Providing a tax receipt for material donations ensures that both the donor and the recipient organization have a clear record for tax purposes. It’s crucial to include all the relevant details to meet legal requirements and ensure the donor can claim the appropriate deductions.

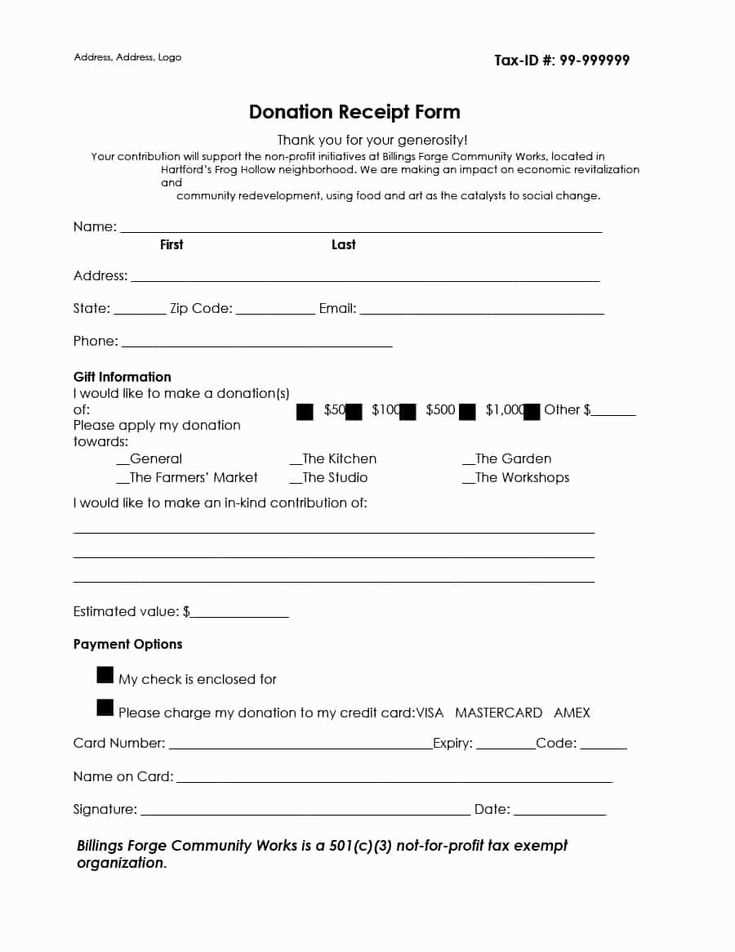

Start by including the name and address of both the donor and the receiving organization. Make sure to list the date of the donation and the description of the materials donated. This information will be used to confirm the value of the donation, which is necessary for tax reporting.

If the donation involves items that have a clear market value, itemize the donated materials with specific descriptions and values. If the items are less tangible or harder to assess, consider providing a reasonable estimate based on similar items in the market.

Lastly, add a statement declaring whether any goods or services were provided in exchange for the donation. This helps avoid any confusion and ensures the donor knows how much of their contribution is eligible for a tax deduction.

Updated lines with the elimination of word repetition:

Focus on clarity by avoiding unnecessary repetition of terms in donation receipts. Adjusting sentence structure can significantly enhance readability.

- Make sure to list the donated items concisely, detailing the quantity and type of materials.

- Provide the date of donation and the estimated value without redundancy.

- State the donor’s name and contact information once, rather than repeating these details in various sections.

Rewriting the content in a more straightforward manner increases the document’s professionalism while maintaining transparency.

- Template for Material Donations Tax Receipt

To create a tax receipt for material donations, ensure that the following details are included to meet legal requirements and provide a clear acknowledgment of the contribution.

Required Information

| Field | Description |

|---|---|

| Donor’s Name | Include the full name or business name of the donor. |

| Donation Date | Specify the date the donation was received. |

| Description of Donated Items | Clearly describe the donated materials. Include type, condition, and quantity if possible. |

| Value of Donation | If applicable, indicate the estimated fair market value of the items donated. The IRS does not require donors to attach an appraisal, but it may be useful for higher-value donations. |

| Statement of Non-Exchange | State that no goods or services were provided in exchange for the donation. |

| Organization Name | Provide the legal name of your organization or charity. |

| Tax ID Number | Include the organization’s tax identification number (TIN) or EIN for tax reporting purposes. |

Additional Notes

Make sure to provide a copy of this receipt to the donor. Retain a copy for your records in case of future audits or reporting. If the donation involves a significant number of items, a list or inventory may be requested by the IRS or other tax authorities.

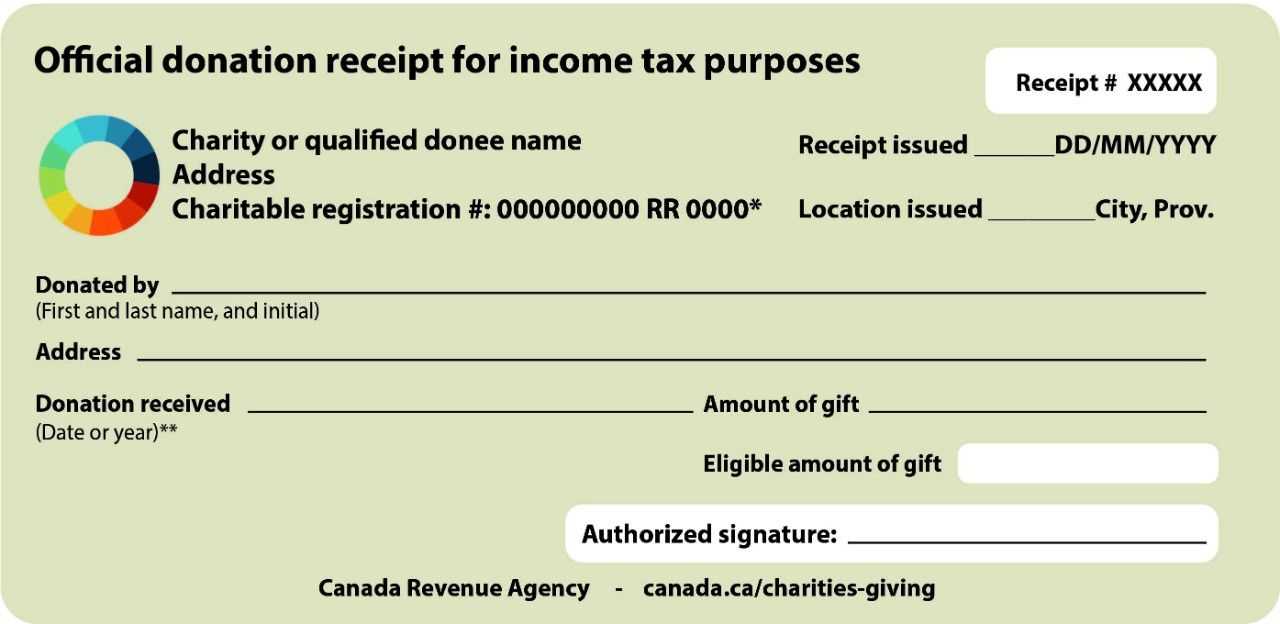

Clearly outline the donor’s name and contact details at the top of the receipt. Ensure the donor’s full name is listed, along with their address or email for any follow-up communications. Next, identify the charitable organization receiving the donation, including its legal name and tax ID number for verification purposes.

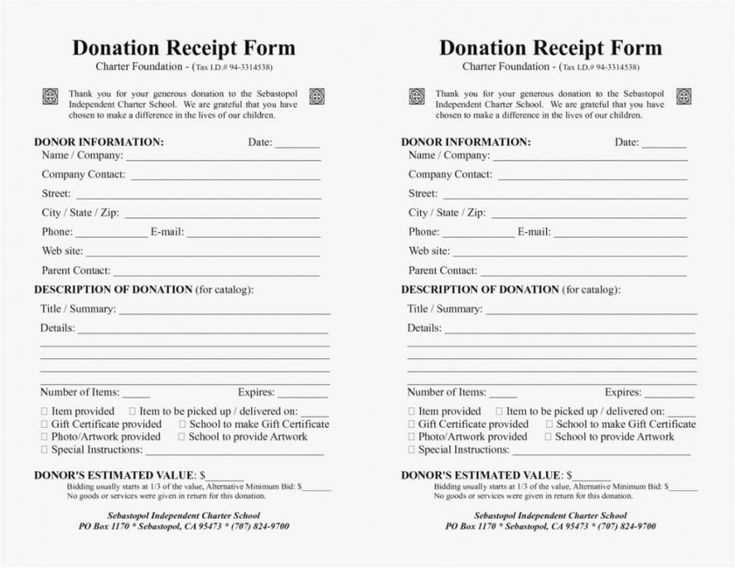

Specify the date the donation was made and the value of the contribution. For material donations, provide a description of the items, their estimated fair market value, and any other relevant information to clarify the type and value of the donation.

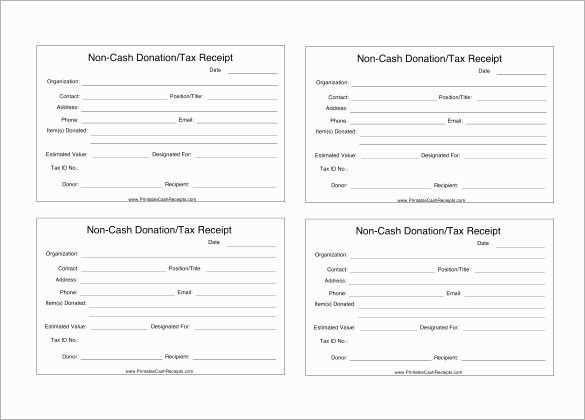

If applicable, indicate whether the donation was in cash or in-kind. For non-cash contributions, ensure that a proper valuation method is mentioned to avoid ambiguity. Include a statement confirming that the donor did not receive any goods or services in exchange for the contribution, as this affects the tax deductibility.

Finally, include the signature or authorization of a representative from the organization, along with the organization’s contact information. This assures the donor that their contribution has been formally recorded and acknowledged by the receiving entity.

Include the donor’s full name and address. This is necessary to validate the receipt and match it to the donor’s records for tax purposes. Provide the donation date and a description of the donated materials. If the items are valuable, offer a brief estimate or appraised value. However, do not assign an exact amount if you’re not qualified to do so. Always specify if no goods or services were provided in exchange for the donation, as this affects the tax deduction eligibility.

Itemization of Donated Materials

List each item or category of items separately, especially for high-value donations. This helps clarify the donation’s scope and value. If possible, indicate the condition of the items to show transparency and accuracy in reporting. If multiple items of a similar kind are donated, group them by category for simplicity and ease of reference.

Legal Language and Signatures

Ensure the receipt includes a statement confirming that the donation is a gift, with no goods or services given in return. Include a signature from an authorized representative of the recipient organization, along with their position. This validates the receipt and makes it official for tax submission purposes.

Ensure accurate valuation by consulting the fair market value of the donated items at the time of the donation. Use reliable sources like online marketplaces, appraisers, or donation centers to determine the price. If necessary, get an appraisal for high-value items, especially those over a certain threshold. Keep detailed records of valuations and sources used to support your estimation. This will help ensure compliance with tax regulations and provide transparency if the donation is ever questioned.

The IRS requires that charities issue written acknowledgment for donations over $250. This acknowledgment must include the name of the charity, the amount or description of the donated property, and a statement that no goods or services were provided in exchange for the gift, or a description of those goods or services. If the donor received something in return for their donation, the acknowledgment should specify the fair market value of those items.

Donors must receive acknowledgment by the earlier of the date of filing the charity’s return or the due date (including extensions) for filing that return. Keep in mind that the donor must have this acknowledgment before they can claim a charitable deduction on their tax return.

It is important to ensure the acknowledgment is clear and accurate, as errors may delay the donor’s ability to claim the deduction. Including the date of the donation is also highly recommended to avoid confusion and to ensure compliance with IRS regulations.

Ensure the donor’s full name and address are accurately listed. Missing or incorrect information can lead to confusion during tax filing. Double-check the donation amount, including any currency conversions if applicable. A common mistake is incorrectly noting the value of donated goods, especially when they are non-cash contributions.

Clearly define whether the donation was made in cash or goods. Without this distinction, it’s difficult to classify the donation properly for tax purposes. Another frequent issue is failing to include a statement about the donor receiving no goods or services in exchange for the contribution, which is required for tax-exempt status. Always include a clear description of the donation, even if it’s non-monetary.

Ensure the charity’s tax-exempt status is indicated, along with the proper legal name of the organization. An error here could invalidate the receipt’s legitimacy. Finally, check that the receipt is signed by a representative of the organization, as this signature adds credibility and helps avoid disputes during audits.

Ensure that your tax receipt for material donations includes accurate details. The receipt should list the donor’s name, donation date, description of the items donated, and their estimated value. Record the fair market value of each item to help with tax deductions. Keep a copy of the receipt for your records and submit it as part of your tax filing. If you’re uncertain about valuation, consider obtaining an appraisal for high-value items. Proper documentation will support your claim and streamline the filing process. Stay organized by keeping receipts in a dedicated folder for easy access when it’s time to file taxes.

Ensure clarity in your donation receipt by listing the donated items precisely. Use a simple and organized format to avoid confusion and make the document easy to understand.

- Include the donor’s name and address at the top.

- Provide a brief description of each donated item, including quantity, condition, and any distinguishing features.

- List the estimated value of each item. Be realistic in your valuation to avoid any potential issues with tax authorities.

- Note the date of the donation for reference.

- Clearly indicate the organization receiving the donation, along with contact information for verification.

For ease of use, add a statement at the bottom confirming that no goods or services were provided in exchange for the donation. This ensures compliance with tax rules and simplifies record-keeping.