When a donor gives a charitable contribution, they expect to receive a proper receipt that allows them to claim a tax deduction. A well-structured donation receipt letter is vital in meeting IRS requirements while ensuring transparency and trust between you and the donor. A clear and accurate template saves time and reduces the chance of errors when issuing receipts.

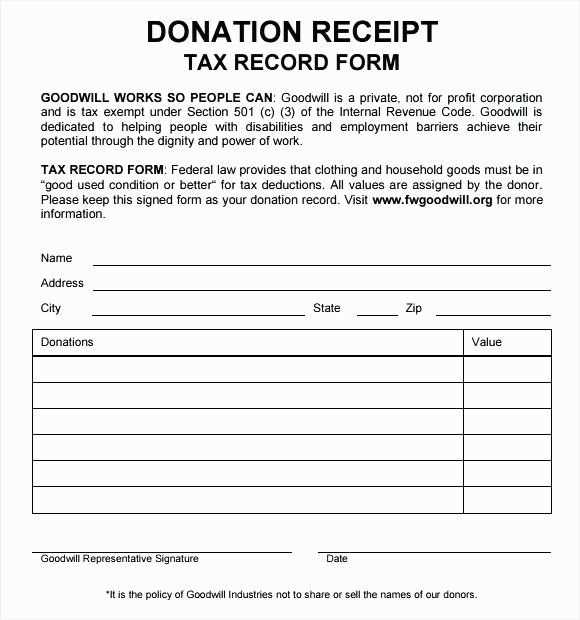

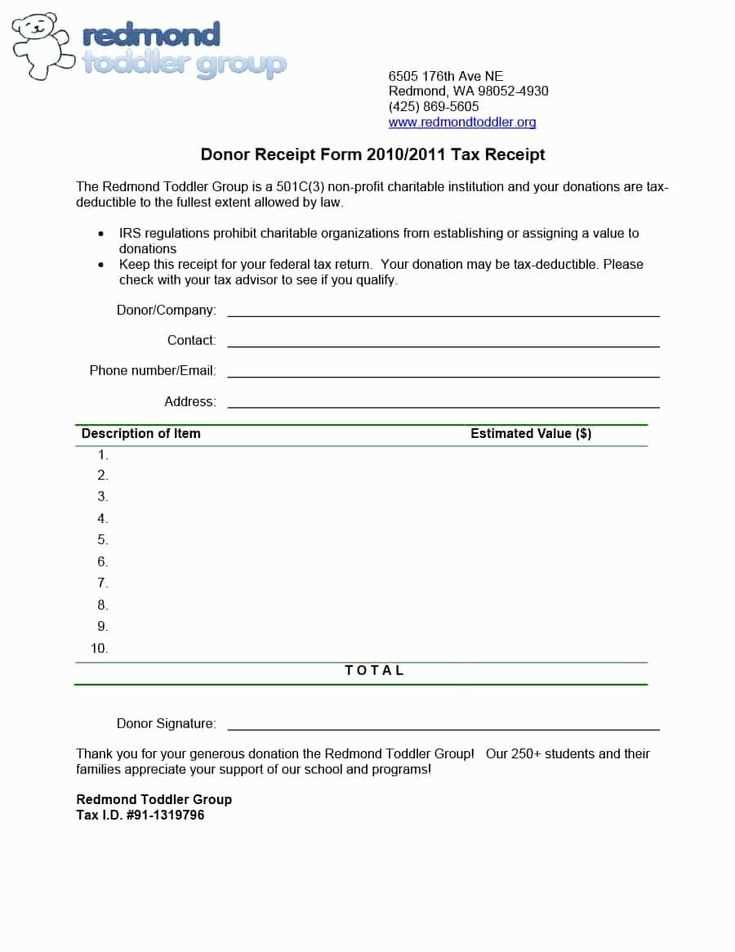

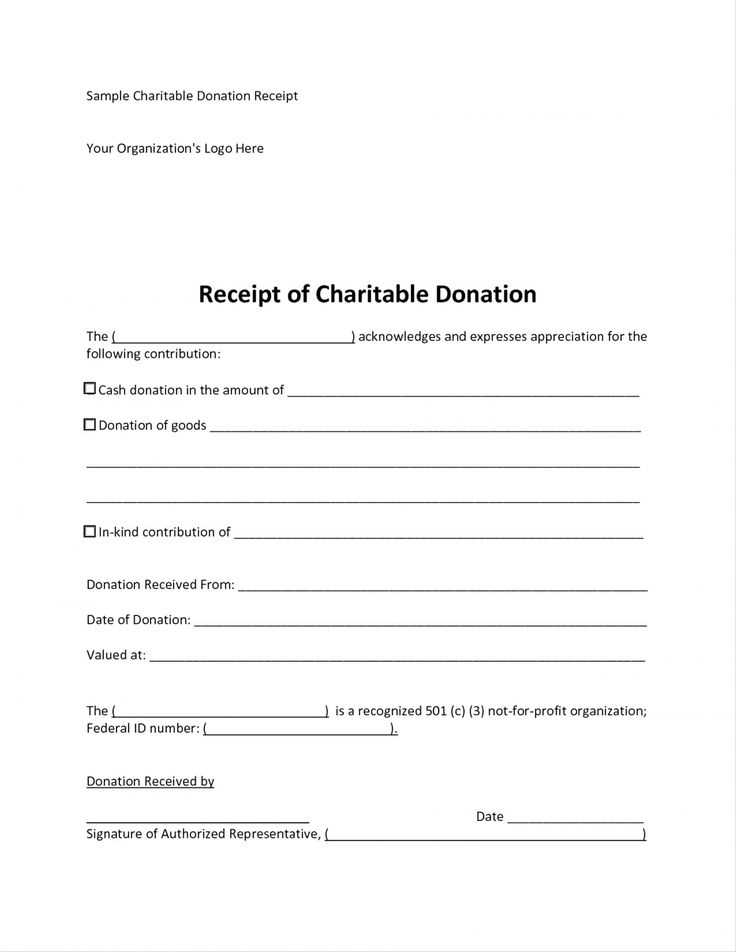

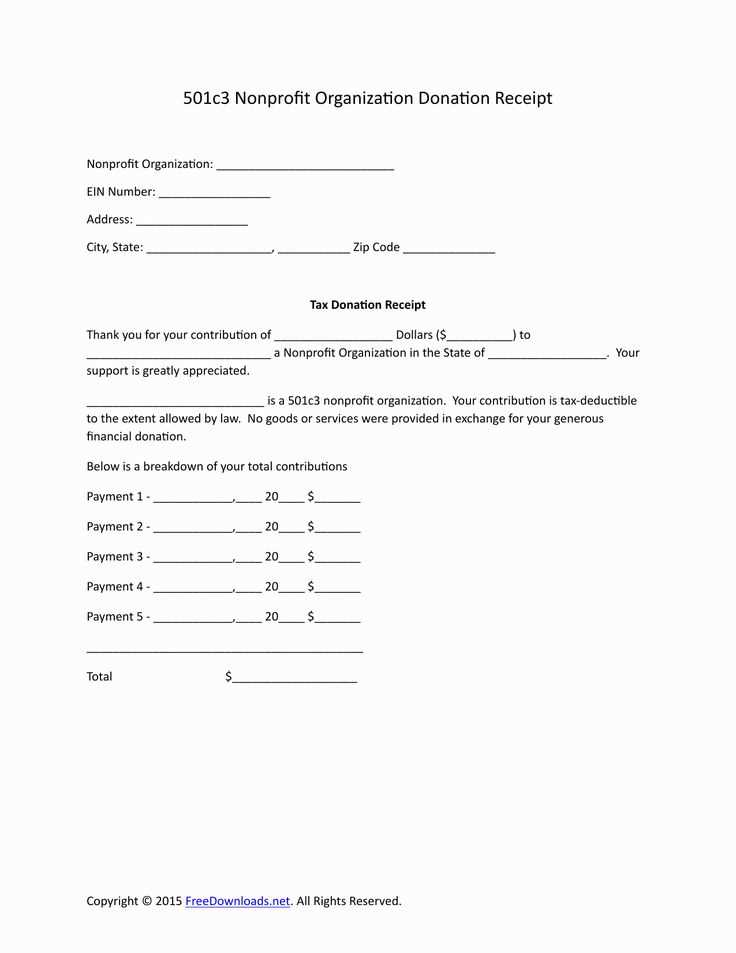

Include the organization’s name, address, and tax-exempt status at the top of your letter. Make sure to clearly state the date of the donation, the donor’s information, and a description of the donation. If the contribution was non-cash, include details on the type and condition of the donated items. Don’t forget to mention whether anything of value was provided in exchange for the donation. This part of the letter is crucial for both the donor’s record-keeping and your compliance with tax laws.

Next, make sure your donation receipt includes a statement that confirms no goods or services were provided in exchange for the gift, if applicable. This helps the donor know that their full contribution is deductible. Additionally, a brief, polite closing that invites the donor to reach out for further questions ensures a positive relationship and encourages future contributions.

Following this simple structure can help ensure that both you and the donor are prepared for tax season, reducing any confusion or potential issues with tax filings.

Here’s the corrected version, incorporating all your suggestions:

Make sure to address the donor personally at the start of the letter. Use their full name for a more formal tone and maintain professionalism throughout. The purpose of the letter should be clear from the beginning: confirm the receipt of their donation and acknowledge its significance. Keep the language simple and direct to avoid confusion.

Donation Details

Include specifics about the donation: the amount, type of donation (money, goods, etc.), and the date it was received. If applicable, mention if the donor provided any special instructions. This transparency helps both the donor and your organization for record-keeping purposes.

| Donation Type | Amount | Donation Date |

|---|---|---|

| Monetary | $500 | January 15, 2025 |

| Goods | Various electronics | January 20, 2025 |

Tax Deductible Information

Clearly state that the donation is tax-deductible. Include the organization’s tax ID number to provide the donor with the necessary information for their tax filing. This helps avoid any confusion during tax season and ensures the donor can claim their deduction without issues.

End the letter with a note of gratitude, emphasizing how their contribution will make a difference. It’s also a good practice to invite the donor to stay involved with the organization through future updates or volunteer opportunities, ensuring a lasting relationship.

- Tax Deductible Donation Receipt Letter Template

Provide your donors with a clear and accurate receipt for their tax-deductible contributions. This receipt ensures they can claim their donation on their taxes. Below is a simple template that you can use to create a letter for your donors. It includes all the required elements that both you and your donors need to comply with tax laws.

Tax Deductible Donation Receipt Letter Template

Dear [Donor’s Name],

Thank you for your generous donation to [Organization Name]. We are pleased to acknowledge your support. Below is the information regarding your donation:

- Donation Amount: $[Amount]

- Date of Donation: [Donation Date]

- Organization Name: [Organization Name]

- Tax ID Number: [Tax ID Number]

- Type of Contribution: [Cash/Non-Cash]

- Description of Non-Cash Donation (if applicable): [Description]

We confirm that no goods or services were provided in exchange for this donation, as required by IRS regulations. Please keep this letter for your records as it may be used for tax purposes.

Thank you again for your generous support. If you have any questions, please do not hesitate to contact us at [Organization Contact Information].

Sincerely,

[Your Name]

[Your Title]

[Organization Name]

Hey! How’s it going?

A tax-deductible receipt letter must clearly include specific details to be valid. The following information ensures compliance with tax laws and helps donors claim their deductions without issues.

1. Organization’s Name and Contact Details

Include the full legal name of your organization, as well as your address and phone number. Donors should easily be able to contact you if they need further documentation or clarification.

2. Donor’s Information

State the donor’s full name, address, and any other identifying details relevant to the donation. This helps ensure that the receipt is linked to the correct individual or entity.

3. Date and Amount of Donation

Provide the exact date the donation was received. Include the monetary value of the contribution, or if non-cash, a brief description and estimated value based on fair market price.

4. Statement of Tax-Deductibility

Clearly state that the donation is tax-deductible and that no goods or services were exchanged for the contribution, unless applicable. This confirms the donor’s ability to claim the deduction.

5. Description of Donated Property (if applicable)

If the donation includes property or goods instead of money, provide a brief description, including quantities and conditions. If it’s a non-cash donation, an estimated fair market value must be included.

6. Acknowledgment of Tax-Exempt Status

If your organization is tax-exempt, include a statement confirming this status, referencing your IRS 501(c)(3) designation or equivalent. This validates your authority to issue tax-deductible receipts.

Common Mistakes to Avoid When Writing a Donation Acknowledgment

Ensure that your donation acknowledgment letter includes the correct details. Here are key mistakes to avoid:

- Omitting the Donation Amount – Always state the exact amount donated. Failing to do so can cause confusion and may prevent the donor from receiving accurate tax benefits.

- Incorrect or Incomplete Donor Information – Double-check the donor’s name, address, and contact details. Errors in this information can lead to delays or issues with tax filings.

- Missing Date – The donation date should always be included. This helps the donor with their tax records and ensures that the acknowledgment is timely.

- Failure to Specify the Nonprofit’s Tax-Exempt Status – Include the nonprofit’s tax-exempt status and its EIN (Employer Identification Number). Donors need this for their records to validate their tax deduction eligibility.

- Not Including a Description of the Donation – Provide a clear description of the donation. For non-cash donations, mention the item’s condition and the value, especially if a third-party valuation was done.

- Unclear or Vague Language – Use clear and straightforward language. Avoid ambiguous terms like “generous donation” without specifying the amount or type of contribution.

- Not Acknowledging Volunteer Time – If the donor has volunteered time instead of donating money, acknowledge the value of their hours, especially if your organization offers a volunteer grant program.

By avoiding these mistakes, you ensure a smoother process for both the organization and the donor while maintaining the integrity of the tax-deductible donation acknowledgment.

Personalizing a donation receipt letter can strengthen your relationship with donors and demonstrate appreciation for their support. The way you tailor your letter can vary depending on the donor category, ensuring that it aligns with their level of involvement and contribution. Here’s how to adapt your letters for different types of donors.

1. For Individual Donors

When addressing individual donors, be sure to use their full name and refer to their specific contribution. Acknowledge the impact of their donation, and make the letter personal by mentioning how their support helps your cause. If they’ve donated multiple times, reference their ongoing commitment to the mission. A clear, heartfelt thank you can make a significant impact.

2. For Corporate Donors

Corporate donors often require a more formal tone. Mention the name of the company, and recognize their contribution to the broader community. If the donation is large, it’s a good idea to highlight the potential projects or programs that will benefit from their support. For businesses, it’s valuable to express how their involvement enhances their corporate social responsibility profile.

3. For Major Donors

Major donors should feel like their contribution has been game-changing. Acknowledge the large sum, and emphasize how it enables your organization to achieve significant milestones. Provide specific details on how the donation will make a difference and invite them for a personal tour or meeting to further discuss the impact of their support. The more specific and high-touch the communication, the better.

4. For Recurring Donors

Recurring donors appreciate recognition of their ongoing commitment. Mention the frequency of their donations, and express how their consistent support is crucial to the success of your mission. Let them know that their continued partnership makes a tangible difference in your operations, and encourage them to keep up the great work with a note of gratitude.

5. For Anonymous Donors

For donors who prefer to remain anonymous, respect their privacy while still acknowledging their contribution. Acknowledge the importance of their support and express gratitude without focusing on personal details. A simple, sincere thank you goes a long way with anonymous donors.

Personalizing each receipt according to the donor’s category creates a stronger connection, making them feel valued and appreciated. Take the time to ensure each letter feels tailored, and your donors will feel more engaged with your cause.

Tax-deductible donation receipts must comply with specific legal standards to be valid. These standards vary by country, but the general principles remain consistent. The receipt must include detailed information about the donor, the organization, and the donation itself to be accepted by tax authorities.

Key Elements of a Valid Receipt

A tax-deductible receipt must clearly state the name of the charity or non-profit organization, its legal status (such as tax-exempt status), and the donor’s name and address. The date of the donation and the exact amount or description of the donated items are also required. If the donor receives any goods or services in exchange for the donation, this must be indicated on the receipt, along with an estimate of their fair market value. This ensures the receipt reflects only the charitable portion of the donation.

Specific Legal Language

The receipt must include specific wording that aligns with the tax laws of the jurisdiction. For instance, in the U.S., the IRS mandates that the receipt contain a statement confirming that no goods or services were provided in exchange for the contribution, or if they were, a description and good-faith estimate of the value. If the donation is over a certain threshold, additional details, such as the organization’s tax identification number, may be necessary.

Deliver tax-deductible donation receipts through email or mail, depending on your donor’s preference. If you’re using digital receipts, ensure they are sent immediately after the donation is made, and include all required details like the donation amount, date, and organization’s EIN. Physical receipts should be mailed within a few days of receiving the donation. Include a thank-you note to personalize the process.

Tracking Donations

To track donations efficiently, use a donor management system (DMS) or CRM software. These tools allow you to monitor contributions, generate receipts, and organize donor data securely. Make sure to categorize donations based on type (monetary, goods, or services) and donor preferences for reporting purposes. Regularly update your records to prevent any discrepancies when preparing for tax season or audits.

Maintain Clear Records

Keep a well-organized database of each donor’s history, including the value of donations, dates, and acknowledgment sent. This will help ensure compliance with tax laws, and will also make it easier to respond to any inquiries. Periodically review and audit your system to ensure the accuracy and completeness of your records.

Replacing “Receipt” and “Donation” with Synonyms to Avoid Repetition

To enhance readability, consider using variations of “receipt” and “donation” throughout your template. Instead of repeating the word “receipt,” try “acknowledgment,” “confirmation,” or “document.” For “donation,” substitute with terms like “contribution,” “gift,” or “charitable offering.” These small changes not only help avoid redundancy but also keep the content engaging and professional.

When you refer to the acknowledgment of a gift, you can use phrases like “written confirmation of the charitable gift” or “formal acknowledgment.” For example, “This document confirms your charitable contribution…” replaces “This receipt confirms your donation…” The use of varied language ensures that your letter remains clear and maintains its purpose.

In the context of contributions, swapping “donation” with “gift” or “charitable offering” can help your letter feel more personalized. For instance, instead of saying “Thank you for your donation,” try “Thank you for your generous gift.” This not only avoids repetition but also creates a more heartfelt message for the donor.