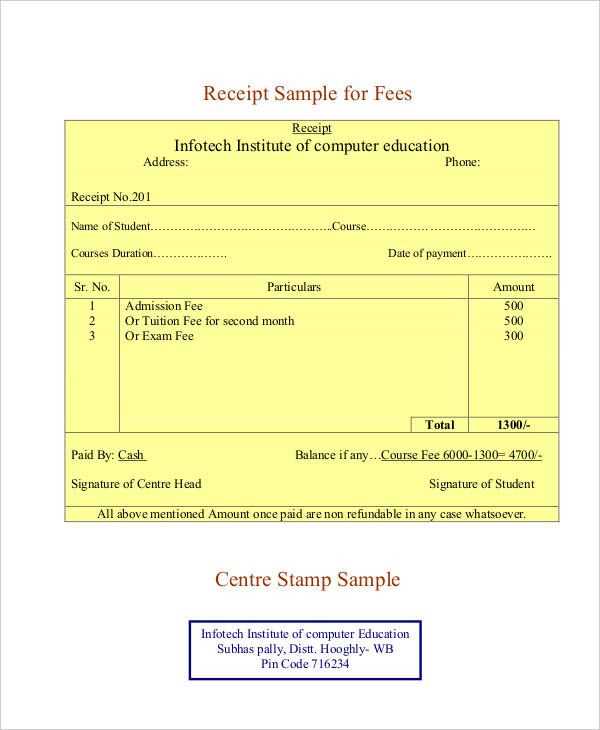

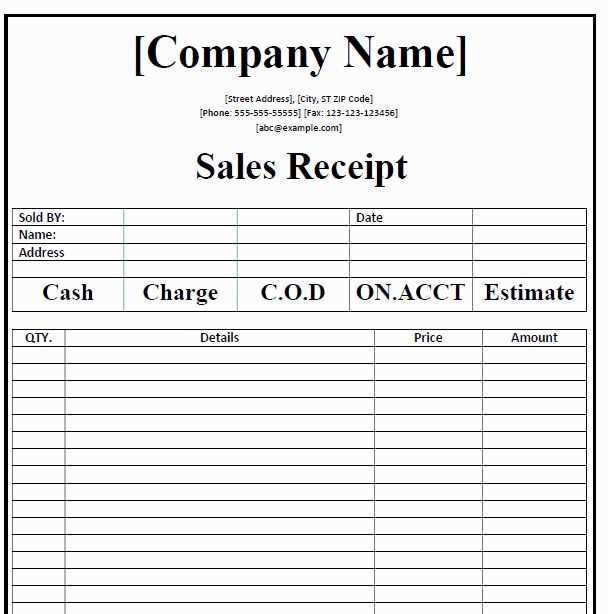

Key Elements to Include

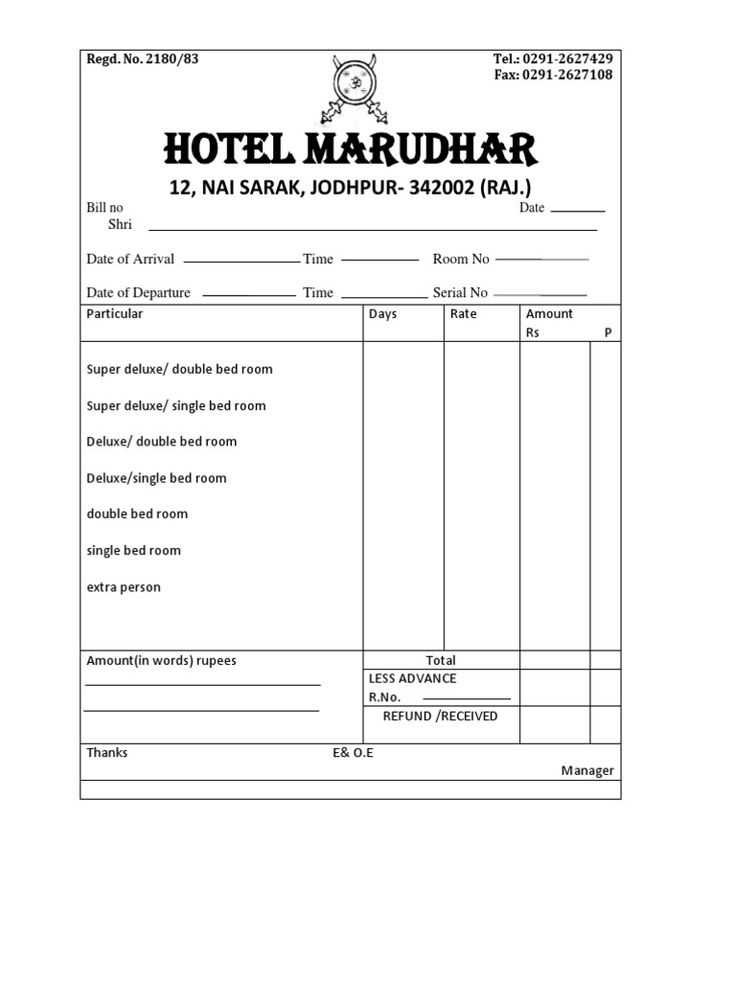

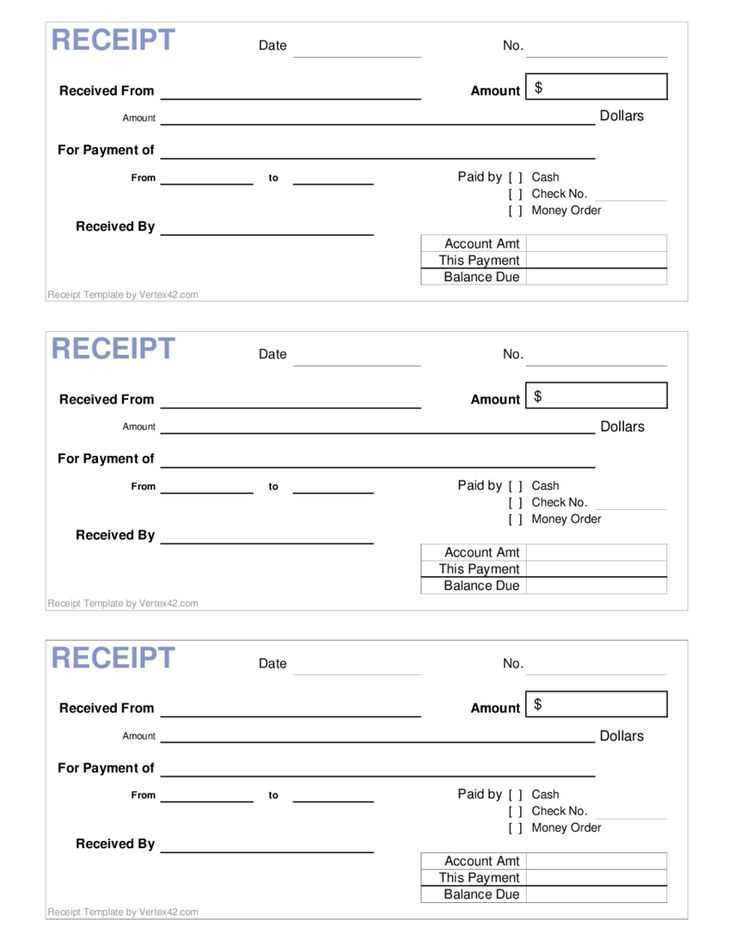

To create a professional lodging receipt template, include the following components:

- Guest Information: Name, contact details, and booking reference number.

- Accommodation Details: Room number, check-in and check-out dates, and the number of nights stayed.

- Charges Breakdown: List all applicable charges, including room rate, taxes, and any additional services such as parking or internet usage.

- Payment Details: Specify the method of payment used (e.g., credit card, cash, or online payment).

- Total Amount Paid: Include the total payment after taxes and fees.

- Hotel Information: Include the name, address, and contact number of the property.

- Receipt Number: A unique reference number for the transaction.

Formatting Tips

Ensure your template is clear and easy to read. Here are some tips:

- Use clear headings: Label sections like “Guest Information,” “Charges,” and “Payment Details” to guide the reader.

- Align totals clearly: Make sure the total amount paid stands out by using bold text or a larger font size.

- Use itemized lists: Break down the charges to provide a detailed view of the payment.

- Provide space for signatures: Include a space at the bottom for both the guest and hotel representative’s signatures, confirming the transaction.

Why It’s Useful

A well-organized lodging receipt template helps ensure transparency between guests and the hotel, clearly detailing all charges and payments. It also serves as an official document for both parties, useful for expense reports, tax purposes, and any future queries.

How to Format Your Lodging Receipt for Professional Purposes

Key Legal Aspects When Creating a Lodging Receipt

Customizing Your Template for Various Lodging Types

How to Integrate the Template into Your Accounting System

Start with clear, consistent information. Include the lodging provider’s name, address, and contact details, along with the guest’s full name and the dates of stay. Specify the room rate, any applicable taxes, additional fees (e.g., service charges), and the total amount paid. Ensure the receipt has a unique identifier such as a receipt number or reference code for easy tracking.

Key Legal Aspects

Make sure the lodging receipt includes the legal requirements of your region. For example, in some areas, it’s mandatory to list the tax identification number of the provider. You may also need to provide an itemized breakdown of charges, particularly for tax or reimbursement purposes. Check local regulations to ensure compliance.

Customizing Your Template

Adapt your receipt template for different types of accommodations. For hotels, the receipt should feature room types, occupancy details, and check-in/check-out times. For vacation rentals or hostels, include specifics like the property type, any cleaning or booking fees, and rental terms. A flexible, customizable template will save time and reduce errors when generating receipts for various lodging types.

Integrate your lodging receipt template with your accounting system by ensuring it supports data export. This allows for seamless record-keeping, expense tracking, and invoicing. By linking your receipt template directly to your accounting software, you reduce manual entry errors and enhance financial transparency.