Cash receipt templates in Excel provide a straightforward way to track payments and keep records organized. They simplify the process of documenting transactions, helping businesses stay on top of incoming payments. A well-designed template allows for easy customization to fit different needs, whether for personal use or small business transactions.

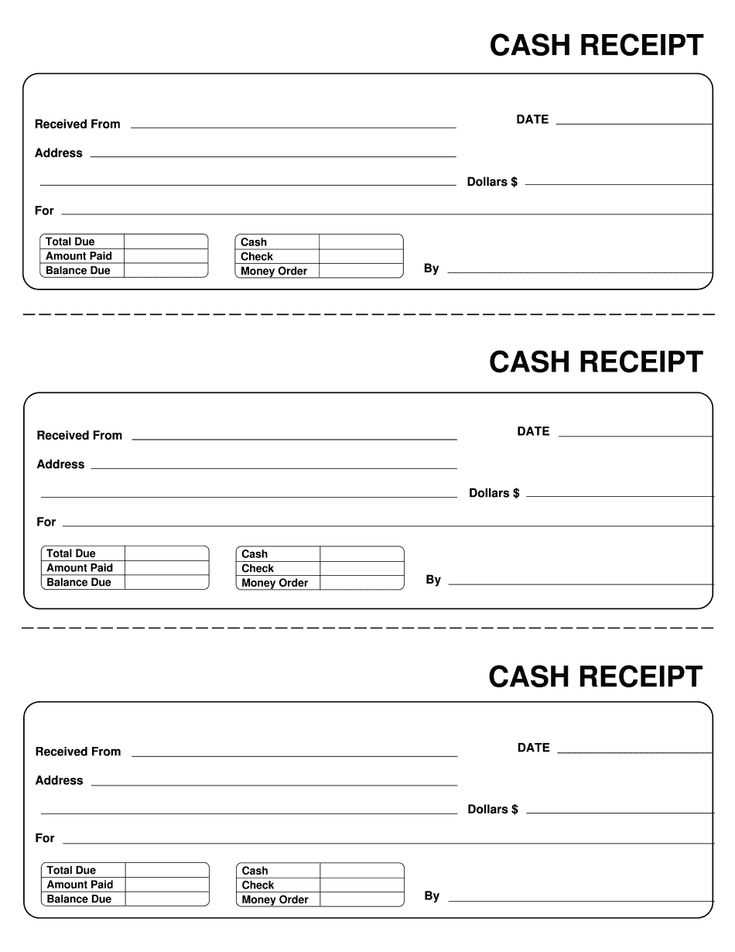

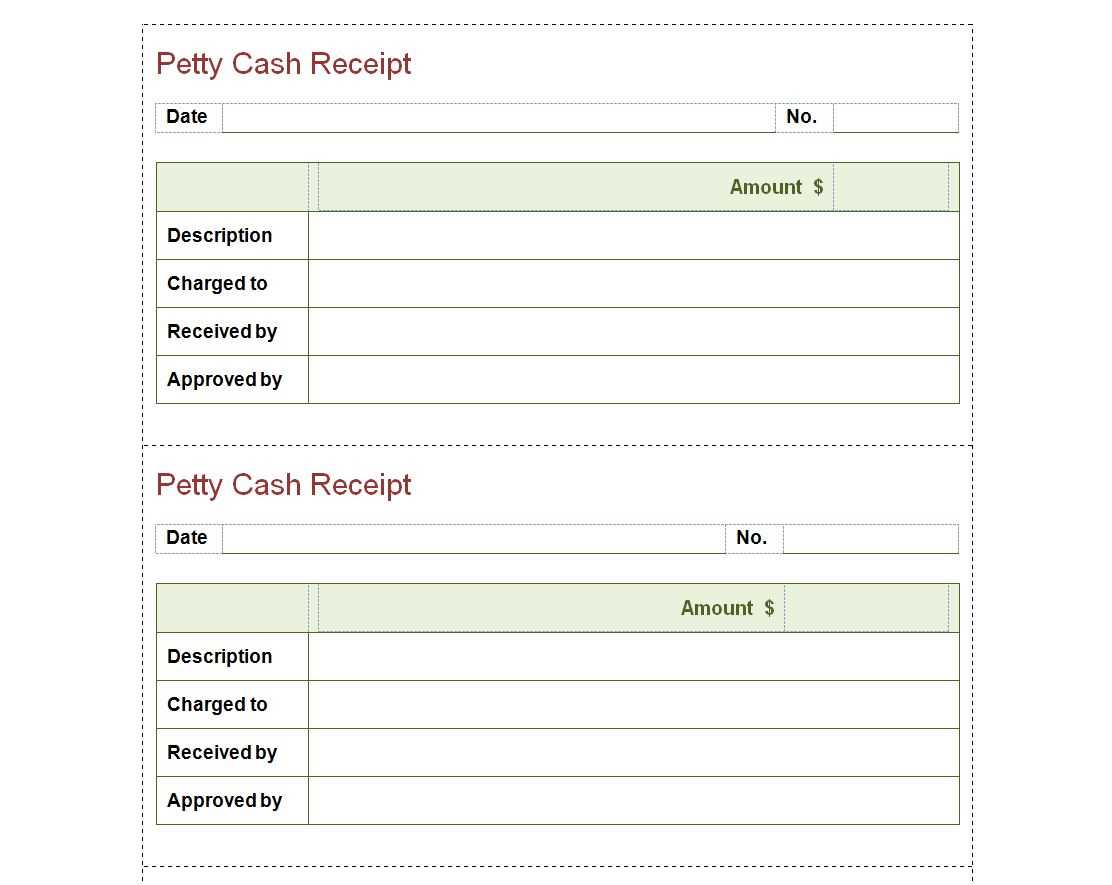

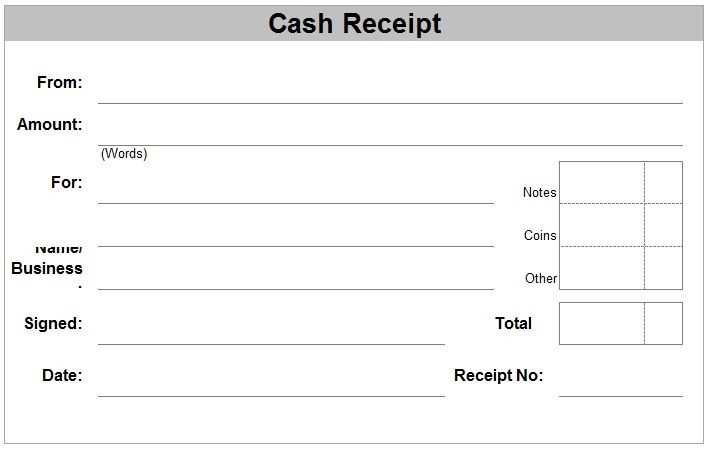

Customize for Your Needs – Excel templates can be tailored to include details such as payer information, amount, date, payment method, and a unique receipt number. Adjusting these fields ensures that your receipts match your specific requirements. You can even add custom columns for additional notes or descriptions as needed.

Track Payments with Ease – Using a cash receipt template in Excel makes it easier to monitor cash flow. With built-in formulas, you can automatically calculate totals and ensure your records are accurate. Excel’s sorting and filtering features also help you quickly locate specific receipts or review payment history over time.

By using cash receipt templates in Excel, you can streamline the way you handle receipts, making the process both faster and more reliable. These templates provide the structure needed to keep records consistent and professional.

Here’s a refined version without excessive repetition of words:

When creating a cash receipt template in Excel, keep it simple and clear. Focus on accuracy and organization to avoid confusion. Start with key columns: Date, Amount, Payment Method, and Description. Use basic formulas for calculations and totals to ensure correctness.

For better readability, apply borders and shading to separate sections. This makes it easier to track payments, especially when dealing with multiple transactions. Include a unique receipt number for each entry to ensure proper documentation and tracking.

| Date | Amount | Payment Method | Description | Receipt Number |

|---|---|---|---|---|

| 2025-02-05 | $200 | Cash | Consulting services | 001 |

| 2025-02-06 | $150 | Credit Card | Product sale | 002 |

Ensure that each receipt entry is clearly formatted, with no unnecessary information. This keeps the record easy to understand for both parties. A well-organized template will reduce errors and speed up your workflow.

- Cash Receipt Templates in Excel

To create an organized cash receipt template in Excel, begin by setting up clear columns for key transaction details. Start with the date, followed by the payer’s name, the amount received, and the payment method (e.g., cash, cheque, or credit card). Add a column for a brief description of the transaction and a space for both the recipient’s and payer’s signatures if needed.

Steps to Build the Template

- Open Excel and create a new sheet.

- Label your columns as follows: “Date”, “Payer’s Name”, “Amount”, “Payment Method”, “Description”, and “Signature”.

- Format the “Amount” column to show currency values.

- Use Excel’s built-in table format to make data entry easier and more organized.

- Consider adding data validation rules for fields like “Payment Method” to ensure consistent input.

Customization Tips

- If you frequently use this template, save it as a reusable model by protecting the sheet or locking specific columns to avoid accidental changes.

- For better readability, apply conditional formatting to highlight certain values, such as amounts over a specified threshold.

- Integrate a total section at the bottom to calculate the sum of all receipts in a given period.

Choose a template that directly aligns with your business’s transaction needs. If you’re a small retail business, opt for a straightforward, user-friendly receipt that includes the basics: item descriptions, quantity, price, and total amount. For service-based businesses, ensure your template includes detailed information such as hourly rates, services provided, and applicable taxes.

Look for templates that are easy to modify and can accommodate your branding. Templates with customizable fields allow you to include your company logo and adjust font styles, making your receipts look professional without additional software. Also, ensure that the template you choose allows for both print and digital formats, giving your customers options based on their preferences.

Consider templates that integrate with your financial tracking systems. For businesses already using accounting software, selecting a receipt template that can export data directly into your financial records reduces manual entry and streamlines your operations.

If your business deals with multiple currencies or tax rates, make sure the template supports these features. A receipt template designed for international transactions will save time and reduce errors, especially if your business operates in different regions.

Lastly, ensure that your selected template complies with local tax and business regulations. A good template should adhere to the standards required in your jurisdiction, ensuring that all necessary legal information is clearly displayed on each receipt.

Modify cash receipt templates to match particular transaction types, industries, or reporting standards. This ensures that the template fits your specific requirements without unnecessary complexity.

- Define the Fields: Identify key information like the payer’s name, payment amount, date, and purpose. Customize fields to reflect the transaction details that matter most to your operations.

- Incorporate Tax Calculations: If applicable, include tax fields in the receipt template. Clearly separate the base amount and tax amount to simplify calculations for both you and your customers.

- Design for Readability: Keep the layout clean with sufficient spacing and clear labels. Ensure the receipt is easy to understand at a glance. This can help customers recognize key details without confusion.

- Add Company Branding: Incorporate your company logo and contact information. This makes your receipts look professional and reinforces your business identity.

- Include Payment Method: Specify the payment method, whether it’s cash, card, or check. This provides clarity on how the payment was made, which is useful for both parties for record-keeping.

- Customize for Industry Standards: Depending on your industry, tailor your receipt template to align with specific legal or regulatory requirements. For example, some industries might require a breakdown of services or materials provided.

- Set Up Automatic Calculations: Utilize Excel’s built-in functions to automatically calculate totals, taxes, or discounts based on inputted values. This reduces the chances of manual errors.

Adapting these elements to your cash receipt template can streamline your financial documentation and improve consistency across transactions.

Use Excel formulas to streamline the process of calculating totals in your receipt templates. By incorporating basic functions such as SUM, multiplication, and subtraction, you can automate the most common calculations, reducing the chance of errors and saving time. For example, apply the SUM formula to add up the prices of multiple items in a receipt, ensuring that the total is always accurate without manual input.

Setting Up Formulas for Item Prices

For item prices, use the multiplication function to calculate the total cost. Suppose you have a column for quantity and another for unit price. In the corresponding row of the total column, multiply the quantity by the unit price using the formula =B2*C2 (where B2 is the quantity and C2 is the unit price). This simple formula ensures that the total cost for each item is automatically calculated.

Calculating Discounts and Taxes

If your receipt includes discounts or taxes, Excel can handle those calculations too. For instance, to apply a discount, you can use the formula =D2*(1-E2), where D2 is the original price and E2 is the discount percentage. For tax calculation, use the formula =D2*F2, where D2 is the price after discount and F2 is the tax rate. These formulas will update automatically as the input values change.

By automating these calculations, you ensure that your receipt templates remain accurate and up to date without the need for manual intervention. This reduces the chances of mistakes and makes it easier to manage multiple receipts at once.

To accurately track payments in receipts, it’s vital to organize and categorize each payment method used. Set up a clear structure in your Excel template with separate columns for cash, credit/debit card, mobile payments, and other payment forms. This ensures clarity and quick access to specific payment data.

Cash Payments

For cash transactions, note the amount in a dedicated column. Include a reference for change given or received to avoid discrepancies. Make sure to calculate the total cash at the end of each day, confirming it matches your records.

Card and Mobile Payments

Record card payments by indicating the card type (Visa, MasterCard, etc.) and the transaction number. For mobile payments like Apple Pay or Google Pay, log the payment method and transaction details. This approach helps to distinguish between the different payment methods used by customers, simplifying future audits and reports.

Double-check the math: Always verify calculations, especially totals, tax rates, and discounts. A small mistake in numbers can lead to confusion and undermine the credibility of the receipt. Use Excel’s built-in formulas like SUM and MULTIPLY to automate the math and minimize errors.

Use templates: Create or download pre-formatted templates that have standard fields like item name, quantity, price, and subtotal. This reduces the chances of missing key details and ensures consistency across receipts.

Consistent formatting: Establish a uniform format for your receipts, such as date format (MM/DD/YYYY) and currency symbols. A consistent approach reduces the likelihood of confusing recipients or creating errors in the document.

Input validation: If possible, set data validation rules in Excel to restrict the entry of incorrect values. For instance, limit the text field for quantities to only accept numbers and prevent errors like entering a letter where a number is required.

Cross-check customer details: Mistakes in customer names, addresses, or email addresses can cause problems. Always verify that the information matches what is provided or on record, especially for returns or follow-up communication.

Review before sending: Before finalizing and sending receipts, do a final review to ensure everything is accurate. This extra step can catch mistakes that may have been overlooked during data entry.

To save an Excel template, select “File” and click “Save As.” Choose “Excel Template” (*.xltx) from the file type options. This ensures that your template remains intact and can be reused without overwriting the original document. It’s recommended to save the template in a dedicated folder for easy access in the future.

Sharing Templates via Email or Cloud Storage

To share the template, simply attach the .xltx file to an email or upload it to a cloud storage service like Google Drive or OneDrive. Sharing via cloud storage allows multiple users to access the template from different devices. Make sure the permissions are set correctly, especially if you want others to only view or edit the template.

Using Template Links for Quick Access

If you need to provide quick access to the template, consider generating a link from your cloud storage. This eliminates the need for attachments and keeps the template centralized. Users with the link can download or make a copy without altering the original version.

To streamline your accounting process, consider using Excel templates for cash receipts. These templates offer a practical solution for recording transactions, reducing the chance of errors. Use predefined fields like date, payer details, payment method, and the amount received. This format ensures quick entry and tracking of your cash inflows.

Start by customizing the template to fit your business needs. Include relevant columns such as transaction description and reference number, which can help identify each receipt uniquely. This will provide clear documentation for both internal purposes and audits.

Keep track of all payments, even small ones, by using separate rows for each receipt. This will make it easier to reconcile cash flows at the end of the month or quarter. Also, implement a simple formula to calculate the total amount received for a given period, providing a quick financial overview.

Regularly update and back up your templates. This avoids the risk of data loss and ensures you always have an accurate record. Share the template with team members responsible for managing payments, ensuring consistency across the organization.