Using an Excel template for purchase receipts can significantly simplify your workflow. A pre-designed template allows you to quickly record transaction details, ensuring accuracy and consistency. With editable fields, you can tailor each receipt to meet specific business needs, whether for personal or professional use.

A well-structured Excel template provides columns for key transaction data, such as date, item description, quantity, price, and total amount. This not only speeds up the process but also ensures that all relevant information is captured. You can also customize the template to include additional details like payment method or taxes, depending on your requirements.

Excel’s built-in formulas, such as those for calculating totals or applying discounts, make it easy to automate calculations, reducing the chance of errors. This streamlined approach saves time, allowing you to focus on other aspects of your business or personal finance management.

By using this method, you create organized records that are easy to track, store, and share. Whether you’re managing multiple transactions or just need a quick solution for receipts, an Excel template offers a practical, customizable, and error-reducing tool for handling purchases.

Purchase Receipt Template Excel

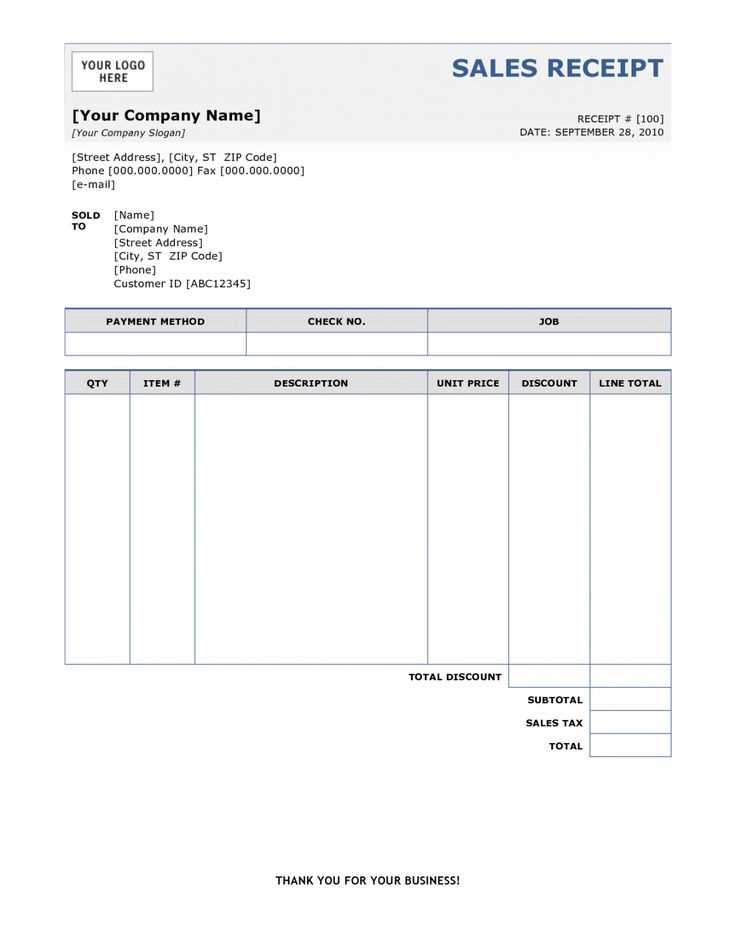

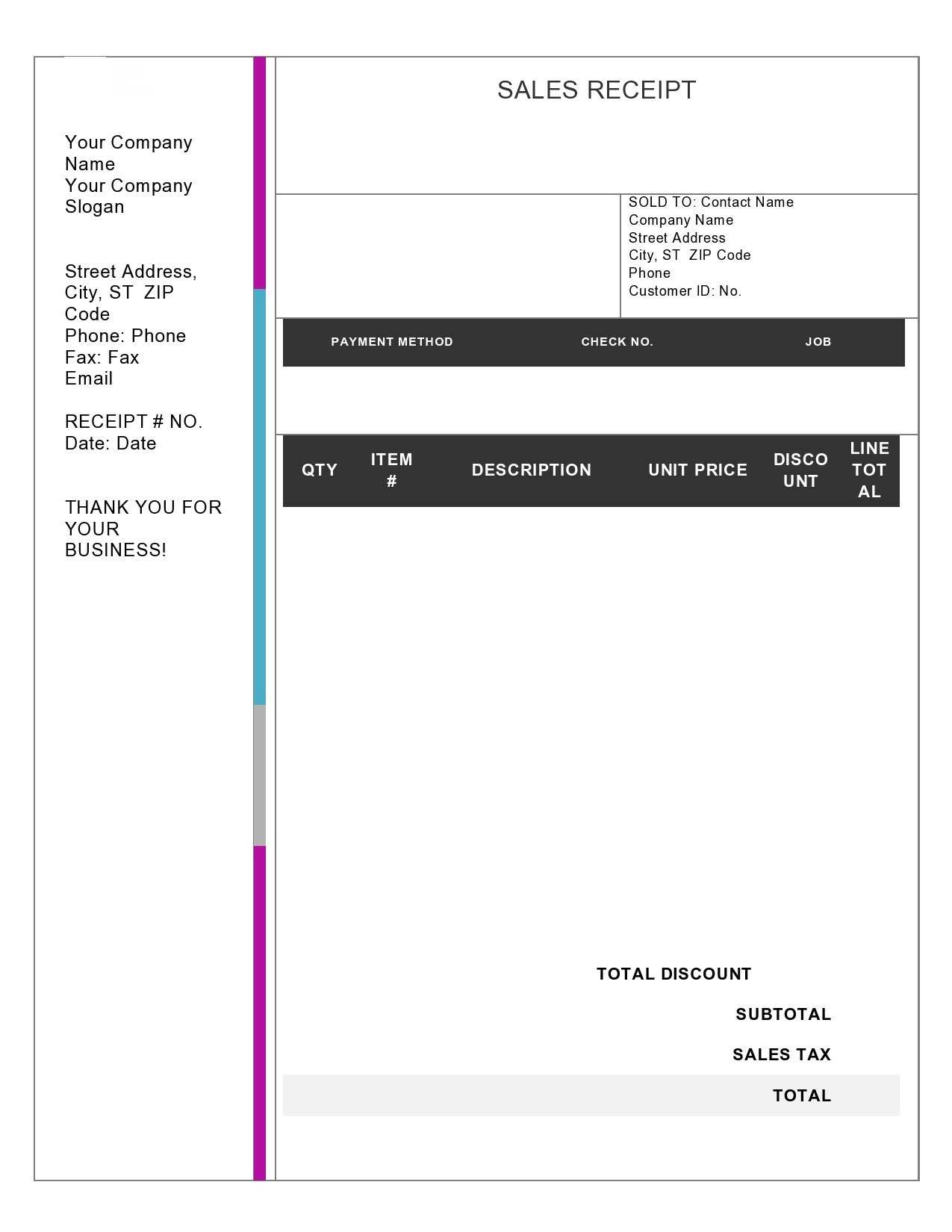

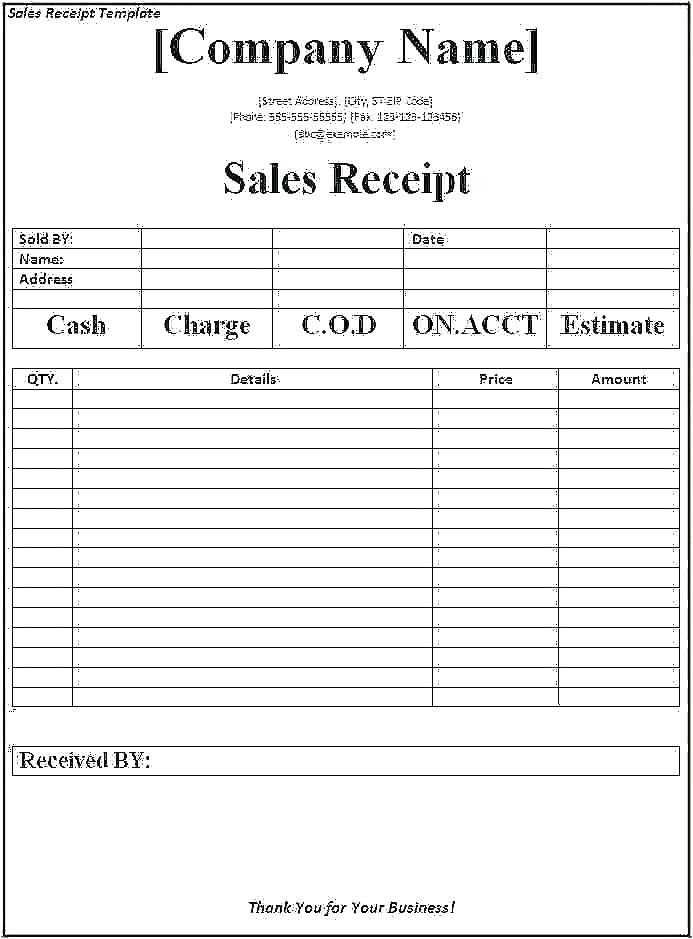

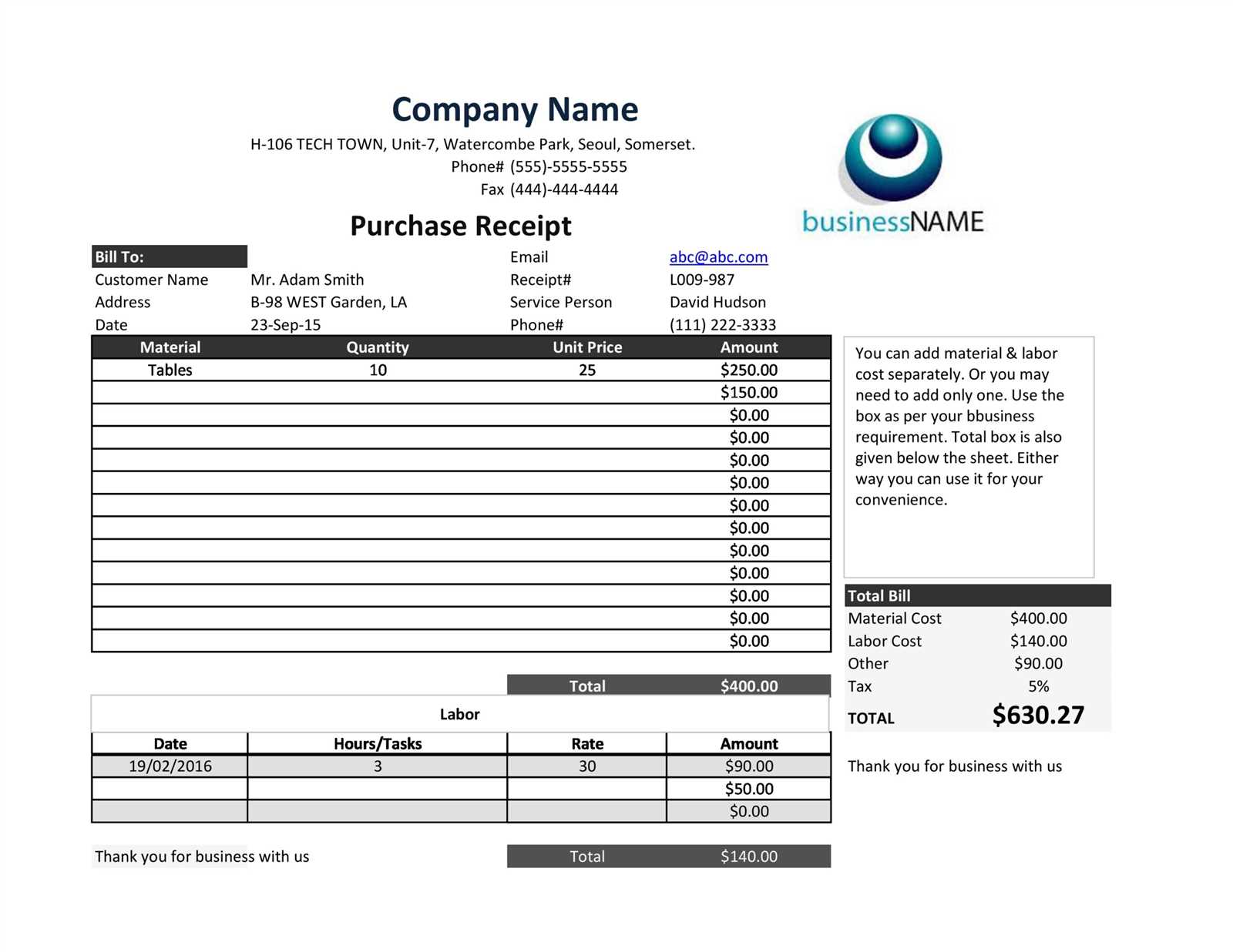

To create a simple yet effective purchase receipt template in Excel, start by setting up a clean and organized layout. Begin with a header section that includes your company’s name, address, contact details, and the receipt title. This helps establish the formality of the document.

Setting up the Columns

For the body, create columns for item descriptions, quantities, unit prices, and total prices. Include a column for taxes if applicable. Use Excel formulas to automatically calculate totals based on the quantity and unit price entered. Ensure that each item is listed in a new row for clarity.

Formatting for Readability

Apply borders around the cells to separate sections, and use bold formatting for headings. Highlight the total amount due at the bottom of the receipt to make it stand out. You can also use color coding for various sections to improve the overall readability.

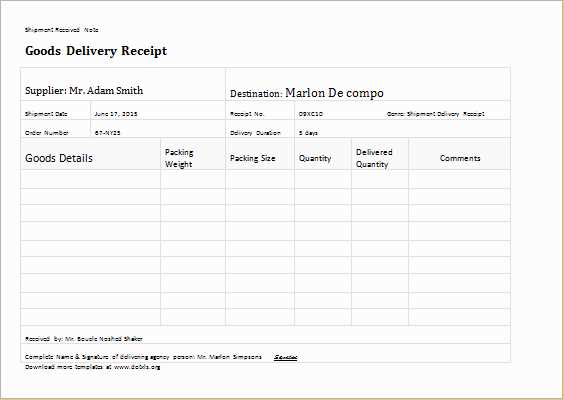

Setting Up Basic Columns for Tracking Transactions

For tracking transactions effectively, begin by establishing key columns in your Excel template. Start with a “Transaction Date” column to log the date of each purchase. This helps organize transactions chronologically for easy reference.

Identifying Key Information

Next, include a “Description” column where you can specify the nature of the transaction, such as product name or service provided. This will provide clarity when reviewing the receipt later. A “Quantity” column is important for keeping track of the number of items purchased, particularly for inventory management.

Adding Financial Details

Include a “Unit Price” column to record the cost per item or service, followed by a “Total” column, which calculates the overall cost for each transaction. Finally, a “Payment Method” column ensures you can identify how the transaction was processed, such as credit card, cash, or bank transfer.

Adding Itemized Details for Clear Itemization

Include a separate column for each item’s description, quantity, price, and total cost to make the breakdown easy to follow. This clarity helps customers quickly identify the details of each item purchased. Ensure that the information is aligned properly for better readability.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product 1 | 2 | $10.00 | $20.00 |

| Product 2 | 1 | $15.00 | $15.00 |

Use consistent formatting to avoid confusion. Align numbers to the right and ensure that decimals are properly placed. Group similar items together for an organized appearance.

To make the receipt even more user-friendly, you can add rows for taxes, discounts, and shipping costs, each with a clear label and corresponding value. Keep the total at the bottom, highlighted for easy reference.

Incorporating Discount and Tax Calculations in Excel

To apply a discount in Excel, use a simple formula: multiply the original price by the discount percentage and subtract the result from the original price. For example, if the item costs $100 and the discount is 15%, use the formula: =A2 – (A2 * 15%). This will give you the final price after the discount.

For tax calculations, multiply the price after any discounts by the applicable tax rate. If the tax rate is 8%, use: =B2 * 8%. To get the total price including tax, add the tax to the price after the discount: =B2 + (B2 * 8%).

Excel allows you to combine these calculations in a single formula to simplify the process. For instance, to apply a 15% discount and then an 8% tax to a $100 item, use: =A2 – (A2 * 15%) + ((A2 – (A2 * 15%)) * 8%).

To make it dynamic, you can set up separate cells for the discount rate, tax rate, and price. By referencing these cells in your formulas, the calculations update automatically when values change, making it easier to adjust for different scenarios.

Designing for Easy Customization and Reuse

Focus on creating a structure that is simple to adapt. Use clear labels and well-defined fields that can be adjusted based on the specific needs of any transaction. Instead of static text, use formulas to automatically calculate totals, taxes, and discounts. This allows for quick updates without manual changes to the entire layout.

Use Modular Sections

Design the template with distinct sections that can be independently updated. For example, create separate blocks for customer information, product details, pricing, and tax breakdowns. This modularity makes it easier to adjust or replace sections when necessary, without disrupting the overall layout.

Maintain Consistency with Styles

Consistency is key for easy reuse. Define a uniform font style and color scheme that can be applied throughout the document. Avoid unnecessary variations in text formatting, as this can complicate customization. A single consistent design ensures that any user can modify the template quickly without confusion.

Ensuring Consistency with Predefined Formulas

Use predefined formulas to maintain consistency in your purchase receipt template. By incorporating them, you can automate calculations and reduce human error. Here’s how to implement and utilize formulas effectively:

- Subtotal Calculation: Use a formula like

=SUM(B2:B10)to calculate the total cost of items listed in your receipt automatically. - Tax Calculation: Apply a tax rate formula with

=B11*0.05where B11 is the subtotal, ensuring consistent tax application across all receipts. - Discount Application: Use

=B12-(B12*0.10)for applying a 10% discount to the subtotal in cell B12. - Total Calculation: Combine subtotal, tax, and discounts with a formula like

=B12+B13-B14to calculate the final amount due.

These formulas ensure that every aspect of your receipt, from item totals to taxes and discounts, is consistently calculated and error-free. Regularly update the cell references if your template layout changes.

Exporting and Printing the Completed Receipt

To export the completed receipt, click on the “File” tab in the Excel toolbar and select “Save As.” Choose your desired file format, such as PDF or Excel Workbook, and save it in an easily accessible location. For a PDF, ensure you select “PDF” as the format in the “Save as type” dropdown.

To print the receipt, go to “File” and click on “Print.” Make sure the correct printer is selected in the print setup. Adjust page orientation to “Portrait” or “Landscape” based on your layout, and check the print preview to ensure everything is properly aligned. If needed, adjust margins and scaling to fit the receipt content within the page.

If you need to print multiple copies, adjust the number of copies in the print setup window. Before printing, double-check that all the information on the receipt is accurate to avoid reprints and wasted paper.