Key Elements to Include

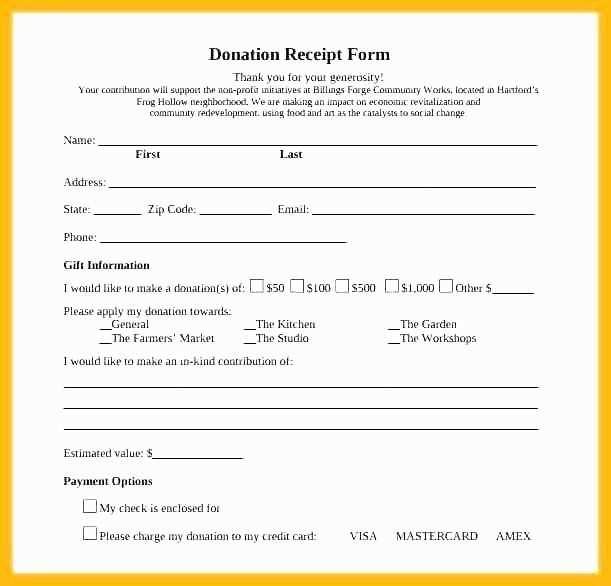

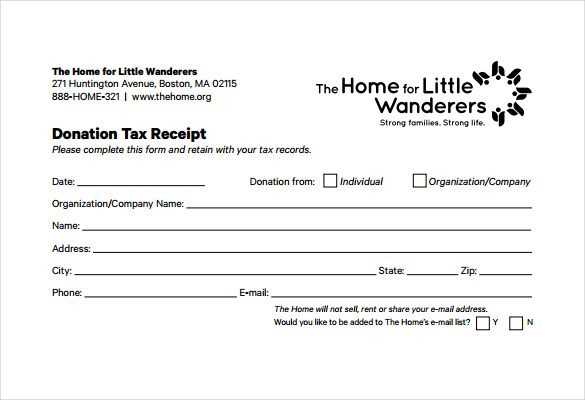

To ensure your donation tax receipt meets all legal and organizational requirements, include these components:

- Organization’s Name and Address: Include the full name of your nonprofit along with the official mailing address.

- Donor’s Name and Address: Make sure to include the full name of the donor as well as their contact details.

- Date of Donation: Clearly state the date when the donation was received.

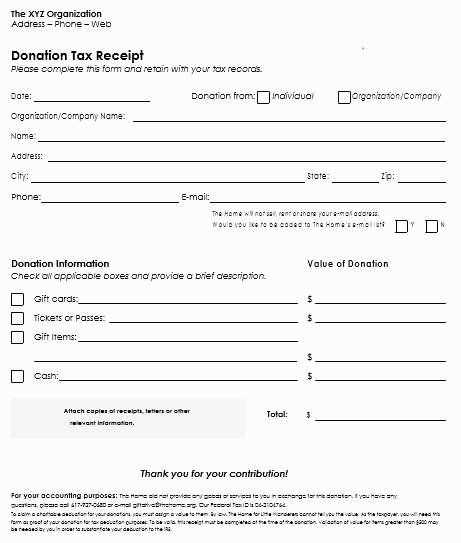

- Donation Amount: Specify the exact value of the gift received, whether it’s in cash, property, or services. For non-cash donations, provide a brief description of the item(s) and their value.

- Nonprofit Tax Status: Clearly indicate that your nonprofit is tax-exempt under IRS section 501(c)(3) or the relevant tax authority.

- Statement of No Goods or Services Received: If no goods or services were provided in exchange for the donation, state this clearly. If there were, outline what was given.

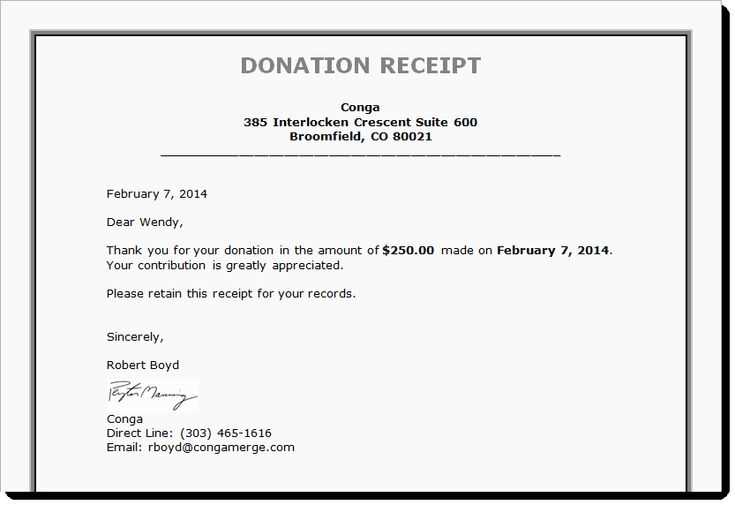

- Signature of Authorized Representative: Include the signature of an authorized individual from your nonprofit, such as a financial officer or executive director.

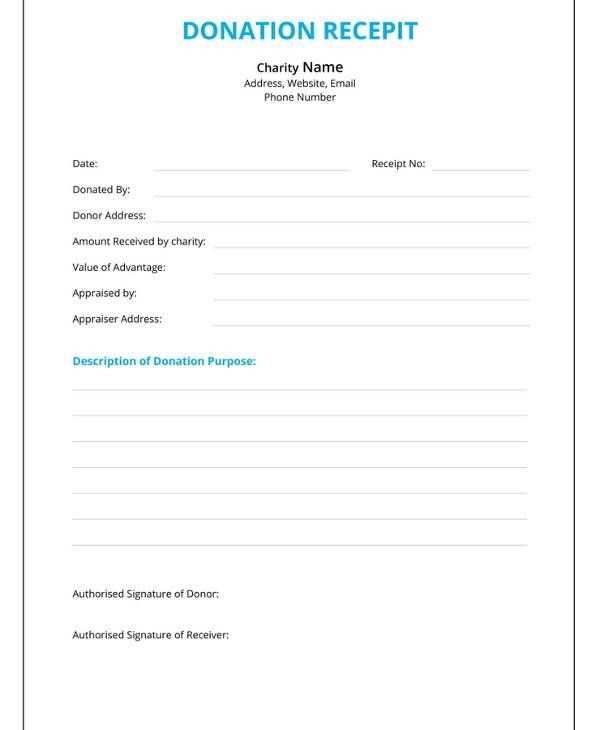

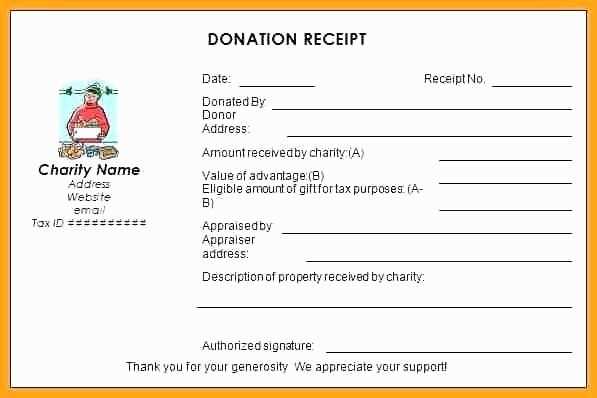

Template Example

Here’s a simple template you can use for creating a donation receipt:

[Nonprofit Name] [Nonprofit Address] [Nonprofit Tax ID Number] [Date] Donor Name: [Donor Name] Donor Address: [Donor Address] Dear [Donor Name], Thank you for your generous donation of [donation amount or description] to [Nonprofit Name]. This receipt serves as confirmation of your charitable contribution. Date of Donation: [Donation Date] Amount of Donation: [Amount] Description of Non-Cash Donation (if applicable): [Description] No goods or services were provided in exchange for this donation. Sincerely, [Authorized Representative Name] [Title] [Nonprofit Name]

Additional Considerations

For transparency, it’s a good idea to keep records of both the donations and the tax receipts you issue. Using accounting software or spreadsheets can help streamline the process of tracking contributions.

Donors appreciate accurate and timely receipts, so consider sending them promptly after the donation is made. Offering these receipts promptly ensures donors have the proper documentation for their tax filings.

Nonprofit Donation Tax Receipt Template

Creating a Legally Compliant Donation Receipt

Key Elements to Include in a Donation Tax Receipt

Personalization Tips for Receipts

Handling Non-Monetary Contributions in Receipts

Tracking and Storing Receipts for Tax Purposes

Common Mistakes to Avoid When Issuing Receipts

Include the donor’s name, address, and the donation amount on each receipt. Specify the date of the contribution and the nonprofit’s name, including its tax-exempt status. For monetary donations, state the amount, while for non-monetary donations, provide a detailed description of the donated items or services.

Make sure the receipt mentions whether the donor received any goods or services in exchange for their contribution, as this impacts the deductible amount. If no goods or services were exchanged, this should be explicitly noted.

Tailor each receipt to the donor by including their personalized information and a heartfelt acknowledgment. A small note of appreciation will make the donor feel valued and can encourage continued support.

For non-monetary gifts, include the fair market value of the items donated if possible. If the value can’t be determined, indicate that the donor is responsible for valuing the donation for tax purposes.

Store all receipts securely, both digitally and physically. Keep detailed records of all donations, including receipts, for at least seven years. This ensures you meet tax reporting requirements and are prepared in case of an audit.

Avoid mistakes like missing dates, incorrect donor names, or inaccurate donation values. Make sure to double-check each receipt before issuing it to ensure it’s legally compliant and error-free.