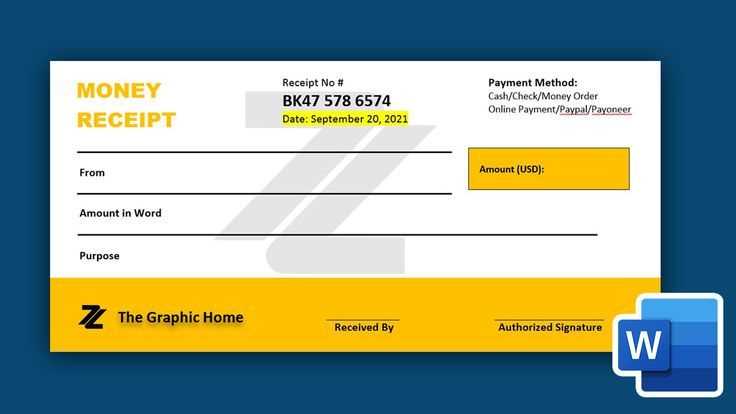

Use the Microsoft Cash Receipt Template to streamline your financial documentation. This pre-made template allows you to record cash transactions easily, ensuring accuracy and organization for your business. It’s designed to help you maintain a clear and concise record of received payments without having to start from scratch each time.

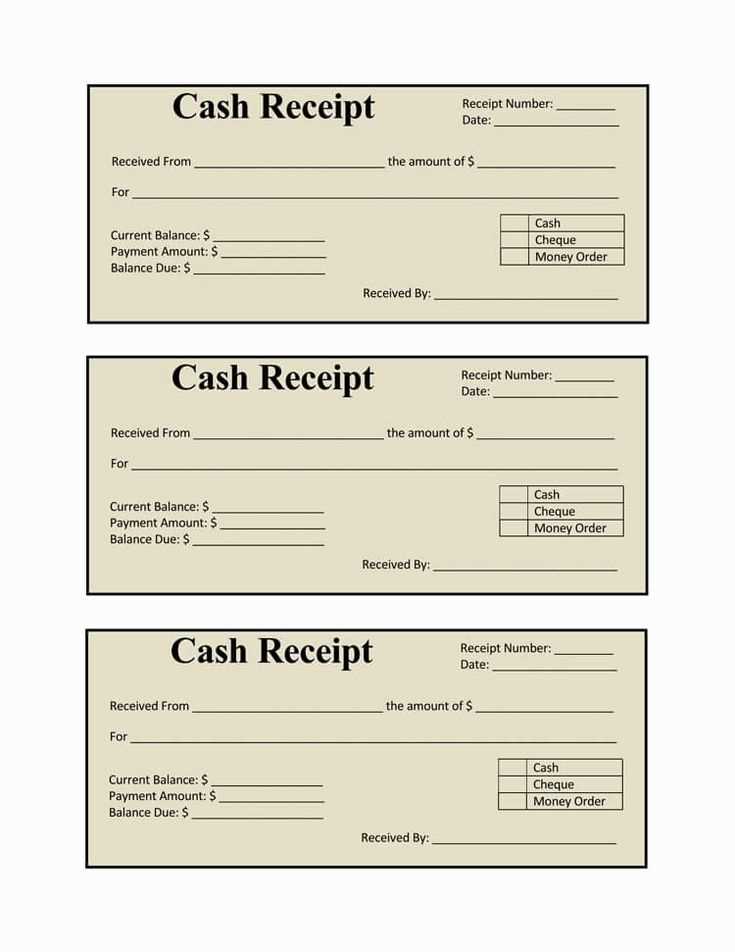

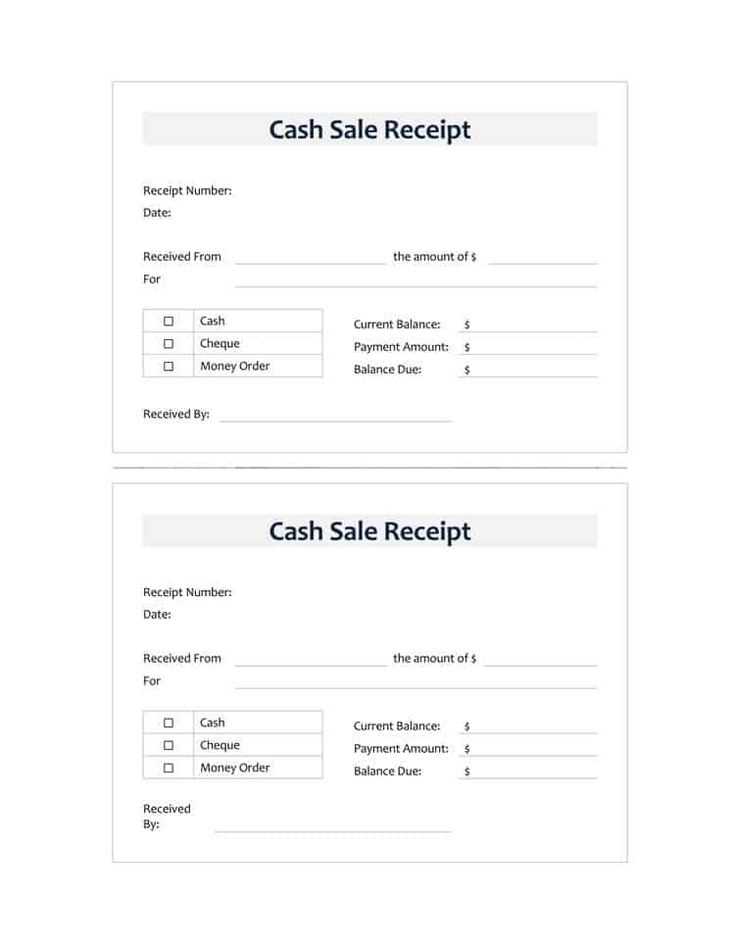

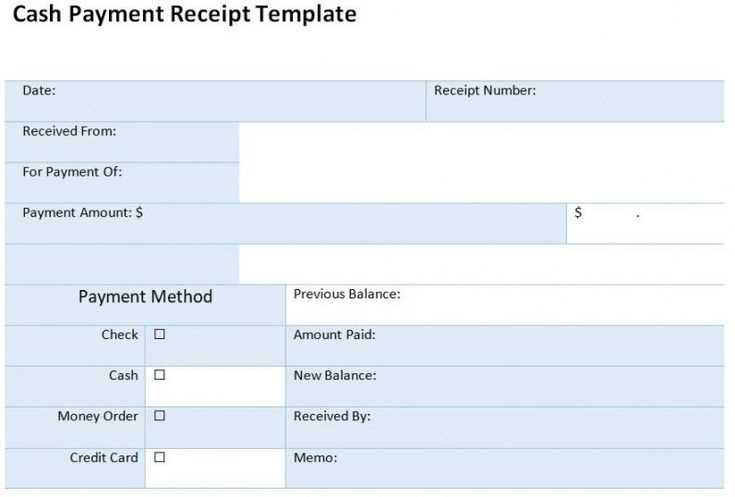

The template includes fields for date, amount received, payer information, and payment method. Customize it as needed to match your business’s specific requirements. You can also add notes for further details about the transaction, making it an excellent tool for tracking cash flow and preparing financial reports.

For efficiency, take advantage of the built-in formulas to automatically calculate totals and balances. This feature can save time and reduce human error when managing finances. Simply input the transaction details, and the template will handle the rest, allowing you to focus on other business priorities.

Here’s the corrected text:

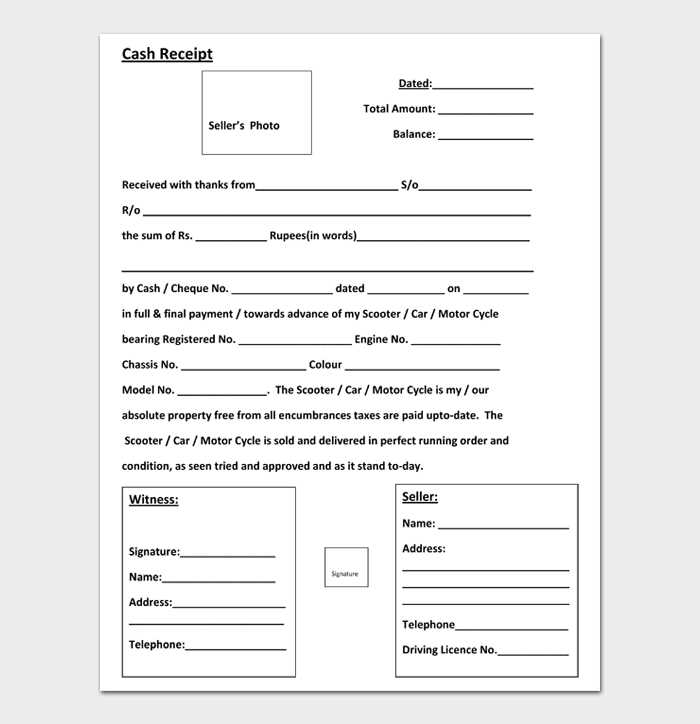

To use a Microsoft cash receipt template effectively, start by entering the transaction date and the amount received. Ensure that the payer’s information is clearly stated, including name and contact details. Use the description field to specify the purpose of the payment, such as for goods, services, or rent. Double-check that the payment method is indicated–whether cash, check, or electronic transfer. Also, ensure the total amount received matches the payment recorded, and include any applicable taxes if relevant.

If there are multiple items or services involved, list each separately with the corresponding amount for clarity. Don’t forget to include your business details such as the company name, address, and contact information to ensure the receipt looks professional. Save a copy for your records and send the receipt to the payer, either electronically or in paper form, depending on their preference.

Finally, review your template regularly to ensure it stays aligned with your business needs and complies with local tax regulations. Make updates as needed to keep everything accurate and efficient.

Microsoft Cash Receipt Template: A Practical Guide

How to Create a Cash Receipt in Microsoft Excel

Customizing Your Receipt Template for Various Payment Methods

Adding Payment Information and Terms to Your Receipt

Managing Multiple Receipts in One Template for Different Transactions

Integrating the Receipt Template with Your Accounting System

Best Practices for Tracking and Storing Receipts in Microsoft Excel

To create a cash receipt in Microsoft Excel, begin by opening a new worksheet. Create a header with your company name, receipt number, and the date of the transaction. Include fields for the payer’s details, amount received, and payment method. You can use Excel’s cell formatting options to make each section stand out for clarity.

Customize your template for various payment methods by adding distinct categories such as cash, check, and credit card. Use dropdown menus or data validation to streamline selection. You can also color-code each method to quickly identify them at a glance.

Include payment information and terms by adding a section for any relevant notes, such as the purpose of the payment or payment due dates. For example, if the receipt pertains to a loan repayment, note the installment amount and due balance. This ensures all necessary details are clear for both you and the payer.

If you manage multiple receipts for different transactions in one template, consider using separate sections for each transaction. Group them by date or transaction type for easier tracking. Excel’s grouping and hiding functions help keep the layout neat while still allowing for comprehensive record-keeping.

Integrating the receipt template with your accounting system can save time and reduce errors. Use Excel formulas to automatically calculate totals and ensure consistency with your accounting entries. You can also export the data to your accounting software, which streamlines data entry and enhances accuracy.

For best practices in tracking and storing receipts, keep your templates organized by saving them in clearly labeled folders, using naming conventions based on receipt numbers or dates. Make backups regularly and use cloud storage to ensure they’re accessible and secure. Regularly review your receipt records to maintain a clean, up-to-date financial picture.