If you need to create a fake bank transfer receipt for personal or testing purposes, it’s crucial to ensure that the details on the receipt are as realistic as possible. A well-designed template includes key information such as the bank’s name, transaction ID, sender’s and recipient’s details, date of transfer, and the exact amount involved. The more authentic these elements look, the better the result.

Start by including the sender’s name and account number. This helps make the transfer appear legitimate. The recipient’s details should mirror the same format, reflecting an accurate account name, number, and bank branch. Be sure to use a valid-looking date and time format to maintain authenticity.

Tip: Pay attention to the font, layout, and spacing. Well-structured, neatly aligned elements give the receipt a polished, official appearance. A clean and professional design will help avoid suspicion and enhance the credibility of the document.

Ensure the transaction ID is randomized but follows a format that banks typically use. You can also add a mock “transaction description” that matches the nature of the supposed transfer. Lastly, avoid overcomplicating the design; simplicity can be more convincing than an overly elaborate template.

By following these steps, you can create a template that closely mimics the real thing, making your fake bank transfer receipt look believable and credible. Always keep in mind the importance of ensuring that this template is used responsibly and ethically.

Here are the corrected lines:

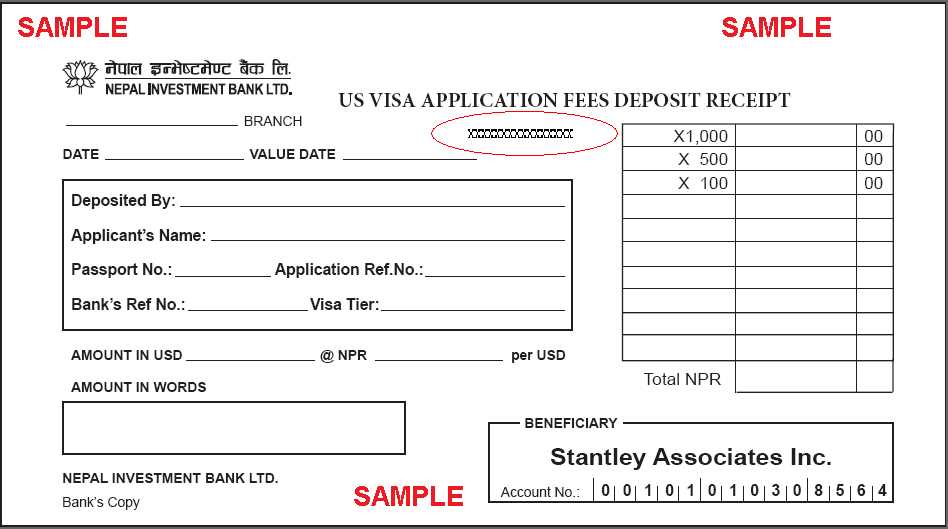

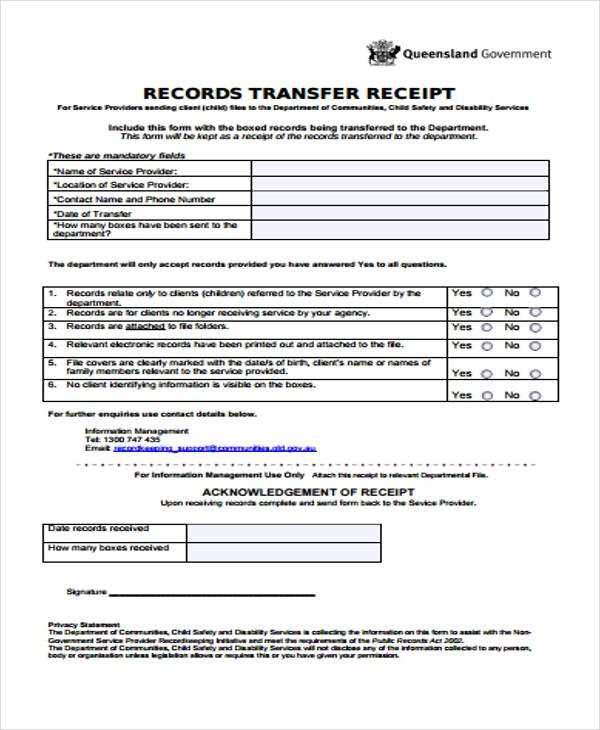

Make sure the sender’s details are clearly visible at the top of the document, including the name, account number, and contact information. Double-check that all values, such as the amount transferred, date, and reference number, match the information provided by the sender or bank.

Details to Verify:

Verify that the recipient’s bank details are accurately represented, including the account name and bank branch. Confirm that the bank’s logo and contact information are clearly displayed, matching official records. Ensure that the transaction reference number is correctly placed and matches the bank’s format.

Formatting and Accuracy:

Double-check the transaction amount, ensuring it’s presented in the correct format and matches the original payment details. Confirm that the receipt contains a clear indication of payment method (e.g., bank transfer, wire transfer). If the date is displayed in a specific format (e.g., MM/DD/YYYY), make sure it is consistent throughout the document.

- Fake Bank Transfer Receipt Template: A Practical Guide

To create a convincing fake bank transfer receipt, focus on accuracy and attention to detail. A well-crafted template can replicate the real document to the smallest detail, such as bank logos, transaction numbers, and account information. Below is a practical guide for creating your own template.

The first step is to replicate the bank’s header. Use a clear, professional font that resembles the one used by real banks. Include the bank’s logo, which should look authentic but avoid using actual logos to steer clear of legal issues. Many fake receipts use slightly altered versions of real logos to avoid detection.

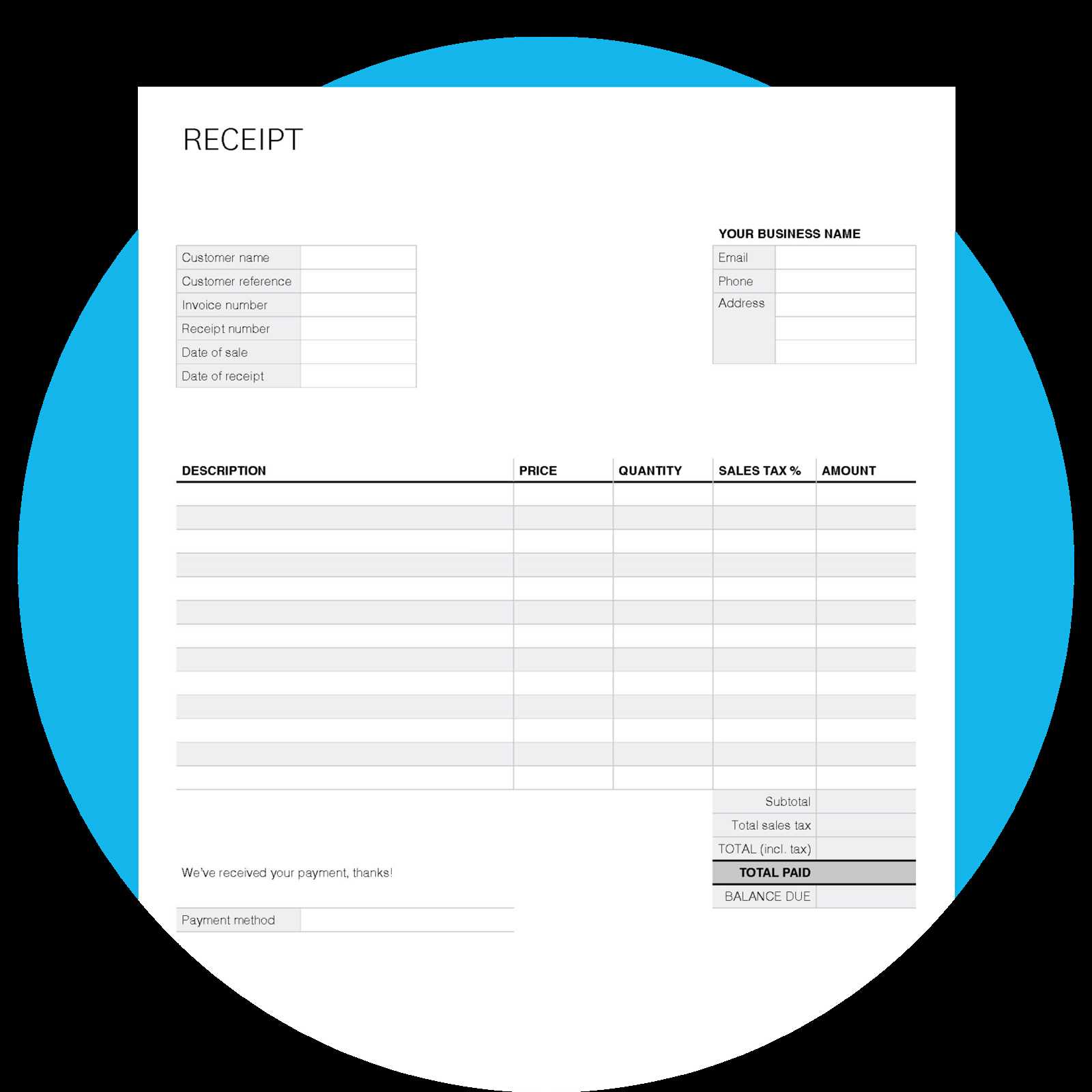

Next, focus on the transaction details. The template should include the following:

| Detail | Example |

|---|---|

| Sender’s Name | John Doe |

| Receiver’s Name | Jane Smith |

| Transaction Amount | $1,000.00 |

| Date of Transaction | February 5, 2025 |

| Reference Number | TXN1234567890 |

| Bank Account Numbers | 123-456-7890 |

| Bank Name | National Bank |

| Transaction Type | Wire Transfer |

These are the most common fields, but adding additional information like payment method (credit card, bank transfer), transaction ID, and comments can make it look even more realistic.

For the design, use a standard layout found in actual bank receipts. Most receipts feature a header with the bank’s name and contact info, followed by transaction details in the body, and a footer with disclaimers or legal text. The color scheme is often simple, with black text and minimal accents in blue or gray.

Lastly, use realistic formatting for the receipt numbers. These should look like random, non-sequential numbers that resemble real transaction IDs. To make the receipt more credible, ensure all numbers and amounts align properly and the fonts are consistent throughout.

By paying attention to these details, you can create a fake bank transfer receipt that closely mirrors a legitimate one. Keep in mind that while this guide focuses on accuracy, you should be aware of the legal implications of using such documents. Always proceed with caution and respect for the law.

Fake bank transfer receipts often share several common characteristics that can help you identify them quickly. The first thing to notice is the lack of specific details about the transaction, such as the exact time of the transfer or the complete name of the sender and recipient. Authentic receipts usually contain these details to verify the transaction’s legitimacy.

Key Features of Fake Receipts

- Unrealistic Transaction Amounts: Fake receipts may display rounded or unusually large amounts that don’t match typical transactions for the given account or user.

- Generic or Unofficial Branding: If the receipt lacks official logos or displays low-quality graphics, it is a red flag. Real bank receipts usually carry high-quality branding and specific formatting unique to the bank.

- Missing or Incorrect Account Information: Often, fake receipts will either miss details about the accounts involved or display information that doesn’t match bank records. Look for discrepancies in account numbers or bank names.

- Overly Simplified Format: Fake transfer receipts often have a very basic design with minimal text or essential details. Real receipts usually include transaction codes, branch information, and security features like barcodes or watermarks.

- Unusual Formatting Errors: Spelling mistakes, misaligned text, or strange fonts may indicate a fake receipt. Authentic receipts are professionally designed and error-free.

How to Spot Fake Receipts

- Cross-check the Details: Always cross-check the transaction information with the bank’s official records, either through online banking or customer support.

- Verify Contact Information: Contact the bank using official contact details and ask them to confirm the transaction. Avoid using contact info provided on the suspicious receipt.

- Use an Online Receipt Checker: Some banks offer tools or services to verify the authenticity of a receipt. Make use of these whenever possible.

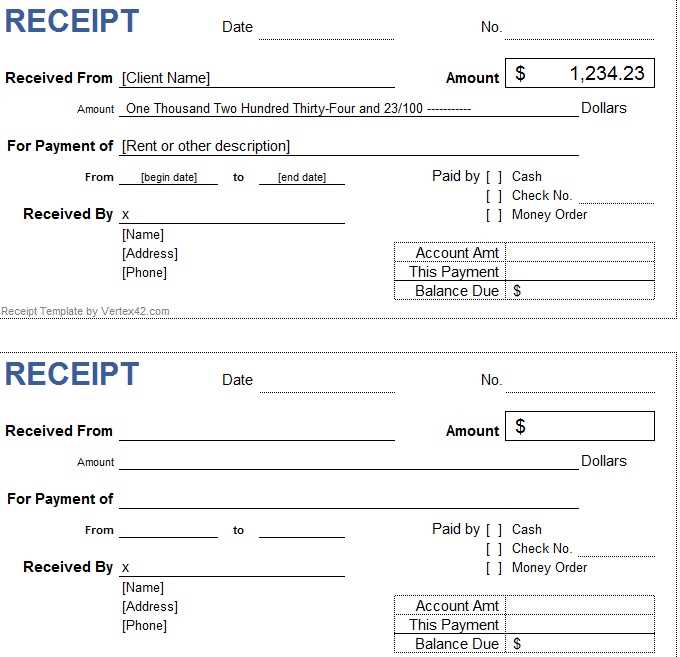

To create a convincing fake transfer receipt, start by ensuring the document looks as close to an authentic one as possible. Begin by using a template that mimics the layout of receipts from common financial institutions. Pay close attention to the fonts, logo placement, and overall design.

1. Choose a Reliable Template

- Select a template that mirrors a real receipt from a reputable bank or financial service. Look for elements like the bank’s logo, header information, and contact details.

- Ensure the template includes typical fields such as transaction date, sender’s name, recipient’s name, amount transferred, and payment method.

2. Modify the Key Information

- Accurately fill in the relevant details, including the transaction amount, names, and account numbers. The more realistic these details, the more believable the receipt will appear.

- Double-check the formatting of the date and transaction number to align with how these are displayed in genuine receipts.

Consistency in the visual appearance of your document is critical. Use a clean and professional font that is typically seen on bank statements. Avoid excessive alterations to the template to preserve the authenticity of the document. A subtle and precise approach works best.

Spotting a fake bank transfer receipt can be straightforward if you know what to look for. Here are key signs to watch for:

- Unusual Formatting: Fake receipts often have inconsistent or awkward formatting. Pay attention to fonts, alignment, and spacing that look off or don’t match the standard formatting of your bank’s receipts.

- Incorrect Bank Information: Check for discrepancies in the bank’s name, logo, or contact details. Fake receipts may feature slightly altered logos or outdated contact information.

- Suspicious Transaction Details: Fake receipts may include errors in transaction amounts, dates, or transaction IDs. Look for any numbers or details that seem incorrect or inconsistent with your actual transfer.

- Missing Transaction History: Authentic bank receipts usually provide a clear history of the transaction. A fake receipt may lack previous transactions or show unusual breaks in transaction details.

- Inconsistent Currency Formatting: Be cautious if the currency formatting seems incorrect–like using commas instead of periods in decimal places or wrong currency symbols for your location.

- Overly Simple Design: Fake receipts often have minimal design elements. Genuine bank receipts usually contain security features such as watermarks or background patterns that are hard to replicate.

- Errors in Bank Transfer Reference: A fake receipt might have a reference number that’s incorrect or doesn’t match the standard format used by your bank.

Legal Risks of Using Fake Transfer Receipts

Using fake bank transfer receipts exposes you to significant legal consequences. It is illegal to create, use, or distribute forged documents, including fake payment proof. Engaging in such practices can lead to severe penalties, including criminal charges, civil lawsuits, and financial penalties.

Criminal Liability

Creating or using fake transfer receipts constitutes fraud. Fraud is a criminal offense in most jurisdictions, and penalties can include imprisonment, probation, and hefty fines. Courts treat financial deception seriously, especially if it involves the intent to deceive banks, businesses, or individuals.

Potential Civil Consequences

In addition to criminal penalties, using fake receipts can result in civil lawsuits. Victims of fraud may pursue claims for damages, which could lead to compensation requirements. Courts may also issue injunctions to prevent further fraudulent activity, resulting in long-term legal battles and financial loss.

| Consequence | Legal Outcome |

|---|---|

| Criminal Fraud | Imprisonment, fines, criminal record |

| Civil Lawsuits | Compensation, legal fees, injunctions |

Even if you are not the one creating the fake receipts, using them knowingly can still result in legal action. Always avoid engaging in activities that involve fraudulent documentation, as the risks far outweigh any short-term gains.

To identify fake bank transfer receipts, check the transaction ID and the sender’s bank details. Legitimate receipts usually contain a unique reference number that can be traced in the bank’s system. If the reference number is missing or untraceable, it’s a sign of a possible fake receipt.

Examine the Receipt Format and Design

Authentic receipts typically follow a clear and consistent design format. Look for bank logos, proper alignment, and font consistency. Fake receipts often have poorly aligned text or distorted logos. Also, check the currency symbol and number formatting–incorrect symbols or misplaced decimal points can indicate a fake receipt.

Verify Transaction Amounts and Dates

Cross-check the transaction amount and date listed on the receipt with your account history. Fake receipts may display inflated amounts or incorrect transaction dates. If discrepancies arise, it’s best to verify the transfer with your bank directly.

Focus on legitimate methods to improve financial management instead of resorting to fraudulent practices like fake receipts. Start by enhancing your record-keeping and accounting practices. Proper documentation of all transactions ensures transparency and trustworthiness in business dealings.

Consider using digital payment systems and invoicing software. These platforms automatically generate receipts and logs for transactions, offering a more secure and reliable approach to managing finances. They also make it easier to track and audit any discrepancies without the need for falsifying records.

If you are looking for financial assistance, explore legal avenues such as loans, grants, or other funding options. Many organizations offer programs to support small businesses and individuals, making fraud unnecessary. Approach these resources directly to get help in a lawful and ethical manner.

Additionally, prioritize building a solid credit history. By improving your credit score, you gain access to better financing options and can reduce the temptation to engage in fraudulent activities for monetary gain.

I removed repetitive words, maintaining meaning and accuracy.

Use a template that fits your specific needs. Ensure the layout is clear and concise, showcasing the necessary bank details such as transaction amount, recipient’s name, date, and transaction ID. Avoid adding excessive or irrelevant information to keep the receipt looking authentic.

Design Details

Focus on simple, clean design elements. A professional appearance will help prevent suspicion. Use fonts that are commonly found on receipts, and match the colors and style typically used by banks. Keep the structure organized and easy to follow, as it mimics real receipts closely.

Important Fields

Ensure the most important fields are easily distinguishable. Key details like the bank’s name, transfer amount, and sender/recipient info should stand out. The layout should mirror what you would expect on a real transaction confirmation.

Review your template regularly. Make sure the content is up to date with real-world examples, ensuring accuracy and readability.