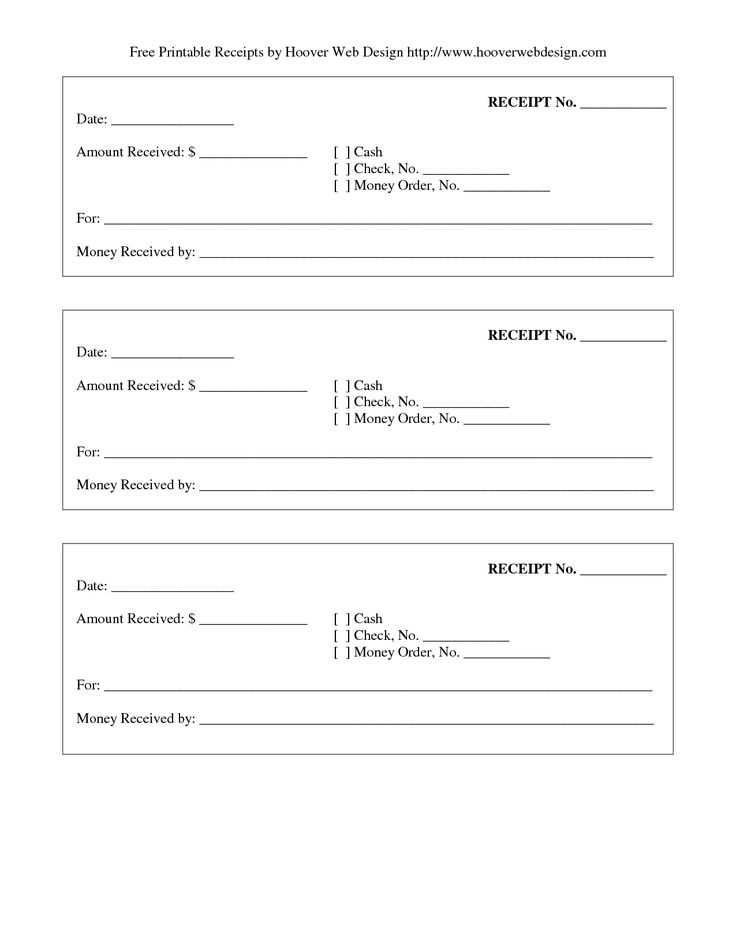

A receipt for borrowed money should clearly outline the agreement between the lender and borrower, ensuring both parties understand the terms. Start by specifying the exact amount of money borrowed, the date of the transaction, and the repayment details.

In the body of the document, include the names of the lender and borrower. Be sure to state the payment method, interest rate (if applicable), and repayment schedule. Highlight any conditions or agreements that both parties have mutually decided upon.

To make the document legally binding, add a space for both the lender and borrower to sign. This confirms their acknowledgment and agreement to the terms laid out in the receipt.

Use clear, concise language. Avoid ambiguity to prevent misunderstandings or disputes down the line. A well-structured receipt can provide peace of mind and ensure both parties remain accountable.

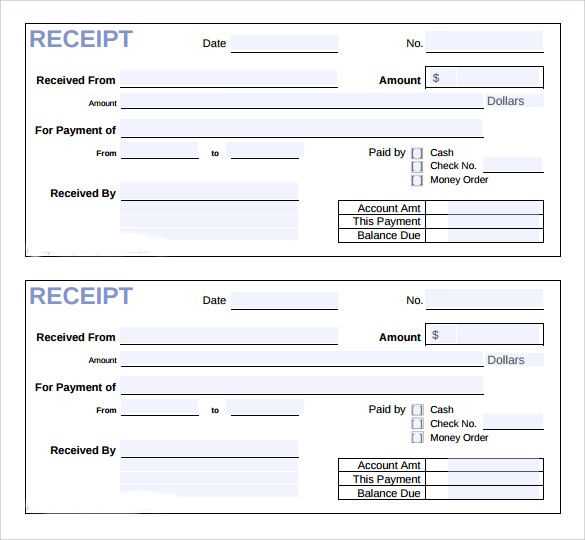

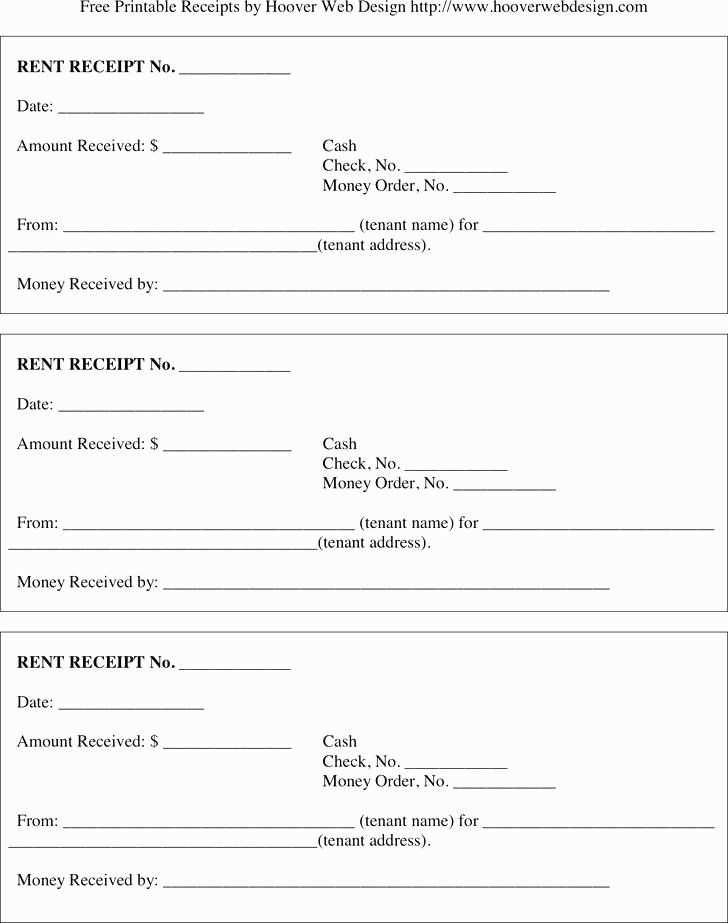

Template of Receipt for Borrowed Money

Begin with the lender’s and borrower’s names, addresses, and contact details. Include the loan amount, currency, and date of the transaction. Specify the repayment terms, such as the due date and any interest rate applied. Clearly mention whether the loan is secured or unsecured. Confirm the payment method, whether cash, check, or bank transfer, and specify the date of the transaction.

Key Details to Include

Ensure the receipt contains both parties’ signatures to validate the document. Write out the loan amount in words to prevent ambiguity. Be explicit about any collateral if applicable. If applicable, include a clause specifying the consequences of non-payment or late payment. Provide a space for amendments, such as any future changes to terms.

Additional Considerations

For added clarity, keep a copy of the receipt for both the lender and borrower. Make sure the document is dated and signed on the same day to avoid confusion. If any agreement changes, amend the receipt and sign it again to ensure both parties are aware of the modifications.

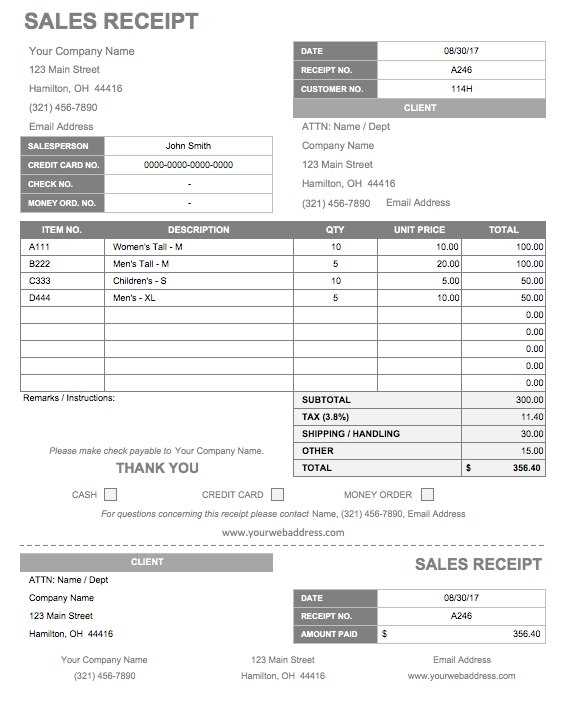

How to Start a Money Loan Receipt

Clearly state the total amount of money being lent. This avoids any confusion about the loan’s size. Specify both the amount in words and figures to ensure accuracy. For example, “I, [Lender’s Name], loan the sum of Five Thousand Dollars ($5,000) to [Borrower’s Name].”

Loan Terms and Conditions

Next, outline the repayment terms. Define the loan duration, interest rate, and repayment schedule. For instance, “The borrower agrees to repay the total sum in monthly installments of $500 over a period of 10 months, starting on [Start Date].”

Borrower’s Acknowledgment

Include a section where the borrower confirms their understanding and agreement with the terms. A simple sentence such as “The borrower acknowledges the receipt of the loan and agrees to the terms specified herein” works well.

| Item | Details |

|---|---|

| Loan Amount | $5,000 |

| Repayment Start Date | [Start Date] |

| Monthly Repayment | $500 |

| Loan Duration | 10 months |

Details to Include for Borrower’s Identification

Ensure the borrower’s full legal name is clearly stated. Include any aliases or previous names if applicable to avoid confusion. Record the borrower’s current address with details like street name, city, state, and postal code. Add a phone number, preferably a mobile number, and email address for quick contact.

Next, confirm the borrower’s date of birth to verify age and identity. Incorporate their social security number or another government-issued identification number, such as a passport or driver’s license number. If available, include a copy of the borrower’s ID for additional verification.

It’s also helpful to note the borrower’s occupation and place of employment. This gives context to their ability to repay. If relevant, include emergency contact information, such as the name, relationship, and phone number of a person who could be reached in case of urgent need.

Double-check the accuracy of all information before finalizing the document. Any discrepancy or omission can lead to issues during repayment or enforcement of the loan agreement.

Essential Terms to Mention in a Loan Agreement

Clearly state the loan amount at the beginning. Specify the total sum being borrowed, ensuring both parties are aligned on the financial terms.

- Loan Amount: Clearly state the exact amount of money being lent, with no ambiguity.

- Interest Rate: Outline the interest rate charged on the loan. Specify whether it is fixed or variable, and how often it will be applied.

- Repayment Schedule: List the dates or periods in which the borrower must repay the loan. Include any grace periods and the total duration.

- Payment Method: Mention the method of repayment, such as bank transfer, check, or cash.

Address penalties for late payments or missed installments. Define the consequences for not following the repayment schedule, including any additional fees or interest that will accrue.

- Late Fees: Specify any fees that will be added if payments are missed or delayed.

- Default Clause: State what constitutes default and what actions will be taken if the borrower defaults on the loan.

Clearly outline the collateral, if any, offered to secure the loan. If the borrower is pledging assets, these should be identified and described in detail.

- Collateral: Identify any property or assets put up as security against the loan.

Include a clause regarding early repayment options. Specify if the borrower can pay off the loan earlier than scheduled and whether any penalties apply.

- Early Repayment Terms: Define if early repayment is allowed and if there are any fees for doing so.

Finally, ensure that both parties agree to a legal jurisdiction in case of disputes. State which laws will govern the agreement and where any legal issues will be resolved.

- Governing Law: Specify the jurisdiction that will handle legal matters related to the loan.

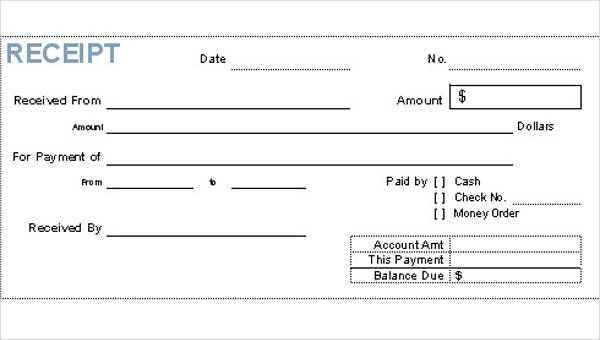

Setting the Loan Amount and Payment Schedule

Clearly define the loan amount and payment schedule in your receipt. Be specific to avoid confusion later. Here’s how:

- Loan Amount: Write the exact amount borrowed. Include both the principal and any additional charges, if applicable.

- Payment Frequency: Specify how often payments are due (e.g., weekly, monthly). This ensures both parties agree on the timing of repayments.

- Due Dates: List all due dates for payments. If possible, align them with the borrower’s pay cycle.

- Payment Method: Clarify how the borrower will make payments (e.g., bank transfer, check, or cash). This avoids any disputes about payment methods later on.

- Late Fees: If applicable, include a clear policy for late fees. Specify the amount or percentage and when it will be charged.

Ensure both parties sign the agreement to confirm they understand and accept the terms. This avoids misunderstandings as the loan progresses.

How to Define Interest and Repayment Terms

Set a clear interest rate that reflects the agreement between both parties. This can be a fixed percentage or a variable rate, but make sure it is explicitly stated in the agreement. Specify the calculation method, whether it’s daily, monthly, or yearly. Avoid ambiguity in how interest accrues.

Outline the repayment schedule. Define the exact dates when payments are due and whether payments will be made in installments or as a lump sum. Include the total amount to be paid, breaking it down into principal and interest portions, so both parties know the exact figures.

Determine if there are any penalties for missed or late payments. Include a clear statement about what happens if a payment is overdue, such as an additional interest charge or an extension of the repayment period. This will help set expectations and prevent misunderstandings.

Finally, specify any early repayment options. State whether the borrower can repay the loan early without penalties or if early repayment will lead to a reduction in interest charges. This ensures both sides are aligned on how early payments are handled.

Creating a Simple Acknowledgement Clause

State the acknowledgment clearly. Begin with a direct declaration that the borrower has received the loan amount. For example: “I, [Borrower’s Name], acknowledge receipt of [Loan Amount] on [Date].”

Be specific about the terms. Include the loan’s purpose and any conditions tied to repayment. For instance: “This loan is for [Purpose], with the understanding that it will be repaid in full by [Due Date].”

Consider specifying the agreed-upon interest rate or mention if the loan is interest-free. Make sure to define the method of repayment, such as cash, check, or bank transfer, and include any relevant details for the repayment schedule.

Leave no room for ambiguity. Clearly state the lender’s and borrower’s obligations. For example: “The lender, [Lender’s Name], agrees to provide the loan as described, and the borrower, [Borrower’s Name], agrees to repay the loan according to the terms set forth.”