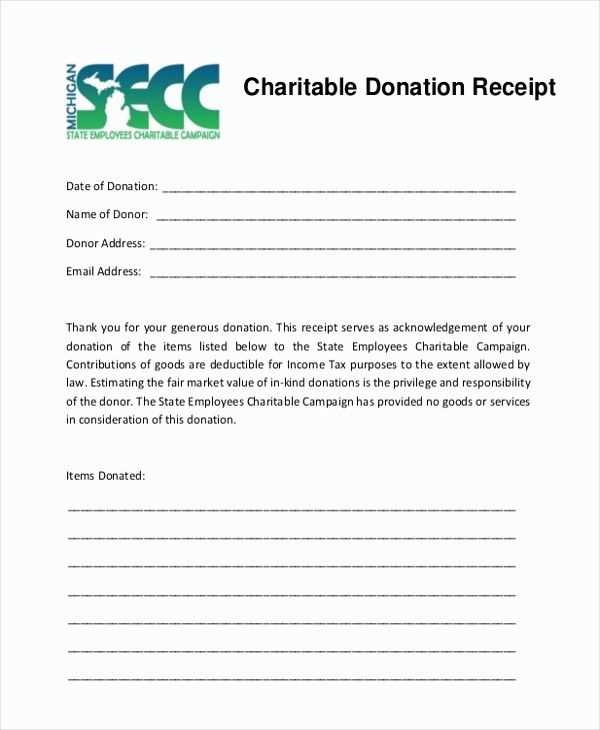

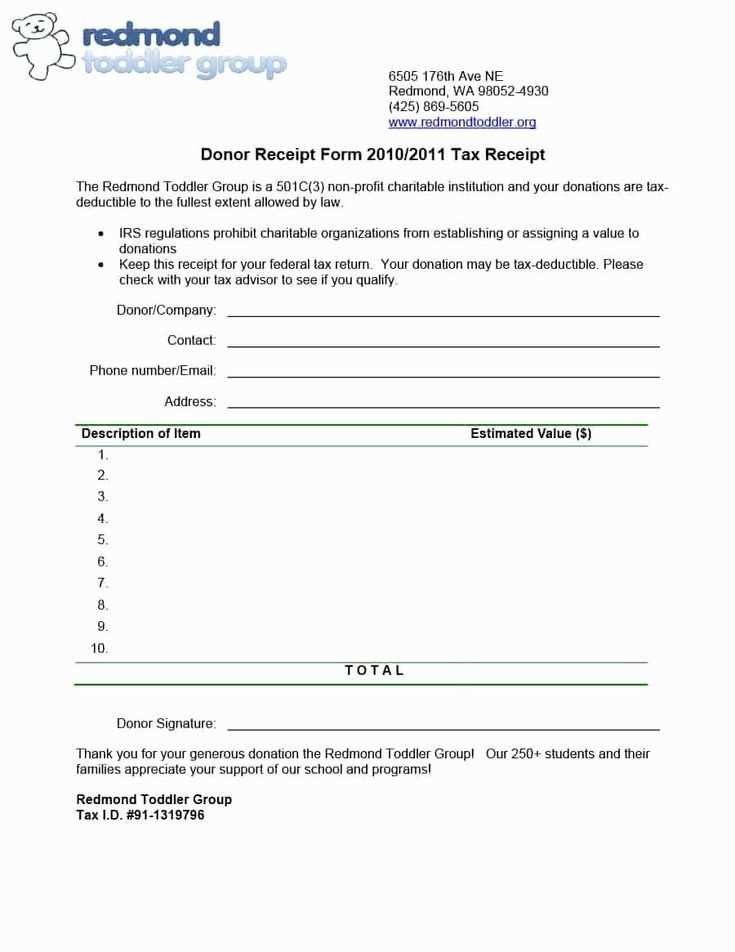

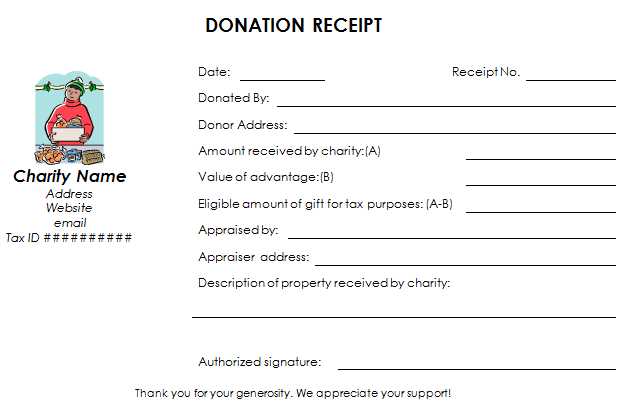

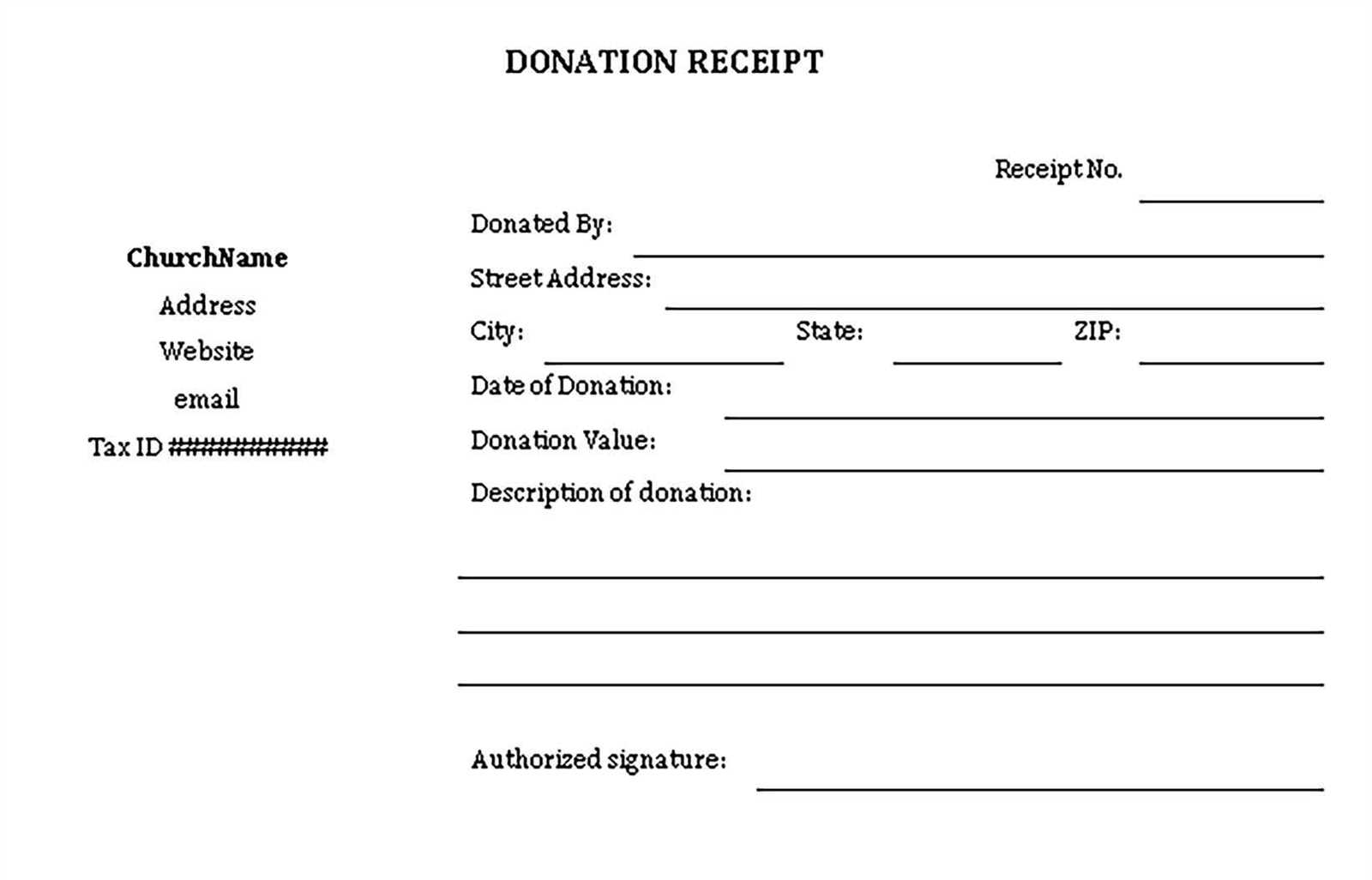

Creating a charitable donation receipt doesn’t have to be complicated. Use a free template to make the process quick and professional. A receipt for charitable donations serves as a formal acknowledgment for donors and is crucial for both tax purposes and transparency in the donation process. Ensure the template includes all necessary details such as the donor’s name, donation amount, date, and the charity’s tax-exempt status.

The template should be easy to customize. Look for a free version that allows you to add your charity’s logo, address, and any other relevant information. This personalization adds credibility and helps maintain your organization’s branding. A well-structured receipt can also include a brief description of how the donation will be used, offering donors reassurance about the impact of their contribution.

Incorporate a thank-you message at the end of the receipt to express your gratitude. This small gesture not only makes donors feel valued but also encourages ongoing support for your cause. With the right template, you can efficiently manage donation records and maintain a strong relationship with your supporters.

Got it! Is there a new topic or article you’re working on that I can help with today?

- Charitable Donation Receipt Template

Provide a clear and concise record of donations with a charitable donation receipt template. Include the donor’s name, donation date, amount, and the organization’s details. Clearly state whether the contribution is cash, goods, or services. Add a statement confirming that no goods or services were provided in exchange for the donation, if applicable. Ensure the receipt includes the charity’s tax-exempt number to meet legal requirements. This template can be customized for different donation types and can be printed or emailed to donors as a formal acknowledgment of their support.

To create a donation receipt, follow these steps:

- Include donor information: Add the donor’s full name and address. This ensures accurate record-keeping for both the donor and the organization.

- Specify the donation details: Clearly list the amount donated. If the donation is in-kind (e.g., goods), describe the items donated with their estimated value.

- Include the organization’s details: Mention the nonprofit’s name, address, and tax-exempt status. This is vital for tax purposes.

- Date the receipt: Include the exact date the donation was received. This helps donors track their charitable contributions for tax filing.

- State the purpose: If the donation is for a specific cause or event, mention it. This provides clarity on how the funds will be used.

- Include a thank-you message: A brief acknowledgment of the donor’s generosity helps build positive relationships.

By organizing the receipt with these elements, donors will have all the necessary information for their tax records and the charity can maintain accurate financial documentation.

Ensure that the receipt contains the date of the donation. This helps both the donor and recipient keep accurate records for tax or legal purposes.

List the donor’s full name and contact details. This personalizes the receipt and makes it easier to confirm the donation if necessary.

Donation Amount and Description

Clearly state the exact amount of the donation. If the donation is in-kind, provide a description of the items donated, including their approximate value.

Organization’s Details

Include the charity’s name, address, and tax identification number. This confirms that the donation is going to an eligible charitable organization.

Finally, add a statement confirming whether the donation is tax-deductible, and if so, the percentage that is eligible for deduction. This provides clarity for the donor’s financial records.

Donation receipt templates can be easily generated using various free online tools. These platforms allow nonprofits and individuals to create professional, customizable receipts quickly. Here are some reliable options:

1. Donorbox Receipt Generator

Donorbox offers a free receipt generator designed for organizations accepting online donations. It automatically creates receipts for every donation, including the donor’s name, donation amount, and a unique ID for tracking. The tool is user-friendly, saving time on manual entry.

2. GiveLively Donation Receipt Generator

GiveLively provides a free tool for generating donation receipts with essential details, including tax-deductible status. This platform is excellent for nonprofits that need to issue receipts quickly after receiving donations. It also allows easy customization of branding elements to match the nonprofit’s identity.

Using these tools, you can streamline the process of issuing receipts, making sure your donors receive proper acknowledgment while keeping everything organized.

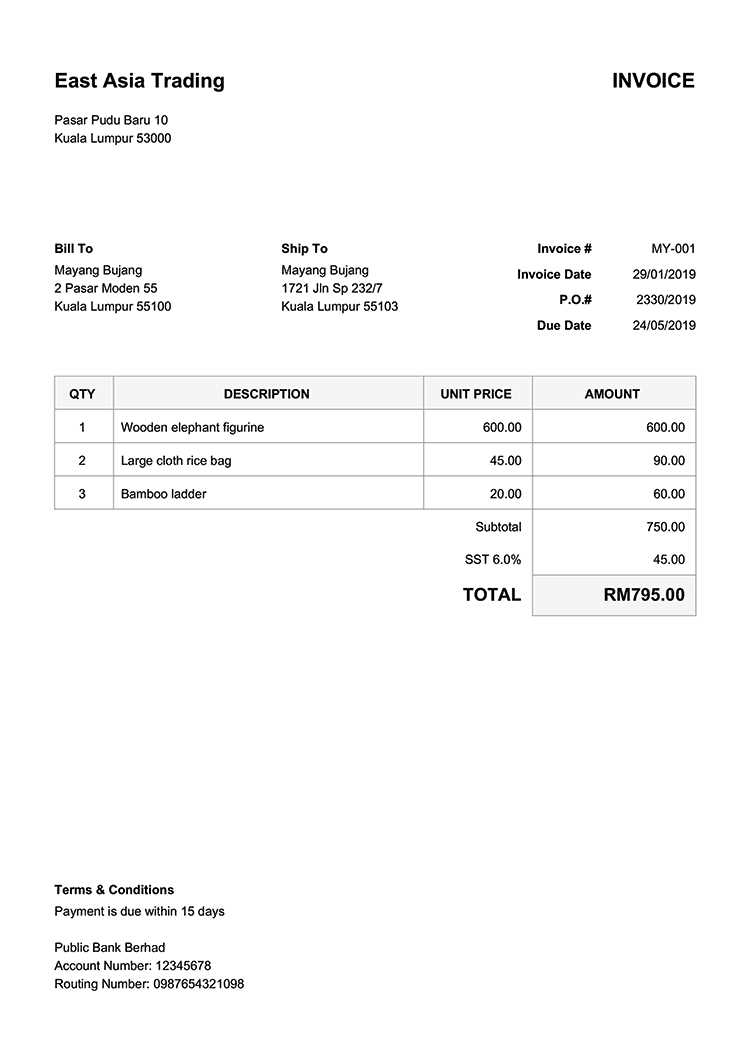

Adjust the receipt format depending on the donation type. For monetary donations, clearly indicate the amount given and the payment method. For non-cash donations, specify the type of item, its estimated value, and condition. When donations are in-kind, include a detailed description of the items donated. This helps ensure accurate documentation and makes it easier for donors to file taxes.

If the receipt is for a recurring donation, include a section noting the schedule (e.g., monthly, yearly) and the donation total for the specified period. This adds transparency and helps the donor track their contributions over time.

Customize the receipt for special events or campaigns by adding personalized details like event names, specific fundraisers, or matching gifts, making the document more meaningful. This adds a personal touch that aligns with the specific donation purpose.

Consider adding contact details for any inquiries, ensuring donors can reach you if needed. Clear instructions for any follow-up actions, such as confirming the tax-deductibility of the donation, also make the receipt more user-friendly.

Donation receipts must meet specific legal criteria to be valid for tax deductions. The IRS, for example, requires that non-profit organizations issue written acknowledgments for donations exceeding $250. This acknowledgment must include the name of the donor, the date, and the amount of the donation. If the donation includes goods or services, the organization must provide a description of these items and their fair market value.

Key Information to Include

Receipts should list the donor’s name and address, the organization’s name and address, and a statement clarifying whether any goods or services were provided in exchange for the donation. If no goods or services were exchanged, the receipt must include a statement to this effect. It’s important to note that the IRS specifies that these receipts be issued before the donor files their tax return, typically by January 31 of the year following the donation.

Record-Keeping Responsibilities

Non-profits are also required to keep detailed records of donations. This includes retaining copies of all receipts and acknowledgments issued, as well as a record of the total value of non-cash donations. These records must be maintained for at least three years, as the IRS may request them for verification purposes during an audit.

Using a free template for charitable donation receipts saves both time and effort. Templates provide a ready-made structure, ensuring accuracy and consistency in your receipts. With standardized fields, you eliminate the risk of overlooking important details, such as donor information or donation amount.

The accessibility of free templates means you can get started immediately without any additional costs. This is especially helpful for small organizations or individual fundraisers with limited resources.

- Templates streamline the donation process by organizing information clearly, improving donor experience.

- Customizable options allow for quick adjustments to match your organization’s branding or specific needs.

- Templates often include necessary tax information, helping donors track their contributions for tax deductions.

- Using a template reduces errors in formatting and calculations, making the process more professional.

With the added convenience of digital templates, you can easily generate receipts, store them, and provide electronic copies to donors instantly. This accessibility enhances efficiency in managing donations.

Charitable Donation Receipt Template

Ensure your charitable donation receipt includes the necessary details for both the donor and the charity. Clearly state the donor’s name, the donation date, and the value of the contribution. If the donation is monetary, specify the exact amount. For non-monetary items, describe each item in detail, including its condition and estimated value.

The receipt should also feature the charity’s full name, address, and tax identification number. Add a statement confirming whether the donor received any goods or services in exchange for the donation. If so, the fair market value of those items must be disclosed, reducing the total deductible amount.

It’s critical to acknowledge the donor’s generosity while maintaining compliance with tax regulations. Providing a simple, clear template helps streamline the process for both parties, ensuring accuracy in tax filings.