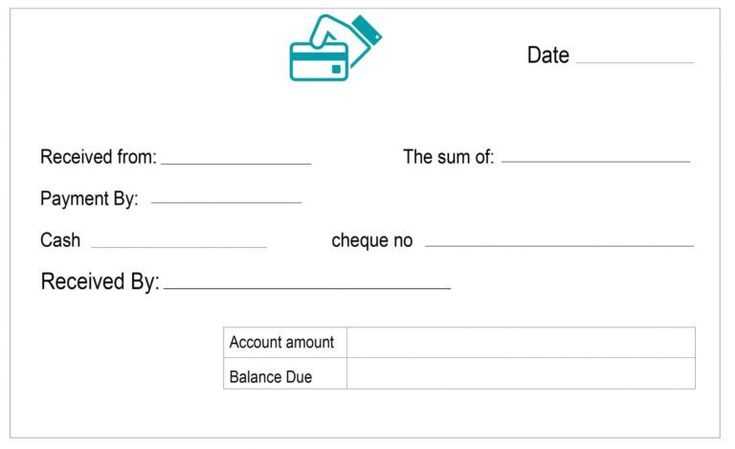

A well-organized cash receipt template streamlines transactions and ensures clarity. This simple document acts as proof of payment for both businesses and customers, helping to avoid misunderstandings. Use a template that clearly outlines the date, amount, and payer details to maintain transparency and accuracy.

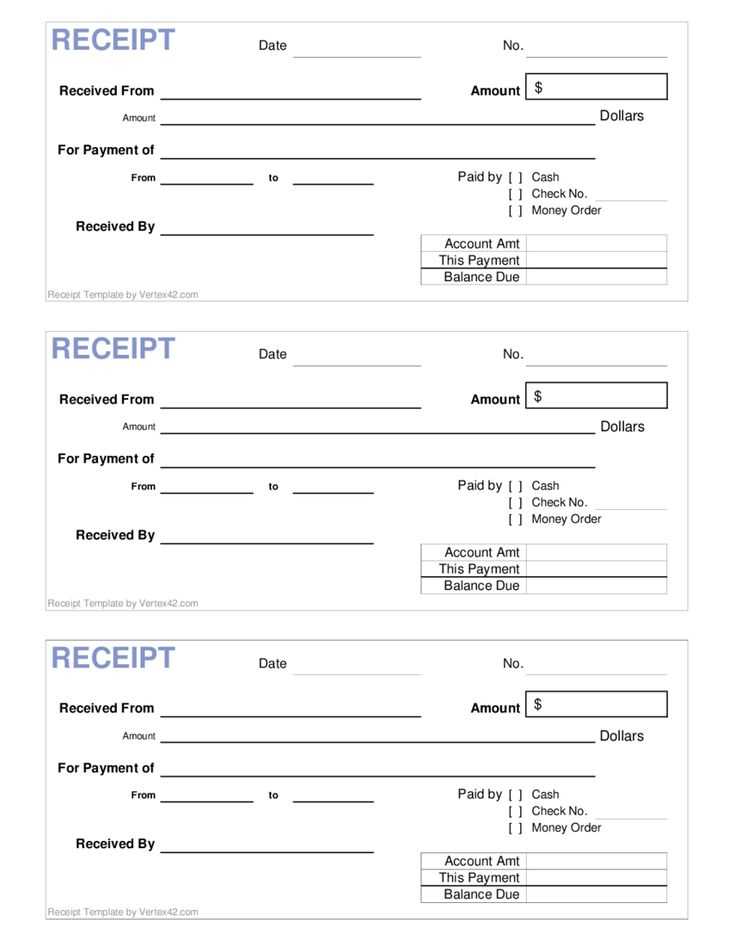

Incorporate a unique receipt number to track payments, which becomes especially helpful for bookkeeping. Ensure the template includes sections for both the amount paid and the remaining balance, if applicable. You can also add payment method details, whether it’s cash, check, or electronic transfer, to give the full picture of the transaction.

Choosing a clear and consistent format will save time and reduce errors. Customizing the template with your company logo and contact information adds a professional touch. Regularly reviewing and updating the template can further enhance its efficiency in daily operations.

Here’s the corrected version:

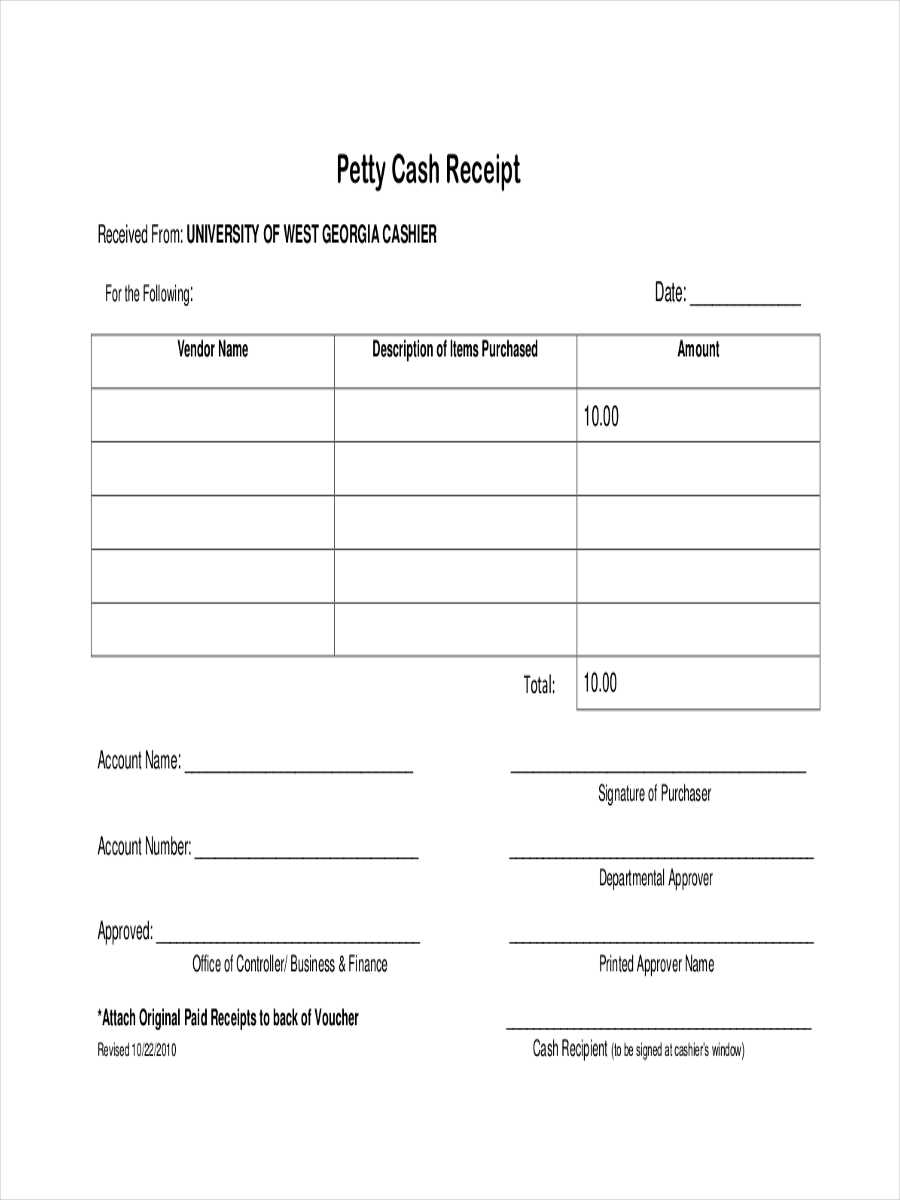

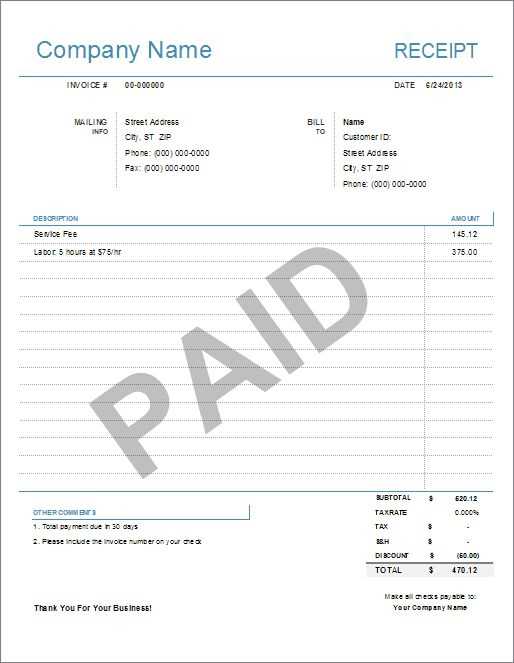

To streamline the receipt process, make sure your template clearly distinguishes between the payer and payee details. Include fields for the payer’s name, address, and contact information. List the amount paid and the method of payment, such as cash, check, or credit card. Additionally, add a section for a receipt number for easy reference. A signature line for both the payer and receiver ensures validity. Always include the transaction date, and specify whether taxes or discounts were applied to avoid confusion.

Ensure the template uses a clean layout. Clear headings, organized fields, and logical placement improve readability. Avoid clutter, and keep essential information to a minimum. This creates a user-friendly receipt that clients can quickly understand and use for their records.

Review the template regularly to ensure it meets any legal or industry-specific requirements. If you’re using this template in a business environment, adjust it to reflect your business’s branding and relevant regulations.

Business Cash Receipt Template: A Practical Guide

How to Create a Simple Template for Your Business Receipts

Key Information to Include in Your Receipt Template

Understanding Different Formats for Cash Receipts in Business

How to Customize Your Template for Specific Transactions

Best Practices for Organizing and Storing Receipts

How to Integrate Receipt Templates with Your Accounting System

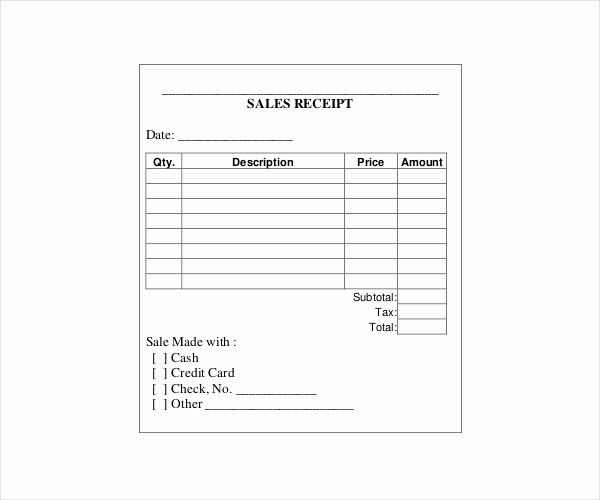

Start by incorporating the key components in your cash receipt template. Include fields for the date, receipt number, business name, buyer’s name, payment amount, payment method, and a description of the goods or services. Ensure there’s space for both your signature and the buyer’s, which can act as confirmation of the transaction. This basic structure ensures clarity for both you and the customer.

Different formats work for various business types. A simple cash receipt might be enough for small transactions, while more complex businesses may require detailed line items for each purchased product or service. Digital receipt templates can simplify record-keeping and make it easy to send receipts via email, while printed receipts can still be useful in a face-to-face transaction setting. Choose a format that aligns with your transaction volume and complexity.

Customize your template for specific transaction types. For example, if you’re dealing with a product sale, make sure to add fields for item details, quantity, and unit price. For service-based transactions, you can include hourly rates, work performed, and hours worked. Customizing these elements ensures that the receipt reflects the nature of each unique business interaction.

Organizing and storing receipts is key for smooth accounting. Keep digital copies of all receipts in a well-organized system, such as a cloud storage service with folders for each month or transaction category. If you deal with physical receipts, make sure they’re stored securely and grouped by date or category. Regularly backup digital records to prevent loss.

Integrating receipt templates into your accounting system saves time and prevents errors. Many accounting tools allow you to import receipt data directly from templates, making reconciliation and bookkeeping more straightforward. Consider using software that automatically generates receipts when you process a sale, ensuring consistency and accuracy across your records.