To ensure clarity and accuracy in tracking sales commissions, create a payment receipt that outlines all the necessary details. A well-structured template will help both parties–the company and the salesperson–stay organized and reduce confusion. Below is a straightforward template that can be customized for each commission payment.

Start with the date of the payment and include both the name of the salesperson and the company. Then, provide a breakdown of the sales made, including the amount, the commission rate, and the total commission earned. This ensures transparency and keeps both sides informed about the details of the transaction.

It’s also helpful to reference any specific sales agreements or contracts that apply to the commission. Including these references will make the receipt more reliable and provide a clear record of the terms. To finish, don’t forget to include the method of payment and any other relevant notes such as tax deductions or additional bonuses.

By using this template, both the company and the salesperson will have an easy-to-reference document that helps streamline the commission payment process. Ensure that all fields are filled accurately to avoid any misunderstandings down the line.

Here’s how to rewrite sentences to avoid excessive repetition while maintaining meaning and accuracy:

Instead of repeatedly using the word “payment,” you can substitute it with terms like “remittance” or “settlement” when appropriate. This helps maintain clarity while diversifying the language. For example, instead of saying “Payment for commission was received on the 5th. Payment was processed the same day,” you could say, “Commission was received on the 5th and settled the same day.”

When referencing the commission itself, avoid redundancy by using alternatives such as “earnings,” “compensation,” or “commission amount.” For instance, instead of writing “The commission amount is $500. The commission amount was transferred,” rephrase it as “The $500 commission was transferred.” This reduces repetition without losing meaning.

Additionally, consider restructuring sentences to eliminate the need for repeated words. Rather than saying “The payment receipt was issued on the 10th. The receipt was provided to the client,” say “The payment receipt was issued to the client on the 10th.” This concise phrasing removes unnecessary duplication while keeping the message clear.

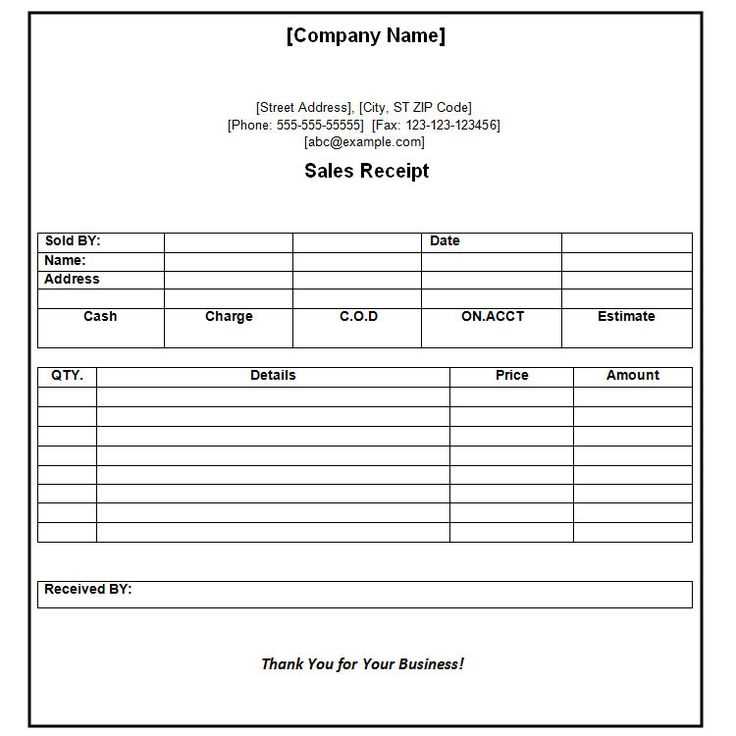

- How to Format a Sales Commission Payment Slip

Begin by clearly stating the payment details at the top. Include the company name, payment date, and the name of the recipient to avoid any confusion.

- Payment Date: This should be prominently displayed, so both parties know when the payment was issued.

- Recipient’s Information: Include the full name of the employee or agent receiving the commission, as well as their unique identification number if applicable.

Next, specify the details of the sale. Include the total value of the sale or sales that the commission is based on, along with any applicable discounts or adjustments.

- Total Sale Value: List the total amount of the sale before any deductions.

- Adjustments or Discounts: If any discounts or adjustments were made, clearly show how they affect the final value.

Indicate the commission rate being applied to the sale. This is typically expressed as a percentage, but if it’s a flat rate, that should be clarified as well.

- Commission Rate: Whether it’s a percentage or fixed amount, make sure this is clearly shown to avoid misunderstandings.

After this, calculate the commission amount. Multiply the sale value by the commission rate to get the exact amount to be paid.

- Commission Amount: This should be the result of multiplying the sale value by the agreed commission rate.

Finally, list any deductions or additional payments, such as taxes or advance payments, to clarify the net amount payable.

- Deductions: If there are taxes, fees, or previous advances to subtract, clearly outline them so the net amount is transparent.

- Net Commission: Display the final amount the recipient will receive after all deductions.

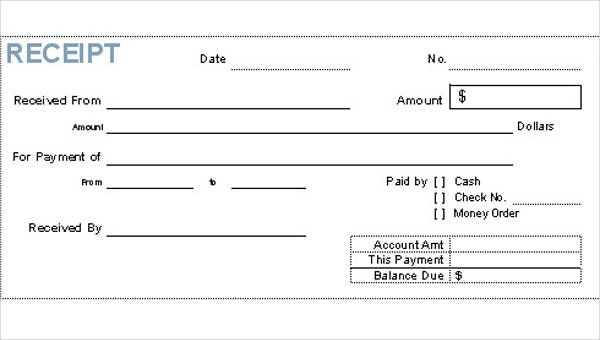

Each payment receipt should clearly outline the transaction details. The following fields are critical to include:

- Payment Date: Specify the exact date the payment was received to track the timing of the transaction.

- Amount Paid: Clearly state the total sum received, ensuring accuracy for both parties involved.

- Payment Method: Indicate how the payment was made (e.g., bank transfer, check, cash, etc.).

- Commission Rate: If the payment is related to commission, include the agreed-upon commission percentage or amount.

- Sale Details: Reference the specific sale or deal that the commission is tied to, such as invoice number or contract reference.

- Payee Information: Include the name and contact details of the recipient to avoid any confusion regarding the payment.

- Payer Information: List the details of the person or company making the payment, which can be helpful for record-keeping.

- Unique Receipt Number: Assign a unique identifier to each receipt for easier tracking and organization of payments.

Make sure all fields are filled out clearly and correctly. This will ensure transparency and help prevent any disputes later on.

To ensure clarity and transparency, itemize all payments and deductions in the commission receipt. Always list the total sales amount before applying any deductions to avoid confusion. Specify the percentage or fixed amount deducted for each item, such as taxes or administrative fees.

Breaking Down Deductions

Clearly separate each deduction to provide a clear view of what is being withheld from the total commission. For example, if a sales commission is subject to a tax or a processing fee, it should be indicated next to the total commission amount.

| Description | Amount |

|---|---|

| Gross Sales | $5000.00 |

| Commission (10%) | $500.00 |

| Tax Deduction (5%) | -$25.00 |

| Processing Fee | -$10.00 |

| Net Payable | $465.00 |

Using Clear Labels

Each amount should be labeled with a brief description, such as “Commission Rate,” “Tax,” or “Fee,” so that there’s no ambiguity. This ensures the payee understands how the deductions were calculated and where their earnings stand after deductions.

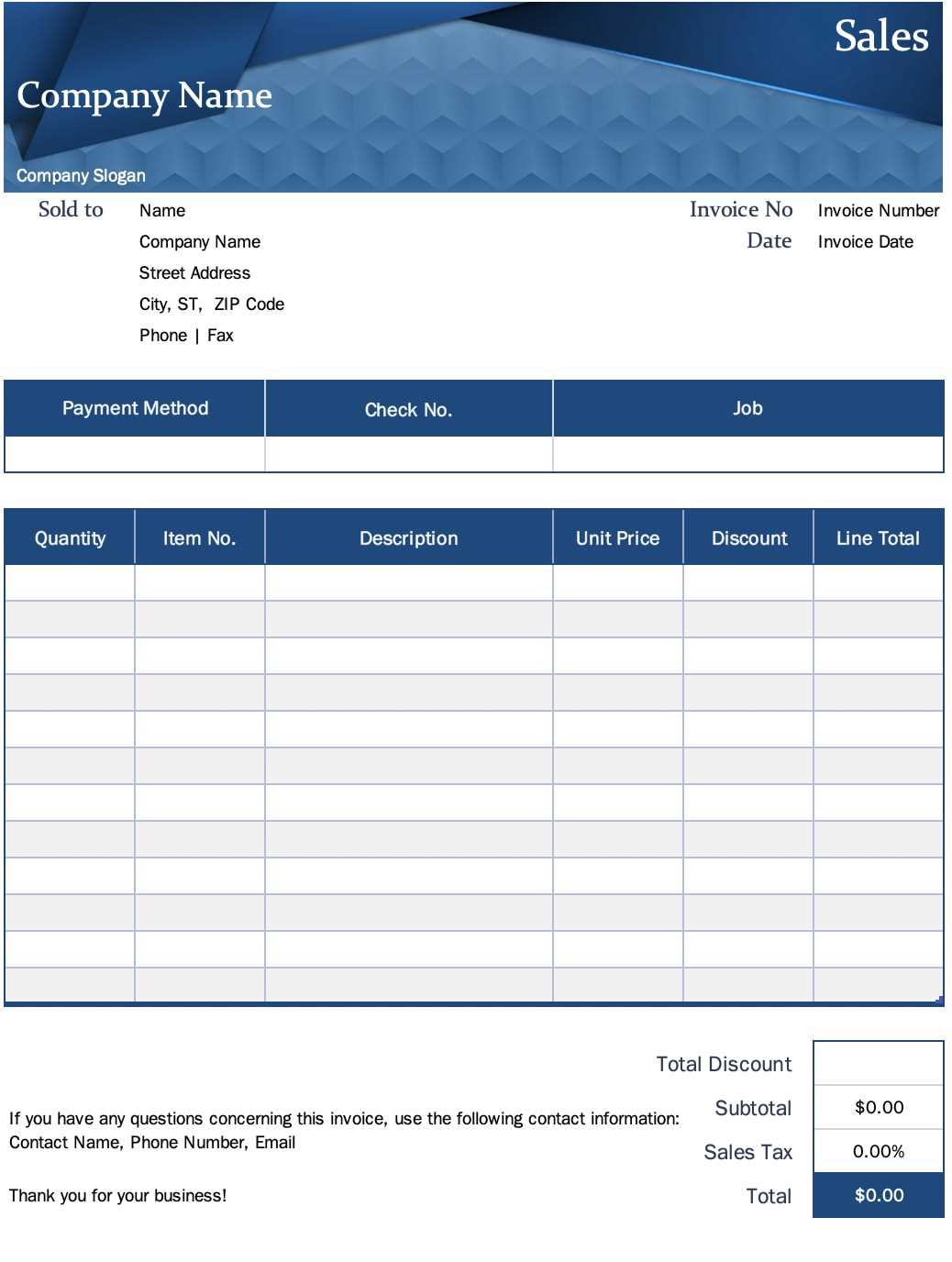

Begin by establishing a flexible structure that adapts to different sales circumstances. Include fields that allow you to modify the commission rate based on the product type, sales volume, or specific agreements. Add customizable sections for the salesperson’s name, sale date, product details, and payment method to make the template versatile for various scenarios.

Incorporate a formula-driven calculation system for commissions to ensure it automatically adjusts based on the inputted data. This eliminates the need for manual calculations and reduces the chances of errors. Make the template user-friendly by keeping the most common fields pre-filled, leaving only essential details to be entered each time.

Use dropdown menus or checkboxes for elements like payment status (paid, pending, or delayed) to simplify the process. Consider including a notes section for any special conditions or adjustments tied to that specific sale. This makes the template adaptable to both straightforward and complex transactions, providing clarity without overcomplicating the structure.

Ensure that commission payments are seamlessly integrated into your payroll system for accurate and timely processing. Automate the calculation of commissions based on sales data and ensure that these amounts are reflected in employees’ paychecks on payday. Use payroll software that allows you to configure commission structures, either as a percentage of sales or a fixed amount per sale, and link it directly to your existing payroll process. By doing so, you reduce manual errors and save time. Ensure that any changes in commission rates are updated in the system immediately, preventing discrepancies during payroll processing. Additionally, coordinate with your finance team to ensure that commission payments are included in tax calculations and meet legal requirements. Keep clear records for auditing purposes, and ensure that employees have access to transparent breakdowns of their commission payments within their pay stubs. This integration enhances accuracy and improves employee satisfaction by providing clarity and consistency in payments.

Ensure that commission records are clear, accurate, and aligned with local laws and tax regulations. Document all sales transactions, commissions earned, and the basis for each commission payment. Specify payment terms, deadlines, and any conditions that affect the commission amount. Record the exact dates of sales, payments, and commission calculation to avoid discrepancies.

Adhere to tax reporting requirements, including withholding taxes where applicable. Keep detailed records for audit purposes, as some jurisdictions require companies to maintain financial documents for several years. This ensures you can quickly respond to any inquiries from tax authorities or legal entities.

Include both the agreed commission rate and any deductions or additional payments, as this transparency prevents misunderstandings. Regularly update commission records in accordance with changes in sales agreements or tax laws to remain compliant with the latest legal standards.

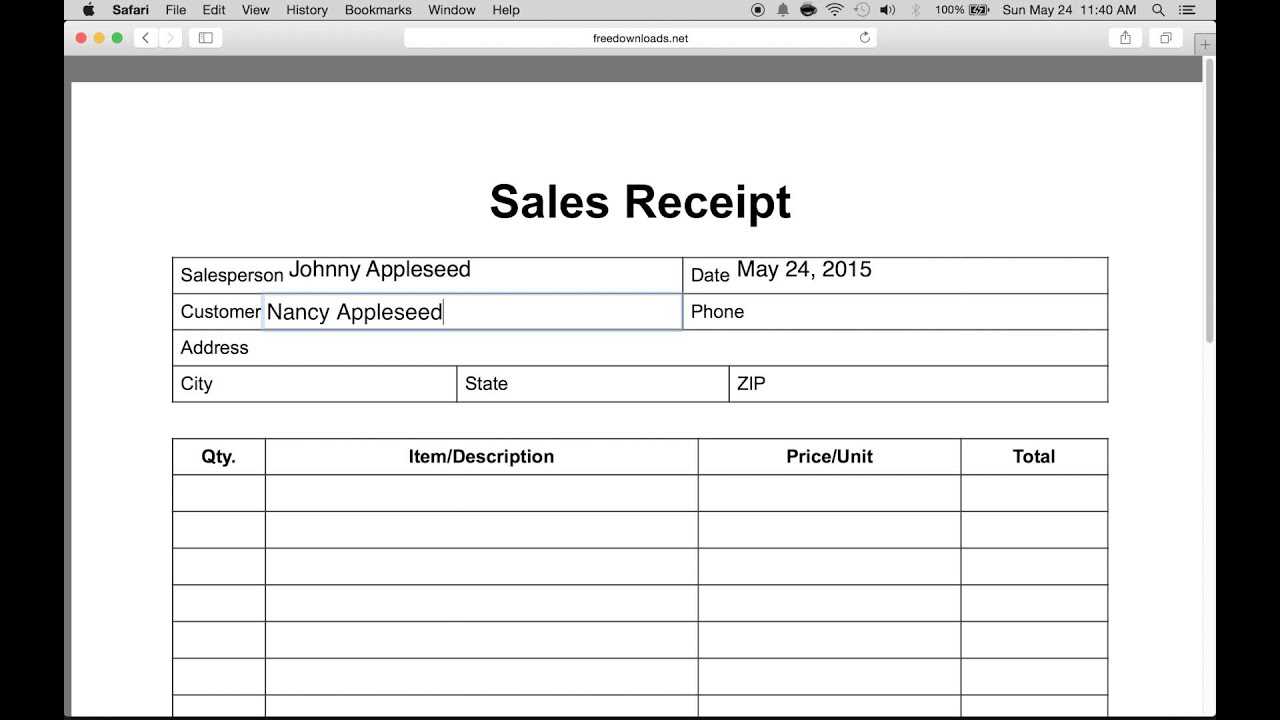

Payment Receipt Template for Sales Commission

Start by including key details like the date of the payment, the recipient’s name, and the amount paid for the sales commission. Clearly list the commission percentage applied to the total sale value, followed by the total amount earned. Add any deductions, if applicable, such as taxes or fees, to give a clear view of the net payment.

Basic Information

Ensure that the name of the salesperson is clearly stated, along with the invoice or transaction number for easy reference. Include the payment method, whether it’s a bank transfer, cheque, or other methods. If relevant, note the period for which the commission is being paid.

Commission Breakdown

Provide a breakdown of the sales figures that led to the commission. This should include the total value of sales, the rate at which commission is calculated, and the final commission amount. Transparency here ensures trust and accountability.