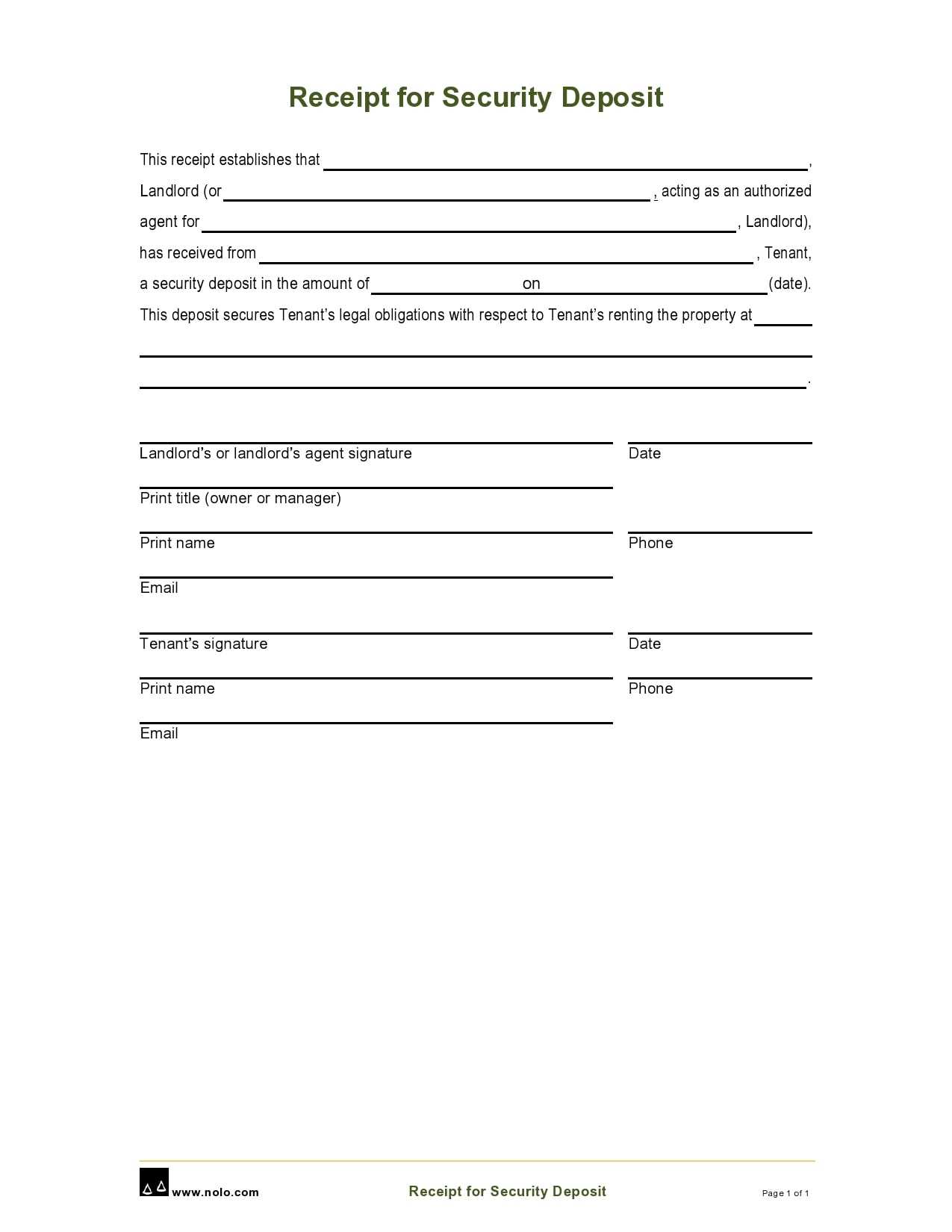

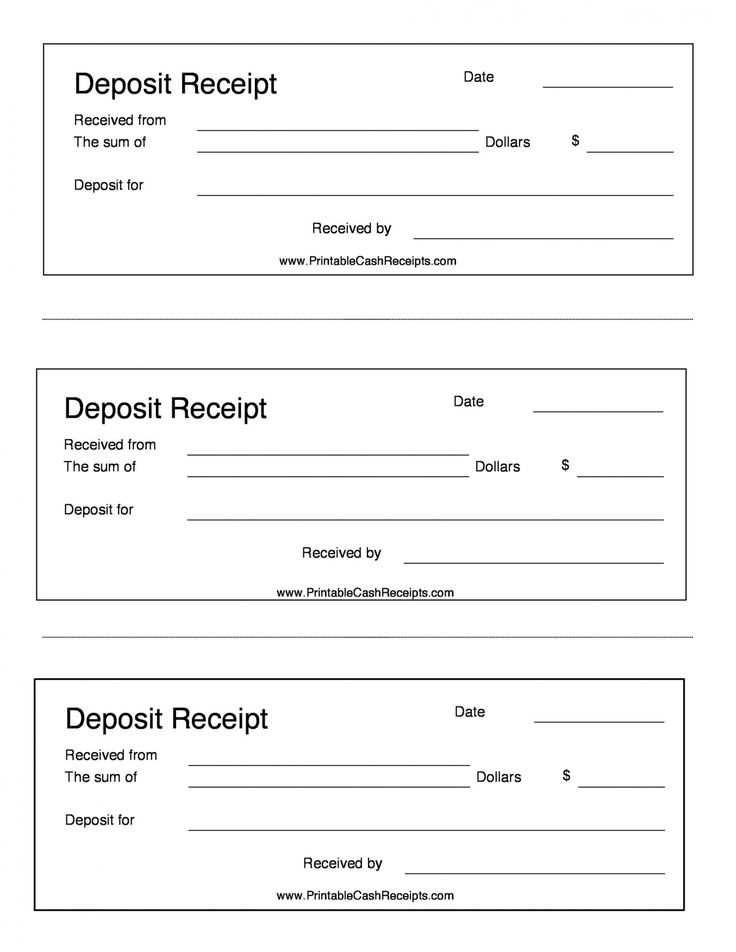

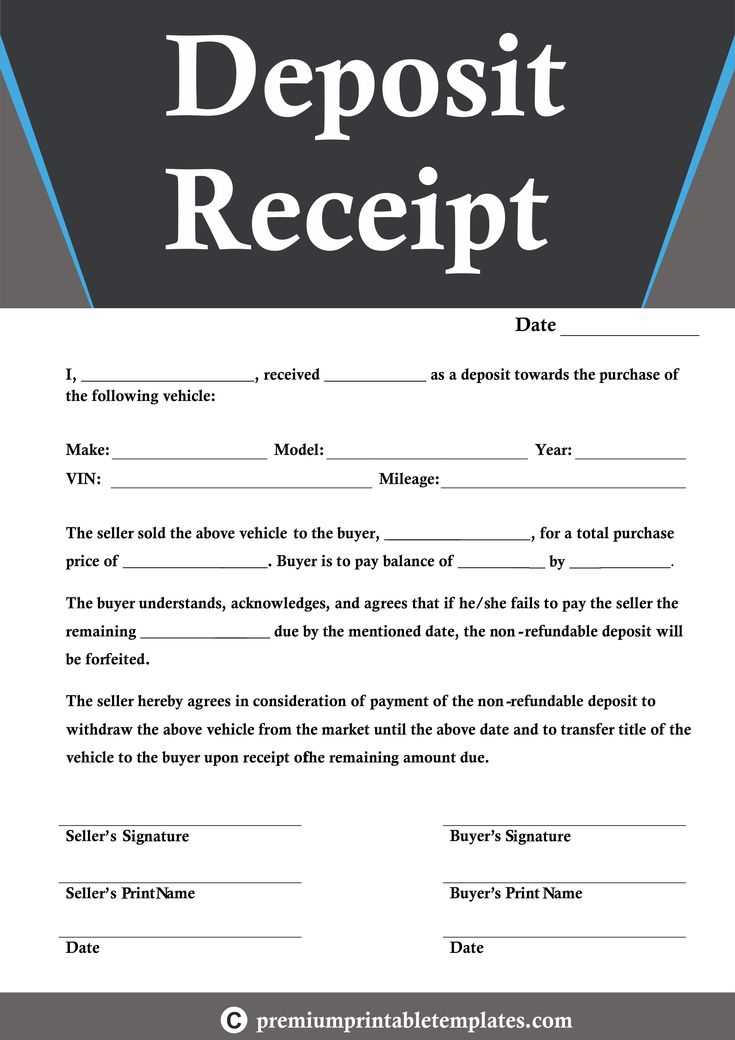

To simplify the process of selling a car, it’s important to have a clear, professional deposit receipt. A deposit receipt serves as proof of payment and outlines the terms agreed upon by both parties. By using a template, you can ensure that all necessary details are included and reduce the likelihood of confusion.

The template should include the buyer’s name, the seller’s name, the amount of the deposit, and the date of the transaction. Be specific about the payment method, whether it’s cash, check, or electronic transfer. Clarifying the deposit’s purpose, such as securing the car or holding it for a specific period, helps avoid misunderstandings.

Additionally, include details about the remaining balance, the agreed-upon date for full payment, and any terms for refunding the deposit if the deal falls through. Having these elements clearly laid out helps both parties stay on the same page and protects the transaction.

Here’s the updated version:

Update the deposit receipt to include detailed buyer and seller information, the amount deposited, and the agreed upon terms for the car sale. A clear breakdown of payment methods and deadlines will ensure that both parties are on the same page. Ensure that the receipt has a section for the buyer’s and seller’s signatures to confirm mutual understanding.

| Detail | Description |

|---|---|

| Buyer Information | Name, contact information, and address of the buyer |

| Seller Information | Name, contact information, and address of the seller |

| Deposit Amount | Clearly state the amount paid as a deposit |

| Payment Method | Specify the method of payment (cash, check, bank transfer, etc.) |

| Payment Deadline | Clearly state the due date for the remaining balance |

| Signatures | Spaces for buyer and seller signatures to validate the receipt |

This structure ensures a straightforward, understandable receipt, which is key for both parties’ peace of mind. Confirm all information is correct and complete before signing.

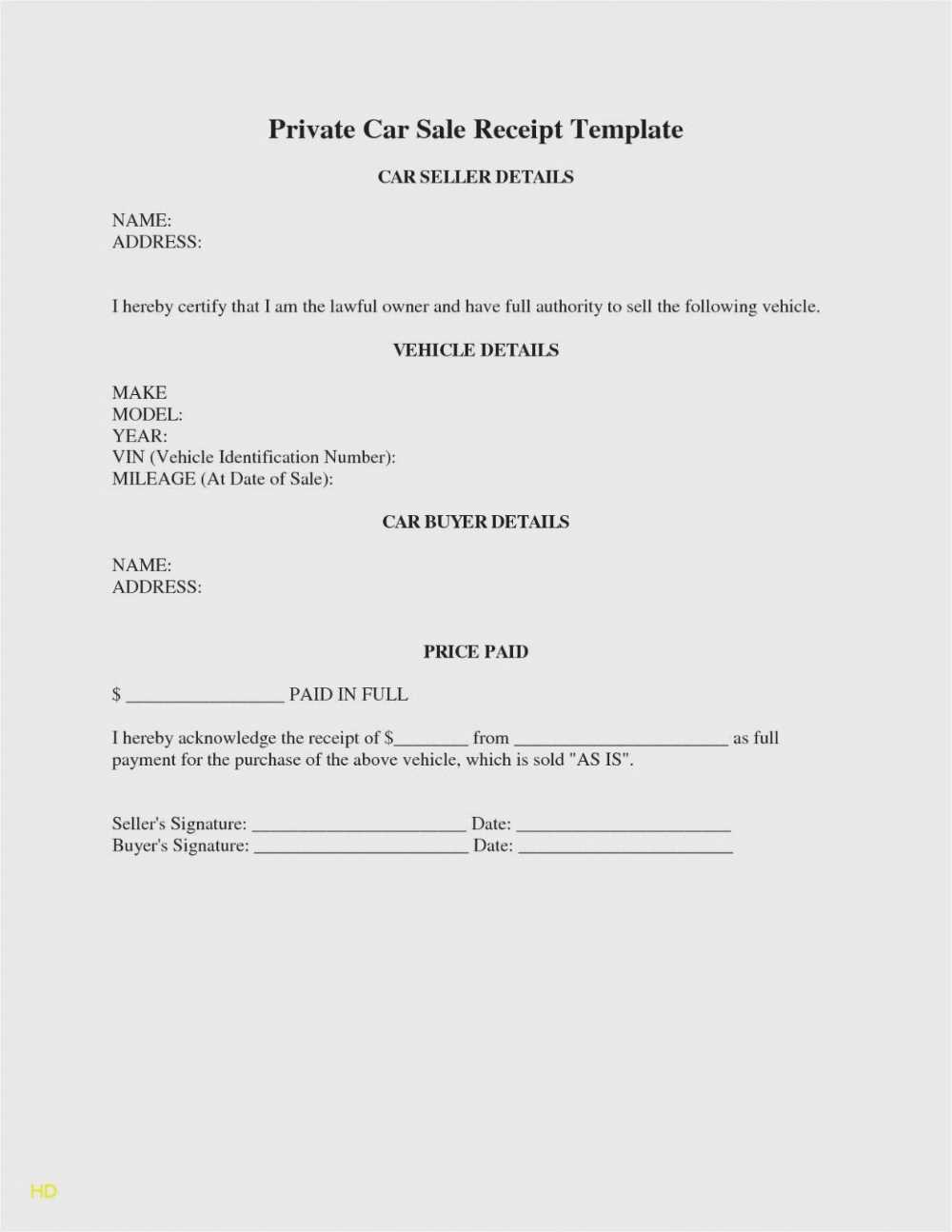

- Deposit Receipt Template for Car Sale

When preparing a deposit receipt for a car sale, make sure it includes specific details to protect both the buyer and the seller. Here’s what to include:

- Date of Transaction: Clearly state the exact date when the deposit was made.

- Buyer and Seller Information: Include the full names, addresses, and contact details of both parties.

- Vehicle Details: Provide a description of the car, including make, model, year, VIN (Vehicle Identification Number), and any other identifiers.

- Deposit Amount: Specify the amount of money received as a deposit. Include the method of payment (cash, check, bank transfer, etc.).

- Total Purchase Price: Mention the agreed-upon price for the car and clarify how the deposit will be applied to the total amount.

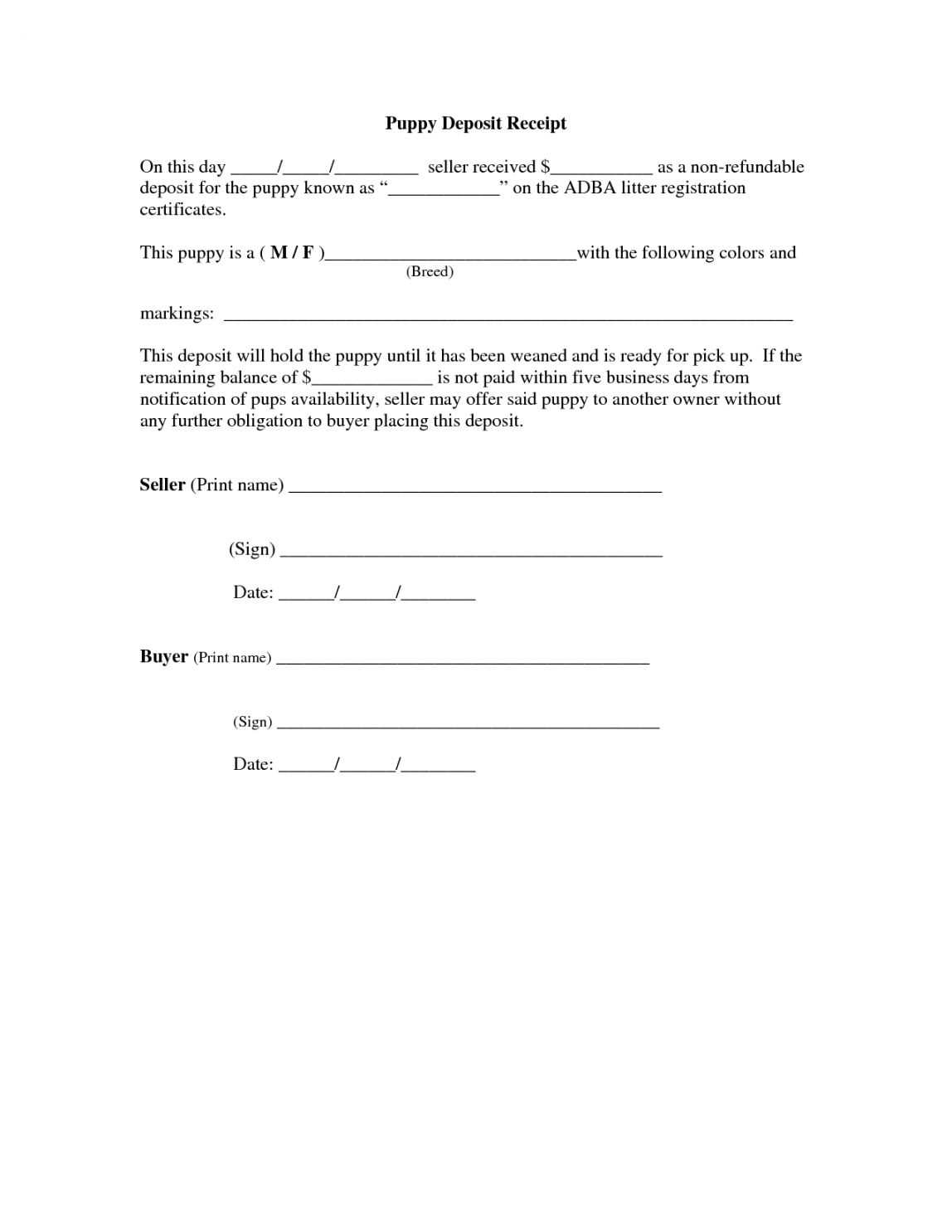

- Refund Conditions: If applicable, state the terms under which the deposit is refundable or non-refundable.

- Agreement to Finalize Sale: Include a clause that confirms both parties intend to complete the transaction based on the agreed terms.

- Signature of Buyer and Seller: Ensure both parties sign the receipt to validate the transaction.

This template helps ensure a smooth transaction by clearly outlining the details of the deposit and any related agreements. Make sure both parties review the receipt before signing to avoid misunderstandings.

Clearly outlining the deposit breakdown ensures both parties understand the financial aspects of the sale. List the total deposit amount at the top, followed by a clear explanation of each component. For example, if the deposit is split into smaller portions, break down how much of it goes toward the car price, taxes, or any additional fees.

Detailing Payment Categories

Each part of the deposit should have a labeled section, such as “Car Price Deposit,” “Tax Contribution,” and “Processing Fees.” This transparency prevents misunderstandings. Provide the amounts in each section and their respective percentages of the total deposit.

Clarifying Refundable and Non-Refundable Amounts

If any part of the deposit is non-refundable, state this explicitly. For refundable portions, specify the conditions under which they can be returned. Including these details gives clarity and helps both parties avoid confusion later.

Include both parties’ names, addresses, and contact information. Specify the vehicle’s make, model, year, and Vehicle Identification Number (VIN). Clearly mention the agreed sale price and payment method. If a deposit has been made, state the exact amount and the payment date. List the vehicle’s mileage at the time of sale. Note whether the vehicle is sold “as-is” or with a warranty, if applicable. Mention the transaction date and include both parties’ signatures to confirm the agreement.

Additional Details

Include any extra items included in the sale, such as keys, manuals, or spare parts. If the buyer is expected to make future payments, outline the payment terms and due dates.

Ensure the receipt includes all required information, such as the buyer and seller’s full names, contact details, and vehicle specifics like make, model, and VIN number. This establishes the legal ownership of the vehicle and prevents disputes later on.

Include the payment amount and the date of the transaction. Specify whether the payment is in full or a partial deposit, and note any balance due. Both parties must sign the receipt, acknowledging the agreement and confirming the transaction details.

Be clear about the terms of the sale, including any warranties or conditions. This transparency minimizes the risk of misunderstandings between the buyer and seller.

To avoid issues with tax authorities, ensure the receipt complies with local tax regulations. In some regions, sales tax or VAT must be included in the payment amount. Verify the applicable tax rate and apply it correctly.

For a clear and legally valid document, follow these steps to format the receipt:

| Required Information | Details |

|---|---|

| Buyer Name | Full legal name of the buyer |

| Seller Name | Full legal name of the seller |

| Vehicle Information | Make, model, VIN, year, color |

| Payment Amount | Total amount paid or deposit |

| Date of Transaction | Date payment was made |

| Terms and Conditions | Warranties, balance due, and special conditions |

| Signatures | Signature of buyer and seller |

Double-check local legal requirements to ensure the document is valid. For example, some jurisdictions may require notarization or additional disclosures. Review these regulations to guarantee full compliance.

For clarity, structure the receipt in a straightforward manner. Begin with the date and time of the transaction. This provides context for both parties, ensuring there is no confusion about when the sale occurred.

Key Details to Include

Ensure that the buyer and seller’s full names, addresses, and contact information are listed clearly. This helps prevent misunderstandings if questions arise later. Add a description of the car being sold, including its make, model, year, and Vehicle Identification Number (VIN), ensuring the information is easily readable.

Payment Information

Outline the total payment amount, specifying any down payment or remaining balance. If the payment method is by check or bank transfer, include the relevant details. For added transparency, break down additional costs such as taxes or registration fees, if applicable.

Finish with a simple signature section for both parties. This final step confirms mutual agreement and helps ensure the transaction is legally valid.

Be specific with the deposit amount. Always state the exact sum of money paid by the buyer to avoid confusion or disputes later. Avoid using vague terms like “some” or “a portion of the total price.” A clear amount should be written, including the currency.

Do not omit the vehicle details. List the make, model, year, and VIN (Vehicle Identification Number). Missing or incorrect details can lead to problems when completing the sale or with registration.

Failing to include the date can cause problems, especially if there are delays or misunderstandings. Always note the exact date of the deposit to provide a clear reference point.

Don’t skip the payment method. Clearly indicate how the deposit was made, whether it was by cash, check, or bank transfer. This helps both parties track the transaction history and avoid confusion later.

Be sure to outline any contingencies or conditions that affect the deposit. If the deposit is refundable under certain circumstances, state the terms explicitly. Avoid ambiguity about refund policies.

Lastly, don’t forget to have both parties sign the receipt. An unsigned document lacks legal validity and may not protect either party in case of disputes. Always ensure both the buyer and the seller sign and date the receipt.

To tailor a deposit receipt template for different car sale situations, focus on adjusting key sections based on the transaction type. For private sales, include buyer and seller details, vehicle condition description, and agreed payment amount. For dealership sales, you might want to highlight financing details, terms of trade-in offers, and applicable taxes or fees. Ensure that each sale type clearly states the deposit amount and what it secures, such as a reserved vehicle or a partial payment for the car. Include cancellation terms, refund conditions, and the time frame for final payment, based on the nature of the sale.

Private Sale Customizations

For private car sales, the template should outline the agreement between two individuals. Incorporate specific terms about the car’s current state, including any repairs or issues discussed prior to the transaction. It’s essential to note the deposit amount, which might serve as a commitment to hold the car for a certain period. Clarify whether the deposit is refundable under any circumstances and specify any relevant conditions for refunding the amount.

Dealership Sale Customizations

In dealership transactions, the deposit receipt should reflect the more formal structure of the sale. Include details such as the dealer’s contact information, any trade-in vehicle involved, and the financing agreement if applicable. Make sure to list any promotions, extended warranties, or optional extras. Clearly define deposit terms and the balance payment schedule, as well as the dealership’s refund policy in case of financing rejection or other cancellation scenarios.

Deposit Receipt Template for Car Sale

Make sure the receipt includes all relevant information for both the buyer and the seller. The document should detail the deposit amount, vehicle information, and terms of the sale. Include clear fields for the date, seller’s and buyer’s contact details, and the agreed upon payment schedule. Specify whether the deposit is refundable or non-refundable.

Key Information to Include

- Buyer’s Name and Contact Information: Always collect full name, address, and phone number.

- Seller’s Name and Contact Information: Same as above to ensure clarity and transparency.

- Deposit Amount: Clearly state the sum being paid as a deposit.

- Vehicle Details: Include make, model, year, VIN number, and color.

- Payment Terms: Include the remaining balance and the due date.

- Refund Clause: Clearly specify if the deposit is refundable or not.

- Signature Lines: Ensure both buyer and seller sign the receipt for verification.

Why This Template Works

By including all these details, you avoid potential disputes and provide a clear record for both parties. This template ensures transparency and secures the transaction with all necessary information for future reference.