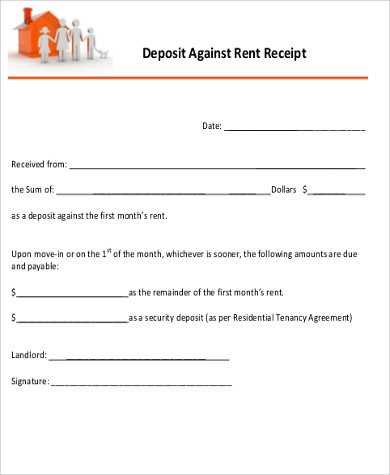

If you’re managing rental properties, providing a clear and professional receipt for tenancy deposits is a must. A tenancy deposit receipt serves as proof that the deposit has been paid and ensures both landlord and tenant are on the same page. It’s important to include specific details that protect both parties in case of disputes over the deposit at the end of the tenancy.

For landlords in the UK, using a free tenancy deposit receipt template can streamline the process and reduce the chances of misunderstandings. This template should cover all necessary information such as the amount paid, the property address, and the terms under which the deposit was taken. It’s a simple document but can save a lot of trouble later.

When filling out the template, make sure to include the date of payment, tenant’s full name, and the details of any damage or issues that may affect the return of the deposit. Keep this document for your records and provide a copy to the tenant. Having a well-organized system for tenancy deposits helps ensure a smoother and more transparent renting experience for everyone involved.

Here’s the revised version without repeating words too much while preserving the meaning and correctness:

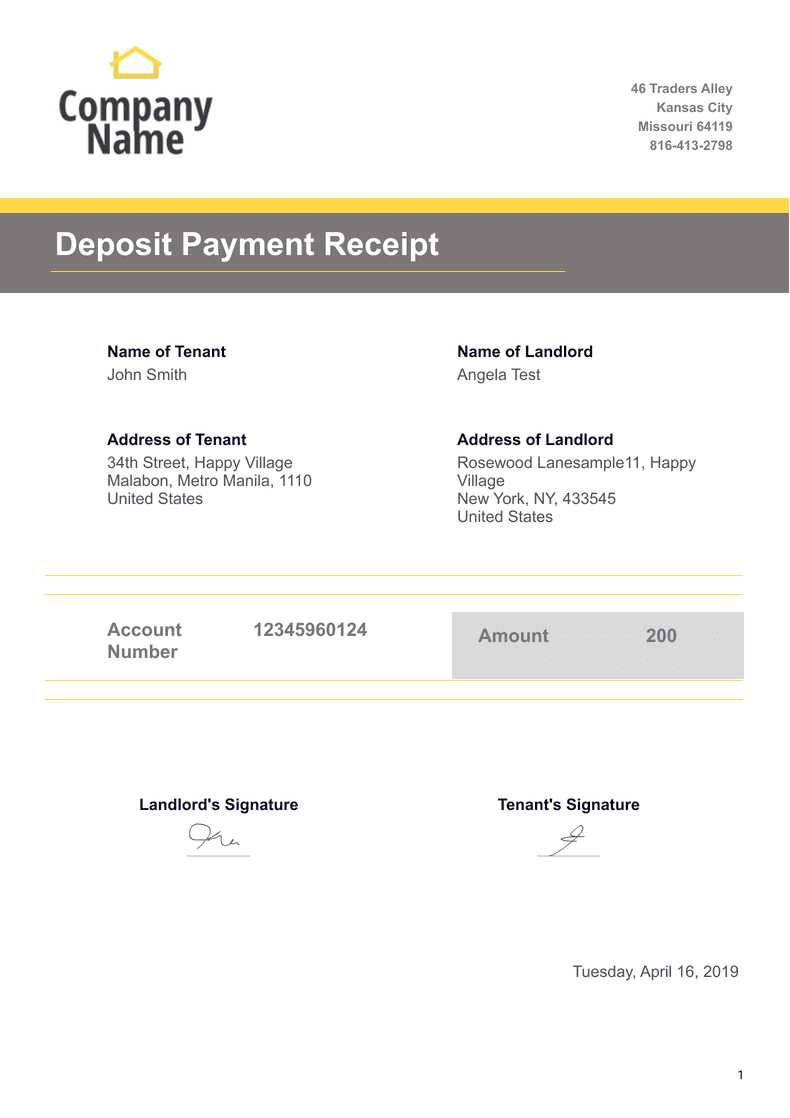

Make sure to include all necessary details when completing a tenancy deposit receipt. Clearly state the deposit amount, property address, and the tenant’s full name. It’s important to outline any specific conditions related to the deposit, such as deductions for damages or unpaid rent. Always include the landlord’s contact information for transparency. Provide the date the deposit was received and specify the terms for refunding the deposit after the tenancy ends.

Ensure both parties sign the document to acknowledge their understanding and agreement. Keep a copy of the receipt for future reference. This document can serve as a helpful record in case of any disputes regarding the deposit at the end of the tenancy.

- Tenancy Deposit Receipt Template UK Free

If you’re a landlord or tenant in the UK, providing or receiving a tenancy deposit receipt is crucial for clear documentation of the agreement. This template helps record important details like the deposit amount, the property address, and the parties involved.

- Basic Information: Include the tenant’s name, landlord’s details, and the full address of the rental property.

- Deposit Amount: Clearly state the amount paid as a deposit, along with the date it was received.

- Terms and Conditions: Specify whether the deposit is refundable and outline any deductions that may apply at the end of the tenancy.

- Signatures: Ensure both the landlord and tenant sign the receipt to confirm agreement and understanding of the terms.

- Additional Notes: Mention any other relevant information, such as the tenancy length or specific conditions for deposit return.

This template is available for free and can be adapted to suit your specific needs. Make sure to keep a copy for both parties for future reference.

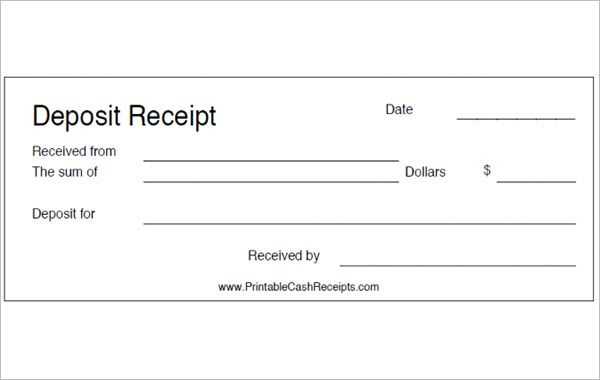

To create a deposit receipt for tenancy, start by including the essential details of the transaction. These should cover the tenant’s name, the landlord’s name, the amount paid, the address of the rental property, and the date of the transaction.

Key Information to Include

- Tenant’s Information: Full name and contact details.

- Landlord’s Information: Full name and contact details.

- Deposit Amount: Specify the total deposit amount received.

- Property Address: Clearly state the address of the rental property.

- Date: The date when the deposit was paid.

Deposit Receipt Format

The receipt should be clear and simple. It’s a good idea to break down the deposit into smaller parts, such as rent deposits or security deposits, if applicable. You can also include terms that explain the conditions for refunding the deposit, including any deductions that might be made. This ensures transparency and avoids misunderstandings.

End the receipt with a clear statement confirming that the deposit has been received, and provide spaces for both the tenant and landlord’s signatures.

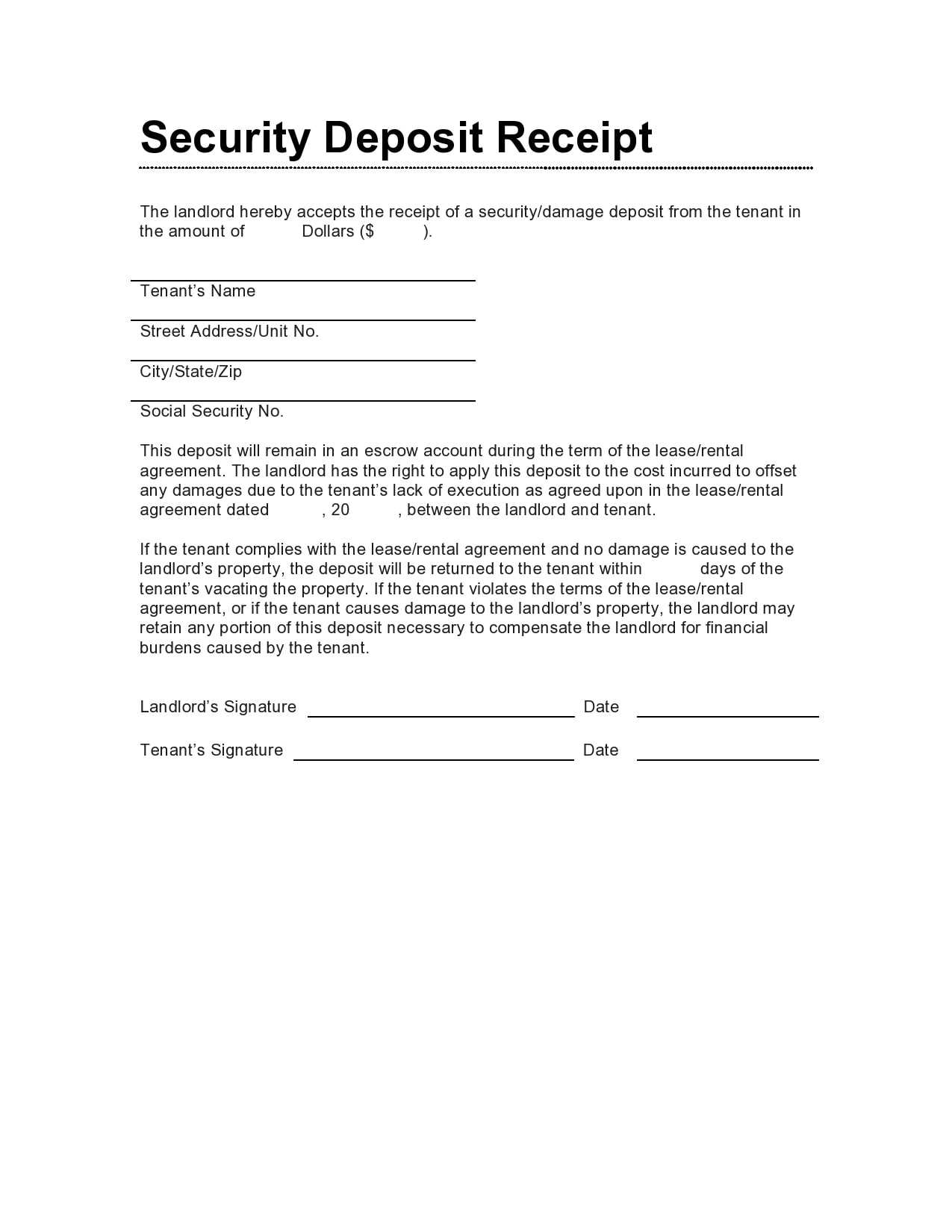

When creating a tenancy deposit receipt template, make sure to include these core elements to ensure clarity and prevent disputes:

Tenant and Landlord Information

Include full names and contact details for both parties. This ensures both the tenant and landlord can be easily identified if needed.

Property Address

List the exact address of the rental property. This helps avoid confusion, especially if the tenant is renting multiple properties from the same landlord.

Deposit Amount

State the exact amount of the deposit paid. It is important to specify the currency and the method of payment to eliminate any misunderstandings.

Deposit Protection Scheme

Provide details of the deposit protection scheme used. Include the name of the scheme and a reference number. This confirms the legal protection of the deposit.

Conditions for Return

Outline the conditions under which the deposit will be returned, such as property inspection results, unpaid rent, or damages. This sets clear expectations for both parties.

Signature Section

Both the tenant and landlord should sign the receipt to acknowledge the agreement. Ensure that the date is also included to mark the official record of the transaction.

Landlords in the UK must protect tenants’ deposits in a government-approved scheme within 30 days of receiving it. This applies to assured shorthold tenancies (ASTs). Failure to comply can result in penalties, including being unable to evict tenants until the deposit is protected and the tenant is provided with the required details. The deposit protection must be for the duration of the tenancy, and tenants must receive confirmation in writing of where their deposit is held.

Landlords must also provide tenants with a “prescribed information” document. This outlines the details of the deposit protection scheme and the conditions for its return. The document ensures tenants are informed about the procedure for claiming back their deposit at the end of the tenancy. If the landlord does not provide this information, tenants can apply to the court for compensation.

If there is a dispute regarding the deposit at the end of the tenancy, tenants are entitled to use the scheme’s dispute resolution service. This is a free service provided by the deposit protection schemes to resolve disagreements about the amount of the deposit to be returned.

Landlords must return the deposit within 10 days after both parties agree on the amount to be returned. If a deduction is made, landlords must explain why and provide evidence. If the tenant disputes these deductions, the scheme will handle the issue through its resolution process.

Several websites offer free tenancy deposit receipt templates, which you can download without any cost. These resources help ensure that your rental agreement is clear and legally binding, offering peace of mind to both landlords and tenants.

1. Government Websites

The UK government website often provides free downloadable templates for various legal documents, including tenancy deposit receipts. These templates are designed to meet legal standards, ensuring that you stay compliant with regulations.

2. Legal Blogs and Forums

Some legal blogs and forums offer downloadable templates for tenancy deposit receipts. These resources are generally created by legal experts who are familiar with housing law, offering templates that can be easily customized for your needs.

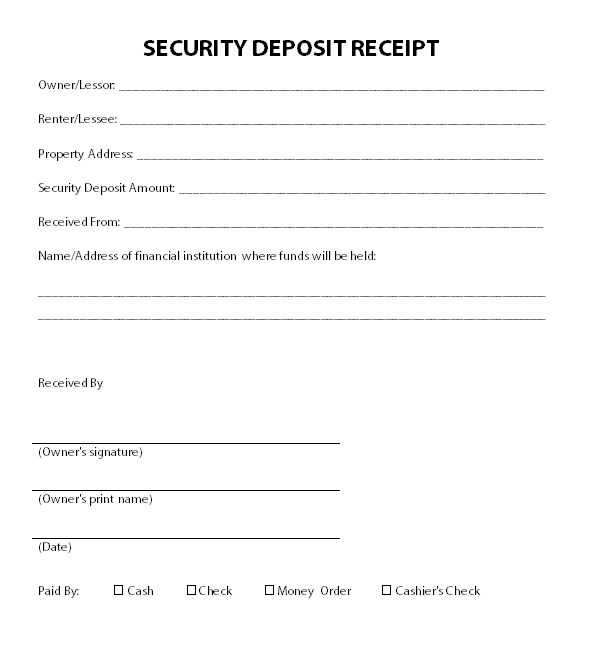

Fill out the tenancy deposit receipt carefully to avoid misunderstandings between tenants and landlords. Ensure all required fields are filled with accurate details to avoid any disputes later on.

Start by clearly identifying the property address and the names of both the landlord and tenant. This ensures that both parties understand exactly which rental agreement the receipt refers to.

Next, specify the deposit amount paid. Include the currency and make sure the amount is consistent with what was agreed upon in the tenancy contract. Double-check the numbers to avoid discrepancies.

State the date the deposit was paid and the method of payment. This will help establish a clear record of the transaction and prevent any confusion about the payment timeline.

In the next section, include any conditions tied to the deposit. If there are specific terms for refunding or deducting from the deposit, make these clear. This may include charges for damage, unpaid rent, or cleaning costs.

Finally, both parties should sign and date the receipt. This serves as confirmation that both the landlord and tenant agree with the terms of the deposit and ensures the document’s legal validity.

| Step | Action |

|---|---|

| 1 | Identify property, landlord, and tenant |

| 2 | Specify the deposit amount |

| 3 | State the payment date and method |

| 4 | Outline conditions for refund or deductions |

| 5 | Get signatures from both parties |

Ensure you update all the fields in the template with accurate information. Leaving blank spaces or filling them with placeholders can lead to confusion and legal issues. Double-check tenant names, property addresses, and deposit amounts to make sure they are correct.

Avoid using a generic template without tailoring it to your specific situation. Each tenancy agreement is unique, so adjust the clauses and terms based on the agreement made with your tenant. Failing to do so can result in misunderstandings or unenforceable terms.

Check the template’s legal compliance. Legislation around tenancy deposits can vary depending on jurisdiction, so make sure the template follows the latest rules and regulations. Templates that are outdated or not jurisdiction-specific may cause you to miss key legal requirements.

Ensure both parties sign the document. An unsigned deposit receipt is not valid. Make sure to obtain signatures from both the landlord and tenant before finalizing the agreement to avoid disputes later.

Do not forget to provide a copy of the signed document to the tenant. It is important to keep a record for both parties. Not distributing a copy can cause problems if the deposit needs to be returned or disputed.

Here’s a quick checklist for avoiding errors:

| Error | Solution |

|---|---|

| Leaving fields incomplete | Fill in all fields with correct details |

| Using a generic template | Customize the template to suit your agreement |

| Not checking legal compliance | Ensure the template follows local laws |

| Missing signatures | Get signatures from both parties |

| Not providing a copy | Give the tenant a signed copy |

Ensure your tenancy deposit receipt template includes clear and concise details to avoid misunderstandings. A well-structured document helps protect both the tenant and landlord, providing transparency.

- Include the full name and address of both parties (tenant and landlord).

- State the amount of the deposit and the date it was paid.

- Provide details on where the deposit is held, such as the name of the deposit protection scheme and its registration number.

- Clarify the conditions under which the deposit will be returned, including any deductions for damages or unpaid rent.

- Ensure both parties sign and date the receipt to validate the agreement.

Using a free template can help simplify this process, ensuring all the necessary information is included. Customize it according to your specific needs while adhering to legal requirements in the UK.