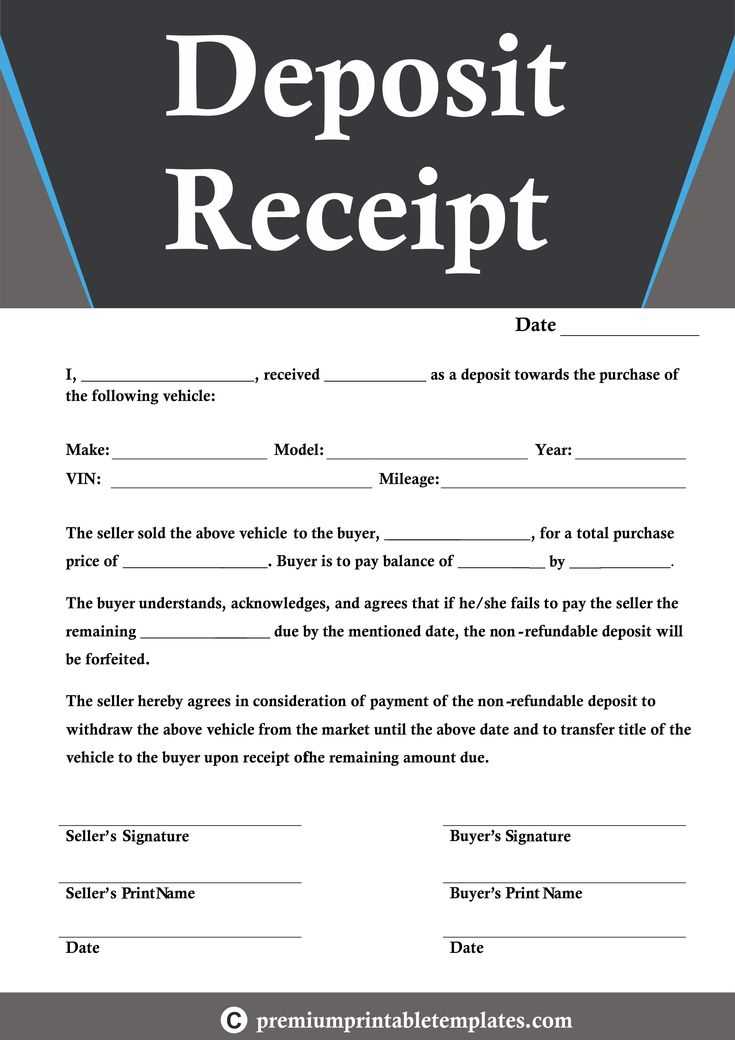

When you’re ready to secure a property, a deposit receipt plays a pivotal role in the transaction process. This document serves as a formal acknowledgment that a buyer has provided a deposit to the seller. It’s crucial to have a clear and well-structured receipt to avoid misunderstandings down the line.

Start by including the basic details: the names of both parties, the property address, and the exact amount of the deposit. Ensure that the document specifies the date the payment was made and outlines the terms related to the deposit’s refund or non-refund. This information helps to clarify both parties’ responsibilities and agreements moving forward.

Adding a section that details the payment method can provide extra clarity. Whether the payment is made via cheque, bank transfer, or cash, documenting this will leave no room for confusion. Also, include a note confirming that the payment will be applied toward the final purchase price of the property.

Finally, make sure both parties sign the receipt. This not only reinforces the authenticity of the transaction but also ensures that both buyer and seller acknowledge and agree to the terms outlined in the document. By keeping everything transparent, you’ll avoid potential disputes down the road.

Sure! Here’s the revised version:

When drafting a house purchase deposit receipt, ensure it includes key details like the buyer’s and seller’s names, the property address, the deposit amount, and the date of the transaction. Clearly state the payment method used, whether it’s cash, cheque, or bank transfer. Add a line confirming that the deposit is part of the overall purchase price and note any conditions under which the deposit might be refunded, such as contract failure or financing issues. Lastly, include both parties’ signatures to authenticate the agreement. Keep the tone straightforward and precise to avoid misunderstandings.

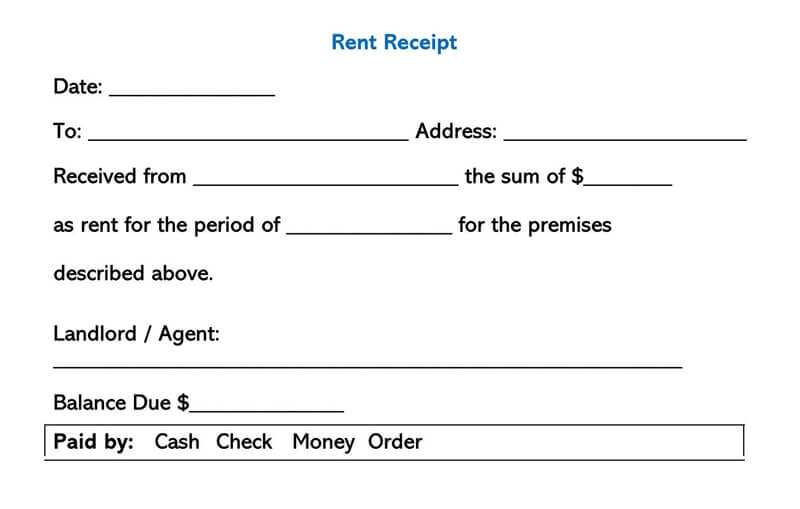

- House Purchase Deposit Receipt Template

When preparing a receipt for a house purchase deposit, be clear and concise. A well-structured receipt includes all necessary details for both the buyer and the seller to confirm the transaction.

- Date of Payment: The exact date when the deposit is made.

- Buyer’s Information: Full name and contact details of the buyer.

- Seller’s Information: Full name and contact details of the seller.

- Property Information: Address and details of the property being purchased.

- Deposit Amount: The exact amount of the deposit paid, including the currency.

- Payment Method: Specify if the payment was made by cheque, bank transfer, or another method.

- Deposit Purpose: Mention that the deposit is for securing the property purchase.

- Receipt Number: Assign a unique number to each receipt for record-keeping.

- Signatures: Both the buyer and seller should sign the receipt to acknowledge the transaction.

Ensure all information is accurate to avoid any confusion in the future. This template helps in tracking the deposit and acts as a proof of payment during the house purchase process.

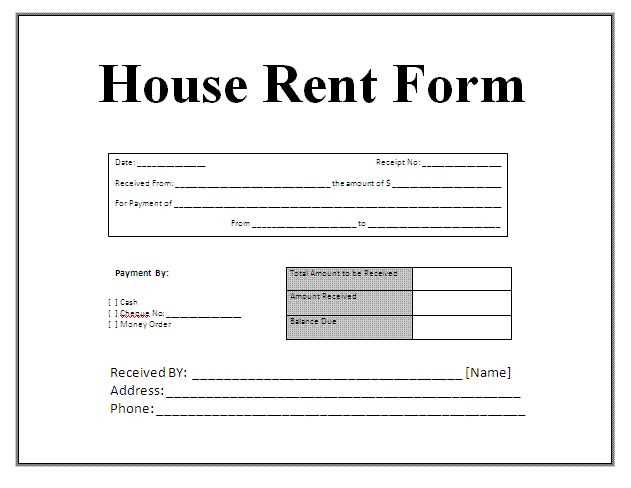

Ensure the deposit receipt clearly states the following details:

- Buyer and Seller Information: Full names, addresses, and contact details of both parties.

- Property Details: Address and legal description of the property being purchased.

- Deposit Amount: The exact sum paid as the deposit and the payment method used.

- Payment Date: The date when the deposit was made.

- Transaction Reference: A unique reference number or code for the transaction.

- Agreement Terms: Any specific conditions tied to the deposit, such as refundable or non-refundable terms.

- Signatures: Signatures of both the buyer and seller, along with the date of signing.

These details help both parties maintain clear records of the transaction and prevent potential disputes.

Begin by clearly stating the title at the top of the document, such as “House Purchase Deposit Receipt.” This ensures the purpose of the document is immediately clear.

Include the date of the transaction, as well as the name and address of both the buyer and the seller. These details confirm the identities of all parties involved.

Next, outline the amount paid for the deposit. Be sure to use the full figure, followed by the currency. For example: “Deposit Amount: $5,000.” This eliminates ambiguity.

Specify the payment method, whether it was through bank transfer, check, or cash. For bank transfers, include transaction references or any associated numbers for traceability.

Indicate the address of the property being purchased, along with any reference number for the property listing or contract. This links the deposit directly to the property in question.

Include a short statement confirming that the deposit is non-refundable, if applicable, and describe any conditions under which it might be returned.

Finally, provide a signature line for both parties, along with the date the receipt is signed. This finalizes the document and confirms mutual agreement.

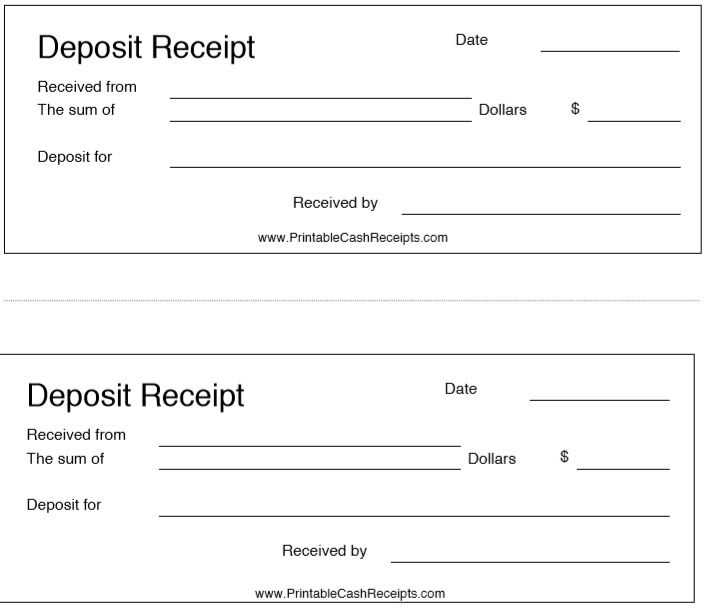

Deposit receipts serve as a formal agreement and proof of payment, establishing the buyer’s commitment. Ensure the receipt includes clear details about the deposit amount, the parties involved, and the terms under which the deposit is refundable or non-refundable. This helps avoid disputes should the sale fall through.

Verify that the receipt states the purpose of the deposit–whether it secures the purchase or guarantees a certain condition. Any changes to the agreement must be made in writing and signed by both parties to maintain legal integrity.

In some jurisdictions, deposit receipts are legally binding only when certain conditions, such as a written contract or agreement, are met. Always confirm that the terms align with local laws to ensure full protection. Consider including a clause specifying the refund conditions in case the transaction does not proceed, to avoid confusion.

Seek legal advice if necessary, especially if the receipt involves a significant amount of money or complicated contractual terms. This ensures the receipt complies with relevant regulations and reduces future risks.

Ensure all required details are included, such as the buyer’s and seller’s names, transaction date, and amount. Missing key information can lead to confusion or disputes.

Incorrect Formatting

Consistent formatting is necessary to make the receipt readable. Avoid mixing fonts, colors, or excessive decoration. A cluttered design may obscure important details, making it harder to verify the transaction.

Unclear Payment Terms

Provide clear payment instructions. Avoid vague descriptions like “payment received,” as this can create confusion. Always specify the method of payment, amount received, and any remaining balance, if applicable.

Inaccurate dates can complicate record-keeping. Always double-check the transaction date before finalizing the receipt. Incorrect dates can result in misunderstandings about when the payment was made.

Lastly, failing to use the proper language can create legal issues. Make sure the wording accurately reflects the nature of the transaction to prevent misinterpretation of the agreement.

First, identify the key details required for the receipt, such as the names of the buyer and seller, the transaction amount, and the property address. Customize the fields to match the specific transaction and ensure all necessary information is included.

Next, adjust the payment terms section. Specify the deposit amount, payment date, and any relevant conditions, such as refundable or non-refundable clauses, to reflect your arrangement accurately.

Modify the property description section. Provide clear details about the property being purchased, including any distinguishing features or characteristics that apply to the agreement.

Consider adding any additional clauses that apply to your situation, such as contingencies or special instructions. This can include inspection periods, financing conditions, or deadlines that might impact the agreement.

Finally, check the template for clarity and accuracy. Ensure that all information is correct and matches the terms of your deal, and make any necessary adjustments to ensure the receipt is legally sound for both parties.

Store your deposit receipts in a secure and easily accessible location. Whether you prefer physical or digital methods, the goal is to ensure the receipts are well-organized and protected from loss or damage.

Physical Storage

Use a dedicated file or binder with clear plastic sleeves to store paper receipts. Label each section for different transactions, such as “House Purchase Deposits” or “Rental Payments,” to keep everything organized. Keep this file in a safe or lockbox for added security.

Digital Storage

Scan each receipt and save it in a cloud storage service like Google Drive or Dropbox. Create folders for different years or types of deposits, making it easier to find specific documents. Use file names that include the date and transaction type to simplify searching.

For additional security, encrypt digital files or use password-protected folders. Regularly back up your digital storage to ensure data is not lost. Both methods, physical and digital, help keep your receipts safe and accessible whenever you need them.

House Purchase Deposit Receipt Template

Make sure the deposit receipt clearly specifies the amount paid and the property details. This provides transparency for both parties involved and ensures that the transaction is properly documented. Below are key elements to include in your deposit receipt:

Key Elements of a Deposit Receipt

| Section | Description |

|---|---|

| Buyer and Seller Information | Include the full names and contact details of both the buyer and seller. |

| Deposit Amount | State the exact amount paid as a deposit, including the currency. |

| Property Details | Specify the property address, including the city, zip code, and other relevant identifiers. |

| Payment Date | Indicate the date the deposit was made, ensuring it matches with transaction records. |

| Deposit Terms | Outline any terms or conditions associated with the deposit, such as non-refundable clauses or deadlines. |

| Signatures | Both buyer and seller must sign to confirm the receipt. |

Ensure that all the details are clearly documented and agreed upon by both parties to avoid future disputes. Always retain a copy for your records.