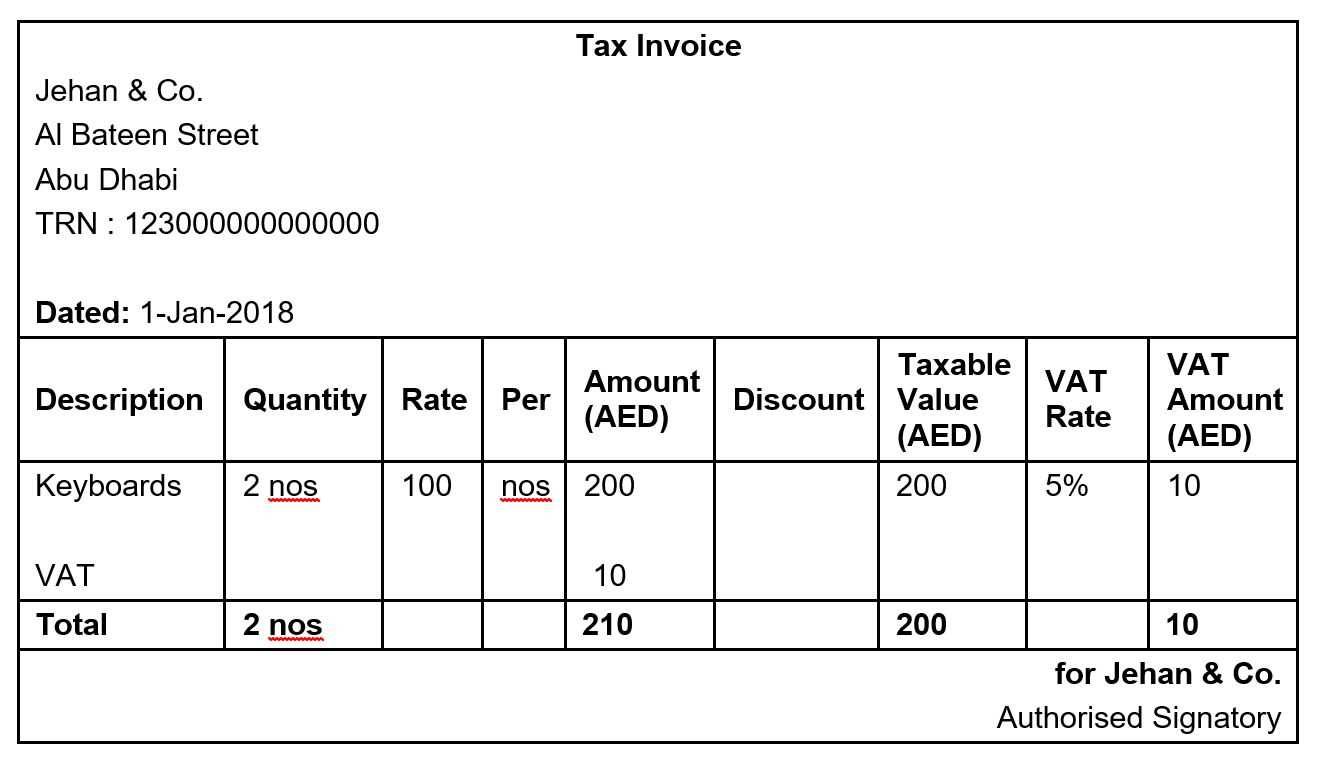

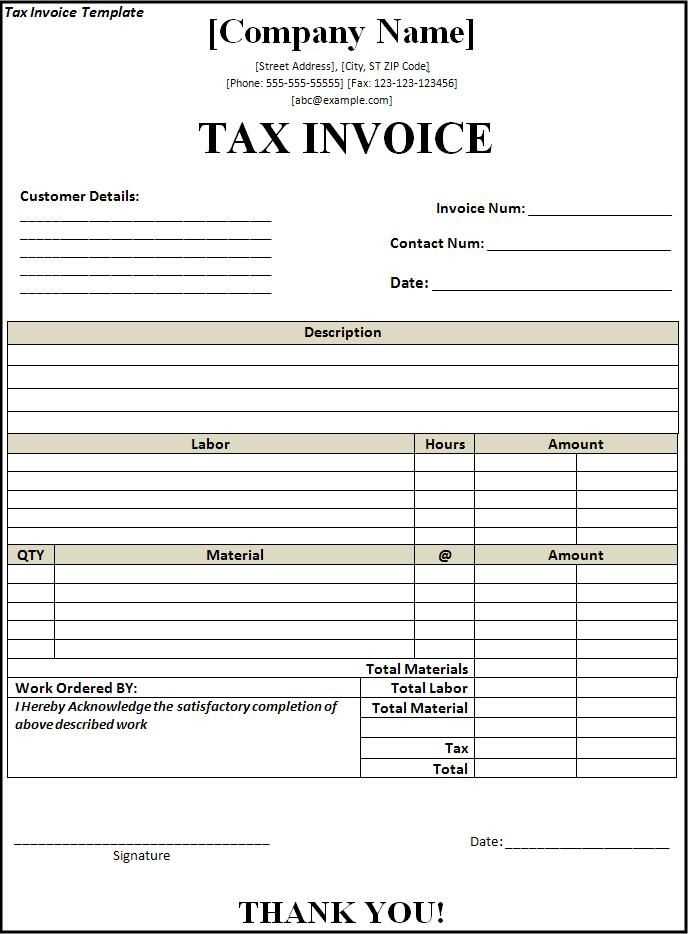

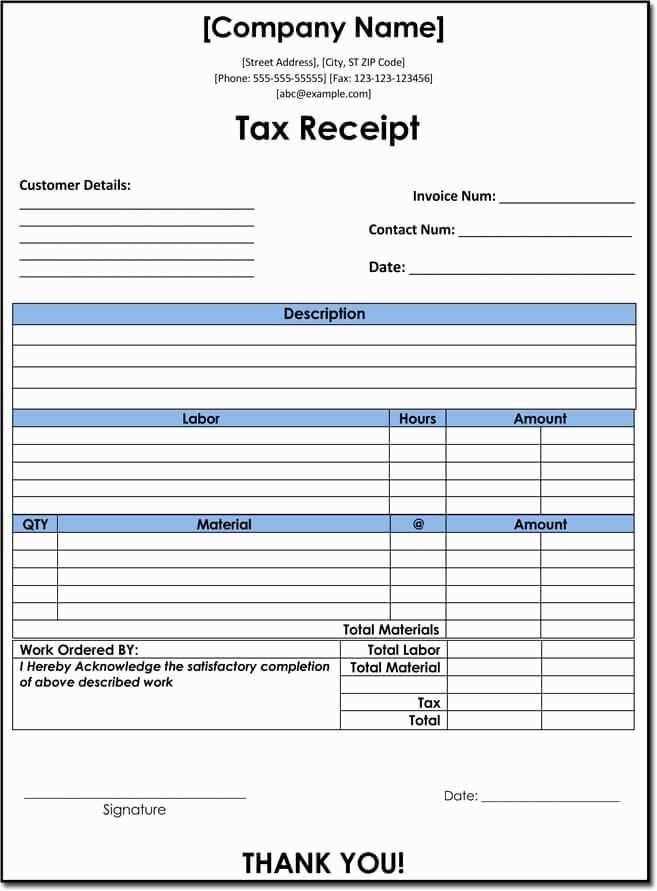

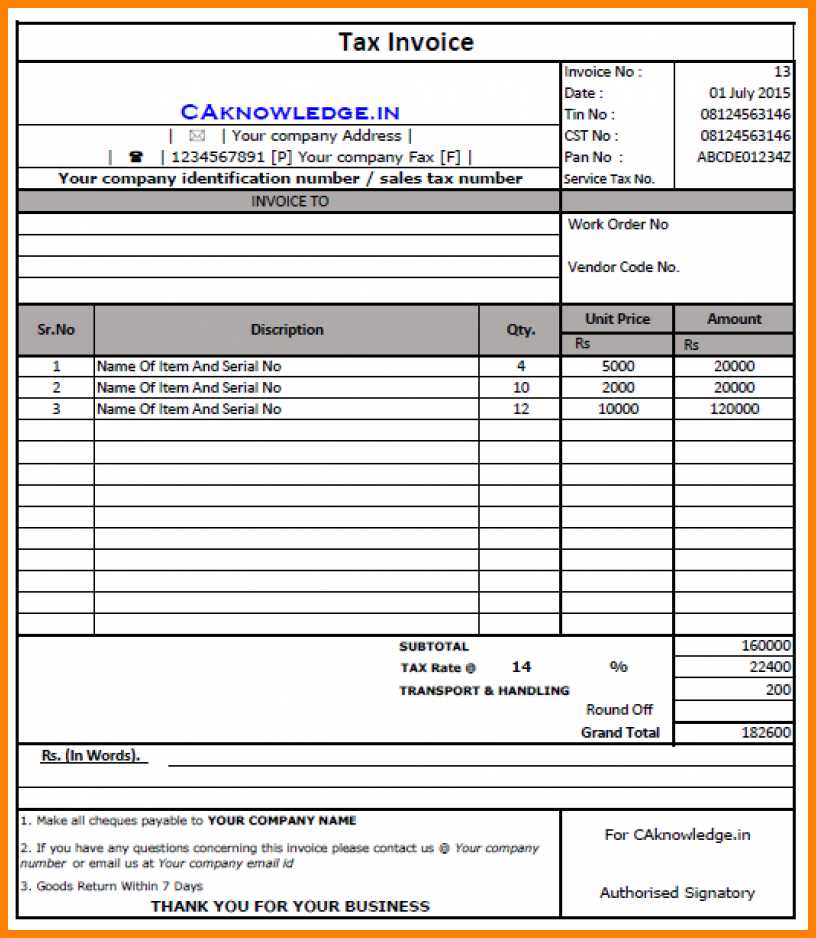

Creating a tax receipt in the UAE requires attention to specific details to ensure it meets the local tax laws and standards. A well-structured template should contain key information such as the name and address of the business, the tax registration number, the date of the transaction, and a breakdown of the goods or services provided. Make sure that the amount paid, along with any applicable taxes, is clearly stated, and the total sum is easy to identify.

When designing your tax receipt template, focus on clarity and compliance. Use standard formats that match the UAE’s regulations to avoid errors. Include the VAT registration number if your business is VAT-registered, and always list the VAT amount separately from the total amount paid. This ensures that the receipt is legally sound and transparent for both you and your customers.

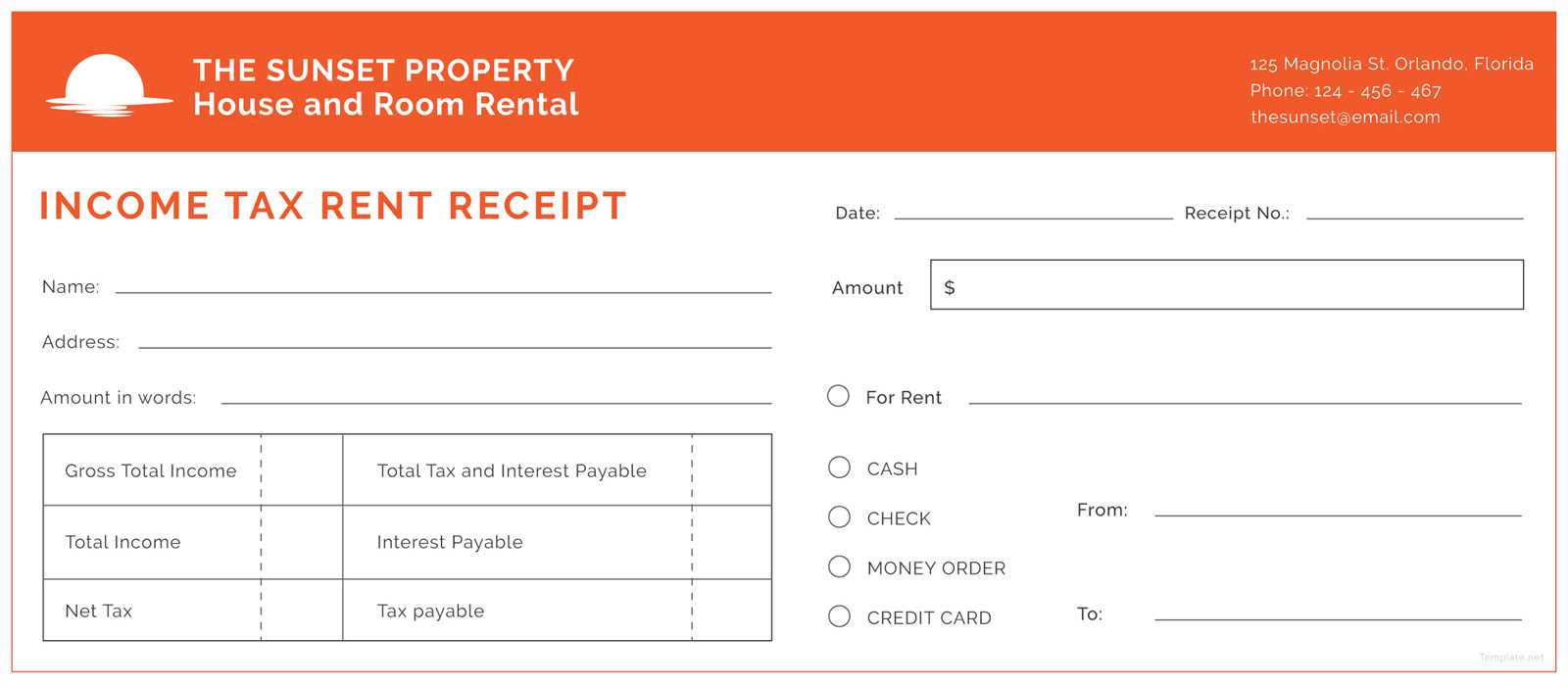

Keep it simple but precise. The template should also include space for the customer’s information, as some transactions require this. The receipt format can be created using any word processor or specialized accounting software, but remember that it must be printable or available in digital format for easy access. Regularly updating the template for compliance with any new tax regulations is a good practice.

Finally, whether you’re handling a small business or a larger enterprise, a tax receipt is a document that builds trust. Clear, accurate receipts not only help customers keep track of their purchases but also ensure smooth tax filings for your business.

Here’s a version with reduced repetition of words, while keeping the meaning intact:

Use clear and concise phrasing to reduce redundancy in tax receipt templates. For example, instead of repeating “amount paid,” simply state “paid” or “payment made.” Remove any unnecessary adjectives and phrases that don’t add clarity. Make sure each word serves a specific purpose to maintain clarity and precision.

Example of Streamlined Tax Receipt Template

Receipt No: 12345

Date: 5th February 2025

Amount Paid: AED 500

Service: Tax Consultation

Received By: John Doe

Key Adjustments

Notice how information is presented directly, with fewer words. This structure ensures that recipients immediately grasp the essential details without sifting through unnecessary information. Keep your receipts easy to read and avoid over-complicating the layout with redundant wording.

Tax Receipt Template UAE: A Practical Guide

Understanding the Purpose of a Tax Receipt in the UAE

Key Elements to Include in a UAE Tax Receipt

How to Customize a Receipt Template for Your Business

Legal Requirements for Issuing Receipts in the UAE

Common Mistakes to Avoid When Issuing Tax Documents in the UAE

Best Tools and Software for Creating Tax Receipts in the UAE

A tax receipt in the UAE serves as proof of a transaction that has been subject to VAT (Value Added Tax) and helps both businesses and customers track tax payments. It provides transparency, ensuring that businesses comply with tax laws and consumers have a record for their tax filings.

Key Elements to Include in a UAE Tax Receipt

Each UAE tax receipt must include certain details to meet legal standards. Make sure your receipt includes the following:

- Tax Registration Number (TRN): The business’s unique identification number issued by the Federal Tax Authority (FTA).

- Receipt Number: A unique, sequential number to track receipts.

- Transaction Date: The date when the transaction took place.

- Business Name and Address: Your company’s name, legal status, and physical address.

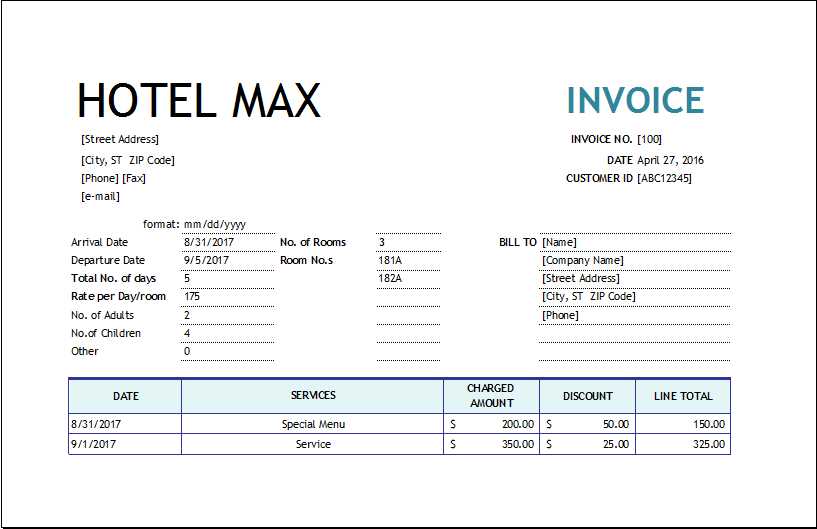

- Details of the Goods/Services: A description of what was sold, including quantities and price per item.

- VAT Amount: The amount of VAT applied on the transaction, with the percentage rate used (usually 5% in the UAE).

- Total Amount Paid: The total amount after VAT is applied.

- Customer’s Name (Optional): This can be included, especially if it’s a business-to-business transaction.

How to Customize a Receipt Template for Your Business

Customizing a tax receipt template is simple. Ensure your template reflects your brand and contains the mandatory information. Many accounting software options allow you to create personalized templates with your business’s logo and colors. If you’re using a manual method, ensure the template you create adheres to legal requirements while keeping it clear and professional.

Be sure to check whether your template can generate receipts in both printed and electronic forms, as some businesses may require both formats.

Legal Requirements for Issuing Receipts in the UAE

In the UAE, businesses must issue tax receipts for all transactions subject to VAT. Non-compliance can result in penalties from the FTA. The receipt should be issued at the time of sale or within a reasonable period afterward. For digital or e-commerce businesses, electronic tax invoices are allowed, but they must still comply with the same information requirements.

Common Mistakes to Avoid When Issuing Tax Documents in the UAE

Some businesses overlook key details, which can result in invalid receipts. Avoid these mistakes:

- Missing the TRN number on receipts.

- Incorrect or missing VAT calculations.

- Failing to include all transaction details (like item descriptions or prices).

- Issuing receipts with outdated formats or non-compliant templates.

- Not keeping accurate records of all issued receipts for tax filing purposes.

Best Tools and Software for Creating Tax Receipts in the UAE

Many businesses use software tools for managing tax receipts efficiently. Some of the best tools for creating tax receipts include:

- Zoho Books: Allows you to generate compliant tax receipts automatically and keep track of payments.

- QuickBooks: This popular accounting software supports VAT receipts and integrates well with the UAE’s tax system.

- Xero: Offers customizable templates for tax receipts and includes features for VAT compliance.

- FreshBooks: Ideal for small businesses, it helps create clear and compliant tax receipts.

Choosing the right tool depends on your business’s needs, but always ensure that the software is aligned with UAE’s VAT regulations. These tools can simplify the process of issuing and managing receipts, saving you time and reducing the risk of errors.