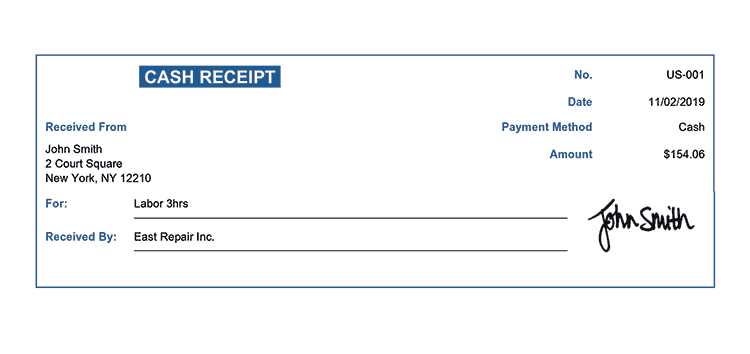

A clear and concise receipt for cash payments is crucial for both the payer and the payee. It serves as a legal document confirming the transaction and helps both parties keep accurate records. When creating this template, ensure it includes key details: the date of payment, the amount received, the purpose of the payment, and the names of both the payer and payee.

Start by listing the transaction date at the top of the receipt. This will establish the time frame of the agreement. Then, include the total amount paid in both numerical and written form to avoid any confusion. Be specific about what the payment is for, whether it’s for goods, services, or another purpose. Including this detail will help clarify the nature of the transaction.

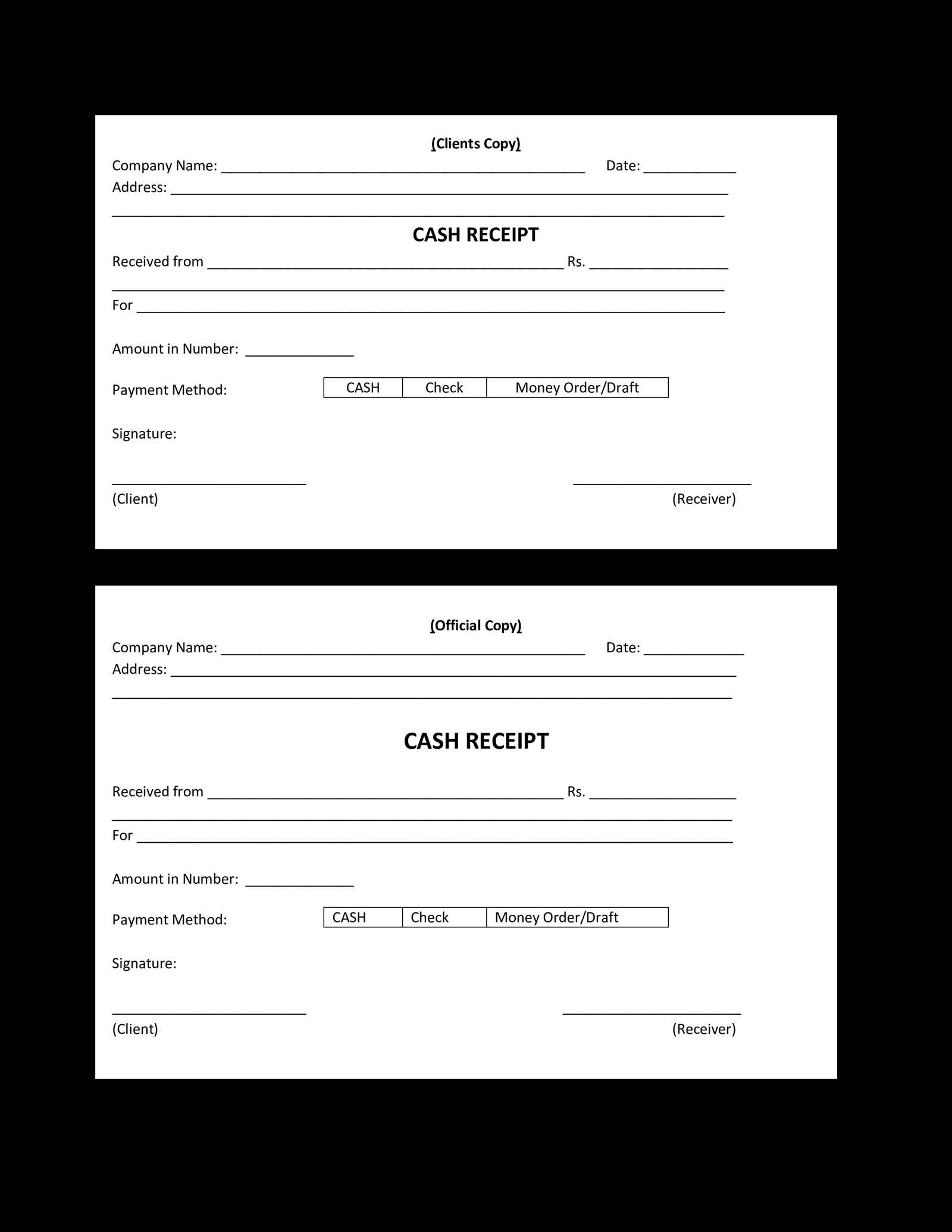

Next, provide the names of the payer and payee clearly. This ensures that both parties are identifiable should the need for verification arise later. You can also add a space for signatures or initials, which can further authenticate the receipt if needed. Make sure all of this information is easy to read and well-organized for future reference.

Here’s the corrected version without repetitions, maintaining their quantity and meaning:

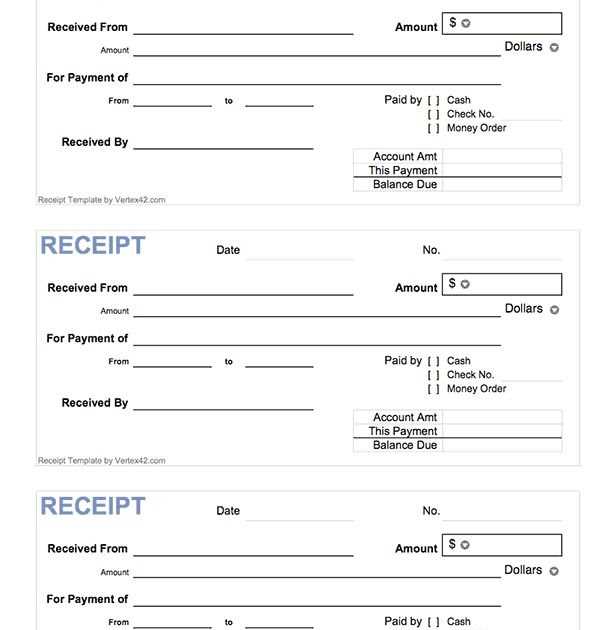

Ensure that the template clearly indicates the total amount of cash received. The header should state “Cash Payment Receipt” with a space to fill in the date, recipient, and payer details. The section for the amount should include both words and figures, preventing confusion. Below the amount, include a note confirming the payment method as cash.

Details to Include

Make sure each field is well-defined, leaving room for the payer’s signature. Include a clear statement at the bottom confirming the receipt of funds. Avoid overcomplicating the structure to maintain clarity and quick usability.

Sample Layout

| Field | Details |

|---|---|

| Date | Insert date of transaction |

| Amount Received | Insert cash amount in words and figures |

| Payer Name | Insert the full name of the person paying |

| Recipient Name | Insert the full name of the person receiving |

| Signature | Place for payer’s and recipient’s signatures |

- Cash Payment Receipt Template

For a clear and precise cash payment receipt, include the following key elements:

Basic Information

Start with the date of payment, the name of the payer, and the amount received. These details are crucial for record-keeping and future reference.

Payment Description

Provide a brief description of the goods or services for which the payment was made. Include any relevant invoice or transaction numbers if applicable.

Ensure the receipt includes the signature of the receiver, confirming the transaction. This adds a layer of authenticity and accountability to the document.

Finally, create space for both parties to include additional comments or details about the transaction, if necessary.

A payment receipt acts as both proof of transaction and a record for the buyer and seller. It ensures transparency by confirming the exchange of money for goods or services. The document provides the buyer with a tangible confirmation of the payment, while the seller maintains an official record for their financial records.

Documenting the Transaction

Every payment receipt includes key details such as the amount paid, date of transaction, method of payment, and a description of the goods or services provided. These details are critical for future reference in case of disputes or queries regarding the payment.

Legal and Tax Implications

A payment receipt is a legally binding document, often necessary for tax reporting purposes. Both parties can rely on the receipt during audits, legal claims, or warranty claims, ensuring there’s no ambiguity surrounding financial exchanges.

Ensure the receipt contains the following details for accuracy and clarity:

- Date and Time: Record the exact date and time of the transaction to avoid confusion later.

- Payee Information: Include the full name of the recipient, their address, or business name if applicable.

- Payment Amount: Clearly state the exact amount paid in both numerical and written forms.

- Payment Method: Specify how the payment was made (e.g., cash, cheque, credit card).

- Transaction Purpose: Briefly describe the reason for the payment, such as service rendered or goods sold.

- Receipt Number: Include a unique reference number for easy tracking and identification.

Additional Elements

- Issuer’s Details: Add the name and contact details of the person issuing the receipt.

- Signatures: Have both parties sign the document, if required, for confirmation.

- Terms and Conditions: Include any relevant terms regarding refunds or exchanges if applicable.

Ensure your payment proof includes all required details, such as the payer’s name, the amount paid, the method of payment, and the date of transaction. Always provide a clear description of the goods or services exchanged to avoid ambiguity.

Incorporate both the payer’s and the recipient’s signatures, along with a unique transaction identifier. This not only verifies the transaction but also provides evidence in case of disputes. If possible, use a numbering system for receipts to make each one traceable and unique.

Verify that your receipt includes the legal disclaimers relevant to your jurisdiction, such as tax identification numbers and compliance statements. Including this information ensures the receipt meets legal requirements and can serve as proof for tax or accounting purposes.

For electronic transactions, ensure that your receipt complies with local digital signature standards and includes an encrypted transaction record. This makes the receipt tamper-proof and legally valid in digital transactions.

Adjust the layout of your cash payment receipt template based on transaction types. For instance, when issuing receipts for services, include fields for service description, date, and payment method. For product transactions, add itemized lists with quantities and prices. This approach ensures that the receipt accurately reflects the nature of the transaction.

Incorporating Customer Details

Incorporate customer information like name, address, or account number for transactions involving large sums or recurring payments. This addition adds transparency and clarity, making it easier for both parties to track payments. You can also add a section for payment terms, such as due dates or late fees, when relevant.

Adding Tax Information

If applicable, include tax-related fields in the receipt. For example, a line for tax rates and another for total tax amount ensures that the customer is aware of how much tax is being charged. This is especially useful for businesses that handle VAT or other forms of taxation.

Store documents in organized folders with clear, descriptive names. This helps with easy retrieval when needed. Avoid generic titles; instead, use specific references to the content or date of the transaction.

Implement a systematic backup system for both physical and digital files. Keep copies in secure off-site locations or use cloud-based storage services that provide encryption and regular updates.

Ensure proper access control by limiting who can view or modify documents. For sensitive financial records, apply strict authentication and user permissions to maintain confidentiality.

Regularly update your filing system. Outdated or unnecessary documents should be purged to free up space and reduce clutter. Perform audits periodically to confirm that all documents are in their proper place.

| Storage Method | Pros | Cons |

|---|---|---|

| Physical Storage | Can be easily accessed without technology, ideal for certain legal documents | Space-consuming, can degrade over time, vulnerable to physical damage |

| Cloud Storage | Accessible from anywhere, easy to back up, saves physical space | Requires internet access, potential security concerns |

| External Hard Drives | Portable, large storage capacity, no ongoing subscription fees | Can be lost or damaged, susceptible to failure without regular backups |

Use tags or keywords to label important documents for faster searchability. Incorporating a consistent naming convention and metadata can greatly enhance the ability to find specific files quickly.

Ensure all documents are categorized and stored by their type (e.g., receipts, contracts, invoices) to simplify the management process. Having predefined categories reduces time spent on searching and organizing.

Ensure accurate receipt details to avoid disputes and confusion. Small errors in issuing receipts can cause bigger issues down the line. Here are key mistakes to watch out for:

- Incorrect Date – Double-check the date of transaction. An incorrect date can lead to problems, especially with returns or accounting practices.

- Missing or Incorrect Amount – Verify that the total amount received matches the transaction. Even minor discrepancies could create trust issues.

- Failure to Include Relevant Tax Information – Tax details must be clear and accurate. Missing tax rates or amounts can make the receipt invalid for tax purposes.

- Unclear Payment Methods – Specify the payment method used (cash, card, cheque). Confusion can arise if the method is not documented clearly.

- Failure to Include Seller Information – Include the business name, address, and contact information. Without this, the receipt might be deemed incomplete.

- Typographical Errors – Even small typos can make a receipt look unprofessional and lead to misinterpretation. Proofread each receipt carefully.

- Omitting a Receipt Number – Always assign a unique receipt number for tracking. It helps both the customer and seller during future inquiries.

How to Avoid These Mistakes

- Use automated systems that generate receipts with preset fields to minimize human error.

- Regularly train staff on the importance of accurate receipt creation.

- Implement checks before handing over a receipt to ensure all details are correct.

When creating a template for a cash payment receipt, prioritize clarity and accuracy. Use simple, straightforward language to detail the transaction and ensure that all relevant information is included.

Key Elements to Include:

- Date and Time: Always indicate the exact moment the payment was received.

- Amount Paid: Clearly state the total amount received, including the currency.

- Payment Method: Specify the form of cash payment, whether in bills, coins, or both.

- Receiver’s Name: Include the name of the person or organization accepting the payment.

- Transaction Details: Provide a description of the goods or services purchased, along with any applicable identifiers (e.g., invoice number).

- Signature: Both the payer and payee should sign to acknowledge the transaction.

Formatting Tips:

- Legibility: Use a clean font with a professional layout. Avoid clutter and ensure all text is easy to read.

- Logical Order: Organize the receipt with the most critical information at the top, following the list above.

- Space for Custom Notes: Leave space for additional comments or details that may be relevant to the specific transaction.