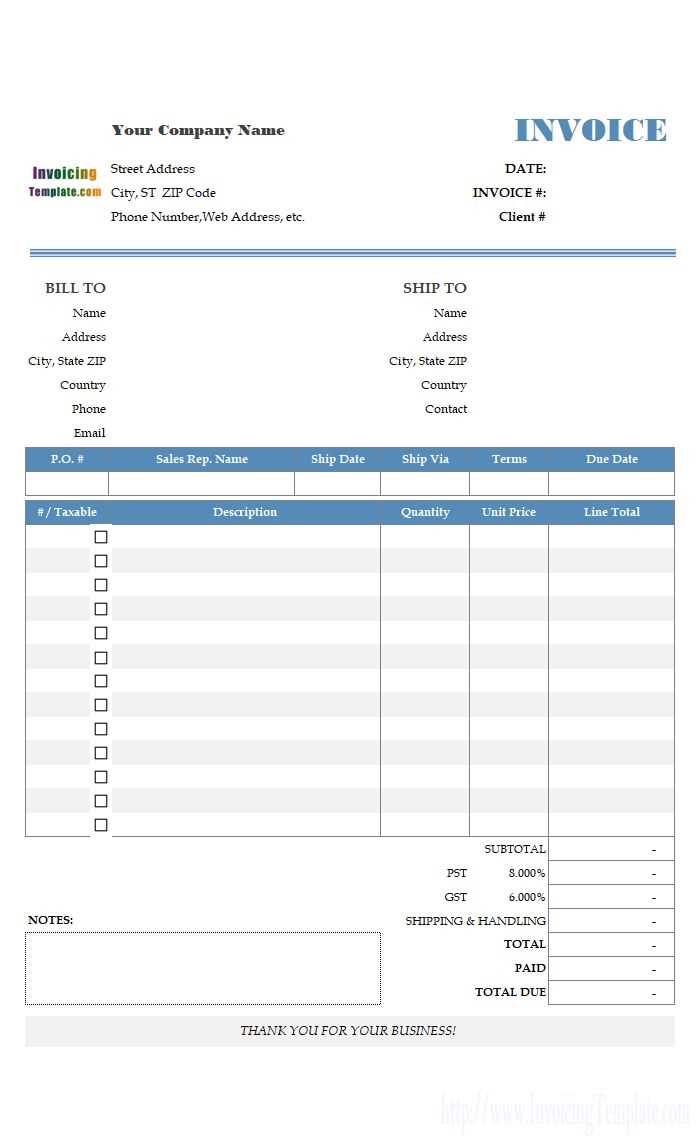

Creating a clear and professional sales receipt is easy with the right template. Here are key elements to include in your UK sales receipt template:

- Business Information: Add your business name, address, contact number, and VAT registration number if applicable.

- Receipt Number: Assign a unique receipt number to track each transaction for accounting purposes.

- Date of Sale: Clearly state the date the transaction took place.

- Item Description: List the products or services purchased, including quantities and individual prices.

- VAT Details: Show the VAT rate and amount if VAT applies to the sale.

- Total Amount: Include the total amount due, broken down by item, taxes, and any discounts applied.

- Payment Method: Indicate how the payment was made, whether by cash, card, or other methods.

- Terms & Conditions: If relevant, mention return policies or warranty information.

A good template simplifies your work and ensures you meet legal requirements in the UK.

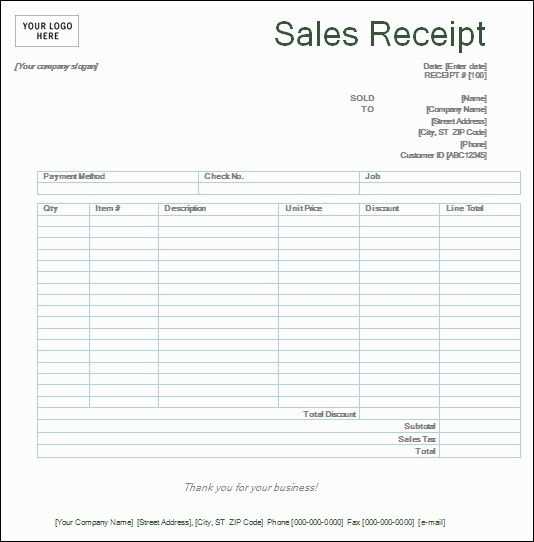

To create a simple receipt template for your UK business, focus on including the necessary details that ensure legal compliance and clarity for your customers.

1. Include Your Business Details

Start by adding your business name, address, and contact details, including email or phone number. This ensures your customers can easily reach you for any inquiries or follow-ups.

2. Receipt Information

Include the date and a unique receipt number for each transaction. This helps in keeping track of sales and simplifies future reference. Use a simple sequential numbering system, such as “Receipt #001,” to maintain an organized record.

3. List Items Sold

Clearly itemize the products or services purchased. Include each item’s description, quantity, price, and total. This makes it easier for both you and your customer to verify the transaction.

4. VAT and Total Amount

If your business is VAT registered, ensure that the VAT rate and total VAT amount are displayed separately. The total amount due, including VAT, should be clearly stated at the bottom of the receipt.

5. Payment Method

Specify how the payment was made, whether it’s by cash, card, bank transfer, or another method. This provides an accurate record of the transaction.

6. Terms and Conditions

If applicable, include any return or exchange policies. This will help avoid disputes and ensure transparency in your business transactions.

Include the transaction date clearly at the top of the receipt. This marks the exact moment the sale was completed, which is vital for both the seller and the buyer. You can format it as “DD/MM/YYYY” for simplicity.

List the business name and contact details. The business name should be prominent, followed by an address, phone number, and email. This provides buyers with easy access to any needed support or returns. If the business is VAT-registered, show the VAT number too.

Provide a unique receipt number. This reference number helps in tracking and managing sales records efficiently, especially for returns or disputes. It should be sequential and clearly identifiable.

Clearly itemize products or services purchased. For each product, include the name, description, quantity, unit price, and total price. This ensures both parties can verify the exact details of the transaction.

| Item Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Product A | 2 | £10.00 | £20.00 |

| Product B | 1 | £15.00 | £15.00 |

Show the total amount paid. Include the subtotal, any discounts, VAT, and the final total. Clearly state the VAT amount, as it’s required for VAT-registered businesses in the UK.

Include payment method information. Specify whether the payment was made by cash, card, bank transfer, or any other method, helping both parties track the transaction.

Finally, provide a return policy or terms and conditions if applicable. Buyers need clarity on whether they can return goods and under what conditions, especially for businesses with a returns policy.

Opt for a format that suits your business needs and is easy for customers to read. A clear, straightforward layout ensures that all necessary details are visible without clutter.

Consider the Key Information

Your receipt must include key details like the transaction date, business name, items or services purchased, price, and payment method. If relevant, add tax details, discounts, and the total amount. Keep the layout simple to avoid overwhelming the customer with excessive information.

Printed vs. Digital Formats

Printed receipts are suitable for in-store purchases, while digital receipts work well for online transactions. If you opt for a digital format, consider sending it via email or offering a downloadable link. This approach helps reduce paper waste and is often more convenient for the customer.

When choosing the format, think about the user experience. A clean design with a logical flow of information will always make a positive impression.

Tailor your sales receipt template to the specific needs of your business by adjusting the layout, information, and design elements. Start by incorporating industry-specific fields such as product codes for retail, invoice numbers for services, or project names for construction. These tweaks help make the receipt more relevant to your clients and create a professional, cohesive experience.

Retail Industry

In retail, include a section for SKU numbers, discounts, and loyalty points if applicable. Ensure the receipt has space for multiple items with a clean breakdown of quantities, unit prices, and total costs. Adding tax information clearly is also critical for retail receipts, as it helps both you and the customer track financial details with precision.

Construction and Trades

For construction businesses, a detailed breakdown of services or materials used, along with hourly rates or unit prices, is key. Additionally, including project references or job numbers will make it easier for both parties to track work and payments. It’s helpful to include a field for deposit amounts or progress payments if relevant to the job.

Adjusting fonts, colours, and layout based on your business type enhances the user experience and reinforces your brand identity. Whether you’re selling products or services, make sure the information is easy to read and clearly organised for all clients.

In the UK, businesses are not legally required to provide a receipt for every transaction, but it is a good practice, especially for taxable goods and services. Receipts should contain certain details to ensure they are compliant with tax regulations. The main legal requirement is that the receipt must clearly indicate the transaction details for both the customer and the business.

The following elements must be included on a receipt issued for a transaction:

| Required Element | Description |

|---|---|

| Date of Transaction | Must specify the date the purchase was made. |

| Itemized List of Goods or Services | Each item or service purchased must be listed separately with its price. |

| Total Amount Paid | The total sum the customer paid, including VAT (if applicable). |

| VAT Details | If VAT is applicable, the VAT rate and amount must be shown on the receipt. |

| Business Details | The name, address, and contact details of the business. |

| Receipt Number | A unique identifier for the receipt should be included for record-keeping. |

If VAT is charged, businesses must also ensure that the receipt complies with HMRC guidelines regarding VAT invoices, which require a VAT registration number and a breakdown of the VAT rate applied. While receipts are not mandatory for every transaction, businesses should provide them upon request for transparency and customer service purposes.

In addition to complying with tax laws, receipts can serve as proof of purchase for warranties, returns, or disputes, so businesses should issue them consistently.

To generate or download a receipt template online, follow these steps:

- Search for a trusted website offering free or paid receipt templates, such as Microsoft Office templates or Template.net.

- Choose a template based on your needs. Look for options that match the style and layout you require for your receipts.

- Download the template in a format compatible with your software (e.g., Microsoft Word, Excel, or PDF). Ensure it’s editable if you plan to customize it for your business.

- If you need customization, use an online receipt generator like Canva or Shopify. These platforms allow you to modify templates quickly by adding your business information, logo, and payment details.

- Once downloaded or generated, save the file in a secure location. You can print or send it digitally to customers as needed.

Some websites also offer additional features like cloud storage or automatic receipt generation, making it easier to manage multiple transactions.

Ensure your sales receipt template includes clear itemized sections: date of purchase, item description, quantity, unit price, and total price. Keep the layout simple and organized for quick reading. Add a space for the buyer’s name and address, as well as a unique receipt number for tracking. Be sure to include your business details, such as company name, address, and VAT registration number if applicable. Lastly, provide a section for payment method (cash, card, etc.) to reflect how the transaction was completed.